In the realm of travel, uncertainty often looms, threatening to disrupt meticulously planned itineraries. Travel insurance emerges as a beacon of hope, providing a safety net to protect travelers from unforeseen events that can turn dream vacations into stressful nightmares.

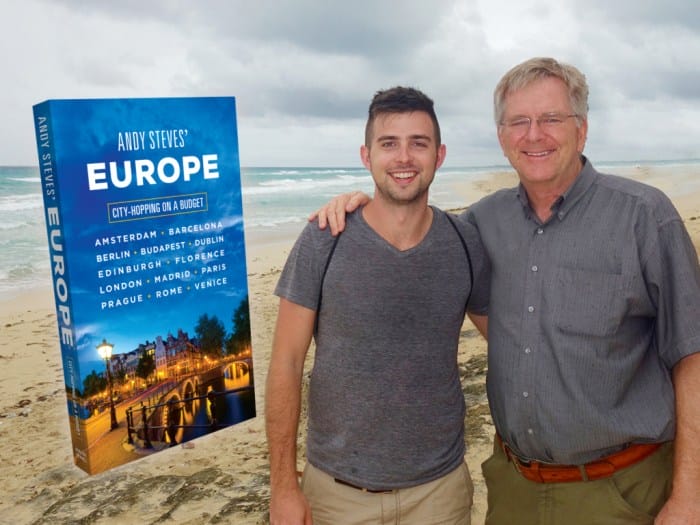

With Rick Steves, the trusted travel expert, as our guide, let’s delve into the intricacies of travel insurance coverage, unraveling its benefits, considerations, and intricacies to ensure a journey filled with peace of mind and security.

Understanding Travel Insurance Coverage

In the realm of travel, uncertainties lurk around every corner, and the consequences of unforeseen events can be substantial. Travel insurance emerges as a beacon of protection, safeguarding individuals from financial setbacks and ensuring peace of mind during their journeys.

It’s a comprehensive shield against unexpected occurrences, providing coverage for a wide range of scenarios that could disrupt or even jeopardize a trip.

Types of Coverage Typically Included in Travel Insurance Policies

Travel insurance policies typically encompass a diverse range of coverage options, catering to the varied needs of travelers. These may include:

- Trip Cancellation and Interruption Coverage: Reimburses expenses incurred due to unexpected trip cancellations or interruptions caused by covered reasons, such as illness, natural disasters, or airline strikes.

- Medical and Emergency Coverage: Provides coverage for medical expenses, emergency medical transportation, and repatriation in case of accidents or illnesses during the trip.

- Baggage and Personal Belongings Coverage: Protects against loss, theft, or damage to checked or carry-on luggage and personal belongings.

- Flight Delay and Missed Connection Coverage: Reimburses expenses associated with flight delays or missed connections, including meals, accommodation, and transportation costs.

- Rental Car Damage Coverage: Covers damage to rental vehicles caused by accidents or theft.

How Travel Insurance Can Protect Individuals During Their Trips

Travel insurance serves as a safety net, mitigating the financial impact of unforeseen events that could otherwise derail a trip. It offers peace of mind by providing:

- Financial Protection: Reimburses expenses incurred due to covered events, preventing significant financial losses.

- Access to Quality Healthcare: Ensures access to quality medical care and emergency services in unfamiliar destinations.

- Assistance in Emergencies: Provides 24/7 assistance in case of emergencies, including lost passports, stolen luggage, or medical emergencies.

- Peace of Mind: Knowing that you’re covered in case of unexpected events can significantly reduce stress and anxiety during travel.

Benefits of Travel Insurance

Purchasing travel insurance is a wise investment that can provide peace of mind and security before embarking on a journey. It offers a range of benefits that can assist travelers in various situations, protecting them from unforeseen events and ensuring a hassle-free trip.

Travel insurance can be especially beneficial for those traveling to unfamiliar destinations or engaging in adventurous activities. It can also provide coverage for unexpected medical emergencies, lost or stolen luggage, trip delays, and cancellations. By investing in travel insurance, travelers can safeguard their financial well-being and enjoy their journey with confidence.

Peace of Mind and Security

One of the primary benefits of travel insurance is the peace of mind it offers. Knowing that you are protected against potential risks and uncertainties can significantly reduce stress and anxiety associated with travel. Travel insurance provides a safety net that allows you to focus on enjoying your trip without worrying about unexpected events.

Moreover, travel insurance can provide a sense of security in unfamiliar environments. Whether you are exploring a foreign country or participating in adventurous activities, having travel insurance can give you the confidence to embrace new experiences without fear of financial setbacks or medical emergencies.

