In the ever-evolving digital landscape, social media has become a powerful tool for insurance companies to connect with customers, build brand loyalty, and drive growth. Embracing the unique characteristics and potential of each platform, insurance companies can leverage social media to effectively engage with their target audience, showcase their expertise, and provide exceptional customer service.

With the right strategies and a commitment to authenticity, insurance companies can harness the power of social media to achieve their business objectives and stay ahead in the competitive market.

Understanding Social Media Platforms

Social media platforms are the online spaces where individuals and businesses interact, share information, and connect with each other. These platforms have revolutionized the way businesses communicate with their customers and have become essential tools for insurance companies to reach their target audience, build brand awareness, and generate leads.Each

social media platform has its own unique characteristics, target audience, and content formats. Insurance companies need to understand these differences in order to effectively engage with their customers on each platform.

Target Audience and Demographics

The target audience for each social media platform varies depending on the platform’s purpose and features. For example, Facebook is a general-interest platform with a wide range of users, while LinkedIn is a professional networking site with a focus on business and career-related content.

Insurance companies need to identify their target audience on each platform and tailor their content accordingly.

Content Formats and Engagement Strategies

The type of content that is most effective on each social media platform also varies. Some platforms, such as Instagram, are more visual, while others, such as Twitter, are more text-based. Insurance companies need to create content that is visually appealing, informative, and engaging for each platform.In

addition to creating great content, insurance companies also need to develop effective engagement strategies for each social media platform. This includes responding to comments and messages, running contests and giveaways, and partnering with influencers.

Creating Engaging Content

Engaging content is the key to capturing attention, driving engagement, and boosting your social media presence. It’s not just about posting content; it’s about creating content that resonates with your audience, encourages interaction, and compels them to share it with their networks.

To create engaging content, focus on crafting compelling headlines, captions, and visuals that instantly grab attention and make people want to learn more. Use strong verbs, intriguing questions, and relevant s that align with your target audience’s interests. Keep your content concise and to the point, avoiding unnecessary jargon or technical terms that might alienate readers.

Visual Appeal

Visuals are a powerful tool for capturing attention and conveying messages quickly and effectively. Use high-quality images, videos, infographics, and GIFs to break up text and make your content more visually appealing. Choose visuals that align with your brand identity and resonate with your target audience.

Remember, a picture is worth a thousand words, so make sure your visuals are compelling and tell a story.

Curating and Repurposing Content

Creating engaging content consistently can be time-consuming, but it doesn’t always have to be from scratch. Curating and repurposing existing content can save time and effort while still providing valuable information to your audience. Share relevant articles, blog posts, videos, or social media posts from reputable sources, adding your own commentary or insights to provide a unique perspective.

You can also repurpose your own content by creating different formats, such as turning a blog post into an infographic or a video into a series of social media posts. This extends the lifespan of your content and reaches a wider audience.

Building a Strong Brand Presence

Establishing a strong brand presence on social media is pivotal in today’s digital landscape. It enables insurance companies to connect with potential customers, build trust, and differentiate themselves in a competitive market.A consistent brand identity across all social media platforms reinforces recognition and recall.

This includes using the same logo, color scheme, fonts, and tone of voice. By doing so, insurance companies can create a cohesive and recognizable brand experience for their audience.

Showcasing Company Culture, Values, and Expertise

Social media platforms offer an excellent opportunity for insurance companies to showcase their company culture, values, and expertise. By sharing behind-the-scenes glimpses, employee stories, and thought leadership content, companies can humanize their brand and build a connection with their audience.

Additionally, providing valuable content that educates and informs potential customers establishes the company as a trusted source of information and builds credibility.

Engaging with Customers

Engaging with customers on social media platforms is crucial for insurance companies to build strong relationships, enhance customer satisfaction, and drive business growth. Customers expect insurance companies to be active on social media and provide a seamless, personalized experience.

