In today’s dynamic world, securing reliable car insurance is paramount. With the advent of SDIP 3 coverage, drivers now have access to comprehensive protection that caters to their evolving needs. However, navigating the insurance landscape can be daunting, leaving many unsure of how to find the best policy.

This comprehensive guide delves into the intricacies of SDIP 3 car insurance, providing valuable insights and practical tips to help you make informed decisions and safeguard your driving experience.

From deciphering safety ratings and understanding coverage options to evaluating financial stability and customer service, we’ll explore the key factors that contribute to a superior insurance policy. Additionally, we’ll uncover industry trends, regulatory influences, and consumer advocacy resources to empower you as an informed consumer.

Join us on this journey as we unlock the secrets to finding the perfect SDIP 3 car insurance policy, ensuring peace of mind and a smooth ride ahead.

Safety Ratings

When evaluating car insurance companies with SDIP 3 coverage, it’s crucial to consider their safety ratings. Safety ratings assess an insurance provider’s ability to protect policyholders from financial losses due to accidents, theft, and other covered events. These ratings are assigned by independent organizations based on various factors, including the company’s financial strength, claims handling process, customer satisfaction, and underwriting practices.

Safety ratings play a significant role in choosing an insurance provider as they provide valuable insights into the company’s overall performance and reliability. A higher safety rating typically indicates a more financially stable company with a strong track record of paying claims promptly and efficiently.

This can give policyholders peace of mind knowing that their claims will be handled fairly and without unnecessary delays.

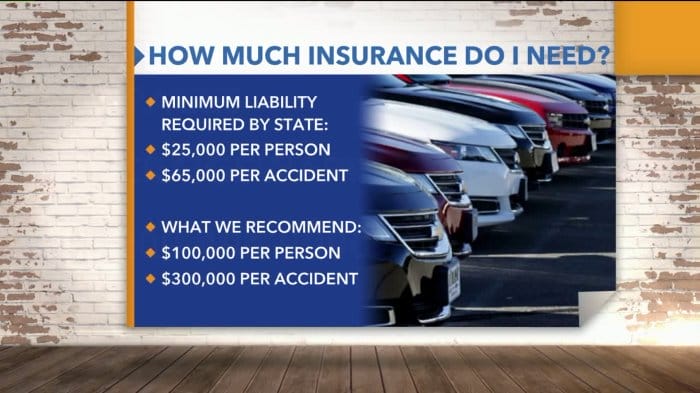

Impact on Insurance Premiums and Overall Costs

Safety ratings can also impact insurance premiums and overall costs. Insurance companies with higher safety ratings may offer lower premiums to policyholders as they are considered less risky to insure. This is because these companies have demonstrated a lower likelihood of paying out claims, resulting in lower overall costs for the insurer.

Additionally, a higher safety rating can lead to better terms and conditions in the insurance policy, such as lower deductibles and higher coverage limits.

Coverage Options

Understanding the various coverage options available under SDIP 3 car insurance policies is crucial to selecting a plan that aligns with your specific needs and circumstances. SDIP 3 policies typically offer a range of coverage options, each with its own benefits, limitations, and applicability to different scenarios.

The coverage options available under SDIP 3 car insurance policies can be broadly categorized into two types: comprehensive coverage and third-party coverage.

Comprehensive Coverage

Comprehensive coverage provides comprehensive protection for your vehicle, including coverage for damage caused by accidents, theft, vandalism, and natural disasters. This type of coverage is typically more expensive than third-party coverage, but it offers a wider range of protection.

- Collision Coverage: Covers damage to your vehicle caused by a collision with another vehicle or object.

- Comprehensive Coverage: Covers damage to your vehicle caused by theft, vandalism, natural disasters, and other non-collision events.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers in the event of an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: Covers damage to your vehicle and injuries to you and your passengers caused by a driver who is uninsured or underinsured.

Third-Party Coverage

Third-party coverage provides coverage for damage or injuries caused to other people or their property in the event of an accident that you cause. This type of coverage is typically less expensive than comprehensive coverage, but it does not provide protection for your own vehicle.

- Liability Coverage: Covers your legal liability for bodily injury or property damage caused to others in an accident that you cause.

- Medical Payments Coverage: Covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: Covers damage to your vehicle and injuries to you and your passengers caused by a driver who is uninsured or underinsured.

Financial Stability

Assessing the financial stability of car insurance companies offering SDIP 3 coverage is crucial for ensuring your peace of mind and the reliability of your insurance coverage. A financially stable insurance provider is more likely to honor claims promptly, maintain competitive rates, and provide consistent customer service.