Coverage Considerations

Choosing the right travel insurance policy involves careful consideration of several key factors. Understanding your trip’s purpose, duration, destinations, and activities will help determine the coverage limits and types of coverage you need.

Before purchasing a policy, it’s crucial to grasp the policy terms and conditions, including exclusions, limitations, and any potential deductibles.

Trip Duration and Destination

The length and destination of your trip play a significant role in determining the coverage you need. For shorter trips within your home country, basic coverage may suffice. However, for extended trips or those involving international destinations, comprehensive coverage is advisable.

Types of Activities

Consider the activities you plan to engage in during your trip. If you’re an adventurous traveler planning activities like skiing, scuba diving, or bungee jumping, you’ll need coverage that specifically includes these activities.

Medical Coverage

Medical coverage is a crucial component of travel insurance, especially for international trips. Ensure your policy provides adequate coverage for medical emergencies, hospitalizations, and prescription medications.

Trip Cancellation and Interruption

Trip cancellation and interruption coverage protects you financially if you have to cancel or interrupt your trip due to unforeseen circumstances like illness, natural disasters, or flight cancellations.

Baggage and Personal Belongings

Coverage for baggage and personal belongings protects you against loss, theft, or damage to your luggage and its contents. Consider the value of your belongings and choose a policy with appropriate coverage limits.

Policy Terms and Conditions

Before purchasing a travel insurance policy, thoroughly read and understand the policy terms and conditions. Pay attention to exclusions, limitations, and deductibles. Knowing what’s covered and what’s not will help you make an informed decision.

Pre-Trip Planning

Planning and purchasing travel insurance well in advance of a trip is essential to ensure adequate coverage and peace of mind during your journey. Here’s why it’s important and what you should do before departure:

Checklist for a Smooth Trip

To ensure a smooth and stress-free travel experience, consider the following checklist:

- Medical Records: Make copies of your medical records, including prescriptions and immunization records. Keep these documents with you during your trip in case of emergencies.

- Emergency Contacts: Provide emergency contacts to your travel companions and leave a copy with a trusted person at home. Include their name, phone number, and relationship to you.

- Copies of Important Documents: Make copies of your passport, visa, driver’s license, and other important travel documents. Keep these copies separate from the originals in case of loss or theft.

- Travel Itinerary: Create a detailed travel itinerary that includes your flight information, hotel reservations, and planned activities. Share this itinerary with your travel companions and leave a copy with a trusted person at home.

- Packing Essentials: Pack essential items such as comfortable clothing, toiletries, and medications. Consider the weather and activities you’ll be participating in when packing.

- Travel Insurance Policy: Keep a copy of your travel insurance policy with you during your trip. Familiarize yourself with the terms and conditions of the policy, including coverage limits and exclusions.

Tips for a Smooth Travel Experience

Here are some additional tips for ensuring a smooth and stress-free travel experience:

- Arrive at the Airport Early: Allow ample time for check-in, security, and boarding. Aim to arrive at the airport at least two hours before your flight departure.

- Be Prepared for Delays: Delays can happen for various reasons. Pack a book, snacks, and entertainment to keep yourself occupied in case of unexpected delays.

- Stay Informed: Keep up-to-date on travel advisories and weather forecasts for your destination. Monitor the news and social media for any potential disruptions or changes in travel plans.

- Be Respectful of Local Customs: Familiarize yourself with the local customs and traditions of your destination. Be respectful of the culture and avoid any behavior that may be considered offensive.

- Stay Connected: Keep your phone charged and have a local SIM card or international roaming activated to stay connected during your trip. Inform your family and friends about your travel plans and check in with them regularly.

Emergency Assistance Services

Travel insurance companies often provide emergency assistance services that can prove invaluable in times of need. These services are designed to help travelers navigate unexpected situations, such as medical emergencies, lost luggage, or flight cancellations.

Contacting Emergency Assistance Providers

Accessing emergency assistance services is typically straightforward. Policyholders can usually contact their insurance provider 24/7 via a toll-free number or an online portal. Once connected with an assistance provider, travelers can explain their situation and receive guidance on how to proceed.

The assistance provider can arrange for medical care, transportation, or other necessary services, and can also help policyholders file a claim for reimbursement.

Medical Emergencies

One of the most important benefits of travel insurance is access to emergency medical assistance. If a traveler becomes ill or injured while abroad, their travel insurance policy can cover the cost of medical treatment, including hospitalization, surgery, and medication.

Emergency medical assistance services can also arrange for medical evacuation, if necessary.

