In today’s healthcare landscape, understanding and selecting the right health insurance plan can be a daunting task. With the introduction of health insurance exchanges, individuals and families now have access to a marketplace where they can compare and enroll in various health insurance plans.

This guide provides comprehensive tips and insights to help you navigate the health insurance exchange and make an informed decision about your coverage.

The health insurance exchange serves as a platform that connects individuals and families with health insurance providers, enabling them to compare plans, understand their benefits, and enroll in coverage that best suits their needs. Whether you’re a first-time enrollee or seeking a new plan, this guide will equip you with the knowledge and strategies to make an informed choice.

Understanding Health Insurance Exchanges

Health insurance exchanges are online marketplaces where individuals and families can shop for and purchase health insurance plans. These exchanges were created as part of the Affordable Care Act (ACA) to make health insurance more accessible and affordable.

There are two types of health insurance exchanges: state-based exchanges and the federally-facilitated exchange. State-based exchanges are run by individual states, while the federally-facilitated exchange is run by the federal government. Most states have their own exchange, but some states have chosen to use the federally-facilitated exchange.

Eligibility Criteria and Enrollment Process

To be eligible for health insurance through an exchange, you must be a U.S. citizen or legal resident and not be incarcerated. You must also meet certain income requirements. The income limits for eligibility vary depending on the state and the type of health insurance plan you are applying for.

To enroll in health insurance through an exchange, you must create an account on the exchange website. Once you have created an account, you can shop for and compare health insurance plans. You can also get help from a certified navigator or broker.

Navigators and brokers can help you understand your options and choose the best health insurance plan for your needs.

Evaluating Health Insurance Plans

Selecting the most appropriate health insurance plan on the exchange requires careful evaluation. Key factors to consider include the premium, deductible, copay, coinsurance, and out-of-pocket maximum. Understanding these terms and assessing the cost and coverage of various plans is essential for making an informed decision.

Premium

The premium is the monthly payment you make to your insurance company for coverage. Premiums can vary significantly between plans, so it’s important to compare them carefully. Generally, plans with lower premiums have higher deductibles and copays, while plans with higher premiums have lower deductibles and copays.

Deductible

The deductible is the amount you must pay out-of-pocket before your insurance starts to cover your expenses. Deductibles can range from $0 to thousands of dollars. A higher deductible means you will pay less in premiums, but you will have to pay more out-of-pocket before your insurance kicks in.

Copay

A copay is a fixed amount you pay for certain medical services, such as doctor’s visits or prescription drugs. Copays are typically lower for preventive care services, such as annual checkups and screenings.

Coinsurance

Coinsurance is a percentage of the cost of covered medical expenses that you pay after you have met your deductible. Coinsurance rates vary between plans, but they are typically between 20% and 50%. For example, if you have a coinsurance rate of 20%, you would pay 20% of the cost of a covered medical expense after you have met your deductible.

Out-of-Pocket Maximum

The out-of-pocket maximum is the most you will have to pay for covered medical expenses in a year. Once you reach your out-of-pocket maximum, your insurance company will pay for all covered expenses for the rest of the year.

Tips for Assessing the Cost and Coverage of Different Plans

- Consider your overall health and the likelihood of needing medical care.

- Compare the premiums, deductibles, copays, coinsurance rates, and out-of-pocket maximums of different plans.

- Choose a plan that has a network of providers that you are comfortable with.

- Read the plan’s summary of benefits and coverage carefully to understand what is covered and what is not.

- Talk to your doctor or a health insurance agent to get help choosing the right plan for you.

