Water damage, a common household nightmare, can leave you feeling overwhelmed and uncertain. However, with the right knowledge and approach, you can effectively navigate the insurance claim process and secure the compensation you deserve. Rainie’s Rainstorm: A Comprehensive Guide to Navigating Water Damage Insurance Claims provides a step-by-step roadmap to help you understand the process, gather necessary evidence, communicate effectively with your insurance company, and ensure a fair settlement.

From understanding the basics of filing a claim to preventing future water damage, this guide covers everything you need to know. Whether you’re dealing with a leaky faucet or a devastating flood, Rainie’s Rainstorm will empower you to take control of the situation and protect your interests.

Claim Process Overview

Navigating a water damage insurance claim can be daunting, but understanding the process and taking prompt action can ease the burden. Here’s an overview of the steps involved in filing a water damage insurance claim and initiating the process with your insurance company.

Filing a Water Damage Insurance Claim

To file a water damage insurance claim, follow these steps:

- Document the Damage: Take photos and videos of the damage, including close-ups of affected areas and wide shots showing the extent of the damage.

- Contact Your Insurance Company: Call your insurance company’s customer service number or visit their website to initiate the claim process. Be prepared to provide information about the date and cause of the damage, as well as your policy number and contact details.

- File a Claim Form: The insurance company will provide you with a claim form to fill out. Be thorough and provide accurate information, including details about the damage, the cause of the damage, and any steps you have taken to mitigate further damage.

- Assign an Adjuster: The insurance company will assign an adjuster to your claim. The adjuster will visit your property to assess the damage, take measurements, and gather additional information.

- Receive a Claim Settlement: Once the adjuster has completed their assessment, they will determine the amount of your claim settlement. This amount will be based on the coverage limits in your policy and the extent of the damage.

Documentation and Evidence

A comprehensive documentation of the water damage is crucial for a successful insurance claim. This includes gathering essential documents, photographs, and videos to support your claim.

Accurate documentation not only strengthens your case but also helps the insurance company process your claim efficiently. It provides tangible evidence of the damage, its extent, and the need for repairs or replacements.

Essential Documents

- Insurance Policy: A copy of your insurance policy is essential to verify your coverage and the terms and conditions.

- Proof of Ownership: Provide documents that establish your ownership of the damaged property, such as a deed, title, or lease agreement.

- Contact Information: Include your contact information, including your name, address, phone number, and email address, to facilitate communication during the claims process.

- Loss Inventory: Create a detailed inventory of all damaged items, including their description, condition, and estimated value. Photographs or videos can supplement this inventory.

- Receipts and Invoices: Collect receipts and invoices for any expenses incurred due to the water damage, such as repairs, cleanup, or temporary living arrangements.

Significance of Photos and Videos

Visual documentation plays a vital role in supporting your water damage insurance claim. Photographs and videos provide a clear and comprehensive record of the damage, its severity, and the affected areas.

When taking photos and videos, ensure they are clear, well-lit, and capture the damage from various angles. Include close-ups of specific areas, as well as wide shots that show the overall extent of the damage.

Label each photo and video with the date, time, and location where it was taken. This documentation will help the insurance adjuster assess the damage accurately and determine the appropriate compensation.

Communication with Insurance Company

Maintaining clear and effective communication with the insurance company is vital during the water damage claim process. Establishing a positive relationship with the insurance adjuster assigned to your case can expedite the process and ensure a favorable outcome.

To communicate effectively, it’s essential to be:

Be Clear and Concise

- Provide a Detailed Explanation: Describe the water damage, its cause, and the extent of the damage. Be specific about the affected areas, the type of damage (e.g., flooding, leaks), and the estimated cost of repairs.

- Use Simple Language: Avoid technical jargon or complex terminology that the adjuster might not understand. Communicate in a straightforward and easy-to-understand manner.

- Be Organized: Keep all relevant documents, photographs, and receipts related to the damage in an organized manner. This will make it easier to provide the adjuster with the necessary information.

Be Prompt and Responsive

- Respond Quickly: Respond promptly to any requests for information or documentation from the insurance company. Delays in communication can hinder the claim process and potentially jeopardize your claim.

- Be Available: Make yourself available for inspections, assessments, or meetings with the insurance adjuster. Providing access to the damaged property and promptly addressing any questions or concerns can expedite the claim settlement process.

