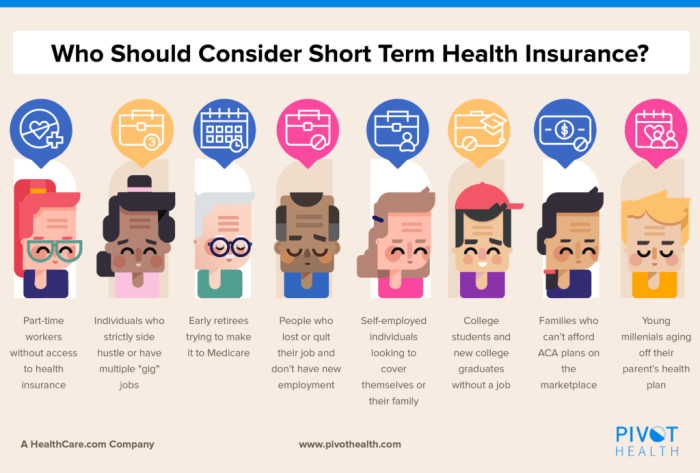

In the realm of healthcare, understanding your options for health insurance is paramount. Among the various types available, short-term health insurance has emerged as a viable solution for individuals seeking temporary coverage or those bridging gaps between major plans. Join us on an informative journey as we delve into the intricacies of short-term health insurance, exploring its benefits, eligibility criteria, coverage options, and essential tips to ensure a smooth and successful enrollment process.

Short-term health insurance serves as a safety net, providing peace of mind during life’s unpredictable moments. Whether you’re navigating a job transition, facing a gap in coverage, or simply seeking temporary protection, this guide will equip you with the knowledge and strategies to make informed decisions about your healthcare needs.

Defining Short-Term Health Insurance

Short-term health insurance provides temporary health coverage for a limited period, typically lasting from 30 days to 12 months. It offers a cost-effective option for individuals who need health coverage for a short period of time, such as during a gap in employment or while waiting for permanent health insurance to take effect.Short-term

health insurance can also be beneficial for individuals who are traveling abroad, as it can provide coverage for unexpected medical expenses incurred during their trip. It is important to note that short-term health insurance plans may have limitations on coverage and may not cover pre-existing conditions.

Benefits of Short-Term Health Insurance

Short-term health insurance offers several benefits, including:

- Temporary Coverage: Provides temporary health coverage for a specific period of time.

- Cost-Effective: Generally more affordable than traditional health insurance plans.

- Flexibility: Can be purchased for a short period of time, making it ideal for individuals with temporary needs.

- Coverage Options: Offers a range of coverage options to suit individual needs and budgets.

Duration and Renewal

Short-term health insurance policies typically offer coverage for a specific period, ranging from 30 days to 364 days. This duration allows individuals to bridge gaps in coverage between job changes, waiting periods for employer-sponsored plans, or while traveling abroad.

Renewal Process

The renewal process for short-term health insurance varies depending on the insurance provider and the policy terms. Some providers offer automatic renewal, while others require the policyholder to actively renew the policy before the coverage expires. It’s important to carefully review the renewal terms and conditions to avoid any lapse in coverage.

Changes in Coverage or Premiums

During the renewal process, the insurance provider may make changes to the coverage terms, including the benefits covered, the premium rates, or the deductible. It’s essential to thoroughly review these changes and understand how they may impact the coverage. If there are significant changes that are not acceptable, the policyholder can consider shopping for a new short-term health insurance plan.

Comparing Plans and Providers

Before finalizing your short-term health insurance policy, it’s essential to compare different plans and providers to make an informed decision. Consider these factors:

Coverage

Evaluate the coverage provided by each plan, including the types of medical services covered, annual or lifetime limits, deductibles, and copayments. Ensure the plan covers your essential healthcare needs and any pre-existing conditions you may have.

Cost

Compare the premiums, deductibles, and copayments associated with different plans. Consider your budget and choose a plan that fits your financial situation. Remember, the cheapest plan may not always be the best value.

