In the labyrinth of higher education, students face a myriad of challenges, both academic and financial. Among these, securing adequate health insurance coverage can be a daunting task. This guide delves into the intricacies of student insurance plans, providing essential tips and insights to help students make informed decisions and safeguard their well-being.

With rising healthcare costs and the complexities of insurance policies, understanding the nuances of student insurance plans is paramount. This comprehensive guide unravels the key components of these plans, empowering students to navigate the complexities of coverage options, deductibles, co-pays, and coinsurance.

Furthermore, it explores the significance of medical, mental health, prescription drug, dental, vision, and emergency coverage, ensuring students have a holistic understanding of the protection they seek.

Plan Basics

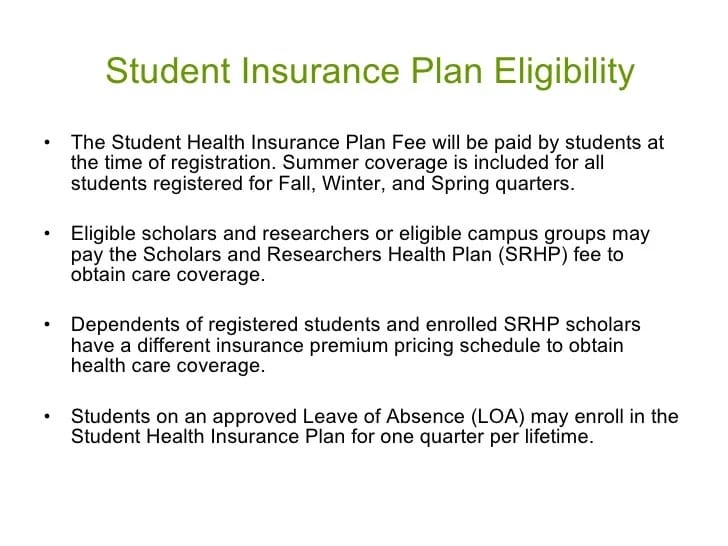

A student insurance plan serves as a safety net to protect your health and finances while you’re pursuing your education. Understanding the fundamental components of your plan will empower you to make informed decisions about your coverage.

Your student insurance plan typically consists of:

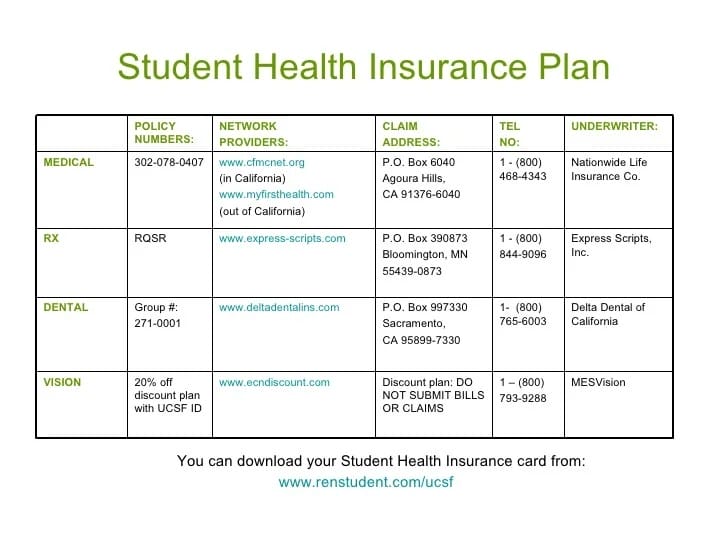

- Medical coverage: This covers expenses related to doctor visits, hospital stays, prescription drugs, and other medical treatments.

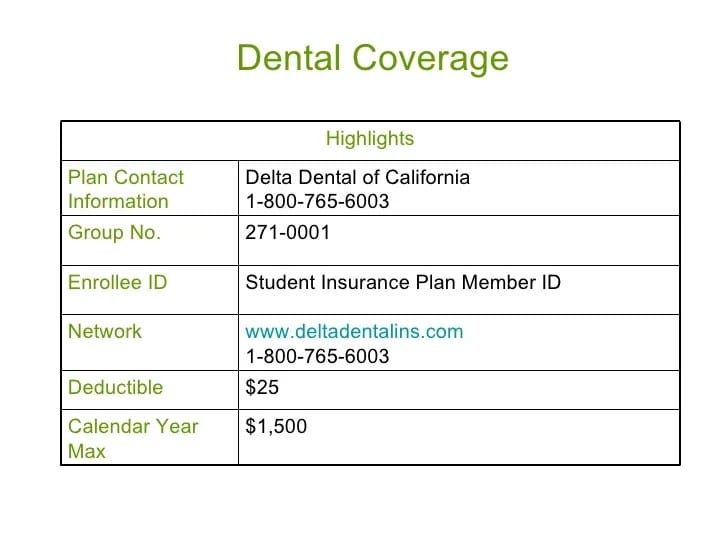

- Dental coverage: This covers expenses related to dental care, such as cleanings, fillings, and extractions.

