In the realm of insurance, the treatment of tips has garnered significant attention, prompting inquiries into their classification as gross income. This intricate subject encompasses various facets, including tax implications, policy provisions, and ethical considerations. Delving into the nuances of this topic, we will explore the interplay between tips and insurance, unraveling their impact on coverage, insurability, and premiums.

From the perspective of taxation, tips are generally considered income and subject to reporting requirements. However, the insurance industry often presents unique scenarios that necessitate a closer examination of how tips are defined and categorized. Insurance policies may contain specific provisions addressing the treatment of tips, potentially influencing coverage and payouts.

Moreover, the ethical implications of handling tips in the insurance context demand careful consideration, emphasizing transparency and disclosure.

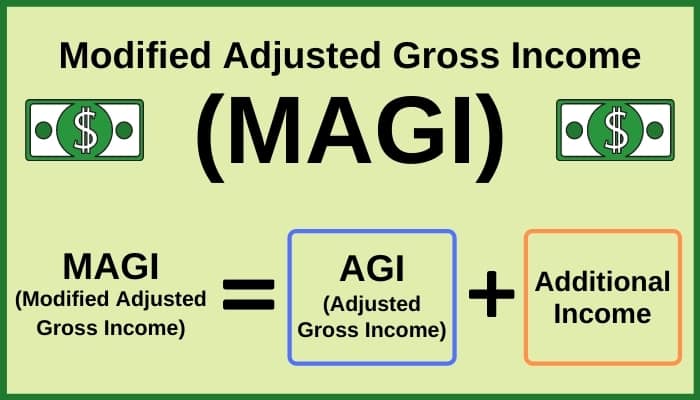

Gross Income Definition

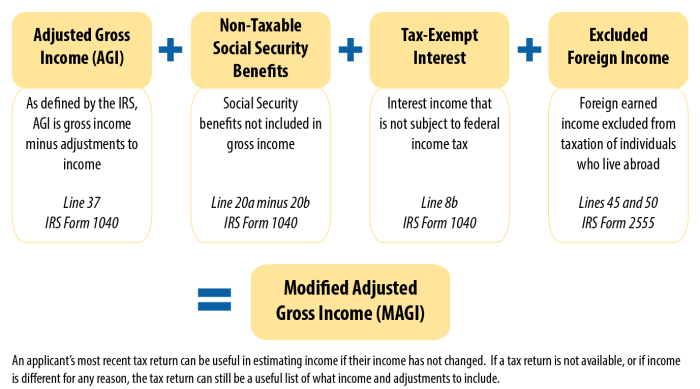

In the context of insurance, gross income refers to the total amount of money an individual or business earns before deducting any expenses or costs.

Common examples of items included in gross income are:

- Salaries, wages, and commissions

- Interest and dividends

- Rental income

- Business profits

- Capital gains

- Alimony and child support payments

Tips as Income

In the insurance industry, tips can be a significant source of income for certain employees, particularly those in customer-facing roles. The treatment of tips as income for tax purposes is generally consistent with the general rules for other forms of compensation, with some specific considerations unique to the insurance industry.

Definition and Categorization of Tips

In the insurance industry, tips are typically defined as any gratuity or voluntary payment made by a policyholder or customer to an employee in recognition of exceptional service. Tips can be provided in cash, check, or electronic form and may be subject to specific reporting and taxation requirements.

Tips are often categorized into two types:

- Direct Tips: These are tips received directly from policyholders or customers, such as cash tips or tips paid through a credit card.

- Indirect Tips: These are tips that are not directly received from policyholders or customers but are generated through the business operations of the insurance company. Examples include service charges, gratuities added to bills, or tips collected through tip pools.

Insurance Policies and Tips

Insurance policies often contain provisions that specifically address tips received by insured individuals. These provisions vary from policy to policy, but they typically define tips as any monetary or non-monetary compensation received by an insured individual in connection with the provision of a service.

For example, a commercial general liability (CGL) policy may include a provision that states that tips are considered part of the insured’s gross income and are therefore subject to coverage under the policy. This means that if an insured individual is sued for an injury that was allegedly caused by the insured’s negligence, the insurance company may be liable for damages up to the policy’s limits, even if those damages include tips that the insured individual received.

Specific Policy Provisions Related to Tips

In addition to defining tips, insurance policies may also contain provisions that specifically address how tips are to be treated for purposes of coverage. For example, a policy may state that tips are not considered earned income for purposes of calculating the insured’s premium.

