In the realm of personal finance, maximizing tax savings is a crucial aspect of prudent financial planning. One often-overlooked avenue for tax savings lies in the realm of insurance premiums. This comprehensive guide delves into the intricacies of tax savings on insurance premiums, providing a thorough understanding of the concept, eligibility criteria, tax implications, and strategies for optimizing these savings.

The concept of tax savings on insurance premiums revolves around the deductibility of certain insurance premiums from taxable income. By understanding the tax laws and regulations governing insurance deductions, individuals and businesses can leverage this opportunity to reduce their tax liability.

This guide explores the various types of insurance policies that offer tax benefits, the criteria for determining eligibility for these deductions, and the tax implications of different insurance policies.

Tax Savings on Insurance Premiums

Tax savings on insurance premiums refer to the ability to deduct certain insurance premiums from your taxable income, potentially reducing the amount of taxes you owe. Insurance policies that provide tax benefits typically cover health, life, and disability insurance.

Health Insurance Premiums

Health insurance premiums paid for yourself, your spouse, and your dependents may be tax-deductible if you itemize your deductions on your tax return. The amount of the deduction is limited to the amount of your total medical expenses that exceed 7.5% of your adjusted gross income (AGI).

Life Insurance Premiums

Life insurance premiums are generally not tax-deductible. However, there are some exceptions to this rule. For example, premiums paid for life insurance policies that are part of a qualified retirement plan, such as a 401(k) or IRA, may be tax-deductible.

Disability Insurance Premiums

Disability insurance premiums may be tax-deductible if you are self-employed. The amount of the deduction is limited to the amount of your disability insurance premiums that exceed 2% of your net income from self-employment.

Understanding Tax Deductions for Insurance Premiums

Tax deductions for insurance premiums can be a valuable way to reduce your tax liability. By understanding the different types of insurance premiums that are deductible and how they are taxed, you can maximize your tax savings.

There are a number of different types of insurance premiums that may be deductible on your tax return, including:

- Health insurance premiums

- Dental insurance premiums

- Vision insurance premiums

- Long-term care insurance premiums

- Disability insurance premiums

- Homeowners insurance premiums

- Renters insurance premiums

- Car insurance premiums

The tax treatment of different types of insurance policies varies. Some premiums are deductible above the line, which means they are deducted from your gross income before you calculate your taxable income. Other premiums are deductible below the line, which means they are deducted from your adjusted gross income (AGI) after you calculate your taxable income.

| Type of Insurance | Tax Treatment |

|---|---|

| Health insurance premiums | Deductible above the line |

| Dental insurance premiums | Deductible above the line |

| Vision insurance premiums | Deductible above the line |

| Long-term care insurance premiums | Deductible above the line |

| Disability insurance premiums | Deductible above the line |

| Homeowners insurance premiums | Deductible below the line |

| Renters insurance premiums | Deductible below the line |

| Car insurance premiums | Not deductible |

To maximize your tax savings through insurance deductions, it is important to keep track of all of your insurance premiums throughout the year. You should also be aware of the different tax rules that apply to different types of insurance policies.

By understanding the tax deductions available for insurance premiums, you can make sure that you are taking advantage of all of the tax savings that you are entitled to.

Eligibility for Tax Deductions on Insurance Premiums

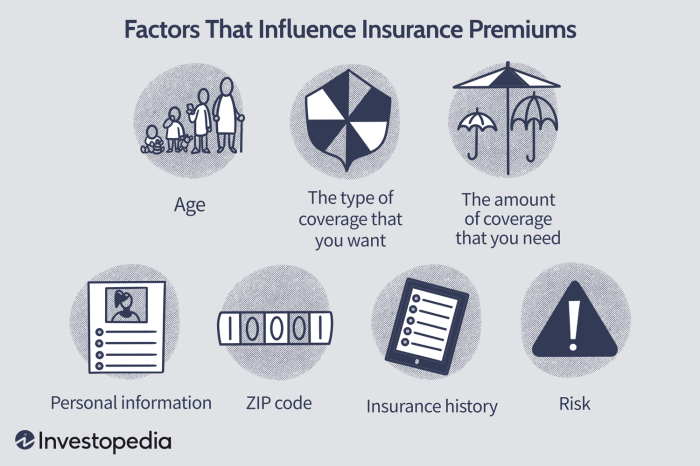

Determining eligibility for tax deductions on insurance premiums involves understanding the criteria set by the Internal Revenue Service (IRS). These criteria consider factors such as income, filing status, and the type of insurance policy. Let’s explore the details to gain a comprehensive understanding of eligibility requirements.

