Stepping into the realm of homeownership often involves navigating the complexities of private mortgage insurance (PMI). This insurance serves as a safety net for lenders, protecting them against potential losses in case of loan default. As a homebuyer, understanding PMI is crucial to making informed decisions and ensuring a smooth path towards homeownership.

This comprehensive guide delves into the intricacies of PMI, exploring its purpose, eligibility criteria, costs, benefits, drawbacks, and alternatives. We will also provide practical strategies for reducing PMI costs and optimizing your homeownership journey.

Private Mortgage Insurance (PMI) Basics

Private mortgage insurance (PMI) is a type of insurance that protects the lender in case the borrower defaults on their mortgage. PMI is typically required when the borrower makes a down payment of less than 20% of the purchase price of the home.

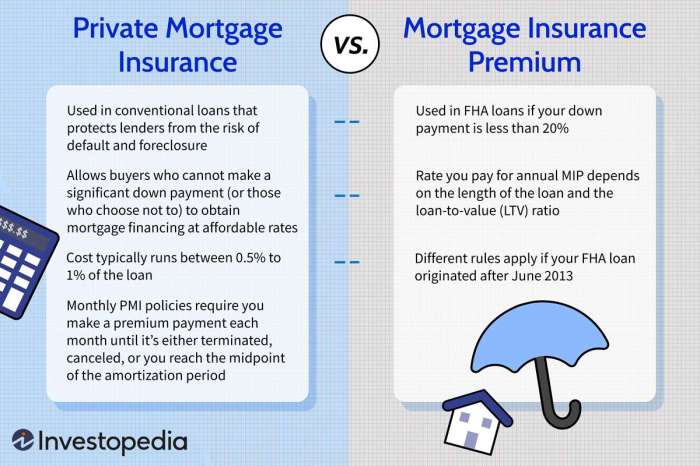

There are two main types of PMI: mortgage insurance premium (MIP) and private mortgage insurance (PMI) . MIP is a type of PMI that is required by the government for loans backed by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA).

PMI is a type of PMI that is offered by private lenders.

Understanding PMI Costs

The cost of PMI varies depending on the lender, the loan amount, and the borrower’s credit score. In general, the higher the loan amount and the lower the borrower’s credit score, the higher the PMI cost will be.

How to Avoid PMI

There are a few ways to avoid paying PMI. One way is to make a down payment of 20% or more of the purchase price of the home. Another way is to get a loan from a lender that does not require PMI.

Finally, some borrowers may be able to cancel PMI once they have reached a certain amount of equity in their home.

PMI Eligibility and Requirements

To be eligible for PMI, borrowers must meet certain credit score and down payment requirements. Lenders typically require a minimum credit score of 620 to qualify for PMI. However, some lenders may offer PMI to borrowers with credit scores as low as 600.

In addition to a minimum credit score, borrowers must also make a down payment of at least 3% to 5% of the purchase price of the home. The higher the down payment, the lower the PMI premium will be.

Debt-to-Income Ratio

Another factor that lenders consider when determining PMI eligibility is the borrower’s debt-to-income ratio (DTI). DTI is the percentage of a borrower’s monthly gross income that is used to pay monthly debt payments, including the mortgage payment, other housing expenses, and other debts such as car loans and credit card payments.

Lenders typically require a DTI of no more than 36% to 43% to qualify for PMI. However, some lenders may offer PMI to borrowers with DTIs as high as 50%.

Calculating PMI Costs

PMI premiums vary based on several factors, including the loan amount, interest rate, and PMI type. Here’s a step-by-step guide to calculate PMI premiums:

Loan Amount

The loan amount is the principal amount borrowed from the lender to purchase a home. A higher loan amount generally results in higher PMI premiums.

Interest Rate

The interest rate is the cost of borrowing money from the lender. A higher interest rate typically leads to higher PMI premiums.

PMI Type

There are two main types of PMI: upfront PMI and annual PMI . Upfront PMI is paid as a lump sum at closing, while annual PMI is paid in monthly installments over the life of the loan.

Upfront PMI is typically less expensive than annual PMI, but it can increase the overall cost of the loan.

Calculating PMI Premiums

To calculate your PMI premium, you can use the following formula:

PMI Premium = (Loan Amount x Interest Rate x PMI Factor) / 12

Where:

- Loan Amount is the principal amount borrowed from the lender.

- Interest Rate is the cost of borrowing money from the lender.

- PMI Factor is a percentage that varies based on the loan amount, interest rate, and PMI type.