Credit Ratings

Credit ratings are an essential indicator of a company’s financial strength and ability to meet its obligations. These ratings are assigned by independent agencies like Standard & Poor’s, Moody’s, and Fitch. Higher credit ratings indicate a lower risk of default, which means the insurance company is more likely to be able to pay claims.

Capitalization

Capitalization refers to the amount of money an insurance company has on hand to cover its obligations. A well-capitalized company is more likely to be able to withstand unexpected losses and continue operating smoothly. You can find information about a company’s capitalization in its financial statements.

Loss Ratio

The loss ratio is the percentage of premiums an insurance company pays out in claims. A high loss ratio can indicate that the company is taking on more risk than it can handle, which could lead to financial instability. You can find information about a company’s loss ratio in its annual report.

Customer Reviews

Customer reviews can provide valuable insights into the financial stability and reliability of an insurance company. Look for reviews that mention the company’s claims handling process, customer service, and overall satisfaction. These reviews can help you understand how the company operates and whether it is likely to be there for you when you need it most.

Customer Service

Evaluating customer service quality is crucial when choosing a car insurance company with SDIP 3 coverage. Positive customer experiences reflect a company’s commitment to resolving issues promptly and effectively. Conversely, numerous complaints and negative reviews may indicate potential problems.

To assess customer service quality, consider the following:

Customer Service Ratings and Reviews

Review ratings and feedback from reputable sources like the Better Business Bureau (BBB), Consumer Reports, and J.D. Power. High ratings and positive reviews often indicate satisfied customers, while low ratings and negative reviews may raise concerns.

Common Customer Service Issues

Research common customer service issues associated with different insurance providers. These may include difficulties reaching customer service representatives, delays in processing claims, disputes over coverage, and unsatisfactory resolutions.

Evaluating Customer Service Quality

- Responsiveness: Assess how quickly and efficiently customer service representatives respond to inquiries and resolve issues.

- Knowledge and Expertise: Evaluate the knowledge and expertise of customer service representatives in addressing your specific insurance needs and concerns.

- Courtesy and Professionalism: Consider the courtesy and professionalism of customer service representatives during interactions, ensuring they are respectful and helpful.

- Claims Handling: Examine the company’s claims handling process, including the ease of filing claims, the timeliness of claim settlements, and the overall satisfaction of customers with the claims experience.

By carefully evaluating customer service quality, you can choose an insurance company with SDIP 3 coverage that offers excellent service, ensuring a positive and hassle-free experience.

Claims Handling

Efficient and fair claims handling is a crucial aspect of choosing the right car insurance company with SDIP 3 coverage. When faced with an accident or covered loss, the insurance company’s claims process can greatly impact your experience and satisfaction.

Here are key factors to consider when evaluating the claims handling process of car insurance companies:

Timeliness of Claims Settlement

Timely claims settlement is of utmost importance. A prompt and efficient claims process ensures that you receive the necessary financial assistance and repairs quickly, minimizing the inconvenience caused by the accident or loss.

- Look for insurance companies known for settling claims promptly, meeting or exceeding industry standards for claim turnaround time.

- Consider the company’s track record in resolving claims within a reasonable timeframe, as this reflects their commitment to customer satisfaction.

Fairness of Claims Settlement

Fair claims settlement involves providing a just and reasonable settlement amount that adequately covers the damages or losses incurred.

- Assess the insurance company’s reputation for fair claim settlements, ensuring they have a history of treating policyholders fairly and resolving disputes amicably.

- Research the company’s claims settlement ratios, which indicate the percentage of claims paid out compared to the total claims received. A higher ratio generally indicates a fair claims settlement approach.

Transparency and Communication During the Claims Process

Transparency and clear communication throughout the claims process are essential for building trust and ensuring a positive customer experience.

- Look for insurance companies that provide clear and detailed information about the claims process, including step-by-step guides and timelines.

- Consider companies that offer multiple communication channels, such as online portals, phone lines, and email, making it convenient for policyholders to reach them.

Claims Handling Efficiency

Efficient claims handling involves minimizing paperwork, simplifying procedures, and leveraging technology to expedite the claims process.

- Check if the insurance company has an online claims reporting system, allowing policyholders to submit claims quickly and easily.

- Consider companies that offer mobile apps or online portals where policyholders can track the status of their claims and access relevant information.

Customer Service During the Claims Process

Excellent customer service during the claims process is crucial for resolving issues promptly and providing support to policyholders.

- Look for insurance companies with a reputation for providing responsive and helpful customer service, ensuring that policyholders feel valued and supported during the claims process.

- Consider companies that offer 24/7 customer support, ensuring that policyholders can reach them anytime they need assistance.