Income and Filing Status

The eligibility for tax deductions on insurance premiums is subject to income and filing status requirements. For individual taxpayers, the deduction is generally allowed if their Adjusted Gross Income (AGI) falls below certain limits. These limits vary based on filing status, with higher AGI limits for married couples filing jointly compared to single filers.

Type of Insurance

The type of insurance policy also plays a crucial role in determining eligibility for tax deductions. Generally, premiums paid for certain types of insurance, such as health insurance, dental insurance, and long-term care insurance, are eligible for tax deductions. However, premiums paid for other types of insurance, such as life insurance, homeowners insurance, and auto insurance, are not deductible.

Examples of Eligibility Scenarios

To illustrate the eligibility criteria, let’s consider a few scenarios:

- A married couple filing jointly with an AGI of $100,000 can deduct premiums paid for health insurance and long-term care insurance.

- A single taxpayer with an AGI of $75,000 can deduct premiums paid for health insurance and dental insurance.

- A business owner can deduct premiums paid for health insurance and workers’ compensation insurance for employees.

These examples highlight how income, filing status, and the type of insurance impact eligibility for tax deductions on insurance premiums. It’s important to consult with a tax professional or refer to IRS guidelines for specific details and potential changes in eligibility requirements.

Tax Implications of Different Insurance Policies

Insurance policies are a means of managing risk and protecting against financial losses. They also have tax implications that vary depending on the type of insurance policy and the tax laws of the jurisdiction in which the policy is held.

Understanding these tax implications is essential for making informed decisions about insurance coverage and maximizing potential tax benefits.

Health Insurance

Health insurance premiums are generally tax-deductible for individuals and employers. The amount of the deduction is limited to the amount of premiums paid during the year, up to certain limits set by the tax laws. Health insurance benefits, such as reimbursements for medical expenses, are generally not taxable.

Life Insurance

Life insurance premiums are not tax-deductible for individuals. However, the death benefit paid to beneficiaries is generally not taxable.

Property and Casualty Insurance

Property and casualty insurance premiums are generally tax-deductible for businesses. The amount of the deduction is limited to the amount of premiums paid during the year, up to certain limits set by the tax laws. Property and casualty insurance benefits, such as reimbursements for property damage or liability claims, are generally not taxable.

Examples of Tax Implications of Different Insurance Policies

- An individual who pays $1,200 in health insurance premiums during the year may be able to deduct that amount from their taxable income, reducing their tax liability.

- A business that pays $5,000 in property and casualty insurance premiums during the year may be able to deduct that amount from its taxable income, reducing its tax liability.

- A beneficiary who receives a $100,000 death benefit from a life insurance policy will not have to pay taxes on that amount.

Strategies for Maximizing Tax Savings on Insurance Premiums

Taking advantage of tax deductions and credits related to insurance premiums can significantly reduce your tax liability. Here are some strategies to help you maximize your tax savings on insurance premiums:

Review your insurance policies regularly: Assess your coverage needs annually and consider adjusting your policies accordingly. You may be able to reduce your premiums by dropping unnecessary coverage or increasing deductibles.

Bundling Insurance Policies

Bundling multiple insurance policies with the same insurer often leads to discounted rates and lower premiums. Explore bundling options for auto, home, and other insurance policies to potentially save money.

Raising Deductibles

Increasing your insurance deductibles can result in lower premiums. While this means paying more out-of-pocket expenses in the event of a claim, it can be a worthwhile trade-off for those who can afford it.

Exploring Premium Payment Options

Some insurance companies offer discounts for paying premiums annually instead of in installments. Consider this option if you have the financial means to do so.

Maintaining a Good Credit Score

Insurance companies often offer lower premiums to policyholders with good credit scores. Work on improving your credit score to potentially qualify for more favorable rates.

