In the ever-evolving world of insurance, risk management and crime prevention have become paramount concerns for carriers. With the increasing complexity of financial transactions and the growing sophistication of criminal activities, insurance carriers face a multitude of challenges in safeguarding their operations and protecting their policyholders.

This comprehensive guide delves into the intricacies of risk management and crime prevention strategies, providing valuable insights and practical tips to help insurance carriers navigate the complexities of this dynamic landscape.

From identifying potential risks and implementing proactive mitigation strategies to enhancing claims management and fraud prevention, this guide covers a wide spectrum of essential topics. It explores the significance of cybersecurity measures, employee screening, vendor management, regulatory compliance, and industry collaboration in combating crime and fraud.

By embracing a holistic approach to risk management and crime prevention, insurance carriers can effectively safeguard their interests, protect their policyholders, and foster a safer and more secure insurance ecosystem.

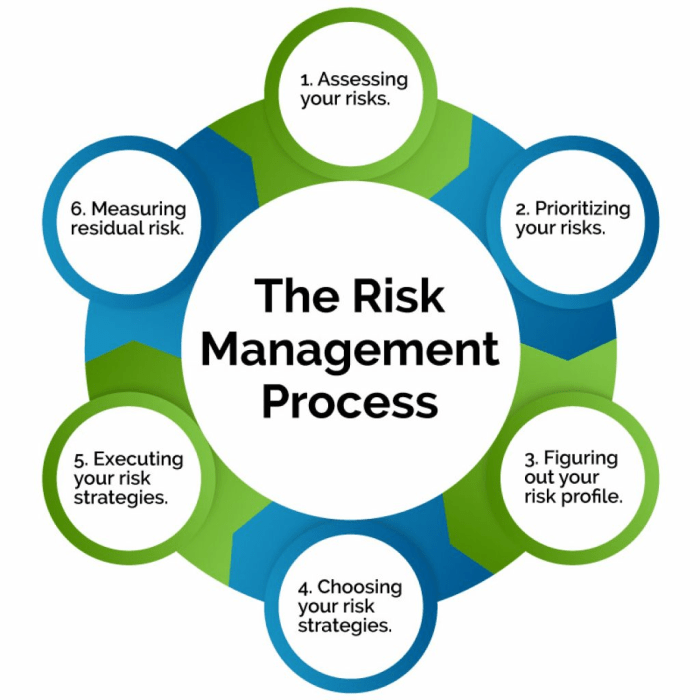

Risk Assessment

To safeguard their operations and finances, insurance carriers must identify and assess potential risks related to crime prevention. Analyzing historical data and industry trends can reveal common areas of exposure, enabling carriers to take proactive measures to mitigate these risks.

Understanding the evolving crime landscape is crucial. For instance, insurance carriers may face increased risks due to emerging cybercrime threats, fraudulent claims, or property-related crimes. Regular monitoring of crime patterns and trends allows carriers to stay informed about evolving risks and adjust their strategies accordingly.

Risk Identification

- Fraudulent Claims: Analyzing claim history and patterns can help identify suspicious activities, such as false or inflated claims, staged accidents, or organized fraud rings. Implementing robust claims investigation processes and partnering with fraud detection services can minimize exposure to fraudulent claims.

- Cybersecurity Breaches: Insurance carriers hold sensitive customer data and financial information, making them attractive targets for cyberattacks. Identifying vulnerabilities in IT systems, implementing strong cybersecurity measures, and educating employees about cyber threats can reduce the risk of data breaches and cyber fraud.

- Property Crimes: Insurance carriers may own or lease properties for office spaces, data centers, or storage facilities. Evaluating property security measures, conducting regular security audits, and implementing access control systems can prevent unauthorized access, theft, or vandalism.

Risk Mitigation Strategies

In the dynamic insurance landscape, proactive risk mitigation strategies play a crucial role in minimizing crime-related risks. Insurance carriers must adopt a multi-pronged approach encompassing comprehensive underwriting guidelines, robust risk selection criteria, and cutting-edge fraud detection systems to effectively address these challenges.

Comprehensive Underwriting Guidelines

Establishing comprehensive underwriting guidelines is the cornerstone of effective risk mitigation. These guidelines should Artikel clear parameters for evaluating and selecting risks, ensuring that only those that meet specific criteria are accepted. Key factors to consider include:

- Industry Analysis: Assess the inherent risks associated with various industries and businesses.

- Financial Stability: Evaluate the financial health and stability of potential policyholders.