Be Professional and Courteous

- Maintain a Professional Demeanor: Communicate with the insurance adjuster in a professional and respectful manner. Avoid being confrontational or aggressive, as this can hinder the communication process.

- Be Patient: Understand that the insurance claim process can take time. Be patient and cooperative with the insurance company throughout the process.

Detailed Description of Damage

Accurately documenting and describing the water damage is crucial for a successful insurance claim. This section provides guidance on assessing and recording the damage to support your claim effectively.

To begin, thoroughly inspect the affected areas to determine the extent and nature of the damage. Note the location of the water source, whether it’s a burst pipe, leaking roof, or flooding. Identify the type of water involved, such as clean water, sewage, or contaminated water, as this can impact the cleanup and restoration process.

Assessing the Damage

- Visual Inspection: Conduct a visual examination of the damaged areas. Look for signs of water stains, discoloration, peeling paint, or warped materials. Check for any structural damage, such as cracks in walls or ceilings.

- Moisture Detection: Use a moisture meter or infrared camera to detect hidden moisture that may not be visible to the naked eye. This is particularly important for areas like walls, floors, and ceilings where water can seep and cause extensive damage.

- Electrical and Plumbing Inspection: If the water damage has affected electrical outlets, appliances, or plumbing fixtures, involve a qualified electrician or plumber to assess the damage and ensure safety.

Documenting the Damage

- Photographs: Take detailed photographs of the damaged areas from various angles. Ensure the photos clearly show the extent of the damage, including close-ups of specific areas.

- Videos: Consider recording videos of the damage to provide a more comprehensive visual representation. This can be especially helpful in cases of extensive or complex damage.

- Written Description: Create a written description of the damage, detailing the affected areas, the type of damage, and any relevant observations. Include the date and time of the damage, as well as the cause if known.

Mitigation and Repairs

Prompt action to minimize further damage is crucial after a water damage incident. Document and track all expenses associated with mitigation and repairs to support your insurance claim.

Immediate Mitigation

- Stop the Water Source: If possible, identify and stop the source of the water leak to prevent further damage.

- Remove Excess Water: Use pumps, mops, and towels to remove standing water promptly. Remove wet carpets, rugs, and furniture from the affected area.

- Open Windows and Doors: Increase ventilation to promote drying and prevent mold growth.

Documenting Expenses

- Receipts and Invoices: Keep receipts for all expenses related to mitigation and repairs, including cleanup, drying equipment, and materials.

- Photographs: Take detailed photos of the damage before, during, and after the mitigation and repair process.

- Contractor Estimates: Obtain written estimates from licensed contractors for repair work.

Communication with Contractors

- Choose Qualified Contractors: Select reputable and experienced contractors specializing in water damage restoration and repairs.

- Clear Communication: Communicate your expectations and preferences to the contractor. Ensure they understand the scope of work and the desired outcomes.

- Progress Updates: Request regular progress updates from the contractor to stay informed about the repair process.

Detailed Description of Damage

Provide a detailed description of the water damage, including the location, extent, and cause. Be specific about the damaged items and the repairs needed.

Claim Form and Submission

When filing an insurance claim for water damage, it’s crucial to complete the claim form accurately and submit it along with the necessary supporting documents to your insurance company.

Here’s a step-by-step guide to help you navigate the claim form and submission process:

Obtaining the Claim Form

- Contact your insurance company through their customer service number or online portal to request a claim form.

- Some insurance companies may provide a downloadable claim form on their website, which you can print and fill out.

Filling Out the Claim Form

- Provide your personal information, including your name, address, phone number, and policy number.

- Describe the water damage incident, including the date and time it occurred, the cause of the damage (if known), and the extent of the damage.

- Include details about the affected property, such as the location of the damage, the type of property (e.g., residential, commercial), and the estimated value of the damage.

- Attach photographs or videos of the damage to support your claim.

- Sign and date the claim form.

Submitting the Claim Form

- Once you have completed the claim form, submit it to your insurance company through the method specified by them.

- This may involve mailing the claim form and supporting documents to a specific address or submitting them electronically through an online portal.

- Make sure to keep a copy of the claim form and all supporting documents for your records.

Negotiation and Settlement

Navigating the negotiation and settlement process with your insurance company is crucial to ensuring a fair outcome for your water damage claim. Effective communication, thorough preparation, and a strategic approach can significantly influence the success of your claim.

