In a world where uncertainties lurk around every corner, safety insurance emerges as a beacon of protection for businesses and individuals alike. It’s a strategic shield against financial setbacks and legal liabilities arising from accidents, injuries, and product defects. This comprehensive guide delves into the intricacies of safety insurance, exploring its significance, benefits, and essential considerations for effective management.

Safety insurance isn’t just a mere financial tool; it’s an investment in peace of mind and resilience. By understanding its nuances, you’ll be better equipped to navigate the complexities of risk mitigation and safeguard your assets. Join us as we embark on this journey to unravel the world of safety insurance and uncover the strategies for navigating its complexities.

Definition and Overview of Safety Insurance

Safety insurance is a type of insurance that provides financial protection to individuals or businesses in the event of an accident or injury. It is designed to cover the costs associated with accidents, such as medical expenses, lost wages, and legal liability.

Safety insurance is an essential component of risk management for businesses and individuals alike. It provides peace of mind and financial security in the event of an unexpected event.

Types of Safety Insurance Policies

There are many different types of safety insurance policies available, each designed to cover specific risks. Some of the most common types of safety insurance policies include:

- General Liability Insurance: This type of insurance covers businesses for claims of bodily injury or property damage caused by their products, services, or operations.

- Workers’ Compensation Insurance: This type of insurance provides benefits to employees who are injured or become ill as a result of their work.

- Product Liability Insurance: This type of insurance covers businesses for claims of injury or damage caused by their products.

Importance of Safety Insurance

Safety insurance plays a pivotal role in safeguarding businesses and individuals from the financial implications of accidents, injuries, and legal liabilities. It acts as a protective shield, mitigating risks and ensuring financial stability in the face of unforeseen events.

Numerous real-life examples underscore the importance of safety insurance. Companies that have comprehensive safety insurance policies in place have been able to recover swiftly from accidents, minimizing downtime and protecting their assets. For instance, a manufacturing company insured against property damage was able to resume operations quickly after a fire incident, thanks to the financial assistance provided by the insurance policy.

Individuals and Personal Safety Insurance

For individuals, safety insurance provides peace of mind and financial security. Accidents and injuries can result in substantial medical expenses, lost wages, and legal liabilities. Personal safety insurance policies, such as health insurance, disability insurance, and liability insurance, offer a safety net, ensuring that individuals can receive the necessary medical care, maintain their income, and protect their assets in the event of an accident or injury.

Businesses and Commercial Safety Insurance

Businesses face a wide range of risks, including property damage, liability claims, and employee injuries. Safety insurance policies tailored to the specific needs of a business can help mitigate these risks and protect the company’s financial stability. For example, a construction company insured against property damage and liability claims was able to continue operating after a construction site accident, as the insurance policy covered the costs of repairs and legal expenses.

In essence, safety insurance is an indispensable tool for managing risks and ensuring financial security. By providing a financial safety net, it empowers businesses and individuals to navigate unforeseen events with greater resilience and confidence.

Benefits of Safety Insurance

Safety insurance offers a wide range of advantages that can provide individuals and businesses with valuable protection and peace of mind. By securing safety insurance, policyholders can benefit from various forms of coverage that can help mitigate risks, manage liabilities, and safeguard their financial well-being.

Financial Protection

One of the primary benefits of safety insurance is the financial protection it provides. In the event of an accident or incident covered by the policy, safety insurance can reimburse policyholders for expenses related to medical treatment, property damage, and legal liabilities.

This financial assistance can help individuals and businesses avoid substantial financial burdens and maintain their financial stability.

Legal Defense

Safety insurance often includes legal defense coverage, which provides policyholders with access to legal representation and assistance in the event of a lawsuit or legal claim. This coverage can be invaluable in defending against allegations of negligence or liability, helping policyholders navigate the legal process and protect their interests.

Risk Management

Safety insurance serves as a proactive risk management tool, enabling policyholders to identify and mitigate potential hazards and risks. By implementing safety measures and adhering to safety standards, policyholders can reduce the likelihood of accidents or incidents occurring, thereby minimizing the potential for losses and liabilities.

Peace of Mind

Having safety insurance can provide policyholders with peace of mind, knowing that they have taken steps to protect themselves and their interests. The assurance of financial protection and legal support can alleviate anxiety and uncertainty, allowing individuals and businesses to focus on their operations and activities without the constant worry of potential risks.