- Loss History: Review past claims history to identify patterns or red flags.

- Management and Ownership: Scrutinize the reputation and track record of company management and ownership.

- Risk Management Practices: Assess the policyholder’s existing risk management measures and controls.

Fraud Detection and Prevention

Fraudulent activities pose a significant threat to insurance carriers, leading to substantial financial losses. Implementing robust fraud detection and prevention systems is crucial to safeguarding against these risks. Effective strategies include:

- Data Analytics: Utilize advanced data analytics techniques to identify suspicious patterns and anomalies in claims data.

- AI-Powered Systems: Employ AI-powered systems to analyze large volumes of data, detect fraud indicators, and flag potentially fraudulent claims.

- Claims Investigation: Conduct thorough investigations of suspicious claims, involving experienced fraud investigators.

- Collaboration: Collaborate with law enforcement agencies, industry associations, and other stakeholders to share information and combat fraud.

Claims Management and Fraud Prevention

Claims management plays a pivotal role in preventing and detecting fraudulent claims. It involves the systematic evaluation, investigation, and settlement of insurance claims, encompassing a range of activities such as documentation review, verification of loss, and communication with policyholders.

Insurance carriers can enhance their claims investigation processes by implementing the following measures:

Training and Education

- Provide comprehensive training to claims adjusters to equip them with the knowledge and skills to identify potential fraud indicators.

- Continuously update adjusters on the latest fraud trends, schemes, and investigative techniques.

Data Analytics and Technology

- Leverage data analytics and fraud detection software to analyze claims data and identify suspicious patterns.

- Utilize artificial intelligence and machine learning algorithms to automate fraud detection and improve the accuracy of claim reviews.

Collaboration with Law Enforcement

Collaboration between insurance carriers and law enforcement agencies is crucial in combating insurance fraud. This can involve:

- Sharing information and intelligence on fraudulent claims and suspected fraud rings.

- Joint investigations and task forces to tackle organized insurance fraud networks.

- Advocating for legislative changes and enhanced penalties for insurance fraud.

Cyber Security and Data Protection

Insurance carriers store and process vast amounts of sensitive data, making them a prime target for cybercriminals. A robust cybersecurity program is crucial to protect this data from unauthorized access, theft, or damage.

Potential Cyber Threats and Vulnerabilities

- Malware Attacks: Malicious software, such as viruses, ransomware, and spyware, can infect systems and compromise data.

- Phishing Scams: These attacks aim to trick users into revealing sensitive information or downloading malware.

- DDoS Attacks: Distributed Denial-of-Service attacks can overwhelm a carrier’s systems, causing outages and disrupting operations.

- Data Breaches: Unauthorized access to sensitive data can result in financial losses, reputational damage, and legal liabilities.

Importance of Robust Cybersecurity Measures

- Protects Sensitive Data: Cybersecurity measures safeguard sensitive data, including customer information, financial data, and claims history.

- Prevents Financial Losses: Cyberattacks can lead to financial losses due to data breaches, ransom payments, or business disruptions.

- Maintains Customer Trust: Strong cybersecurity practices build customer trust and confidence in the carrier’s ability to protect their data.

- Complies with Regulations: Many jurisdictions have regulations that require insurance carriers to implement cybersecurity measures.

Best Practices for Data Encryption, Access Control, and Incident Response

- Data Encryption: Encryption safeguards data at rest and in transit, making it unreadable to unauthorized individuals.

- Access Control: Implementing strong access controls ensures that only authorized personnel have access to sensitive data.

- Incident Response Plan: A well-defined incident response plan helps organizations respond quickly and effectively to cyberattacks.

Employee Screening and Background Checks

In the insurance industry, preventing internal fraud is crucial to maintain trust and integrity. Thorough employee screening and background checks play a vital role in mitigating the risk of fraudulent activities by potential hires.

Insurance carriers commonly conduct various types of background checks, including:

Criminal Record Checks:

- Reviewing local, state, and federal criminal records to identify any prior convictions or pending charges.

- This helps assess the individual’s honesty and integrity, particularly for positions involving financial responsibilities.

Employment Verification:

- Confirming the applicant’s employment history, including dates of employment, job titles, and responsibilities.

- This helps ensure the accuracy of the information provided in the job application and uncovers any potential gaps or discrepancies.

Education Verification:

- Verifying the applicant’s educational qualifications, including degrees, diplomas, and certifications.

- This helps assess the individual’s skills and competencies, ensuring they meet the requirements of the position.

