In the realm of health insurance applications, tipped income individuals often find themselves navigating a unique set of challenges. From eligibility criteria to specific documentation requirements, the process can be daunting. This comprehensive guide aims to demystify the complexities of health insurance applications for tipped income individuals, providing a clear roadmap to secure the coverage they deserve.

With a focus on understanding eligibility requirements, deciphering the application process, exploring available plans, and accessing financial assistance, this guide empowers tipped income individuals to confidently navigate the healthcare landscape. Whether you’re self-employed or employed in the service industry, this guide will equip you with the knowledge and resources to make informed decisions about your health insurance coverage.

Eligibility Requirements

To qualify for health insurance coverage as a tipped income individual, certain criteria must be met. These criteria include income limits and specific calculations for tipped income.

Individuals applying for health insurance based on tipped income must demonstrate that their income falls within the established limits. The income limits vary depending on the state of residence and the size of the household. Generally, the higher the household size, the higher the income limit.

Calculating Tipped Income

Calculating tipped income involves understanding the concept of imputed income. Imputed income refers to the estimated amount of income that an individual receives in the form of tips, even if the tips are not directly reported to the employer.

- In general, the imputed income amount is determined by multiplying the hourly minimum wage by the number of hours worked. This amount is then added to the individual’s reported income to arrive at their total income for the purpose of health insurance eligibility.

- It’s important to note that each state may have its own specific rules and regulations regarding the calculation of tipped income. Therefore, it’s essential to consult with the relevant state agency or health insurance provider to determine the exact method of calculation.

Application Process

Applying for health insurance with tipped income involves a straightforward process that ensures you receive the coverage you need. Let’s delve into the steps and documentation required to complete your application.

To initiate the application process, contact a reputable health insurance provider or an insurance agent. They will guide you through the process and provide the necessary forms and information.

Documentation Required

Gather the following documents to support your application:

- Proof of Income: Pay stubs, W-2 forms, or tax returns demonstrating your tipped income.

- Personal Information: Government-issued ID, such as a driver’s license or passport, along with your Social Security number.

- Employer Information: Name, address, and contact details of your employer.

- Health History: Provide information about your current and past health conditions, including medications you take.

Application Forms

Complete the application forms provided by your chosen health insurance provider. These forms typically include:

- Personal Information Form: Basic details like name, address, date of birth, and contact information.

- Health History Form: Detailed information about your medical history, including any pre-existing conditions.

- Income Verification Form: Proof of your tipped income, such as pay stubs or tax returns.

- Beneficiary Designation Form: Specify who will receive your benefits if something happens to you.

Review the application forms carefully, ensuring you provide accurate and complete information. Incomplete or inaccurate information may delay the processing of your application.

Types of Health Insurance Plans

Tipped income individuals can choose from various health insurance plans that cater to their specific needs and budget. These plans offer a range of benefits, coverage options, and costs, making it crucial to understand the differences to make an informed decision.

The primary types of health insurance plans available to tipped income individuals include:

Health Maintenance Organizations (HMOs)

HMOs provide comprehensive medical care through a network of contracted healthcare providers. Members typically select a primary care physician (PCP) who coordinates their care and refers them to specialists within the network as needed. HMOs often offer lower premiums but may have limited provider choices and require referrals for specialist care.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility in choosing healthcare providers. Members can visit any provider within the network without a referral, but they may pay higher out-of-pocket costs for out-of-network care. PPOs typically have higher premiums than HMOs but provide more freedom in selecting providers.

Exclusive Provider Organizations (EPOs)

EPOs are similar to HMOs in that members must select a PCP and receive referrals for specialist care within the network. However, EPOs typically have lower premiums than HMOs and may offer more comprehensive coverage for in-network services.

Point-of-Service (POS) Plans

POS plans combine features of HMOs and PPOs. Members can choose to receive care within the network or out-of-network, but they may pay higher out-of-pocket costs for out-of-network care. POS plans typically have higher premiums than HMOs but offer more flexibility in choosing providers.

High-Deductible Health Plans (HDHPs)

HDHPs have lower monthly premiums but higher deductibles. Members must pay for healthcare expenses out-of-pocket until they meet the deductible, after which the insurance company begins to cover a portion of the costs. HDHPs are often paired with a health savings account (HSA), which allows members to save money tax-free to pay for healthcare expenses.