Choosing the Right Plan for Your Needs

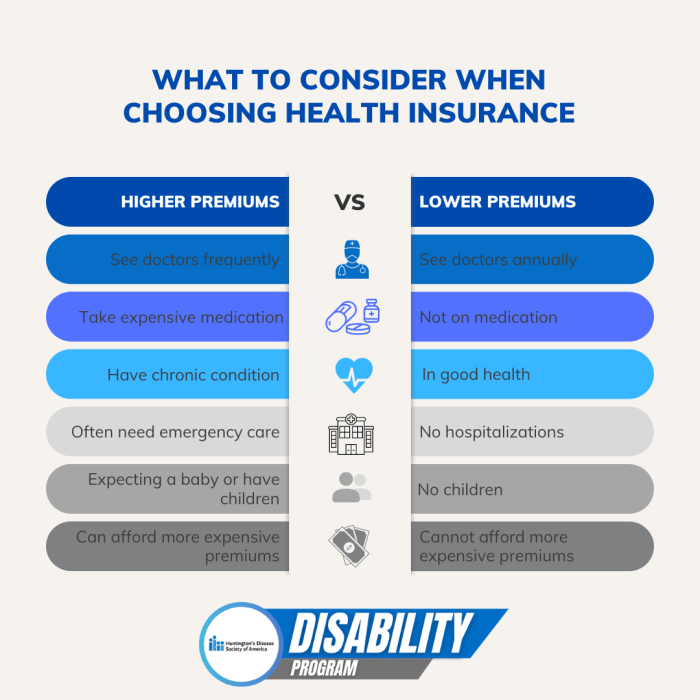

Selecting the right health insurance plan on the exchange is crucial, as it impacts your access to healthcare services and your financial well-being. Consider these factors when making your choice: Individual Health Needs: Assess your current and potential future health needs.

If you have chronic conditions or anticipate medical treatments, choose a plan that covers those services adequately. Family Size: Consider the number of family members who will be covered under the plan. Choose a plan that accommodates your family’s size and healthcare needs.

Budget: Determine your budget for health insurance premiums and out-of-pocket costs, such as deductibles, copays, and coinsurance. Choose a plan that fits your financial situation while providing adequate coverage.

Understanding Health Plan Types

Health insurance plans on the exchange are categorized into different types, each with its advantages and disadvantages. Here are the most common types: Health Maintenance Organization (HMO):

- HMO plans offer a comprehensive network of healthcare providers within a specific geographic area.

- You must choose a primary care physician (PCP) who coordinates your care and refers you to specialists if necessary.

- HMO plans typically have lower premiums but may have limited flexibility in choosing providers.

Preferred Provider Organization (PPO):

- PPO plans provide a broader network of healthcare providers than HMOs, including both in-network and out-of-network providers.

- You can choose any provider within the network without a referral from a PCP.

- PPO plans typically have higher premiums but offer more flexibility in choosing providers.

Exclusive Provider Organization (EPO):

- EPO plans are similar to HMO plans, but they have a more limited network of healthcare providers.

- You must choose a PCP within the network, and referrals are required to see specialists.

- EPO plans typically have lower premiums than PPO plans but may have more restrictions on choosing providers.

Evaluating the Provider Network

When selecting a health insurance plan, carefully evaluate the network of providers and healthcare facilities covered by the plan. Consider the following factors:

Location

Ensure that the plan includes providers and facilities in your area or where you frequently seek healthcare services.

Specialists

If you require specialized care, check if the plan covers the necessary specialists and healthcare facilities.

Quality of Care

Research the quality ratings and patient satisfaction scores of the providers and facilities included in the plan’s network.

Navigating Open Enrollment Periods

Open enrollment periods are crucial for individuals and families seeking health insurance coverage through health insurance exchanges. Understanding these periods and the associated processes is essential to ensure timely access to quality healthcare.

Annual Open Enrollment Period

The annual open enrollment period is a designated time frame during which individuals can apply for or change their health insurance plans through the health insurance exchanges. This period typically runs from November 1st to January 31st each year, allowing ample time for individuals to research and select a plan that best meets their needs and budget.

Applying for Coverage During Open Enrollment

Applying for health insurance coverage during the open enrollment period is a straightforward process. Individuals can visit the health insurance exchange website in their state or contact a licensed health insurance agent or broker to initiate the application process. The following steps are generally involved:

- Create an account on the health insurance exchange website.

- Provide personal information, including name, address, income, and household size.

- Explore available health insurance plans and compare their benefits, costs, and provider networks.

- Select a plan that meets your healthcare needs and budget.

- Submit your application and pay the initial premium payment.