Financial History Checks:

- Reviewing the applicant’s credit history, bankruptcy records, and any outstanding debts or judgments.

- This helps identify any financial issues that may pose a risk to the company, such as potential conflicts of interest or financial instability.

Professional Reference Checks:

- Contacting the applicant’s former supervisors, colleagues, or clients to gather feedback on their work performance, ethics, and trustworthiness.

- This provides valuable insights into the individual’s professional conduct and reputation.

Social Media Checks:

- Reviewing the applicant’s social media presence to assess their online behavior, values, and any potential red flags.

- This helps identify any concerning posts, associations, or activities that may impact the company’s reputation or operations.

To conduct effective employee screenings, insurance carriers should:

- Develop a comprehensive screening policy that Artikels the types of background checks to be conducted and the criteria for making hiring decisions.

- Partner with reputable background check providers that adhere to industry standards and legal requirements.

- Train hiring managers and HR professionals on the importance of thorough screenings and how to interpret the results.

- Implement a secure process for storing and managing sensitive employee data in compliance with data protection regulations.

Vendor Management and Third-Party Risk

Managing risks associated with third-party vendors and service providers is crucial for insurance carriers to maintain their reputation, financial stability, and regulatory compliance. Effective vendor management involves conducting thorough due diligence, risk assessments, and ongoing monitoring to mitigate potential vulnerabilities.

Vendor Due Diligence and Risk Assessments

Prior to engaging with a third-party vendor, insurance carriers should conduct comprehensive due diligence to evaluate their financial stability, operational capabilities, security practices, and compliance with relevant regulations. This includes:

- Reviewing the vendor’s financial statements and credit history to assess their financial stability and ability to fulfill contractual obligations.

- Assessing the vendor’s operational capabilities, including their infrastructure, resources, and expertise, to ensure they can deliver the required services effectively.

- Evaluating the vendor’s security practices, including their data protection measures, cybersecurity protocols, and incident response plans, to ensure they align with the carrier’s own security standards.

- Verifying the vendor’s compliance with relevant regulations and industry standards, such as data privacy laws, financial regulations, and industry-specific requirements.

Monitoring and Managing Ongoing Vendor Relationships

Once a vendor is engaged, insurance carriers should establish a robust monitoring framework to oversee the vendor’s performance and identify potential risks. This includes:

- Regularly reviewing the vendor’s financial performance, operational metrics, and compliance status to ensure they continue to meet contractual obligations and regulatory requirements.

- Conducting periodic security audits and assessments to verify the vendor’s security practices and identify any vulnerabilities or gaps that need to be addressed.

- Establishing clear communication channels and escalation procedures to ensure that any issues or concerns are promptly reported and addressed.

- Implementing contractual provisions that allow the carrier to terminate the relationship or take corrective actions in case of vendor non-performance or breach of contract.

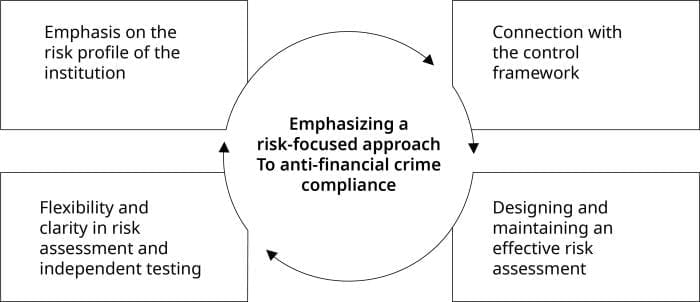

Regulatory Compliance and Legal Considerations

Navigating the complex regulatory landscape and adhering to legal obligations are crucial aspects of crime prevention for insurance carriers. This section delves into key requirements and insights for staying compliant and mitigating risks.

Anti-Money Laundering (AML) and Know-Your-Customer (KYC) Regulations

Insurance carriers must comply with AML and KYC regulations to prevent money laundering and terrorist financing. These regulations require insurers to:

- Establish and maintain a risk-based approach to customer due diligence.

- Collect and verify customer information, including identity, address, and beneficial ownership.

- Monitor transactions for suspicious activity and report suspicious transactions to the appropriate authorities.

Impact of AML and KYC Regulations on Crime Prevention

AML and KYC regulations play a vital role in crime prevention by:

- Preventing criminals from using insurance policies to launder money or finance illegal activities.

- Helping insurance carriers identify and mitigate risks associated with insuring high-risk customers.

- Protecting the integrity of the insurance industry and promoting financial stability.