- Vision coverage: This covers expenses related to eye exams, glasses, and contact lenses.

- Mental health coverage: This covers expenses related to therapy, counseling, and other mental health services.

It’s essential to understand the coverage options, deductibles, co-pays, and coinsurance associated with your plan.

Coverage Options

Coverage options determine the extent of your coverage. Some plans offer comprehensive coverage, while others may have more limited coverage.

- Comprehensive plans: These plans typically offer the most extensive coverage, including coverage for a wide range of medical expenses, including hospitalization, surgery, and prescription drugs.

- Limited plans: These plans typically offer more limited coverage, such as coverage for basic medical expenses, such as doctor visits and preventive care.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Deductibles can vary widely from plan to plan.

- Low-deductible plans: These plans typically have lower deductibles, but higher monthly premiums.

- High-deductible plans: These plans typically have higher deductibles, but lower monthly premiums.

Co-pays

A co-pay is a fixed amount you pay for certain medical services, such as doctor visits or prescription drugs.

Coinsurance

Coinsurance is a percentage of the cost of medical services that you pay after you’ve met your deductible. For example, if your coinsurance is 20%, you’ll pay 20% of the cost of your medical services after you’ve met your deductible.

Medical Coverage

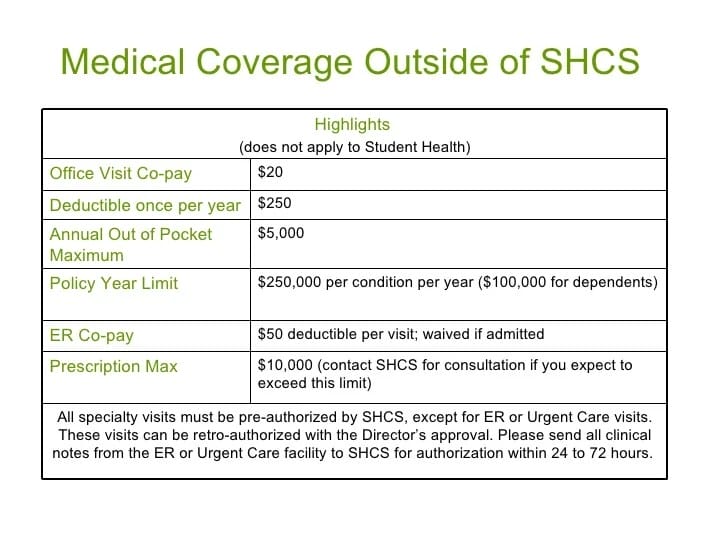

Medical coverage is crucial for students, ensuring access to healthcare services and financial protection in case of illness or injury. Student insurance plans typically offer a range of medical benefits, catering to the unique needs of students, both domestically and internationally.

The medical services covered by student insurance plans vary depending on the plan and provider. However, common services typically include:

- Inpatient and outpatient hospital care

- Physician visits

- Emergency medical services

- Prescription drugs

- Mental health services

- Preventive care, such as checkups and immunizations

These services can help students manage various medical expenses, including:

- Hospital stays

- Surgeries

- Medical tests and procedures

- Prescription medications

- Specialist visits

- Urgent care services

Mental Health Coverage

Mental health coverage is a crucial aspect of student insurance plans. Students face various stressors, including academic pressures, financial concerns, and social adjustments, which can impact their mental well-being. Comprehensive mental health coverage can provide students with access to necessary care and support.

Importance of Mental Health Coverage for Students

Mental health issues among students are prevalent. Studies have shown that approximately one in four students experience a mental health condition each year. These conditions can range from mild anxiety or depression to more severe disorders such as bipolar disorder or schizophrenia.

Without proper treatment, mental health issues can significantly impact students’ academic performance, social life, and overall well-being.