This means that the insured individual will not have to pay a higher premium simply because they receive tips.

Another common provision related to tips is a provision that states that tips are not considered wages for purposes of workers’ compensation coverage. This means that an insured individual who is injured on the job is not entitled to workers’ compensation benefits for any tips that they receive.

Impact on Insurance Coverage

Tips, if considered gross income, can have a potential impact on various types of insurance coverage. Understanding the relevance of tips in insurance policies is essential to ensure accurate calculations of premiums and appropriate coverage.

Life Insurance

In the context of life insurance, tips can influence the insurability of an individual and the determination of premium rates. When applying for life insurance, insurers assess an individual’s financial stability and income to determine their risk profile. If tips constitute a significant portion of an individual’s income, they may be taken into account during the underwriting process.

- Higher Tips, Higher Coverage: Consistent and substantial tip income can positively impact insurability. Insurers may consider tips as evidence of earning potential and financial stability, leading to higher coverage limits and potentially lower premiums.

- Inconsistent Tips, Variable Coverage: In cases where tip income is sporadic or inconsistent, insurers may view the income as less reliable. This can result in lower coverage limits or higher premiums to offset the perceived risk.

Disability Insurance

Similar to life insurance, tips can influence disability insurance coverage. Disability insurance provides income replacement in the event of an illness or injury that prevents an individual from working.

- Tips as Part of Base Income: If tips are considered part of an individual’s base income, they will be taken into account when calculating disability benefits. This ensures that the insured individual receives a comprehensive income replacement, including tips.

- Impact on Premium Rates: The amount of tips earned can affect premium rates for disability insurance. Higher tip income may lead to higher premiums due to the increased risk of disability affecting the individual’s overall income.

Property Insurance

In the context of property insurance, tips are generally not considered as part of an individual’s insurable interest in a property. Insurable interest refers to the financial stake an individual has in a property, which determines the extent of coverage provided by the insurance policy.

- Personal Property: Tips are not typically included in the calculation of personal property coverage limits. Personal property insurance covers items such as furniture, electronics, and clothing. Since tips are not considered personal property, they are not covered under this type of insurance.

- Business Property: For individuals who own businesses and receive tips as part of their income, business property insurance may provide coverage for equipment, inventory, and other business-related assets. However, tips themselves are not considered business property and are not covered under this policy.