Staying Compliant with Evolving Regulatory Landscapes

Insurance carriers must stay updated with evolving regulatory requirements to maintain compliance and effectively prevent crime. This includes:

- Regularly monitoring changes in regulations and legal requirements.

- Implementing appropriate policies and procedures to comply with new regulations.

- Training employees on regulatory requirements and their responsibilities in preventing crime.

Training and Awareness Programs

Training and awareness programs are fundamental to equipping employees with the knowledge and skills necessary to prevent crime and fraud in insurance organizations. These programs play a pivotal role in educating staff about various risks, fostering a culture of integrity, and reinforcing ethical decision-making.

To ensure effectiveness, training modules should be engaging, interactive, and tailored to specific job roles and responsibilities. Examples of effective training modules include simulations, role-playing exercises, case studies, and online courses. Insurance carriers can also provide access to resources such as webinars, e-learning platforms, and training manuals to facilitate continuous learning and reinforcement.

Regular Training Updates

Given the evolving nature of crime and fraud, regular training updates are essential to keep employees informed of emerging threats and best practices. This ensures that staff members are equipped with the latest knowledge and tools to identify and mitigate potential risks effectively.

Updates can be delivered through refresher courses, workshops, or online training modules.

Industry Collaboration and Information Sharing

The insurance industry is a target for various types of crime and fraud. Industry collaboration and information sharing play a vital role in preventing these activities and safeguarding the interests of insurance carriers, policyholders, and the public.

By working together, insurance carriers can pool their resources, knowledge, and expertise to identify emerging risks, develop effective countermeasures, and combat fraudulent activities. Information sharing enables insurers to stay updated on the latest trends, modus operandi, and best practices in risk management and crime prevention.

Successful Collaboration Initiatives

- Insurance Fraud Bureau (IFB): The IFB is a non-profit organization that facilitates information sharing and collaboration among insurance carriers, law enforcement agencies, and government regulators. It maintains a database of suspected fraud cases, which members can access to identify potential risks and prevent fraudulent claims.

- Coalition Against Insurance Fraud (CAIF): CAIF is a global organization that brings together insurance carriers, law enforcement, and industry experts to combat insurance fraud. It provides a platform for members to share information, best practices, and resources, and collaborates on investigations and prosecutions of fraud cases.

- International Insurance Crime Bureau (IICB): The IICB is a non-profit organization dedicated to fighting insurance fraud and related crimes worldwide. It provides a global network for information sharing, training, and investigative support to insurance carriers and law enforcement agencies.

Role of Industry Associations and Organizations

Industry associations and organizations play a crucial role in facilitating information sharing and best practice dissemination among insurance carriers. These organizations provide platforms for members to connect, network, and exchange ideas and experiences. They also organize conferences, workshops, and training programs to educate members on the latest developments in risk management and crime prevention.

- National Association of Insurance Commissioners (NAIC): The NAIC is a U.S.-based organization that develops and promotes uniform standards and regulations for the insurance industry. It facilitates information sharing among state insurance regulators and provides a forum for discussing emerging issues and trends in insurance regulation.

- American Council of Life Insurers (ACLI): The ACLI is a trade association representing life insurance companies in the United States. It provides a platform for members to share information, best practices, and resources related to risk management, fraud prevention, and regulatory compliance.

- Property Casualty Insurers Association of America (PCI): The PCI is a trade association representing property and casualty insurance companies in the United States. It provides a forum for members to discuss common challenges, share best practices, and advocate for legislative and regulatory changes that benefit the industry.