Subsidies and Financial Assistance

The government offers subsidies and financial assistance programs to tipped income individuals to make health insurance more affordable. These programs aim to ensure that everyone has access to comprehensive health coverage, regardless of their income level.

Eligibility Criteria

Eligibility for these programs varies depending on the specific program and state of residence. However, general eligibility criteria often include:

- Income level: Individuals with incomes below a certain threshold may qualify for subsidies.

- Employment status: Tipped income individuals who work a certain number of hours or earn a certain amount of tips may be eligible.

- Household size: The size of the individual’s household may also be considered when determining eligibility.

Applying for Assistance

To apply for subsidies or financial assistance, individuals can:

- Contact their state’s health insurance marketplace or exchange.

- Visit the website of the Centers for Medicare & Medicaid Services (CMS).

- Work with a qualified health insurance agent or broker.

These resources provide information on available programs, eligibility criteria, and the application process. Individuals can also apply for assistance directly through their employer or through a community organization.

Special Considerations for Tipped Income

Individuals who rely on tipped income may encounter unique challenges and considerations when applying for health insurance. Understanding these factors can help ensure a smoother application process and access to suitable coverage.

One key consideration is the fluctuating nature of tipped income. Tipped employees often experience irregular earnings, which can make it difficult to accurately estimate their annual income. This can impact eligibility for certain health insurance plans or subsidies.

Subsidies and Financial Assistance

Tipped income individuals may be eligible for subsidies or financial assistance to help cover the cost of health insurance premiums. However, determining eligibility for these programs can be complex due to the varying income levels and reporting requirements.

In some cases, tipped employees may need to provide additional documentation or proof of income to verify their eligibility for subsidies. This can include pay stubs, tax returns, or other records that demonstrate their earnings.

Challenges and Potential Obstacles

Tipped income individuals may face challenges during the health insurance application process due to the unique characteristics of their income.

- Inconsistent Income: Tipped employees often have irregular or fluctuating income, which can make it difficult to estimate their annual earnings accurately.

- Underreporting: Some tipped employees may underreport their income to avoid taxes, which can result in ineligibility for certain health insurance plans or subsidies.

- Lack of Documentation: Tipped employees may not have traditional pay stubs or W-2 forms, which can make it challenging to provide proof of income when applying for health insurance.

Impact on Premiums

Tipped income can significantly impact health insurance premiums, as it is considered part of an individual’s overall income when determining eligibility and premium costs.

The relationship between tipped income and premium costs can be complex and vary depending on the specific health insurance plan and the individual’s circumstances.

Factors Influencing Premium Costs

Several factors can influence how tipped income affects health insurance premiums:

- Income Level: The higher the individual’s overall income, including tipped income, the higher their health insurance premiums may be.

- Plan Type: Different health insurance plans have different premium structures and may treat tipped income differently.

- Employer Contributions: If the individual receives health insurance through their employer, the employer’s contribution may be based on their total income, including tipped income.

- State Regulations: State regulations can also impact how tipped income is treated when determining health insurance premiums.

Examples and Scenarios

Here are a few examples to illustrate the relationship between tipped income and premium costs:

- Example 1: An individual earning $30,000 per year, including $5,000 in tipped income, may pay higher premiums than someone earning the same amount without tipped income.

- Example 2: If an individual’s employer offers health insurance with a premium based on total income, including tips, their premium may increase if their tipped income increases.

- Example 3: In some states, tipped income may be excluded from the calculation of health insurance premiums, resulting in lower premiums for individuals with tipped income.

Employer-Sponsored Insurance

Tipped income individuals who have access to employer-sponsored health insurance may have an easier time finding affordable coverage. Employer-sponsored plans often offer lower premiums and more comprehensive coverage than individual plans.

However, there are also some drawbacks to employer-sponsored plans. One drawback is that you may have less choice of doctors and hospitals. Another drawback is that you may have to pay more out-of-pocket costs, such as deductibles and copayments.

Comparing Employer-Sponsored Plans and Individual Plans

When deciding whether to enroll in an employer-sponsored plan or an individual plan, it is important to compare the benefits and drawbacks of each type of plan. Here are some factors to consider:

- Cost: Employer-sponsored plans often have lower premiums than individual plans. However, you may have to pay more out-of-pocket costs, such as deductibles and copayments.