Responding to Inquiries, Complaints, and Feedback

- Respond promptly to customer inquiries, complaints, and feedback in a timely and professional manner.

- Utilize social media monitoring tools to track and identify customer interactions, questions, and concerns.

- Provide personalized responses that address the specific needs and concerns of each customer.

- Acknowledge customer complaints and work towards resolving them efficiently and effectively.

- Express empathy and understanding in responses to negative feedback, and offer solutions or remedies.

Creating Opportunities for Customer Interaction

- Create opportunities for customer interaction through contests, giveaways, polls, surveys, and Q&A sessions.

- Encourage customers to share their experiences, feedback, and suggestions through social media platforms.

- Conduct live Q&A sessions or webinars to directly engage with customers and address their queries.

- Offer exclusive promotions, discounts, or early access to new products and services to engaged customers.

- Collaborate with influencers or industry experts to reach a wider audience and generate buzz around your brand.

Leveraging User-Generated Content

In the realm of digital marketing, user-generated content (UGC) stands as a powerful tool for insurance companies to build brand loyalty and authenticity.

By harnessing the voices of their customers, insurance companies can create a sense of community and trust, while simultaneously promoting their products and services in a more engaging and authentic manner.

Encouraging Customer Content Creation

To encourage customers to create and share content related to the insurance company, consider the following strategies:

- Run Contests and Giveaways: Host social media contests or giveaways that encourage customers to share their experiences with the company or its products.

- Provide Incentives: Offer discounts, exclusive access to products or services, or other perks in exchange for user-generated content.

- Create Shareable Content: Develop content that is designed to be shared, such as infographics, videos, or blog posts that customers can easily share with their networks.

- Make it Easy to Share: Provide easy-to-use sharing buttons and links on your website and social media channels, making it seamless for customers to share your content.

- Respond and Interact: Actively respond to and interact with user-generated content, showing appreciation and encouraging further engagement.

Showcasing and Rewarding User-Generated Content

Once you have a collection of user-generated content, it’s important to showcase and reward it in a way that encourages continued participation and engagement.

- Feature User Content: Share user-generated content on your social media channels, website, and in email newsletters.

- Create a Gallery or Hall of Fame: Dedicate a section of your website or social media page to display user-generated content, giving credit to the creators.

- Host Events and Meetups: Organize events and meetups where customers can share their experiences and connect with others, generating additional user-generated content.

- Offer Exclusive Benefits: Provide exclusive benefits, such as discounts or exclusive access to products or services, to customers who actively create and share user-generated content.

Utilizing Social Media Analytics

Social media analytics provide invaluable insights into the effectiveness of your insurance company’s social media campaigns. By tracking and analyzing key metrics, you can optimize your strategies, allocate resources efficiently, and measure the ROI of your social media efforts.

Key Metrics to Monitor

1. Engagement

Measure the level of interaction your posts receive, including likes, comments, shares, and clicks. High engagement indicates that your content resonates with your audience.

2. Reach

Track the number of unique individuals who see your content. A high reach indicates that your content is being seen by a broad audience.

3. Conversion Rates

Monitor the number of social media interactions that lead to desired actions, such as policy inquiries, quote requests, or website visits. High conversion rates indicate that your social media efforts are driving tangible results.

Optimizing Campaigns and Measuring ROI

1. Use Analytics to Identify Top-Performing Content

Analyze which types of content generate the highest engagement, reach, and conversions. Use this information to create more of the content that your audience finds valuable.

2. Fine-Tune Your Targeting

Analyze your audience demographics and interests to refine your targeting strategies. This ensures that your content is reaching the right people.

3. Track Conversions and Calculate ROI

Use social media analytics to track the number of leads and sales generated from your social media efforts. Calculate the ROI of your campaigns by comparing the cost of your social media advertising to the revenue generated.

Running Effective Social Media Ads

Social media advertising presents an exceptional opportunity for insurance companies to connect with a vast and targeted audience. Harnessing the power of social media platforms enables insurers to effectively reach potential customers, generate leads, and boost brand recognition.