Cost and Affordability

![]()

The cost of SDIP 3 car insurance can vary significantly between different providers. Factors that influence insurance premiums include age, driving history, and vehicle type. Younger drivers and those with a history of accidents or traffic violations typically pay higher premiums than older drivers with clean records.

Additionally, the type of vehicle you drive can also affect your premium, with sports cars and luxury vehicles generally costing more to insure than sedans or minivans.

Shopping Around for Affordable SDIP 3 Car Insurance

To find the most affordable SDIP 3 car insurance policy, it is important to shop around and compare quotes from multiple providers. You can use an online insurance comparison tool or contact insurance companies directly to get quotes. It is also important to consider the level of coverage you need and the deductible you are willing to pay.

A higher deductible will typically result in a lower premium, but it is important to make sure you can afford to pay the deductible if you need to file a claim.

Tips for Saving Money on SDIP 3 Car Insurance

- Maintain a good driving record: Avoiding accidents and traffic violations can help you keep your insurance premiums low.

- Choose a vehicle with a low insurance risk: Vehicles that are less likely to be involved in accidents or stolen are typically cheaper to insure.

- Increase your deductible: A higher deductible can lower your premium, but make sure you can afford to pay it if you need to file a claim.

- Bundle your insurance policies: Bundling your car insurance with other policies, such as home or renters insurance, can often save you money.

- Shop around for quotes: Getting quotes from multiple insurance providers can help you find the best deal.

Online Resources

In today’s digital age, many car insurance companies offer comprehensive online resources to help you research, compare, and purchase SDIP 3 coverage. These resources can save you time and effort, allowing you to make informed decisions about your insurance needs.

When evaluating the online resources of different car insurance companies, consider the following factors:

User-Friendliness

The website should be easy to navigate, with clear and concise information. Look for a user-friendly interface that allows you to easily find the information you need.

Available Tools and Features

Some insurance companies offer a range of online tools and features to help you manage your policy, such as online bill pay, policy changes, and claims filing. These features can make it easier to manage your insurance and stay up-to-date on your coverage.

Ability to Obtain Quotes and Purchase Policies Online

Many insurance companies allow you to obtain quotes and purchase policies online. This can be a convenient way to compare rates and coverage options from multiple companies without having to contact each one individually.

| Insurance Company | Website User-Friendliness | Available Tools and Features | Ability to Obtain Quotes and Purchase Policies Online |

|---|---|---|---|

| Company A | Easy to navigate, with clear and concise information | Online bill pay, policy changes, claims filing, quote comparison | Yes |

| Company B | Somewhat cluttered, but still easy to find information | Online bill pay, policy changes, quote comparison | Yes |

| Company C | Clean and modern design, with easy-to-follow instructions | Online bill pay, policy changes, claims filing, quote comparison, accident forgiveness calculator | Yes |

| Company D | Dated design, but still functional | Online bill pay, policy changes, quote comparison | No, must contact an agent |

Industry Trends

The car insurance industry is undergoing significant transformations, driven by technological advancements, changing consumer behaviors, and regulatory shifts. These trends are reshaping the landscape of SDIP 3 car insurance, influencing consumer choices, and paving the way for future innovations.

One prominent trend is the rise of telematics and usage-based insurance (UBI). Telematics devices collect data on driving behavior, such as mileage, speed, and braking patterns, which insurers use to determine premiums. UBI policies reward safe drivers with lower rates, encouraging responsible driving and potentially reducing accidents.

Impact of Technology

- Internet of Things (IoT): IoT devices in cars generate vast amounts of data that insurers can use to assess risk and personalize policies. This data can include vehicle diagnostics, location tracking, and driver behavior.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms analyze data from IoT devices and other sources to predict claims frequency and severity. This enables insurers to offer more accurate and tailored pricing.

- Blockchain Technology: Blockchain can enhance transparency and security in the claims process, reducing fraud and streamlining communication between insurers and policyholders.

Changing Consumer Preferences

- Increased Demand for Personalized Policies: Consumers are increasingly seeking personalized insurance policies that reflect their individual needs and driving habits.

- Growing Awareness of SDIP 3 Coverage: As awareness of SDIP 3 coverage grows, more consumers are seeking policies that provide comprehensive protection against natural disasters.

- Preference for Digital Platforms: Consumers are increasingly using digital platforms to research, compare, and purchase insurance policies, leading to a rise in online insurance marketplaces.

Regulatory Shifts

- Government Mandates: Governments in some regions are implementing mandates that require insurers to offer SDIP 3 coverage, driving demand for these policies.

- Stricter Underwriting Standards: Insurers are adopting stricter underwriting standards in response to rising natural disaster claims, which can impact the availability and affordability of SDIP 3 coverage.