Here are some tips to help you negotiate with your insurance company:

Tips for Negotiating with the Insurance Company

- Research and Understanding: Familiarize yourself with your insurance policy, including coverage limits, exclusions, and the claims process. Research market rates for repairs or replacements to strengthen your negotiation position.

- Gather Evidence: Compile detailed documentation of the water damage, including photos, videos, receipts, and estimates from contractors. These serve as solid evidence to support your claim and strengthen your negotiating position.

- Open Communication: Maintain open and respectful communication with the insurance company’s adjuster. Express your concerns clearly and provide all necessary information promptly. Building rapport can facilitate a more productive negotiation process.

- Be Prepared to Negotiate: Be prepared to negotiate the settlement amount. Start with a reasonable offer based on your research and evidence. Be willing to provide additional information or documentation if requested.

- Consider Mediation: If negotiations reach an impasse, consider involving a mediator to facilitate the discussion and help find a mutually acceptable solution.

When reviewing and responding to the insurance company’s settlement offer, consider the following:

Reviewing and Responding to the Settlement Offer

- Review the Offer Carefully: Examine the settlement offer thoroughly, ensuring it covers all damages and expenses related to the water damage. Check for any discrepancies or omissions.

- Compare with Estimates: Compare the settlement offer with estimates from contractors or experts to assess its fairness. If there are significant differences, consider negotiating further.

- Consider Long-Term Implications: Think about the long-term implications of the settlement. Ensure it adequately addresses not only the immediate damage but also potential future issues arising from the water damage.

- Seek Professional Advice: If you have doubts or concerns about the settlement offer, consult with an attorney or an insurance expert to gain a better understanding of your rights and options.

- Respond Promptly: Respond to the settlement offer within the specified timeframe. If you need more time to review the offer, communicate this to the insurance company promptly.

Claim Resolution Timeline

The claim resolution timeline can vary depending on several factors, but generally, you can expect the process to take anywhere from a few weeks to several months. The timeline can be divided into the following stages:

Initial Filing

Once you have filed your claim with your insurance company, they will assign an adjuster to your case. The adjuster will review your claim and determine the next steps.

Investigation

The adjuster will conduct an investigation to determine the cause of the damage and the extent of the damage. This may involve visiting your property, interviewing witnesses, and gathering evidence.

Estimate of Damages

Once the investigation is complete, the adjuster will prepare an estimate of the damages. This estimate will include the cost of repairs or replacement of damaged property.

Settlement

Once you and the insurance company agree on the amount of the settlement, the insurance company will issue a payment to you. The payment may be in the form of a check or a direct deposit into your bank account.

Factors Impacting the Timeline

Several factors can impact the claim resolution timeline, including:

- The severity of the damage.

- The availability of contractors.

- The insurance company’s claims process.

- The policyholder’s cooperation with the insurance company.

Managing Expectations

It is important to manage your expectations about the claim resolution timeline. The process can take time, so it is important to be patient. You can help move the process along by cooperating with the insurance company and providing them with the necessary information and documentation.

Dealing with Disputes

If a disagreement arises between you and your insurance company regarding your water damage claim, it’s crucial to approach the situation strategically to resolve it effectively.

Open communication and negotiation are key. Engage in discussions with the insurance adjuster, clearly expressing your concerns and providing any additional documentation or evidence that supports your claim. Attempt to reach a mutually agreeable solution.

Appealing a Denied or Undervalued Claim

In case your claim is denied or undervalued, you have the right to appeal the decision. Contact your insurance company to initiate the appeals process, which typically involves submitting additional documentation and evidence to support your claim.

- Review the Denial Letter: Carefully examine the denial letter to understand the specific reasons for the denial. This will help you address the issues effectively in your appeal.

- Gather Additional Evidence: Collect any additional documentation or evidence that can strengthen your case. This may include estimates from contractors, photographs of the damage, and receipts for repairs or replacements.

- Write an Appeal Letter: Compose a formal appeal letter addressed to the insurance company. Clearly state the reasons why you believe the claim should be approved or increased, and include any new evidence or documentation.

- Submit the Appeal: Submit the appeal letter and any supporting documents to the insurance company within the specified timeframe.