Lost Luggage

Lost luggage can be a stressful experience, especially if it contains essential items like medication or travel documents. Travel insurance policies often provide coverage for lost or stolen luggage, up to a certain limit. In the event of lost luggage, policyholders should file a claim with their insurance provider as soon as possible.

The insurance company will then work with the airline or other carrier to locate the luggage or provide reimbursement for the lost items.

Flight Cancellations

Flight cancellations can disrupt travel plans and cause unexpected expenses. Travel insurance policies often provide coverage for flight cancellations, including reimbursement for non-refundable airfare, hotel accommodations, and meals. In some cases, travel insurance may also cover the cost of alternative transportation, such as a train or bus ticket.

Claims Process

Filing a travel insurance claim can be a daunting task, but with the right preparation and documentation, it can be a relatively smooth process. Here are the steps involved in filing a travel insurance claim:

Contact your insurance provider as soon as possible after the incident. The sooner you file your claim, the sooner you can receive reimbursement for your losses. Most insurance companies have a 24/7 claims hotline that you can call to report your claim.

Gather necessary documentation

When you file your claim, you will need to provide documentation to support your claim. This documentation may include:

- A copy of your travel insurance policy

- A copy of your passport and visa (if applicable)

- A copy of your airline tickets and boarding passes

- A copy of your hotel reservations

- A copy of your medical records (if applicable)

- A copy of your receipts for any expenses you incurred as a result of the incident (e.g., medical bills, transportation costs, hotel accommodations, etc.)

Complete the claim form

Your insurance company will provide you with a claim form that you will need to complete. The claim form will ask for information about the incident, your losses, and the documentation you are submitting.

Submit your claim

Once you have completed the claim form and gathered the necessary documentation, you can submit your claim to your insurance company. You can submit your claim online, by mail, or by fax.

Follow up on your claim

Once you have submitted your claim, you should follow up with your insurance company to ensure that it is being processed. You can check the status of your claim online or by calling your insurance company’s customer service department.

Exclusions and Limitations

Travel insurance policies often have exclusions and limitations that restrict the coverage provided. It’s crucial to carefully review the policy terms and conditions to understand what is and is not covered.

Common exclusions include:

- Pre-existing medical conditions: Many policies exclude coverage for medical expenses related to pre-existing conditions.

- High-risk activities: Policies may exclude coverage for injuries or accidents resulting from high-risk activities such as skydiving, scuba diving, or rock climbing.

- Acts of war or terrorism: Policies typically exclude coverage for losses or injuries resulting from acts of war or terrorism.

- Mechanical breakdowns: Policies generally do not cover mechanical breakdowns of vehicles or other equipment.

- Lost or stolen items: Policies may have limited coverage for lost or stolen items, and some items may be excluded altogether.

It’s important to note that these are just a few common exclusions. The specific exclusions and limitations in a policy can vary depending on the provider and the type of coverage purchased. Carefully reviewing the policy terms and conditions is essential to ensure you understand the coverage provided and any potential gaps in coverage.

Examples of Situations Not Covered by Travel Insurance

- A traveler who suffers a heart attack while on a trip may not be covered for medical expenses if they have a pre-existing heart condition.

- A traveler who is injured while skiing may not be covered if the policy excludes coverage for high-risk activities.

- A traveler whose luggage is lost or stolen may not be covered if the policy has limited coverage for lost or stolen items.

Additional Coverage Options

Travel insurance policies typically offer a range of additional coverage options that can be purchased to enhance the basic coverage. These options provide protection for various scenarios that may arise during a trip, such as adventure sports, baggage loss, and trip cancellation.Selecting

the right additional coverage options depends on the type of trip you are taking and the activities you plan to engage in. Consider the following factors when choosing additional coverage:

- Destination: Some destinations may pose higher risks than others, such as those with political instability or a high crime rate. Consider purchasing additional coverage for these destinations.

- Activities: If you plan to engage in adventure sports or other high-risk activities, such as scuba diving or rock climbing, you should purchase coverage that specifically covers these activities.

- Value of belongings: If you are traveling with valuable belongings, such as jewelry or electronics, you may want to purchase additional coverage for baggage and personal effects.

- Trip cost: If you are taking an expensive trip, you may want to purchase trip cancellation coverage to protect yourself in case you need to cancel your trip for a covered reason.

Adventure Sports Coverage

Adventure sports coverage provides protection for injuries or accidents that occur while participating in high-risk activities, such as skiing, snowboarding, scuba diving, and rock climbing. This coverage is typically not included in standard travel insurance policies, so it is important to purchase it separately if you plan to engage in these activities.