Future Innovations

- Autonomous Vehicles: The advent of autonomous vehicles is expected to transform the car insurance industry, potentially leading to new insurance models and risk assessment methods.

- Shared Mobility: The growing popularity of shared mobility services, such as ride-sharing and car-sharing, is challenging traditional car ownership models and influencing insurance needs.

- Climate Change: The increasing frequency and severity of natural disasters due to climate change are driving innovation in SDIP 3 coverage and risk mitigation strategies.

These industry trends are shaping the future of SDIP 3 car insurance, creating opportunities for insurers to develop innovative products and services that meet the evolving needs of consumers.

Regulatory Environment

The regulatory environment governing SDIP 3 car insurance varies across different jurisdictions, with each region implementing specific regulations to ensure consumer protection, maintain market stability, and promote fair competition.

These regulations significantly impact the availability, pricing, and coverage options of SDIP 3 policies, shaping the overall landscape of this specialized insurance segment.

Impact of Regulations

- Availability: Regulatory frameworks determine the eligibility criteria for obtaining SDIP 3 insurance, including factors such as driving history, vehicle type, and geographical location. These regulations influence the accessibility of SDIP 3 policies for drivers with specific risk profiles.

- Pricing: Regulations often impose guidelines for pricing SDIP 3 policies, including rate-setting mechanisms and caps on premiums. These measures aim to ensure fair and competitive pricing practices, preventing excessive or discriminatory rates.

- Coverage Options: Regulatory requirements define the minimum coverage levels and optional add-ons available under SDIP 3 policies. These regulations ensure that consumers have access to a comprehensive range of coverage options tailored to their specific needs and risk exposures.

Recent Regulatory Changes

Regulatory environments governing SDIP 3 car insurance are subject to periodic reviews and updates. Recent regulatory changes have focused on addressing emerging risks, enhancing consumer protections, and promoting innovation in the insurance industry.

- Expansion of Coverage: Some jurisdictions have expanded the scope of SDIP 3 coverage to include additional perils, such as natural disasters and acts of vandalism, providing broader protection for policyholders.

- Telematics and Usage-Based Insurance: Regulatory changes have facilitated the adoption of telematics and usage-based insurance (UBI) programs, which allow insurers to offer personalized premiums based on individual driving behavior and vehicle usage patterns.

- Consumer Protections: Regulatory reforms have strengthened consumer protections by introducing measures to ensure transparent policy disclosures, fair claims handling practices, and accessible dispute resolution mechanisms.

Consumer Advocacy

Car insurance consumers have numerous resources at their disposal, including advocacy organizations and resources that provide essential information and support. These advocates play a pivotal role in fostering transparency, fairness, and affordability within the car insurance industry.

Consumer Advocates: Guardians of Transparency

Consumer advocacy organizations assume the responsibility of representing the interests of car insurance consumers, ensuring that their voices are heard and their concerns are addressed. They work diligently to promote transparency in the industry by:

- Scrutinizing and analyzing insurance policies and practices, exposing any hidden terms or conditions that may disadvantage consumers.

- Advocating for clear and concise policy language, ensuring that consumers can easily understand the coverage they are purchasing.

- Demanding accountability from insurance companies, holding them responsible for any unfair or deceptive practices.

Outcome Summary

Choosing the right SDIP 3 car insurance policy is a crucial decision that requires careful consideration of various factors. By delving into safety ratings, coverage options, financial stability, customer service, claims handling, and affordability, you can make an informed choice that aligns with your specific needs and budget.

Remember to leverage online resources, stay updated on industry trends and regulatory changes, and utilize consumer advocacy organizations to maximize your benefits. With the knowledge gained from this guide, you can confidently navigate the insurance landscape and secure the best SDIP 3 car insurance policy, ensuring a secure and stress-free driving experience.

FAQ

What is SDIP 3 car insurance?

SDIP 3 (Standard Deductible Insurance Plan 3) is a comprehensive car insurance policy that provides coverage for various scenarios, including accidents, theft, and natural disasters. It offers a standard deductible of $500 and allows policyholders to customize their coverage based on their specific needs.

How can I find the best SDIP 3 car insurance policy?

To find the best SDIP 3 car insurance policy, consider factors such as safety ratings, coverage options, financial stability of the insurance company, customer service reviews, claims handling efficiency, affordability, and online resources. Compare quotes from multiple providers to ensure you get the best coverage at a competitive price.

What are the benefits of having SDIP 3 car insurance?

SDIP 3 car insurance offers several benefits, including comprehensive coverage for a wide range of scenarios, customizable coverage options to suit individual needs, and a standard deductible of $500. It provides peace of mind knowing that you’re financially protected in case of an accident or other covered event.