- Choice of doctors and hospitals: Employer-sponsored plans may have a narrower network of doctors and hospitals than individual plans. This means that you may have less choice of where you can go for care.

- Coverage: Employer-sponsored plans may offer more comprehensive coverage than individual plans. This means that they may cover more services and have lower out-of-pocket costs.

- Flexibility: Individual plans offer more flexibility than employer-sponsored plans. You can choose your own doctor and hospital, and you can change your plan each year.

State-Specific Regulations

Navigating the complexities of health insurance can be challenging, and tipped income individuals may encounter additional hurdles depending on their state of residence. Various states have unique regulations and guidelines that specifically impact the application process and coverage options for individuals with tipped income.

The following are examples of states with unique requirements or considerations:

California

California stands out for its robust regulations aimed at protecting tipped workers. The state mandates that employers provide their tipped employees with a written notice detailing their rights and responsibilities regarding minimum wage, overtime pay, and meal and rest periods.

Additionally, California has a higher minimum wage compared to the federal level, which can impact the calculation of tipped income for health insurance purposes.

New York

New York has implemented the “Excluded Tips” provision, which allows tipped employees to exclude a portion of their tips from their gross income when calculating their state income taxes. This provision can have implications for tipped income individuals applying for health insurance, as it may affect their eligibility for premium subsidies or financial assistance.

Washington

Washington state has a unique approach to tipped income by requiring employers to pay a “tip credit” to their tipped employees. This tip credit reduces the amount of hourly wages that the employer is required to pay, with the expectation that tips will make up the difference.

The tip credit can impact the calculation of tipped income for health insurance purposes, as it may affect an individual’s eligibility for certain coverage options or subsidies.

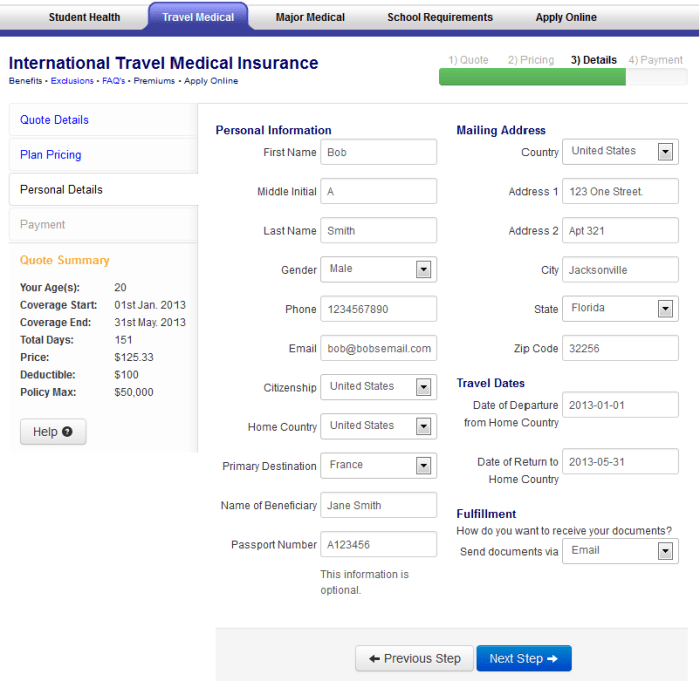

Navigating the Application Process

Tipped income individuals can encounter unique challenges when applying for health insurance. To ensure a smooth and successful application process, consider these tips and strategies:

Be Prepared: Before starting the application, gather all necessary documents and information, including proof of income, Social Security number, and household size. Having these documents readily available will expedite the process.

Streamlining the Application

- Online Platforms: Many health insurance providers offer online application portals. These platforms are user-friendly and allow individuals to complete the application at their convenience.

- Paper Applications: If online applications are not available, individuals can obtain paper applications from insurance companies or brokers. It is crucial to fill out the application accurately and completely.

- Assistance from Brokers: Individuals can also seek assistance from insurance brokers who specialize in health insurance for tipped income individuals. Brokers can guide applicants through the process and help them select the most suitable plan.

Addressing Common Challenges

- Proof of Income: Tipped income can be challenging to document. Individuals should keep accurate records of their tips, such as receipts or logs. Bank statements can also serve as proof of income.