Typical Mental Health Services Covered by Student Insurance Plans

Student insurance plans typically cover a range of mental health services, including:

- Counseling and Therapy: Individual or group therapy sessions with a licensed mental health professional to address various mental health concerns.

- Psychiatric Care: Evaluation and treatment by a psychiatrist, including medication management and monitoring.

- Inpatient and Outpatient Care: Coverage for hospitalizations and partial hospitalization programs if necessary.

- Emergency Mental Health Services: Coverage for emergency mental health care, including crisis intervention and stabilization.

- Substance Abuse Treatment: Coverage for treatment programs for substance use disorders, such as alcohol or drug addiction.

Prescription Drug Coverage

Prescription drug coverage is a vital component of student health insurance, enabling access to essential medications for various conditions. These medications can help manage chronic illnesses, treat acute ailments, or maintain overall health and well-being.

Types of Prescription Drug Plans

There are several types of prescription drug plans available to students, each with its own structure and benefits:

Traditional Fee-for-Service Plans

Under this plan, students pay a set fee for each prescription they fill. This option offers flexibility and allows students to choose their pharmacy. However, it may result in higher out-of-pocket costs for expensive medications.

Preferred Provider Organization (PPO) Plans

PPO plans offer a network of preferred pharmacies where students can fill their prescriptions at discounted rates. These plans typically have lower copayments and coinsurance for medications obtained from network pharmacies.

Health Maintenance Organization (HMO) Plans

HMO plans require students to use a specific network of pharmacies and healthcare providers. While this may limit flexibility, HMO plans often provide lower premiums and out-of-pocket costs for medications covered under the plan.

Mail-Order Prescription Plans

These plans allow students to receive their medications through the mail, often at discounted prices. Mail-order plans are particularly convenient for students taking long-term or maintenance medications.

Tips for Saving Money on Prescription Drugs

Use Generic Drugs

Whenever possible, opt for generic medications, which are typically much more affordable than brand-name drugs. Generic drugs contain the same active ingredients as brand-name drugs but are not subject to brand-name patents.

Shop Around

Compare prices at different pharmacies before filling your prescriptions. Prices for the same medication can vary significantly between pharmacies. Online pharmacies often offer lower prices than traditional brick-and-mortar pharmacies.

Use a Prescription Discount Card

Several prescription discount cards are available, offering discounts on prescription drugs at participating pharmacies. These cards are typically free or low-cost and can save students significant money on their medications.

Ask Your Doctor or Pharmacist About Patient Assistance Programs

Some pharmaceutical companies offer patient assistance programs that provide free or low-cost medications to individuals who meet certain eligibility criteria, such as income or medical condition.

Dental and Vision Coverage

Dental and vision coverage are important aspects of student insurance plans, offering benefits for maintaining oral and eye health. These services can be costly when paid for out-of-pocket, making coverage essential for students on a budget.

Benefits of Dental and Vision Coverage

Dental and vision coverage provide numerous benefits for students, including:

- Preventive Care: Regular dental and eye exams help detect and address potential issues early on, preventing more serious and costly problems in the future.

- Reduced Costs: Dental and vision insurance plans often offer discounted rates for services, making them more affordable for students.

- Access to Specialists: Coverage may include access to specialists such as orthodontists and ophthalmologists, who can provide specialized care for more complex dental and vision issues.

Common Dental and Vision Services Covered by Student Insurance Plans

Student insurance plans typically cover a range of dental and vision services, including:

- Dental: Routine checkups, cleanings, X-rays, fillings, root canals, and extractions.

- Vision: Eye exams, prescription glasses or contact lenses, and treatment for eye conditions.

Maintaining Good Oral and Eye Health

In addition to regular dental and vision checkups, there are several steps students can take to maintain good oral and eye health:

- Oral Hygiene: Brush and floss teeth twice daily, and avoid sugary foods and drinks to prevent cavities and gum disease.

- Eye Care: Use protective eyewear when participating in sports or activities that could result in eye injury, and take breaks from screen time to reduce eye strain.