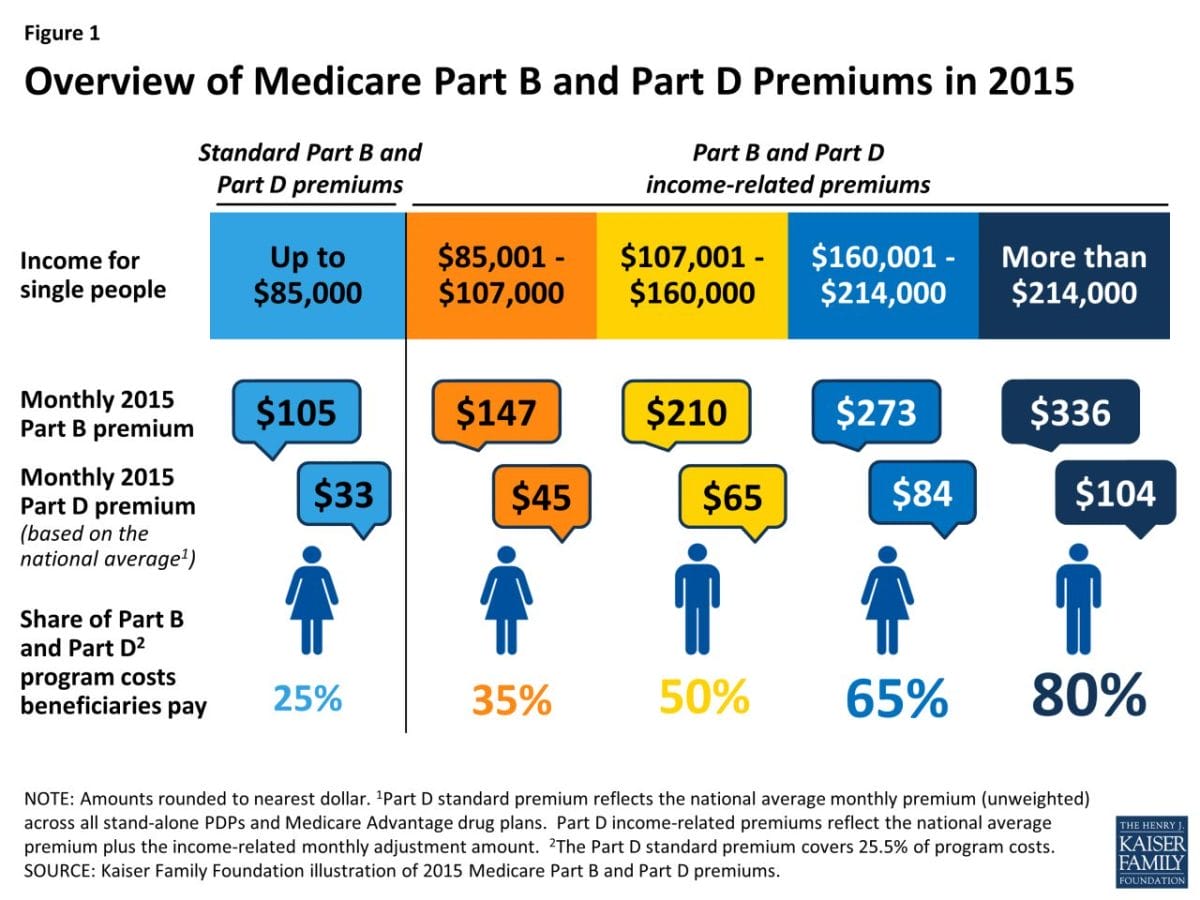

Tax Implications

Tips received by insurance agents and other insurance professionals are considered taxable income and must be reported on their tax returns. The tax implications of tips can vary depending on the jurisdiction and the specific tax laws applicable to insurance professionals.

In general, tips are subject to income tax, social security tax, and Medicare tax. The amount of tax owed on tips will depend on the total amount of tips received, as well as the individual’s other income and deductions.

Reporting Tips on Tax Returns

Insurance agents and other insurance professionals are required to report all tips received on their tax returns. Tips can be reported on Form 1040, Schedule C, Profit or Loss from Business. The amount of tips reported on Schedule C should be the total amount of tips received, minus any expenses incurred in earning the tips.

In addition to reporting tips on Schedule C, insurance agents and other insurance professionals may also need to pay estimated taxes throughout the year. Estimated taxes are payments made to the IRS in advance of the tax filing deadline. Estimated taxes are calculated based on the estimated amount of tax that will be owed for the year.

By paying estimated taxes, insurance agents and other insurance professionals can avoid penalties for underpayment of taxes.

Reporting Requirements

Insurance agents and other insurance professionals are required to report tips they receive as part of their income. This reporting is done through various forms and is subject to specific deadlines.

Forms and Deadlines

Insurance professionals must report tips on their individual income tax returns. The forms used for reporting tips depend on the amount of tips received. For tips totaling $20 or more in a month, Form 4070, Employee’s Report of Tips to Employer , is used.

This form is submitted to the employer, who is then responsible for withholding taxes on the tips. For tips totaling less than $20 in a month, Form 4070A, Employee’s Daily Record of Tips , can be used. This form is kept by the employee for their records and is not submitted to the employer.The

deadline for reporting tips is the same as the deadline for filing individual income tax returns. This is typically April 15th of each year. However, if an extension is filed for the income tax return, the deadline for reporting tips is also extended.

State Regulations

State-specific regulations play a significant role in governing the treatment of tips in the insurance industry. These regulations vary across different states, leading to unique rules and requirements related to tips. Understanding these state-specific regulations is crucial for insurance companies and individuals involved in the insurance sector.

The variations in state regulations primarily stem from the diverse approaches adopted by state legislatures in addressing tips as income. Some states have explicit laws and regulations governing tips, while others rely on general income tax provisions to determine the treatment of tips.

Examples of State-Specific Regulations

-

California:

California has specific regulations governing tips in the insurance industry. Under California law, tips are considered wages and are subject to state income tax. Insurance companies are required to report tips as part of an employee’s gross income and withhold taxes accordingly. -

New York:

In New York, tips are also considered wages and are subject to state income tax. However, New York has a provision that allows employees to exclude a portion of their tips from taxation if they can demonstrate that the tips were not included in their regular wages. -

Texas:

Texas does not have specific regulations governing tips in the insurance industry. Instead, the state relies on general income tax provisions to determine the treatment of tips. Tips are considered taxable income in Texas and must be reported as part of an employee’s gross income.