Taking Advantage of Tax Credits

Certain types of insurance premiums, such as long-term care insurance premiums, may qualify for tax credits. Research available tax credits and ensure you claim them accurately on your tax returns.

Impact of Tax Savings on Insurance Premiums on Financial Planning

Tax savings on insurance premiums can significantly impact an individual’s overall financial planning. These savings offer various advantages that contribute to long-term financial goals and enhance financial security.

One key benefit of tax savings on insurance premiums is the potential for increased investment returns. When a portion of insurance premiums is tax-deductible, it effectively reduces the overall cost of the insurance policy. This allows individuals to allocate more funds towards investments, which can accumulate over time and contribute to wealth accumulation.

Tax Savings and Retirement Planning

Tax savings on insurance premiums can play a crucial role in retirement planning. Many insurance policies, such as annuities and life insurance policies with cash value components, offer tax-deferred growth. This means that the earnings on these policies are not taxed until they are withdrawn, allowing them to grow more efficiently.

Tax Savings and Financial Security

Tax savings on insurance premiums can also enhance financial security. By reducing the cost of insurance, individuals can allocate more funds towards emergency savings or debt repayment. This can provide a financial cushion in case of unexpected events, such as job loss or medical emergencies.

Common Mistakes to Avoid When Claiming Tax Deductions for Insurance Premiums

Claiming tax deductions for insurance premiums can be a complex process, and mistakes can lead to disallowed deductions or even penalties. Here are some common mistakes to avoid:

Failing to Keep Proper Records

One of the most common mistakes is failing to keep proper records of insurance premiums paid. This includes receipts, invoices, and policy statements. Without proper records, it can be difficult to prove the amount of premiums paid and support your deduction claim.

Mixing Personal and Business Expenses

Another common mistake is mixing personal and business insurance expenses. For example, if you use your personal car for business purposes, you can only deduct the portion of your car insurance premiums that is related to business use. It is important to keep track of your business and personal expenses separately to avoid this mistake.

Claiming Deductions for Premiums Not Allowed by Law

Not all insurance premiums are tax-deductible. For example, premiums for life insurance, health insurance, and long-term care insurance are not deductible. It is important to research which insurance premiums are deductible before you file your tax return.

Overstating the Amount of Your Deduction

Another mistake to avoid is overstating the amount of your deduction. This can happen if you include premiums for policies that are not deductible or if you claim a deduction for a larger amount than you actually paid. Overstating your deduction can lead to penalties and interest.

Filing Your Tax Return Late

Finally, filing your tax return late can also lead to problems. If you file your return late, you may miss the deadline for claiming your insurance premium deduction. This can result in you losing out on a valuable tax break.

Tax Laws and Regulations Governing Tax Savings on Insurance Premiums

Navigating the tax landscape surrounding insurance premiums requires an understanding of the governing laws and regulations. The Internal Revenue Service (IRS) plays a crucial role in administering these rules and ensuring compliance.

The tax laws and regulations governing tax savings on insurance premiums are complex and subject to change. It is essential to stay updated on these changes to ensure compliance and take advantage of available deductions and credits.

Role of the Internal Revenue Service (IRS)

The IRS is responsible for administering and enforcing the tax laws and regulations governing tax savings on insurance premiums. Taxpayers can access a wealth of information and resources on the IRS website, including publications, forms, and instructions.

The IRS also provides guidance and assistance to taxpayers through its toll-free helpline and local offices. Taxpayers can also obtain assistance from tax professionals, such as accountants and enrolled agents.

Staying Updated on Changes in Tax Laws and Regulations

Tax laws and regulations are subject to change, making it essential for taxpayers to stay informed of these changes. The IRS regularly issues updates and guidance on tax-related matters.

Taxpayers can stay updated by regularly checking the IRS website, subscribing to IRS publications, and consulting with tax professionals. Additionally, taxpayers should be aware of any changes in state and local tax laws that may affect their tax liability.

Resources for Understanding Tax Savings on Insurance Premiums

Navigating the complexities of tax savings on insurance premiums can be daunting, but numerous resources are available to assist taxpayers in gaining a comprehensive understanding of the topic. These resources range from official government publications to professional organizations and qualified individuals.