Customer Service

Research the reputation and customer service of different providers. Read reviews and testimonials from other policyholders to get an idea of their experiences with the company. Consider factors such as responsiveness, ease of communication, and claim processing times.

Network of Providers

Check the network of providers covered by each plan. Ensure that the plan includes doctors, specialists, and hospitals in your area that you prefer or need to see. A broader network typically means more flexibility and convenience in accessing care.

Additional Benefits

Some short-term health insurance plans offer additional benefits, such as coverage for dental, vision, or prescription drugs. Consider these benefits when comparing plans, as they can add value to your policy.

Cost and Premiums

Understanding the cost and premium structure of short-term health insurance plans is crucial for making informed decisions. Premiums, the regular payments made to the insurance company, are determined by various factors, including age, health status, and the level of coverage selected.

Factors Influencing Premiums

Several factors influence the premium costs for short-term health insurance plans:

- Age: Age is a significant factor in determining premiums. Generally, younger individuals pay lower premiums compared to older individuals, as they are considered to be at lower risk of developing health issues.

- Health Status: Individuals with pre-existing medical conditions or a history of health issues typically pay higher premiums. This is because they are considered to be at higher risk of requiring medical care, leading to higher potential costs for the insurance company.

- Coverage Level: The level of coverage selected also impacts premiums. Plans with more comprehensive coverage, including a wider range of medical services and higher benefit limits, typically have higher premiums compared to plans with limited coverage.

Exclusions and Limitations

Short-term health insurance policies often come with exclusions and limitations that restrict coverage for certain conditions, treatments, or services. Understanding these limitations is crucial before purchasing a plan to avoid unexpected surprises and financial burdens.

Common exclusions in short-term health insurance policies include:

- Pre-existing conditions: Many short-term plans exclude coverage for pre-existing medical conditions, which are health problems that existed before the policy’s effective date. This means that if you have a pre-existing condition, you may not be eligible for coverage or may face higher premiums.

- Routine care and preventive services: Short-term plans typically do not cover routine checkups, immunizations, or preventive care services. This means that you may have to pay out-of-pocket for these services unless you have a separate policy or coverage through your employer.

- Mental health and substance abuse treatment: Some short-term plans may limit or exclude coverage for mental health and substance abuse treatment. This can be a significant limitation for individuals who need these services.

- Prescription drugs: Short-term plans may not cover prescription drugs or may have limited coverage. This means that you may have to pay full price for your medications unless you have a separate prescription drug plan.

- Out-of-network providers: Short-term plans may have limited networks of providers, which means that you may have to pay higher costs if you see a provider outside of the network.

It is important to carefully review the policy’s terms and conditions to understand the specific exclusions and limitations before purchasing a short-term health insurance plan. This will help you make an informed decision and avoid unexpected expenses.

State Regulations and Compliance

Short-term health insurance is regulated at the state level, with each state having its own unique set of laws and regulations governing the availability and coverage of these plans.

State regulations can have a significant impact on the availability and coverage of short-term health insurance plans, as well as the cost and premiums associated with these plans.

Impact of State Regulations

- Availability: State regulations can determine whether or not short-term health insurance plans are available in a particular state.

- Coverage: State regulations can also impact the coverage that is available under short-term health insurance plans, including the types of benefits that are covered and the limits on those benefits.

- Cost and Premiums: State regulations can also affect the cost and premiums associated with short-term health insurance plans, including the maximum amount that can be charged for these plans.

Special Considerations for Pre-Existing Conditions

Navigating health insurance with pre-existing conditions can be challenging. Short-term health insurance plans have specific guidelines for handling pre-existing conditions.

Understanding these guidelines is crucial to ensure you receive appropriate coverage. Here’s what you need to know about pre-existing conditions and short-term health insurance:

Exclusions and Limitations

Short-term health insurance plans often exclude coverage for pre-existing conditions. This means that any medical condition you had before the policy’s effective date may not be covered. The plan may also impose limitations on coverage, such as:

- Waiting periods before coverage begins for pre-existing conditions.