Baggage and Personal Effects Coverage

Baggage and personal effects coverage provides protection for your belongings in case they are lost, stolen, or damaged while in transit. This coverage typically covers items such as clothing, electronics, and jewelry. The amount of coverage you can purchase varies, so be sure to choose a policy that provides adequate protection for your belongings.

Trip Cancellation Coverage

Trip cancellation coverage provides reimbursement for the cost of your trip if you need to cancel for a covered reason, such as illness, injury, or a natural disaster. This coverage can be very valuable if you are taking an expensive trip or if you are concerned about the possibility of having to cancel your trip.

Comparison and Research

Navigating the world of travel insurance can be daunting, especially when faced with a myriad of policies and providers. To make an informed decision, it’s crucial to compare different options and conduct thorough research to find the best coverage that suits your individual needs.

Before embarking on your comparison journey, take some time to assess your travel plans, identify potential risks, and determine the level of coverage you require. This will help you narrow down your search and focus on policies that align with your specific needs.

Researching Reputable Travel Insurance Companies

When selecting a travel insurance provider, reputation and reliability are paramount. Look for companies with a proven track record of customer satisfaction, financial stability, and prompt claims handling. Read online reviews, consult consumer protection agencies, and seek recommendations from friends or family who have used travel insurance services.

Finding the Most Competitive Rates

Travel insurance rates can vary significantly between providers. To secure the most competitive deal, consider obtaining quotes from multiple companies. Online comparison tools can simplify this process by allowing you to compare policies and prices from various insurers simultaneously. Additionally, consider purchasing your travel insurance well in advance of your trip, as early purchase often leads to lower rates.

Peace of Mind and Security

Traveling can be exhilarating, but it also involves inherent uncertainties. Travel insurance offers a safety net that can alleviate stress and anxiety associated with unexpected events during your journey.

The peace of mind provided by travel insurance is invaluable. It allows you to focus on enjoying your trip without the constant worry of what might go wrong. Whether you’re exploring a foreign country or simply taking a domestic vacation, knowing that you’re protected in case of unforeseen circumstances can greatly enhance your travel experience.

Unexpected Medical Expenses

Medical emergencies can happen anywhere, anytime. Travel insurance can provide coverage for medical expenses incurred during your trip, including hospitalization, doctor visits, prescription medications, and emergency medical transportation. This coverage can save you from potentially astronomical medical bills, especially if you’re traveling to a country with a high cost of healthcare.

Trip Delays and Cancellations

Flight delays, cancellations, and missed connections are common travel disruptions that can wreak havoc on your itinerary. Travel insurance can reimburse you for non-refundable expenses, such as airline tickets, hotel reservations, and tour bookings, if your trip is delayed or canceled due to covered reasons.

Lost or Stolen Belongings

Losing your luggage or having your belongings stolen can be a nightmare. Travel insurance can provide coverage for lost, stolen, or damaged baggage and personal items, up to specified limits. This coverage can help you replace essential items and minimize the financial impact of such unfortunate events.

Summary

As you embark on your next adventure, remember that travel insurance is not just a mere expense; it’s an investment in tranquility, a shield against the unpredictable forces that may arise during your travels. With the right coverage, you can confidently navigate the world, knowing that you’re prepared for whatever life throws your way, ensuring a truly enriching and stress-free travel experience.

FAQs

Q: Why is travel insurance important?

A: Travel insurance provides a financial safety net, protecting you from unexpected events such as medical emergencies, lost luggage, trip delays, and more, ensuring peace of mind and a stress-free travel experience.

Q: What are the common types of travel insurance coverage?

A: Travel insurance typically covers trip cancellation or interruption, medical expenses, lost or damaged luggage, emergency assistance, and more. Additional coverage options may include adventure sports, baggage and personal effects, and trip cancellation coverage.

Q: When should I purchase travel insurance?

A: It’s advisable to purchase travel insurance as early as possible, ideally at the time of booking your trip. This ensures that you’re covered from the moment you make your travel arrangements.

Q: How do I file a travel insurance claim?

A: Contact your travel insurance provider as soon as possible after an incident occurs. Gather necessary documentation, such as receipts, medical records, and police reports, to support your claim. Follow the instructions provided by your insurance company to ensure a smooth and efficient claims process.

Q: What are some common exclusions in travel insurance policies?

A: Travel insurance policies typically exclude coverage for pre-existing medical conditions, illegal activities, and events resulting from war or terrorism. Carefully review the policy terms and conditions to understand what is and is not covered.