Industry Standards

Within the insurance sector, established industry standards and best practices guide the handling of tips. These standards aim to ensure transparency, consistency, and ethical conduct in managing tips received by insurance professionals.

The role of industry associations and regulatory bodies is crucial in shaping these standards. They provide a platform for stakeholders to collaborate, share knowledge, and develop guidelines that align with industry needs and regulatory requirements.

Associations and Regulatory Bodies

- Insurance Regulatory Authorities: Governmental bodies responsible for regulating the insurance industry often establish guidelines and regulations related to the handling of tips. These regulations may vary across jurisdictions.

- Industry Associations: Professional organizations representing insurance companies and agents play a significant role in developing industry-wide standards and best practices for handling tips. These associations facilitate discussions, share best practices, and advocate for ethical conduct within the industry.

Transparency and Disclosure

- Clear Policies: Insurance companies typically have clear policies and procedures outlining how tips should be handled. These policies are communicated to employees and customers, ensuring transparency and understanding of the company’s approach to tips.

- Tip Reporting: Employees are often required to report tips received to their employer. This reporting may be done through various methods, such as daily logs, electronic systems, or tip pools. Accurate reporting is essential for compliance with tax regulations and company policies.

Ethical Conduct

- Prohibition of Misrepresentation: Insurance professionals are expected to avoid any misrepresentation or misleading statements regarding tips. They should not imply that tips are required or expected as a condition of service.

- Gratuity as a Courtesy: Tips are generally considered a gratuity or a token of appreciation for exceptional service. Insurance professionals should not solicit or demand tips.

Tax Implications

- Taxable Income: In many jurisdictions, tips received by insurance professionals are considered taxable income. Individuals are responsible for reporting and paying taxes on these tips.

- Employer Responsibilities: Employers may have specific obligations related to withholding taxes on tips received by their employees. These obligations vary depending on the jurisdiction and the employer’s policies.

Case Studies

Real-life examples provide valuable insights into the treatment of tips in insurance claims and disputes. These cases highlight the legal and practical implications of the complex relationship between tips, insurance coverage, and tax reporting.

One notable case is the dispute between a restaurant owner and an insurance company over business interruption coverage during the COVID-19 pandemic. The restaurant owner claimed lost income due to the shutdown, including tips that typically form a significant portion of servers’ earnings.

The insurance company denied the claim, arguing that tips are not considered insurable income.

Legal Implications

The legal implications of this case hinge on the definition of “gross income” in the insurance policy. If tips are considered part of gross income, the restaurant owner may have a valid claim for business interruption coverage. However, if tips are excluded from gross income, the insurance company’s denial of the claim may be upheld.

Practical Implications

The practical implications of this case extend beyond the immediate dispute. It raises questions about the treatment of tips in other insurance contexts, such as disability insurance, workers’ compensation, and life insurance. Furthermore, it highlights the need for clear and consistent definitions of gross income in insurance policies to avoid disputes and ensure fair treatment of policyholders.

Final Conclusion

Navigating the complexities of tips in the insurance industry requires a comprehensive understanding of tax regulations, policy provisions, and ethical considerations. Insurance agents and professionals must remain vigilant in adhering to reporting requirements and industry standards to ensure fair and transparent practices.

As the insurance landscape continues to evolve, staying abreast of regulatory changes and best practices will be paramount in addressing the nuances of tip treatment and its impact on insurance coverage and payouts.

Answers to Common Questions

Q: How are tips typically classified in the insurance industry?

A: In the insurance context, tips are often categorized as either incidental tips or regular tips. Incidental tips are those received occasionally and not as a primary source of income, while regular tips are those received consistently and form a substantial portion of an individual’s earnings.

Q: Can tips influence insurability and premium calculations in insurance?

A: Yes, tips can indeed impact insurability and premium calculations. Insurance companies may consider tips as part of an individual’s income when assessing their financial stability and risk profile. Higher tip income may lead to increased insurability and potentially lower premiums, as it indicates a stronger financial position.

Q: What are some common ethical considerations related to tips in the insurance industry?

A: Ethical considerations in the insurance industry revolve around transparency and disclosure of tips received. Insurance professionals have a responsibility to accurately report all tips as income, ensuring fair treatment and avoiding any misrepresentation of financial information.

Q: How do state regulations impact the treatment of tips in the insurance industry?

A: State regulations can vary in their approach to tips in the insurance industry. Some states may have specific rules or requirements regarding the reporting and taxation of tips, while others may align with federal guidelines. Insurance professionals should be aware of the regulations in their respective states to ensure compliance.