Special Enrollment Periods

In addition to the annual open enrollment period, special enrollment periods may be available for individuals experiencing qualifying life events. These events include:

- Loss of health insurance coverage due to job loss, divorce, or aging out of a parent’s plan.

- Change in household size, such as marriage, birth, or adoption.

- Moving to a new state or county.

- Gaining eligibility for Medicaid or CHIP.

Individuals who experience a qualifying life event may be eligible to apply for health insurance coverage outside of the annual open enrollment period. To do so, they must provide documentation of the life event and meet the eligibility criteria set by the health insurance exchange.

Understanding Premium Tax Credits and Subsidies

In the realm of health insurance exchanges, a significant aspect to consider is the availability of premium tax credits and subsidies. These financial assistance programs are designed to alleviate the burden of healthcare costs for individuals and families meeting certain income requirements.

Individuals and families with household incomes between 100% and 400% of the federal poverty level are eligible for premium tax credits. These credits are calculated based on factors such as income, family size, and the cost of health insurance plans in the applicant’s area.

The amount of the credit is determined by the federal government and is applied directly to the monthly premium, reducing the overall cost of coverage.

Applying for Premium Tax Credits

To apply for premium tax credits, individuals and families can submit an application during the open enrollment period or when experiencing a qualifying life event, such as marriage, birth of a child, or loss of employer-sponsored coverage. The application process involves providing information about household income, family size, and the estimated cost of health insurance plans.

This information can be submitted online, by mail, or through a qualified health insurance agent or broker.

Impact on Overall Cost

The availability of premium tax credits can significantly reduce the overall cost of health insurance coverage. For eligible individuals and families, the tax credits can lower monthly premiums, making health insurance more affordable. This financial assistance can be particularly beneficial for those with lower incomes or those facing high healthcare costs.

Making Changes to Your Plan

During your health insurance plan, there may be times when you need to make changes to your coverage. Understanding the options available and the processes involved can help you manage these changes effectively.

Annual Open Enrollment Period

- The annual Open Enrollment Period (OEP) typically runs from November 1st to January 15th each year.

- During this period, you can make changes to your existing health insurance plan or switch to a new plan offered through the exchange.

- Changes made during the OEP will generally take effect on January 1st of the following year.

Special Enrollment Periods

- Special Enrollment Periods (SEPs) allow you to make changes to your health insurance coverage outside of the annual OEP.

- SEPs are available for certain qualifying life events, such as losing your job, getting married, or having a baby.

- To qualify for an SEP, you must meet the eligibility criteria and submit an application within a specific timeframe.

Switching Plans Within the Same Exchange

- If you want to switch to a different health insurance plan within the same exchange, you can do so during the OEP or an SEP.

- To switch plans, you will need to contact your current insurance company and request a cancellation of your coverage.

- You will then need to apply for a new plan through the exchange. Your new coverage will typically start on the first day of the month following your cancellation date.

Transferring Coverage to a Different Exchange

- If you are moving to a different state, you may need to transfer your health insurance coverage to a different exchange.

- To do this, you will need to contact your current insurance company and request a termination of your coverage.

- You will then need to apply for a new plan through the exchange in your new state. Your new coverage will typically start on the first day of the month following your termination date.

Tips for Managing Changes to Health Insurance Coverage

- Keep accurate records of your health insurance coverage, including your policy number, plan details, and contact information for your insurance company.

- Notify your health insurance company of any changes to your personal information, such as your address, phone number, or email address.

- Update your provider information with your insurance company if you change doctors or healthcare providers.

- Coordinate your care with your healthcare providers to ensure that you are receiving the necessary services and that your claims are processed correctly.

Additional Considerations for Choosing Health Insurance

When selecting a health insurance plan, it’s crucial to consider factors beyond the basics. These include prescription drug coverage, mental health benefits, and financial tools like health savings accounts (HSAs) and flexible spending accounts (FSAs).

Prescription Drug Coverage

Prescription drug coverage is essential for managing chronic conditions and staying healthy. Consider plans that cover your prescribed medications, especially if you take specialty drugs or require ongoing treatment. Compare plans based on their formularies, which list covered medications, and check for any restrictions or limitations.