Accessing IRS Publications and Websites

The Internal Revenue Service (IRS) provides a wealth of information on tax-related matters, including insurance premiums. Taxpayers can access IRS publications, such as Publication 526, “Charitable Contributions,” and Publication 529, “Miscellaneous Deductions,” to gain insights into the deductibility of insurance premiums.

The IRS website also features an extensive database of frequently asked questions (FAQs), allowing taxpayers to find answers to specific queries.

Utilizing Professional Organizations and Qualified Professionals

Professional organizations, such as the National Association of Insurance Commissioners (NAIC) and the American Council of Life Insurers (ACLI), offer valuable resources on insurance-related tax matters. These organizations often publish white papers, conduct webinars, and provide access to educational materials that can enhance taxpayers’ understanding of tax savings on insurance premiums.

Additionally, qualified professionals, such as tax advisors and insurance agents, can provide personalized guidance and assistance to taxpayers in navigating the intricacies of tax deductions for insurance premiums.

Finding Qualified Professionals

Taxpayers seeking qualified professionals to assist with tax-related insurance matters can leverage various resources. The IRS website features a directory of enrolled agents, who are federally authorized to represent taxpayers before the IRS. Additionally, state insurance departments maintain a database of licensed insurance agents who can provide information and guidance on insurance policies and their tax implications.

Professional organizations, such as the NAIC and ACLI, also offer directories of member professionals who specialize in insurance-related tax matters.

Case Studies of Successful Tax Savings Strategies for Insurance Premiums

Exploring real-world examples of successful tax savings strategies for insurance premiums can provide valuable insights into effective approaches. These case studies showcase how individuals and businesses have leveraged tax deductions and credits to minimize their insurance costs.

Individual Case Study: Maximizing Deductions for Health Insurance

John, a self-employed entrepreneur, faced high health insurance premiums. He discovered that he could deduct these premiums from his taxable income. By carefully tracking his medical expenses, including premiums paid, John was able to claim a substantial tax deduction, significantly reducing his overall tax liability.

Business Case Study: Optimizing Insurance Deductions for Business Assets

ABC Company, a small business, sought to minimize its tax burden. The company implemented a strategy to deduct insurance premiums paid for business assets, such as property, equipment, and vehicles. By categorizing these premiums as ordinary and necessary business expenses, ABC Company was able to reduce its taxable income and save on taxes.

Key Takeaways and Applicability to Other Situations

These case studies highlight the importance of understanding tax deductions and credits related to insurance premiums. By carefully reviewing insurance policies and consulting with tax professionals, individuals and businesses can identify opportunities to minimize their tax liability. These strategies can be applied to various situations, including:

- Self-employed individuals with high health insurance premiums.

- Businesses seeking to reduce expenses related to business assets.

- Families with multiple insurance policies.

By implementing similar strategies, taxpayers can potentially save money on their taxes and improve their overall financial well-being.

Last Recap

In conclusion, tax savings on insurance premiums represent a valuable opportunity for individuals and businesses to reduce their tax liability and enhance their financial well-being. By carefully planning and implementing tax-saving strategies, taxpayers can optimize their insurance coverage while minimizing their tax burden.

The insights provided in this guide empower readers with the knowledge and understanding necessary to navigate the complexities of tax savings on insurance premiums, ultimately leading to improved financial outcomes.

FAQ Summary

What are some common mistakes to avoid when claiming tax deductions for insurance premiums?

Common mistakes include claiming deductions for non-deductible premiums, failing to maintain proper records, and exceeding the limits set by the IRS. It is crucial to carefully review the tax laws and consult with a tax professional to ensure accurate reporting and avoid potential penalties.

How can I stay updated on changes in tax laws and regulations governing tax savings on insurance premiums?

To stay informed about changes in tax laws and regulations, regularly visit the Internal Revenue Service (IRS) website, subscribe to tax-related newsletters, and consult with qualified tax professionals. Staying updated ensures compliance and allows for timely adjustments to tax-saving strategies.

Where can I find resources to learn more about tax savings on insurance premiums?

Numerous resources are available to deepen one’s understanding of tax savings on insurance premiums. The IRS website provides comprehensive information, including publications and FAQs. Additionally, professional organizations, such as the National Association of Insurance Commissioners (NAIC), offer valuable resources and guidance.