- Limits on the amount of coverage available for pre-existing conditions.

- Exclusions for certain treatments or medications related to pre-existing conditions.

Finding Plans That Offer Coverage

While many short-term health insurance plans exclude coverage for pre-existing conditions, some plans may offer limited coverage. These plans typically come with higher premiums and may have stricter underwriting guidelines.

To find plans that offer coverage for pre-existing conditions, you can:

- Contact insurance companies directly to inquire about their policies.

- Use an online insurance marketplace to compare plans and coverage options.

- Consult with an insurance agent or broker who specializes in short-term health insurance.

Reviewing the Policy Carefully

If you have a pre-existing condition and are considering a short-term health insurance plan, carefully review the policy’s terms and conditions. Pay particular attention to the plan’s exclusions and limitations related to pre-existing conditions. Make sure you understand the coverage you’re purchasing and the potential costs associated with your pre-existing condition.

Navigating the Application Process

Applying for short-term health insurance involves several key steps. Understanding these steps and providing accurate information can streamline the process and increase the chances of successful enrollment.

Before applying, gather the necessary information, including personal details, medical history, and any current or past health insurance coverage. Having this information readily available will help complete the application form efficiently.

Completing the Application Form

The application form typically consists of personal information, health history, and details about the desired coverage. Answer all questions truthfully and accurately, as any misrepresentation may affect the approval of the policy.

- Review the Application Carefully: Read the application form thoroughly before filling it out. Ensure you understand the questions and provide accurate answers.

- Provide Accurate Personal Information: Include your full name, address, date of birth, and Social Security number.

- Disclose Medical History: Provide details about your current and past medical conditions, including any ongoing treatments or medications. Be honest about any pre-existing conditions, as they may impact the policy’s terms and coverage.

- Specify Desired Coverage: Indicate the type of coverage you seek, such as individual or family coverage, and the desired policy term.

- Review and Sign the Application: Once you have completed the application, review it carefully to ensure all information is accurate and complete. Sign and date the application before submitting it to the insurance provider.

Additional Resources and Support

Finding the right short-term health insurance plan can be a daunting task. Fortunately, there are numerous resources available to help individuals navigate the process and make informed decisions.

One valuable resource is the Health Insurance Marketplace, a government-run website that provides information about short-term health insurance plans and allows individuals to compare plans and purchase coverage. The Marketplace also offers financial assistance to those who qualify.

Contact Information for Assistance

- National Association of Insurance Commissioners (NAIC): (800) 424-9459

- Kaiser Family Foundation: (202) 347-5270

- National Consumers League: (202) 835-3320

These organizations provide information and guidance on short-term health insurance, including how to choose a plan, understand the benefits and limitations, and file a complaint if necessary.

Final Thoughts

As you embark on your short-term health insurance journey, remember that informed choices lead to empowered healthcare decisions. Take the time to thoroughly research your options, compare plans, and seek guidance from experts if needed. By following the tips and considerations Artikeld in this guide, you can confidently navigate the complexities of short-term health insurance and secure the coverage that aligns with your unique needs and circumstances.

Frequently Asked Questions

Question: What are the key factors to consider when comparing short-term health insurance plans?

Answer: When comparing plans, focus on coverage, cost, customer service, and any exclusions or limitations. Ensure the plan meets your specific healthcare needs, fits your budget, and provides reliable support.

Question: How can I find plans that offer coverage for pre-existing conditions?

Answer: Research plans that cater to individuals with pre-existing conditions. Carefully review the policy details to understand the coverage limitations and exclusions related to your specific condition.

Question: What steps should I take to ensure a smooth application process?

Answer: Gather the necessary documents, including proof of identity, income, and health status. Accurately complete the application form, paying attention to details and providing accurate information.

Question: Where can I find reputable resources for more information about short-term health insurance?

Answer: Consult reliable websites, such as healthcare.gov, for comprehensive information. Additionally, contact organizations like the National Association of Insurance Commissioners (NAIC) for guidance and support.