Mental Health Benefits

Mental health is an integral part of overall well-being. Choose a plan that offers comprehensive mental health benefits, including coverage for therapy, counseling, and prescription drugs for mental health conditions. Look for plans with low deductibles and copays for mental health services to ensure affordability.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs and FSAs are tax-advantaged savings accounts that can help you manage healthcare costs. HSAs are available with high-deductible health plans (HDHPs) and allow you to contribute pre-tax dollars to cover eligible medical expenses. FSAs are available with various plans and let you set aside pre-tax money for qualified healthcare expenses.

Customer Service Ratings and Complaint History

Customer service is crucial when dealing with health insurance. Research plans’ customer service ratings and complaint history to gauge their responsiveness, efficiency, and overall customer satisfaction. Consider plans with high ratings and a low number of complaints to ensure a positive experience.

Resources for Assistance and Information

Navigating the health insurance exchange can be a complex process, but various resources are available to provide information and support. These resources include government agencies, non-profit organizations, and online resources.

Government Agencies

The Centers for Medicare & Medicaid Services (CMS) is the federal agency responsible for overseeing the health insurance exchanges. CMS provides information and resources to help individuals understand their health insurance options and enroll in a plan. Individuals can access information through the CMS website, by calling the CMS helpline, or by visiting a local CMS office.

Non-Profit Organizations

Several non-profit organizations provide information and assistance to individuals seeking health insurance through the exchange. These organizations include:

- The National Consumer Law Center (NCLC) provides information and resources on health insurance, including a guide to the health insurance exchanges.

- The Kaiser Family Foundation (KFF) is a non-profit organization that provides information on health insurance and other health policy issues. KFF offers a range of resources on the health insurance exchanges, including a guide to choosing a health insurance plan.

- The Commonwealth Fund is a private foundation that supports research on health care issues. The Commonwealth Fund provides information and resources on the health insurance exchanges, including a guide to understanding health insurance subsidies.

Online Resources

There are several online resources available to help individuals understand their health insurance options and enroll in a plan. These resources include:

- HealthCare.gov is the official website of the health insurance exchanges. Individuals can use HealthCare.gov to compare health insurance plans, enroll in a plan, and manage their health insurance account.

- The National Association of Insurance Commissioners (NAIC) provides information and resources on health insurance, including a guide to the health insurance exchanges.

- The eHealth Insurance Marketplace is a private website that allows individuals to compare health insurance plans and enroll in a plan.

Insurance Brokers and Agents

Insurance brokers and agents can help individuals navigate the health insurance exchange and select a suitable plan. Brokers and agents are licensed professionals who are familiar with the health insurance market and can provide expert advice. Individuals can find a licensed insurance broker or agent through the National Association of Insurance Commissioners (NAIC) website.

Free or Low-Cost Assistance Programs

There are several free or low-cost assistance programs available for individuals with limited resources. These programs can help individuals pay for health insurance premiums, deductibles, and copayments. Individuals can find information about these programs through the CMS website or by contacting their state Medicaid office.

Staying Informed and Up-to-Date

Staying informed about health insurance developments is crucial for making informed decisions and adapting to changes in regulations, policies, and available plans. Proactively monitoring premium rates, coverage options, and network changes helps consumers stay ahead and make timely adjustments to their health insurance coverage.

Monitoring Premium Rates and Coverage Options

Health insurance premium rates and coverage options are subject to change over time due to factors such as healthcare costs, regulatory updates, and market competition. By regularly monitoring these changes, consumers can assess whether their current plan still meets their needs and budget, and explore more affordable or comprehensive options if necessary.

Keeping Track of Network Changes

Health insurance networks can change over time, affecting the availability of healthcare providers and facilities covered under a particular plan. Staying informed about network changes ensures consumers can access the healthcare services they need and avoid unexpected out-of-network expenses.

Healthcare News and Industry Publications

Healthcare news and industry publications provide valuable insights into the latest developments in health insurance regulations, policies, and available plans. By following these sources, consumers can stay informed about changes that may impact their coverage and make informed decisions about their health insurance choices.