Comparison with Other Risk Mitigation Strategies

Compared to other risk mitigation strategies, safety insurance offers several advantages. It provides comprehensive coverage against a wide range of risks, including accidents, injuries, property damage, and legal liabilities. Additionally, safety insurance can help policyholders manage risks proactively by encouraging the implementation of safety measures and compliance with safety standards.

While other risk mitigation strategies, such as self-insurance or risk retention, may offer cost savings in the short term, they also carry significant financial and legal risks. Safety insurance, on the other hand, provides a more reliable and comprehensive approach to risk management, offering policyholders peace of mind and financial protection.

Factors Affecting Safety Insurance Premiums

Safety insurance premiums are not fixed and can vary depending on several factors. Understanding these factors can help businesses and individuals make informed decisions to reduce their insurance costs and ensure adequate coverage.

Industry Type

The type of industry a business operates in can significantly impact its safety insurance premiums. Industries with higher risks, such as construction, manufacturing, and transportation, typically have higher premiums compared to lower-risk industries like office work or retail.

Claims History

A business’s claims history is a crucial factor in determining its safety insurance premiums. Businesses with a history of frequent or severe claims are considered higher-risk and may face higher premiums. Conversely, businesses with a clean claims record may be eligible for lower premiums.

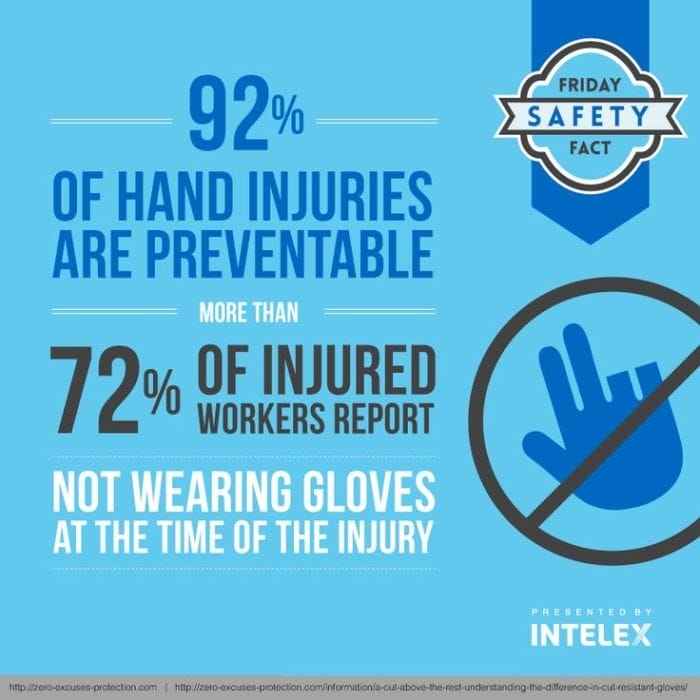

Safety Measures

The safety measures a business implements can positively impact its insurance premiums. Businesses that prioritize safety and implement comprehensive safety programs, such as regular inspections, training, and hazard controls, may be eligible for lower premiums.

Location

The location of a business can also affect its safety insurance premiums. Businesses located in areas with higher crime rates, natural disasters, or other risks may face higher premiums compared to businesses in safer areas.

Choosing the Right Safety Insurance Policy

When selecting a safety insurance policy, it is essential to assess the specific risks and needs of your business or personal situation. This involves identifying potential hazards, evaluating the likelihood of accidents, and determining the extent of coverage required. It is also important to compare quotes from multiple insurance providers to ensure you are getting the best value for your money.

Understanding Policy Terms and Conditions

Before making a decision, carefully review the policy terms and conditions to understand the coverage limits, exclusions, and any special provisions that may apply. It is important to ensure that the policy meets your specific needs and provides adequate protection against potential risks.

Safety Insurance Regulations and Compliance

Safety insurance regulations are a critical aspect of ensuring that businesses and individuals adhere to safety standards and fulfill their legal obligations. These regulations are established to protect workers, the public, and property from potential hazards and accidents.

Regulatory Landscape

The regulatory landscape governing safety insurance encompasses various laws, regulations, and industry standards. These include:

- Occupational Safety and Health Act (OSHA): This federal law sets minimum standards for workplace safety and health in the United States.