- Household Size: Determining household size can be complex for tipped income individuals who may have fluctuating income or multiple sources of income. It is important to include all household members who are eligible for coverage under the health insurance plan.

- Special Circumstances: Individuals with unique circumstances, such as those who are self-employed or have pre-existing conditions, may face additional challenges. It is advisable to consult with an insurance broker or healthcare navigator for guidance.

Maximizing Financial Assistance

- Subsidies: Individuals with low to moderate incomes may qualify for subsidies that can lower their monthly premiums. It is essential to explore these options during the application process.

- Tax Credits: Some states offer tax credits to help individuals pay for health insurance. These credits can significantly reduce the cost of coverage.

- Employer Contributions: Individuals who receive tips as part of their employment may be eligible for employer-sponsored health insurance. Employers are required to contribute a certain amount towards the cost of coverage.

Additional Resources

Finding health insurance can be a complex process, especially for individuals with tipped income. To assist you in your journey, here are some reputable websites, organizations, and resources that provide further information and support:

Websites:

- Healthcare.gov: The official U.S. government website for health insurance. Provides information on plans, subsidies, and enrollment.

- Kaiser Family Foundation: A non-profit organization that provides information on health policy and insurance. Offers resources on health insurance for tipped income individuals.

- National Association of Insurance Commissioners (NAIC): An organization representing state insurance regulators. Provides information on insurance laws and regulations.

Organizations:

- National Women’s Law Center: A non-profit organization that advocates for gender justice. Provides resources on health insurance for women, including those with tipped income.

- National Employment Law Project: A non-profit organization that advocates for workers’ rights. Provides resources on health insurance for low-wage workers, including those with tipped income.

- Center for Public Policy Priorities: A non-profit organization that advocates for policies that improve the lives of low-income and working families. Provides resources on health insurance for low-wage workers, including those with tipped income.

Helplines:

- HealthCare.gov Call Center: 1-800-318-2596

- Kaiser Family Foundation Helpline: 1-888-352-2220

- National Association of Insurance Commissioners (NAIC) Helpline: 1-866-434-NAIC (6242)

These resources provide valuable information and support to help tipped income individuals navigate the complexities of health insurance and find the coverage that best meets their needs.

Closure

The journey to securing health insurance as a tipped income individual may have its complexities, but with the right guidance and resources, it’s a journey worth taking. Remember, you’re not alone in this process. Numerous organizations, agencies, and online resources are dedicated to supporting you.

Embrace the opportunity to take charge of your health and well-being. The peace of mind that comes with knowing you and your loved ones are protected is priceless.

Common Queries

Q: How is tipped income calculated for health insurance applications?

A: Tipped income is typically calculated by multiplying the number of hours worked by the hourly wage, then adding the amount of tips received during those hours. Some states may have specific guidelines or requirements for calculating tipped income for health insurance purposes.

Q: What types of health insurance plans are available to tipped income individuals?

A: Tipped income individuals have access to a variety of health insurance plans, including individual plans, family plans, and employer-sponsored plans. Individual plans can be purchased directly from insurance companies, while employer-sponsored plans are offered through an employer’s group coverage.

Each type of plan has its own benefits, coverage options, and costs.

Q: Can tipped income individuals qualify for subsidies or financial assistance?

A: Yes, tipped income individuals may be eligible for subsidies and financial assistance programs that can help reduce the cost of health insurance. These programs include premium tax credits, cost-sharing reductions, and Medicaid or CHIP coverage. Eligibility for these programs is based on income and household size.

Q: What unique considerations should tipped income individuals be aware of when applying for health insurance?

A: Tipped income individuals should be aware of potential challenges and obstacles they may face during the application process. These challenges may include fluctuating income, difficulty verifying income, and lack of access to employer-sponsored insurance. It’s important to carefully review eligibility requirements and documentation requirements to ensure a smooth application process.

Q: How can tipped income individuals successfully navigate the health insurance application process?

A: To successfully navigate the health insurance application process, tipped income individuals should gather all necessary documentation, including proof of income, tax returns, and pay stubs. They should also carefully review plan options and compare benefits, coverage, and costs. Additionally, they should be prepared to provide additional information or documentation if requested by the insurance company.