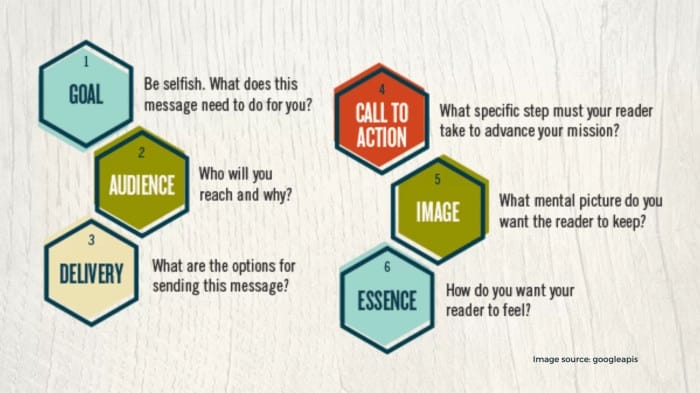

Setting Clear Advertising Objectives

The foundation of successful social media advertising lies in establishing well-defined advertising objectives. These objectives should align seamlessly with the overall marketing goals of the insurance company. Common advertising objectives include:

Generating leads

Capture the interest of potential customers and encourage them to provide their contact information for further communication.

Driving website traffic

Direct users to the insurance company’s website to learn more about products, services, and special offers.

Increasing brand awareness

Elevate the visibility of the insurance company and its offerings, fostering brand recognition and recall among the target audience.

Targeting the Right Audience

Precisely targeting the intended audience is crucial for maximizing the impact of social media advertising campaigns. Insurance companies can leverage the sophisticated targeting capabilities of social media platforms to pinpoint their ideal customers based on various criteria, including:

Demographics

Factors such as age, gender, location, and income level can be used to narrow down the target audience.

Interests

Identifying the specific interests and hobbies of the target audience allows insurance companies to deliver highly relevant ads that resonate with their preferences.

Behaviors

Analyzing online behaviors, such as browsing history and purchase patterns, enables insurance companies to target individuals who have demonstrated an interest in insurance-related products or services.

Creating Compelling Ad Copy and Visuals

Crafting compelling ad copy and visuals is paramount to capturing the attention of users and driving conversions. Effective ad copy should be:

Clear and concise

Convey the key message succinctly and memorably, avoiding jargon and technical terms.

Action-oriented

Incorporate a clear call to action that prompts users to take the desired action, such as visiting a website or requesting a quote.

Emotionally engaging

Evoke emotions that resonate with the target audience, creating a connection that compels them to engage with the ad.Visuals play a pivotal role in grabbing attention and enhancing the overall impact of social media ads. High-quality images, videos, and infographics can:

- Make ads more visually appealing and engaging, increasing the likelihood of user interaction.

- Convey complex information in a visually appealing and easily digestible format, facilitating comprehension.

- Create a lasting impression, fostering brand recall and recognition among the target audience.

Collaborating with Influencers

Harnessing the influence of social media personalities can elevate the insurance company’s reach and engagement. These individuals wield significant sway over their followers, presenting a unique opportunity to connect with new audiences and amplify brand messaging.

Identifying and Selecting Influencers

The key to successful influencer collaborations lies in meticulous selection. Look for individuals whose values, audience demographics, and content style align with the insurance company’s brand identity and target market. Authenticity is paramount; choose influencers who genuinely believe in the company’s products and services and can convey that conviction to their followers.

Creating Authentic and Transparent Collaborations

Transparency is the cornerstone of effective influencer partnerships. Ensure that sponsored content is clearly labeled as such, adhering to regulatory guidelines and fostering trust among the influencer’s audience. Encourage influencers to share their genuine experiences with the insurance company’s products or services, allowing their personal connection to shine through.