- National Institute for Occupational Safety and Health (NIOSH): NIOSH conducts research and provides guidance on workplace safety and health issues.

- American National Standards Institute (ANSI): ANSI develops voluntary consensus standards for various industries, including safety.

- State and Local Regulations: Many states and localities have their own safety regulations that may be more stringent than federal requirements.

Implications of Non-Compliance

Non-compliance with safety insurance regulations can have significant implications for businesses and individuals. These consequences may include:

- Legal Liability: Businesses that fail to comply with safety regulations may be held legally liable for accidents and injuries that occur on their premises.

- Fines and Penalties: Government agencies may impose fines and penalties on businesses that violate safety regulations.

- Loss of Insurance Coverage: Insurance companies may deny or cancel coverage for businesses that fail to comply with safety regulations.

- Damage to Reputation: Non-compliance with safety regulations can damage a business’s reputation and lead to loss of customers and clients.

Claims Process and Dispute Resolution

In the unfortunate event of a workplace accident or incident covered by safety insurance, policyholders must understand the claims process and dispute resolution mechanisms to ensure timely and fair compensation.

Filing a safety insurance claim involves several steps:

- Notification: Promptly notify the insurance provider about the incident or accident, as specified in the policy.

- Documentation: Gather relevant documentation, including accident reports, medical records, witness statements, and any other evidence supporting the claim.

- Submission: Submit the completed claim form, along with the required documentation, to the insurance provider within the specified timeframe.

- Assessment: The insurance provider will review the claim and may conduct an investigation to verify the information provided.

- Settlement: If the claim is approved, the insurance provider will determine the settlement amount based on the policy coverage and the extent of the loss.

- Payment: The insurance provider will issue payment to the policyholder or the designated beneficiary, as per the policy terms.

Common Challenges and Disputes

During the claims process, certain challenges and disputes may arise:

- Policy Interpretation: Disagreements may occur regarding the interpretation of policy terms and conditions, leading to disputes about coverage and liability.

- Claim Denial: The insurance provider may deny a claim based on various factors, such as policy exclusions, insufficient evidence, or failure to comply with policy requirements.

- Settlement Amount: Disputes may arise over the adequacy of the settlement amount offered by the insurance provider, leading to negotiations or further legal action.

Tips for Effective Dispute Resolution

- Open Communication: Maintain open communication with the insurance provider throughout the claims process, promptly responding to inquiries and providing additional information as requested.

- Legal Assistance: Consider seeking legal advice if the dispute becomes complex or if the insurance provider’s decision seems unfair.

- Mediation or Arbitration: Utilize alternative dispute resolution methods, such as mediation or arbitration, to resolve disputes amicably and avoid lengthy legal proceedings.

Emerging Trends and Innovations in Safety Insurance

The safety insurance industry is undergoing a period of rapid transformation, driven by technological advancements, data analytics, and risk assessment tools. These innovations are reshaping the way safety insurance is underwritten, priced, and managed, leading to improved risk management and enhanced safety outcomes.

Technology-Driven Underwriting and Pricing

One of the most significant trends in safety insurance is the use of technology to enhance underwriting and pricing processes. Insurers are leveraging advanced data analytics and machine learning algorithms to assess risks more accurately and tailor policies to the specific needs of businesses.

This data-driven approach enables insurers to price policies more competitively and provide customized coverage that better aligns with the actual risk profile of the insured.

Risk Assessment and Management

Safety insurance companies are increasingly adopting innovative risk assessment tools to help businesses identify and mitigate potential hazards. These tools utilize sensors, IoT devices, and data analytics to monitor and assess risks in real-time, enabling businesses to take proactive measures to prevent accidents and injuries.

By leveraging these tools, companies can enhance their safety performance, reduce the likelihood of claims, and improve their overall risk management strategies.

Digitalization and Automation

The safety insurance industry is also witnessing a surge in digitalization and automation. Insurers are investing in digital platforms and online portals that allow businesses to easily obtain quotes, purchase policies, and manage their coverage. Automated underwriting processes, powered by artificial intelligence, are streamlining the application and approval process, reducing turnaround times and improving the overall customer experience.

Collaborative Risk Management

Another emerging trend in safety insurance is the growing emphasis on collaborative risk management between insurers and businesses. Insurers are working closely with their clients to develop customized risk management plans that address the specific needs and challenges of their operations.