For example, if you have a loan amount of $200,000, an interest rate of 4%, and an annual PMI factor of 0.5%, your PMI premium would be:

PMI Premium = (200,000 x 0.04 x 0.005) / 12 = $41.67

This means that you would pay $41.67 per month for PMI.

Benefits of PMI

Purchasing a home with private mortgage insurance (PMI) offers several advantages, particularly for first-time homebuyers and those with limited down payments. PMI can provide access to lower interest rates, more affordable monthly payments, and the opportunity to enter the housing market sooner.

Lower Interest Rates

When you purchase a home with PMI, you may qualify for a lower interest rate than if you did not have PMI. This is because lenders view borrowers with PMI as less risky, as the insurance protects them in case of default.

The lower interest rate can result in significant savings over the life of the loan.

More Affordable Monthly Payments

PMI can also help make your monthly mortgage payments more affordable. This is because the PMI premium is typically added to your monthly mortgage payment, rather than being paid upfront. This can make it easier to budget for your monthly housing expenses.

Entering the Housing Market

For first-time homebuyers, PMI can be a valuable tool for entering the housing market. PMI allows you to purchase a home with a down payment of as little as 3%, which can make it more affordable to buy a home sooner rather than waiting to save up a larger down payment.

Drawbacks of PMI

While PMI can be beneficial in certain situations, it also comes with some notable drawbacks that homebuyers should consider before making a decision.

The primary disadvantage of PMI is the additional monthly expense it adds to the cost of a mortgage. This can be a significant financial burden, especially for first-time homebuyers or those on a tight budget. Additionally, PMI can impact home equity.

Because PMI is paid to the lender, it does not go towards building equity in the home. This can make it more difficult to sell the home or refinance the mortgage in the future.

Long-term Costs of PMI

PMI can also have a long-term impact on homeownership goals. The longer a homeowner pays PMI, the more money they will spend on it. This can delay the time it takes to reach the 20% equity threshold required to remove PMI.

In some cases, homeowners may end up paying PMI for the entire life of their mortgage.

Alternatives to PMI

If you’re unable to make a 20% down payment, there are several ways to avoid paying PMI. These include increasing your down payment, getting a co-signer, or applying for a government-backed loan.

Increasing Your Down Payment

The most straightforward way to avoid PMI is to increase your down payment. By putting down more money upfront, you’ll reduce the amount of money you need to borrow and, therefore, the amount of interest you’ll pay. In addition, a larger down payment will give you more equity in your home, which can help you build wealth over time.

Getting a Co-Signer

If you can’t afford to increase your down payment, you may be able to get a co-signer. A co-signer is someone who agrees to repay your loan if you default. Having a co-signer can help you qualify for a loan even if you have a low credit score or a high debt-to-income ratio.

However, it’s important to note that a co-signer is also legally responsible for the loan, so you should only ask someone to co-sign if you’re confident that you’ll be able to make the payments.

Applying for a Government-Backed Loan

There are a number of government-backed loans that do not require PMI. These loans include FHA loans, VA loans, and USDA loans. To qualify for an FHA loan, you must have a credit score of at least 580 and a down payment of at least 3.5%. To qualify for a VA loan, you must be a current or former member of the military.

To qualify for a USDA loan, you must be buying a home in a rural area.

Strategies for Reducing PMI Costs

PMI premiums can add a significant amount to your monthly mortgage payments. Here are some strategies you can consider to reduce PMI costs: Make extra payments: Making extra payments on your mortgage can help you reduce your principal balance faster, which can lead to PMI cancellation sooner.

Even small extra payments can make a big difference over time. Improve your credit score: Lenders use your credit score to assess your risk as a borrower. A higher credit score can result in a lower PMI premium.

You can improve your credit score by paying your bills on time, reducing your debt, and keeping your credit utilization low.

PMI Cancellation or Removal

Once you have reached a certain point in your mortgage, you may be able to cancel or remove PMI. Here are some options: 80% loan-to-value (LTV) ratio: Many lenders will automatically cancel PMI once your LTV reaches 80%. This means that you have paid down 20% of your original loan amount.

PMI cancellation request: You can also request PMI cancellation from your lender once you have reached a certain amount of equity in your home. Typically, you need to have at least 20% equity to request PMI cancellation. Refinance your mortgage: Refinancing your mortgage can be a good way to get rid of PMI if you have a high credit score and low interest rates.

When you refinance, you take out a new loan to pay off your old loan. If your new loan amount is less than 80% of your home’s value, you may be able to eliminate PMI.