Managing Social Media Risks

Social media platforms have become indispensable tools for insurance companies to connect with customers and grow their business. However, these platforms also pose potential risks that can damage an insurance company’s reputation and bottom line. Potential Risks Associated with Social Media Use:

Negative Comments and Reviews

Customers can easily post negative comments or reviews about an insurance company’s products or services on social media. These negative posts can quickly go viral, damaging the company’s reputation and discouraging potential customers from doing business with them.

Data Breaches

Social media platforms are a common target for hackers, who can gain access to sensitive customer data, such as names, addresses, and financial information. A data breach can lead to identity theft, fraud, and other financial losses for customers.

Reputational Damage

Social media posts can quickly spread across the internet, potentially causing reputational damage to an insurance company. A single negative post or comment can be seen by thousands of people, and it can take years to repair the damage done to the company’s reputation.

Developing a Social Media Crisis Management Plan

To mitigate the risks associated with social media use, insurance companies should develop a comprehensive social media crisis management plan. This plan should include the following elements:

A Social Media Policy

The policy should Artikel the company’s guidelines for social media use, including what employees are allowed to post and how they should respond to negative comments or reviews.

A Social Media Monitoring System

The company should have a system in place to monitor social media mentions of its brand, products, and services. This system should be able to identify negative posts and comments quickly so that the company can respond in a timely manner.

A Social Media Response Plan

The company should have a plan in place for responding to negative comments or reviews on social media. The plan should include guidelines for how employees should respond to negative posts, as well as a process for escalating issues to management if necessary.

Monitoring Social Media Mentions and Responding to Negative Feedback

Insurance companies should monitor social media mentions of their brand, products, and services on a regular basis. This can be done using a variety of tools, such as social media monitoring software or simply by searching for the company’s name and relevant s on social media platforms.When

a negative comment or review is identified, the company should respond in a timely and appropriate manner. The response should be polite, professional, and informative. The company should also take steps to resolve the issue that led to the negative comment or review.

Staying Up-to-Date with Social Media Trends

Understanding the latest social media trends and algorithm changes is crucial for insurance companies to stay relevant and engage effectively with their target audience. By embracing new features, adapting content strategies, and aligning with evolving user preferences, insurance companies can optimize their social media presence and drive meaningful interactions.

Monitoring Industry Trends and Customer Sentiment

Harnessing the power of social media listening tools enables insurance companies to monitor industry trends, track customer sentiment, and identify emerging opportunities. By analyzing social conversations, brands can gain valuable insights into customer needs, preferences, and pain points. This data-driven approach helps tailor social media strategies to resonate with the target audience and deliver personalized experiences.

Adapting Social Media Strategies

Staying abreast of social media trends allows insurance companies to adapt their strategies swiftly and effectively. This includes experimenting with new content formats, optimizing posting schedules, and leveraging emerging platforms to reach a wider audience. By continuously refining their approach based on data-driven insights, insurance companies can stay ahead of the curve and maintain a strong online presence.

Last Word

In conclusion, social media offers insurance companies a vast platform to connect with their customers, build brand loyalty, and drive growth. By understanding the nuances of each platform, creating engaging content, and actively engaging with their audience, insurance companies can leverage social media to achieve their business goals and stay competitive in the digital age.

FAQ Summary

How can insurance companies use social media to build brand loyalty?

Insurance companies can foster brand loyalty by consistently providing valuable content, engaging with customers, and showcasing their expertise. Sharing customer testimonials, success stories, and industry insights can help build trust and credibility.

What strategies can insurance companies employ to increase customer engagement on social media?

Insurance companies can boost customer engagement by creating interactive content, such as polls, quizzes, and contests. Responding promptly to comments and inquiries, running giveaways, and encouraging user-generated content can also foster a sense of community and engagement.

How can insurance companies leverage user-generated content to enhance their social media presence?

User-generated content can be a powerful tool for insurance companies to build authenticity and connect with their audience. Encouraging customers to share their experiences, testimonials, and photos related to the company can create a sense of community and trust.