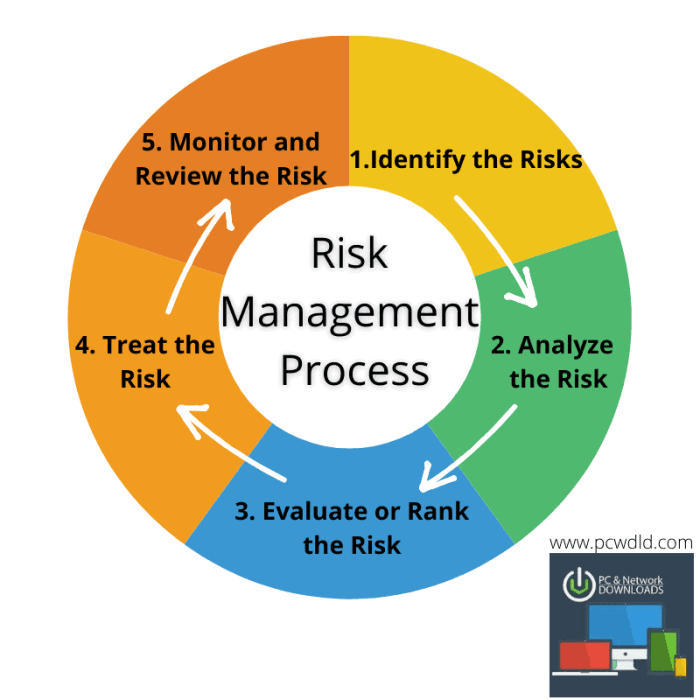

Continuous Improvement and Risk Monitoring

In the ever-changing landscape of crime and risk, complacency is the enemy of effective prevention. Insurance carriers must prioritize continuous risk monitoring and improvement to stay ahead of emerging threats and evolving criminal tactics. By implementing robust monitoring systems and leveraging technology, carriers can proactively identify vulnerabilities, address risks promptly, and enhance their overall crime prevention strategies.

Staying Updated on Emerging Crime Trends

To stay abreast of the latest crime trends, insurance carriers should:

- Monitor Law Enforcement Reports and Crime Statistics: Regularly review local, state, and national law enforcement reports, crime statistics, and trend analyses to stay informed about emerging crime patterns, hot spots, and modus operandi of criminals.

- Subscribe to Industry Publications and Newsletters: Subscribe to industry-specific publications, newsletters, and online forums to stay updated on the latest crime prevention strategies, best practices, and emerging risks.

- Attend Industry Conferences and Seminars: Participate in industry conferences, seminars, and workshops to network with peers, learn about new technologies and solutions, and stay informed about the latest developments in crime prevention.

- Conduct Regular Risk Assessments: Regularly conduct comprehensive risk assessments to identify potential vulnerabilities and areas for improvement in crime prevention strategies.

Leveraging Technology and Data Analytics

Technology and data analytics play a vital role in enhancing risk monitoring and prevention efforts. Insurance carriers can:

- Implement Data Analytics Platforms: Implement data analytics platforms to collect, analyze, and interpret large volumes of data from various sources, including claims history, underwriting data, and external crime statistics.

- Utilize Predictive Analytics: Use predictive analytics to identify high-risk policies, fraud patterns, and potential vulnerabilities, enabling proactive risk management and targeted interventions.

- Employ Geospatial Analysis: Leverage geospatial analysis tools to map crime patterns, identify high-risk areas, and optimize resource allocation for crime prevention.

- Monitor Social Media and Online Platforms: Monitor social media platforms and online forums to identify potential fraud rings, scams, and emerging crime trends.

Outcome Summary

In conclusion, risk management and crime prevention are fundamental pillars for insurance carriers to ensure the integrity and sustainability of their operations. By adopting proactive strategies, leveraging technology, fostering collaboration, and continuously monitoring and adapting to evolving risks, insurance carriers can effectively mitigate threats, safeguard their assets, and maintain the trust of their policyholders.

Embracing a culture of risk awareness and prevention not only protects the financial well-being of the insurance industry but also contributes to a more secure and stable financial landscape for all.

FAQ

What are some common areas of exposure for insurance carriers in terms of crime prevention?

Insurance carriers face a range of crime-related risks, including fraudulent claims, cyberattacks, employee misconduct, and third-party vendor fraud. These areas of exposure can lead to financial losses, reputational damage, and legal liabilities.

How can insurance carriers enhance their claims investigation processes to prevent fraud?

Insurance carriers can improve their claims investigation processes by utilizing data analytics, conducting thorough background checks on claimants, collaborating with law enforcement agencies, and implementing robust anti-fraud measures.

What role does technology play in risk management and crime prevention for insurance carriers?

Technology plays a crucial role in enhancing risk management and crime prevention efforts for insurance carriers. Advanced data analytics, artificial intelligence, and cybersecurity tools can help identify suspicious activities, detect fraud, and protect sensitive data.

How can insurance carriers foster collaboration with law enforcement agencies to combat fraud?

Collaboration between insurance carriers and law enforcement agencies is essential in combating fraud and other criminal activities. This collaboration can involve sharing information, conducting joint investigations, and developing strategies to prevent and prosecute fraudulent claims.

What are some best practices for conducting effective employee screenings and background checks?

Insurance carriers should conduct thorough employee screenings and background checks to prevent internal fraud and misconduct. This includes verifying education and employment history, conducting criminal background checks, and checking references.