This collaborative approach fosters a shared responsibility for safety and encourages businesses to take proactive steps to improve their safety performance and reduce the likelihood of accidents.

Best Practices for Safety Insurance Management

Managing safety insurance policies effectively is crucial for businesses and individuals to protect themselves against potential financial losses and liabilities. Here are some best practices to consider for effective safety insurance management:

Regular Policy Reviews

Regularly reviewing your safety insurance policies is essential to ensure they align with your changing needs and risks. Conduct thorough reviews at least annually, or more frequently if significant changes occur.

Risk Assessments

Conduct thorough risk assessments to identify potential hazards and vulnerabilities within your operations. Use this information to tailor your safety insurance policies and coverage to address specific risks effectively.

Proactive Communication with the Insurance Provider

Maintain open and proactive communication with your insurance provider. Inform them promptly about any changes in your operations, such as new equipment, processes, or locations. This helps ensure your coverage remains adequate and up-to-date.

Maintaining a Strong Safety Record

Implementing and maintaining a robust safety program is key to reducing the likelihood of claims. This includes establishing clear safety policies and procedures, providing employee training, conducting regular safety inspections, and promptly addressing any identified hazards.

Training and Education

Invest in training and education programs to enhance employee awareness of safety protocols and procedures. Regular training can help prevent accidents and injuries, leading to fewer claims and lower insurance premiums.

Emergency Preparedness

Develop comprehensive emergency preparedness plans to respond effectively to accidents or incidents. This includes having clear evacuation procedures, first aid kits, and designated emergency contacts.

Case Studies and Real-World Examples

Safety insurance has proven its worth in numerous real-world scenarios, positively impacting businesses and individuals. Analyzing these case studies offers valuable insights for effective safety insurance management.

Positive Impact on Businesses

- Reduced Financial Burden: A manufacturing company faced a series of accidents resulting in costly lawsuits. Safety insurance coverage helped offset these expenses, preventing financial ruin and allowing the company to continue operations.

- Enhanced Employee Morale: A construction company implemented a comprehensive safety insurance program, leading to a significant decrease in workplace accidents. This improved employee morale, increased productivity, and reduced absenteeism.

- Improved Reputation: A retail chain experienced a product liability lawsuit due to a defective product. Safety insurance coverage not only provided financial protection but also helped maintain the company’s reputation and customer trust.

Positive Impact on Individuals

- Financial Security: An individual involved in a car accident received substantial medical treatment covered by their auto insurance. This financial protection allowed them to focus on recovery without the added stress of medical bills.

- Legal Protection: A homeowner faced a lawsuit due to an injury sustained on their property. Homeowners insurance provided legal defense and coverage for any potential liability, ensuring peace of mind.

- Peace of Mind: A business owner purchased liability insurance to protect against potential claims. This coverage provided reassurance, enabling them to operate their business with confidence.

These case studies underscore the significance of safety insurance in mitigating risks, safeguarding financial stability, and providing peace of mind. Effective safety insurance management involves careful assessment of risks, choosing appropriate coverage, and implementing proactive measures to prevent accidents and minimize liability.

Last Recap

As we conclude our exploration of safety insurance, it’s evident that this intricate web of policies and regulations plays a pivotal role in safeguarding businesses and individuals from unforeseen risks. By embracing best practices, staying informed about emerging trends, and fostering open communication with insurance providers, you can transform safety insurance into a proactive partner in your pursuit of success.

Remember, the true value of safety insurance lies not only in financial protection but also in the peace of mind it brings, allowing you to focus on your aspirations without the burden of uncertainty.

FAQ Corner

What are the common types of safety insurance policies available?

General liability, workers’ compensation, and product liability insurance are some of the most prevalent safety insurance policies.

How can safety insurance benefit businesses?

Safety insurance provides financial protection against liabilities, ensures compliance with regulations, and enhances the company’s reputation.

What factors influence safety insurance premiums?

Industry type, claims history, safety measures implemented, and location are key factors that impact premium rates.

What are the best practices for effective safety insurance management?

Regular policy reviews, risk assessments, proactive communication with the insurance provider, and maintaining a strong safety record are essential for effective safety insurance management.

What are emerging trends and innovations in the safety insurance industry?

The use of technology, data analytics, and risk assessment tools are transforming the way safety insurance is underwritten, priced, and managed.