Making the Final Decision

Choosing a health insurance plan on the exchange is a significant decision that requires careful consideration. Here’s a summary of key factors to remember and a step-by-step checklist to guide you through the decision-making process:

Key Factors to Consider:

- Coverage and Benefits: Review the plan’s coverage details, including the types of medical services, prescription drugs, and preventive care it covers. Ensure that the plan meets your specific healthcare needs and preferences.

- Network of Providers: Check the plan’s network of healthcare providers, including doctors, hospitals, and specialists. Make sure your preferred healthcare providers are included in the network to ensure convenient access to care.

- Costs and Premiums: Compare the monthly premiums, deductibles, copayments, and coinsurance for different plans. Consider your budget and how much you’re willing to pay for healthcare coverage.

- Out-of-Pocket Maximums: Understand the plan’s out-of-pocket maximum, which is the highest amount you’ll have to pay for covered services before the plan starts paying 100% of the costs.

- Customer Service and Support: Research the plan’s customer service reputation, including its responsiveness, accessibility, and ability to resolve issues promptly.

Step-by-Step Checklist:

- Gather Information: Collect information about your healthcare needs, budget, and preferred healthcare providers.

- Research and Compare Plans: Use the exchange’s online tools or consult with a licensed insurance agent to compare different plans and their coverage, costs, and benefits.

- Narrow Down Your Choices: Shortlist a few plans that align with your needs and budget.

- Review Plan Details: Carefully read the plan’s summary of benefits and coverage, as well as the terms and conditions, to understand the coverage limitations and exclusions.

- Consult with Healthcare Providers: If you have specific healthcare needs or ongoing medical conditions, consult with your healthcare providers to ensure the plan covers the necessary services and medications.

- Consider Your Budget: Evaluate the plan’s costs, including premiums, deductibles, copayments, and coinsurance, and make sure they fit within your financial capabilities.

- Make Your Decision: Choose the plan that best meets your healthcare needs, budget, and preferences. Consider the factors discussed above and make an informed decision.

Remember, it’s crucial to carefully review the plan details, terms, and conditions before enrolling. If you have any questions or need assistance understanding the plan’s coverage or provisions, don’t hesitate to contact the insurance company or a licensed insurance agent.

Last Word

Choosing the right health insurance plan on the exchange requires careful consideration of various factors, including your health needs, budget, and preferences. By understanding the different types of plans, evaluating their costs and coverage, and utilizing available resources, you can navigate the exchange with confidence and select a plan that provides you with the protection and peace of mind you deserve.

Common Queries

Q: What is the purpose of a health insurance exchange?

A: A health insurance exchange is a marketplace where individuals and families can compare and enroll in various health insurance plans offered by different providers. It provides a platform for consumers to shop for coverage that meets their specific needs and budget.

Q: What factors should I consider when choosing a health insurance plan?

A: When selecting a health insurance plan, consider factors such as your health needs, budget, preferred healthcare providers, and prescription drug coverage. Evaluate the plan’s premium, deductible, copay, coinsurance, and out-of-pocket maximum to understand the costs associated with the plan.

Q: How can I apply for coverage through the health insurance exchange?

A: To apply for coverage through the health insurance exchange, you can visit the exchange website or contact a qualified insurance agent or broker. You will need to provide personal information, income details, and information about your household members. The open enrollment period typically occurs once a year, so it’s important to apply during this time to avoid any coverage gaps.

Q: What is a premium tax credit, and how can I qualify for it?

A: A premium tax credit is a financial assistance program that helps eligible individuals and families reduce the cost of their health insurance premiums. To qualify for a premium tax credit, you must meet certain income requirements and purchase a qualified health insurance plan through the exchange.

Q: How can I make changes to my health insurance plan?

A: You can make changes to your health insurance plan during the annual open enrollment period or during a special enrollment period if you experience a qualifying life event, such as marriage, birth of a child, or loss of coverage.

You can switch plans within the same exchange or transfer coverage to a different exchange if you move to a new state.