- Follow Up: Keep track of the status of your appeal and follow up with the insurance company periodically. You may need to provide additional information or clarification as requested.

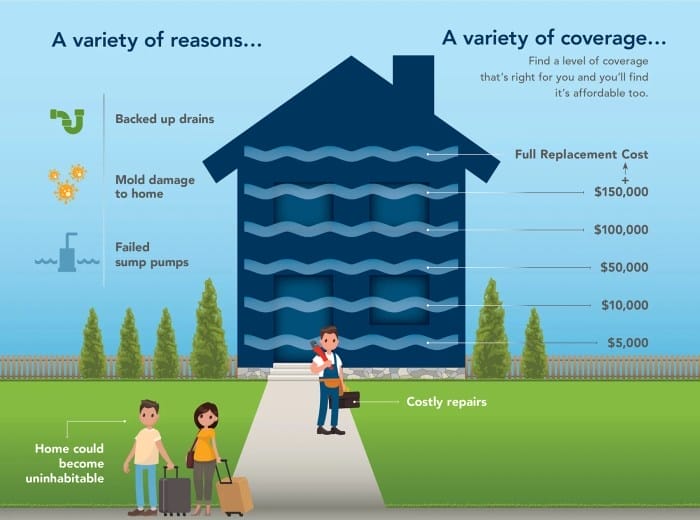

Preventing Future Water Damage

To safeguard your home from future water damage, proactive measures should be implemented. A combination of regular maintenance, prompt repairs, and preventive actions can significantly reduce the risk of water-related disasters. Let’s explore effective strategies for preventing water damage in your home.

Regular maintenance is crucial for detecting and addressing potential issues before they escalate into costly repairs or damage. Conduct routine inspections of your home, paying close attention to areas prone to water damage, such as the roof, plumbing system, and foundation.

Inspect the roof for signs of damage or wear, and clean gutters and downspouts to ensure proper water drainage.

Inspect and Repair Plumbing System

- Inspect the plumbing system for leaks, corrosion, or damage. Tighten loose fittings and replace worn-out pipes. Ensure water hoses are properly connected and in good condition. Consider installing water leak detectors in critical areas to provide early warnings of potential leaks.

- Insulate pipes in unheated areas to prevent freezing and subsequent bursts. During cold weather, keep faucets slightly open to allow a trickle of water to flow, reducing the risk of frozen pipes.

Maintain Foundation and Landscaping

- Ensure proper grading around your home, allowing water to drain away from the foundation. Divert downspouts away from the foundation to prevent water accumulation and seepage.

- Keep gutters and downspouts clean and free of debris to ensure efficient water drainage. Consider installing gutter guards to prevent leaves and debris from clogging the gutters.

Appliances and Water Fixtures

- Inspect and maintain water-using appliances regularly. Look for signs of leaks or damage, and address any issues promptly. Consider installing water-saving devices to reduce water consumption and minimize the risk of leaks.

- Install water shut-off valves near appliances and fixtures to allow for quick isolation of water supply in case of leaks or repairs.

Emergency Preparedness

- Create an emergency plan that includes instructions for responding to water damage. Keep a list of emergency contacts, such as plumbers and insurance providers, readily accessible.

- Assemble an emergency kit with essential items like flashlights, batteries, and a first-aid kit. Store important documents and valuables in a waterproof container.

Last Word

Remember, water damage insurance claims can be complex, but with the right approach and a comprehensive understanding of the process, you can navigate the journey successfully. Rainie’s Rainstorm: A Comprehensive Guide to Navigating Water Damage Insurance Claims is your trusted companion, providing you with the knowledge, tips, and strategies to ensure a positive outcome.

Take charge, protect your property, and restore your peace of mind.

FAQ Summary

Q: What are the essential documents needed to support a water damage insurance claim?

A: Gather your insurance policy, photos and videos of the damage, receipts for repairs and mitigation efforts, and a detailed description of the damage, including the affected areas and the extent of the damage.

Q: How can I effectively communicate with my insurance company during the claim process?

A: Be clear and concise when explaining the damage, provide accurate and detailed information, respond promptly to requests for additional information, and maintain a professional and respectful demeanor throughout the process.

Q: What steps should I take to prevent future water damage in my home?

A: Regularly inspect your plumbing and appliances for leaks, maintain your gutters and downspouts, and consider installing water detectors and alarms to alert you to potential problems early on.