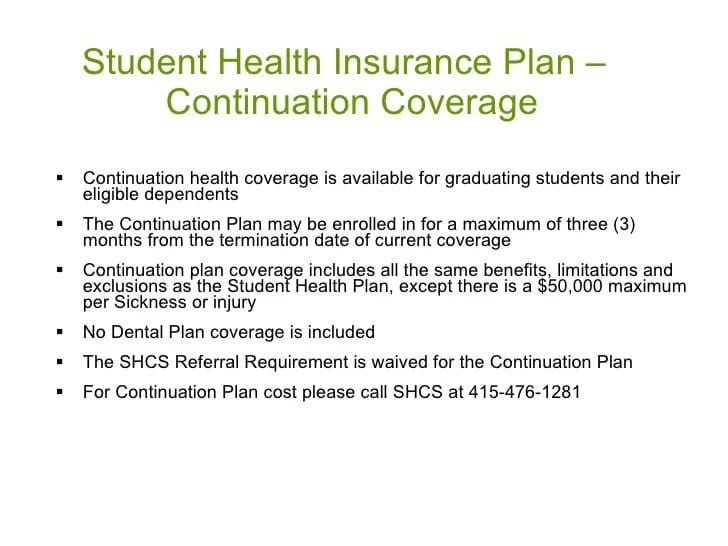

Emergency Coverage

Studying abroad or traveling frequently poses unique risks to students, making emergency coverage a crucial aspect of their insurance plans.Emergency coverage typically includes services like hospitalization, emergency medical treatment, and transportation. It also covers expenses related to medical emergencies, such as ambulance fees, prescription drugs, and emergency dental care.

Examples of Emergency Situations:

- A student studying abroad falls ill and requires hospitalization.

- A student traveling on a school trip suffers a sports injury and needs immediate medical attention.

- A student experiences a sudden allergic reaction and needs emergency medication.

Deductibles, Co-pays, and Coinsurance

Understanding the concept of deductibles, co-pays, and coinsurance is crucial in student insurance plans. These factors influence the overall cost of coverage and the amount of out-of-pocket expenses a student will incur.

A deductible is the fixed amount a student must pay out-of-pocket before the insurance plan begins to cover eligible expenses. Co-pays are fixed dollar amounts paid by the student for specific healthcare services, such as doctor visits or prescription medications.

Coinsurance is a percentage of eligible expenses that the student is responsible for paying after meeting the deductible. For example, if the coinsurance rate is 20%, the student will pay 20% of the eligible expenses, and the insurance plan will cover the remaining 80%.

Minimizing Out-of-Pocket Expenses

Students can employ various strategies to minimize their out-of-pocket expenses:

- Choose a plan with a higher deductible and lower premium. A higher deductible means a lower monthly premium, but the student will have to pay more out-of-pocket expenses before the insurance coverage kicks in.

- Utilize in-network providers. Many insurance plans have a network of healthcare providers who have agreed to provide services at discounted rates. Using in-network providers can significantly reduce out-of-pocket expenses.

- Ask about generic medications. Generic medications are typically less expensive than brand-name medications and offer the same benefits. Students should consult with their healthcare provider about the availability of generic alternatives.

- Take advantage of preventive care services. Many insurance plans cover preventive care services, such as annual checkups and screenings, at no cost. These services can help identify and address health issues early on, potentially preventing more costly medical expenses in the future.

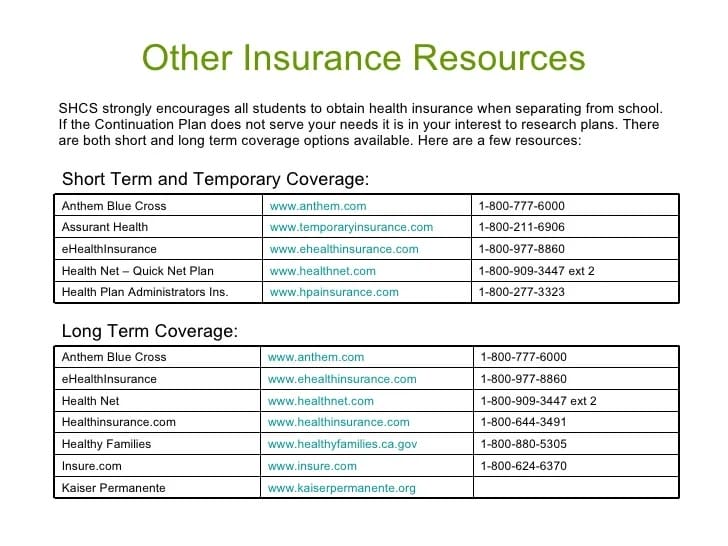

Plan Comparison

Comparing different student insurance plans can be a daunting task, but it’s essential to find the one that best suits your needs and budget. Here are some key factors to consider when comparing plans:

Coverage

The first step is to determine what coverage you need. Consider your medical history, current health status, and any anticipated future needs. Make sure the plan you choose covers the services you’re most likely to use, such as doctor’s visits, hospitalizations, and prescription drugs.