Impact of PMI on Homeownership

PMI can have a significant impact on homeownership, both in the short and long term. In the short term, PMI can increase the monthly mortgage payment, making it more difficult to afford a home. In the long term, PMI can delay the buildup of equity in the home, making it more difficult to sell or refinance.

Potential for Increased Equity and Appreciation

PMI can help homeowners build equity in their homes faster by increasing the amount of money that is paid towards the principal balance of the mortgage each month. This can lead to a faster buildup of equity, which can increase the homeowner’s financial stability and make it easier to sell or refinance the home in the future.

Additionally, PMI can help homeowners benefit from home appreciation. As the value of the home increases, the amount of equity that the homeowner has in the home also increases. This can lead to a significant financial gain for the homeowner when they eventually sell the home.

Overall Cost of Homeownership and Timeline for Achieving Financial Stability

PMI can increase the overall cost of homeownership by increasing the monthly mortgage payment. This can make it more difficult for homeowners to afford a home, especially if they are on a tight budget. Additionally, PMI can delay the timeline for achieving financial stability.

By increasing the monthly mortgage payment, PMI can make it more difficult for homeowners to save money and pay down other debts. This can delay the homeowner’s ability to reach financial stability and make it more difficult to achieve their long-term financial goals.

Consulting with Financial Advisors

Navigating the complexities of PMI and making informed decisions about mortgage options can be challenging. Seeking advice from qualified financial advisors or mortgage lenders is a wise move for homebuyers. These professionals possess the expertise to assess individual financial situations, analyze PMI implications, and guide homebuyers toward the most suitable course of action.

Financial Advisors’ Role in PMI Decisions

Financial advisors play a crucial role in helping homebuyers make informed decisions about PMI. Their comprehensive understanding of mortgage products, PMI requirements, and financial planning strategies enables them to provide tailored advice. By consulting a financial advisor, homebuyers can gain insights into:

- Their current financial situation and ability to afford PMI payments.

- The long-term impact of PMI on their overall financial goals and budget.

- Strategies for minimizing PMI costs and accelerating the removal of PMI.

- Alternative mortgage options that may be better suited to their financial circumstances.

Case Studies and Examples

Real-life examples and case studies can help homebuyers better understand the practical implications of PMI and how different strategies can lead to varying outcomes.

Let’s explore some illustrative case studies:

Case Study 1: Successful PMI Navigation

In 2022, Sarah and John purchased a $300,000 home with a 5% down payment. This meant they had to pay PMI since their loan-to-value (LTV) ratio was above 80%. They opted for a conventional loan with a 30-year term and an interest rate of 3.5%. Their monthly PMI payment was $150.

Sarah and John were diligent in making extra payments towards their principal balance. Within two years, they had increased their equity to 20%, which allowed them to drop PMI. They saved over $3,600 in PMI payments by proactively managing their mortgage.

Case Study 2: PMI Impact on Homeownership Goals

In contrast to Sarah and John, Mark and Jessica also purchased a $300,000 home in 2022 with a 5% down payment. However, they chose a government-backed loan, which allowed them to avoid PMI initially.

Mark and Jessica decided to focus on building their savings instead of making extra mortgage payments. As a result, it took them longer to reach the 20% equity threshold. They ended up paying PMI for four years, totaling over $7,200.

The difference in strategy between Sarah and John versus Mark and Jessica demonstrates how different approaches to PMI management can lead to different outcomes in terms of costs and achieving homeownership goals.

Conclusion

Navigating the complexities of PMI can be daunting, but with the right knowledge and strategies, homebuyers can make informed decisions that align with their financial goals. Consulting with financial advisors or mortgage lenders can provide personalized guidance, ensuring a successful and rewarding homeownership experience.

Answers to Common Questions

Question: What are the different types of PMI available?

Answer: PMI typically falls into two categories: upfront PMI and monthly PMI. Upfront PMI is paid as a lump sum at closing, while monthly PMI is incorporated into your monthly mortgage payments.

Question: How can I avoid paying PMI altogether?

Answer: There are several ways to avoid PMI, including making a larger down payment (typically 20% or more), seeking a co-signer with a strong credit score, or applying for government-backed loans such as FHA or VA loans.

Question: What are some strategies for reducing PMI costs?

Answer: Making extra payments towards your mortgage principal can help reduce your loan balance faster, potentially eliminating PMI sooner. Additionally, improving your credit score over time may allow you to refinance your mortgage at a lower interest rate, which can also reduce PMI costs.