Cost

Student insurance plans can vary significantly in cost. Be sure to compare the monthly premiums, as well as the deductibles, co-pays, and coinsurance. Also, consider the cost of any additional services you may need, such as dental or vision care.

Customer Service

The quality of customer service can vary from plan to plan. Read reviews online or talk to other students who have used the plan to get an idea of what to expect. Make sure the plan you choose has a customer service team that is responsive and helpful.

Tips for Finding the Best Plan

Here are a few tips for finding the best student insurance plan for your needs and budget:

- Start your search early. The sooner you start comparing plans, the more time you’ll have to find the best one for you.

- Get quotes from multiple insurance companies. This will help you get a better idea of the cost and coverage of different plans.

- Read the fine print. Make sure you understand all the terms and conditions of the plan before you sign up.

- Talk to your doctor. If you have any specific medical needs, talk to your doctor about which plan is right for you.

Choosing an Insurance Provider

Selecting a reputable and reliable insurance provider is crucial for students seeking health insurance. Factors to consider include financial stability, customer service ratings, and network of providers. Research and comparison are essential in finding the best insurance provider.

Factors to Consider

- Financial Stability: Verify the provider’s financial health through ratings from independent agencies like AM Best or Standard & Poor’s.

- Customer Service Ratings: Check online reviews and ratings from reputable sources to gauge the provider’s responsiveness and customer satisfaction.

- Network of Providers: Ensure the provider has an extensive network of healthcare professionals and facilities, including specialists, hospitals, and pharmacies.

- Plan Options: Review the variety of plans offered by the provider to find one that aligns with your needs and budget.

Research and Comparison

- Online Research: Use comparison websites, insurance company websites, and online forums to gather information and compare plans.

- Contact Insurance Providers: Reach out to insurance providers directly to inquire about their plans, coverage options, and rates.

- Speak to Peers and Advisors: Seek recommendations and insights from fellow students, friends, family, and academic advisors.

Reading the Fine Print

Diligence in comprehending the intricate details of a student insurance plan is paramount. Beyond merely skimming through the document, it’s essential to decipher the intricacies of the terms and conditions, paying meticulous attention to exclusions, limitations, and waiting periods. These seemingly minor details can profoundly impact your coverage and potential reimbursements.

Navigating Insurance Policies

- Seek Clarity: If certain provisions or clauses appear ambiguous or confusing, don’t hesitate to seek clarification from the insurance provider or an experienced insurance professional. A clear understanding of the policy’s stipulations ensures you’re fully aware of your rights and obligations as an insured individual.

- Be Proactive: Don’t wait until a claim arises to familiarize yourself with the policy’s terms. Proactively reading and comprehending the policy beforehand will equip you to make informed decisions regarding your healthcare and maximize your coverage benefits.

- Review Regularly: Insurance policies are subject to periodic revisions and updates. Make it a habit to review your policy annually or whenever significant life changes occur, such as marriage, childbirth, or a change in employment status, to ensure your coverage remains adequate and aligned with your evolving needs.

Final Summary

In the ever-changing landscape of healthcare, student insurance plans serve as a lifeline, providing peace of mind and financial security. By carefully evaluating plan options, understanding coverage details, and choosing a reputable provider, students can ensure they have the protection they need to thrive academically and personally.

Remember, investing in comprehensive insurance coverage is an investment in your health and well-being, empowering you to focus on your studies and embrace the boundless opportunities that lie ahead.

FAQs

What factors should I consider when comparing student insurance plans?

When comparing student insurance plans, key factors to consider include coverage options, cost, deductibles, co-pays, coinsurance, and the network of providers. Additionally, consider the plan’s reputation, customer service ratings, and any additional benefits or services it may offer.

How can I save money on prescription drugs?

There are several ways to save money on prescription drugs. Ask your doctor about generic alternatives, use mail-order pharmacies, and look for discount programs or coupons. Additionally, some insurance plans offer lower co-pays for generic drugs or have preferred pharmacies with discounted rates.

What is the significance of mental health coverage in student insurance plans?

Mental health coverage is crucial for students as they navigate the stressors of academic life, personal challenges, and transitioning to adulthood. Student insurance plans typically cover a range of mental health services, including therapy, counseling, and medication, providing essential support for students’ emotional well-being.