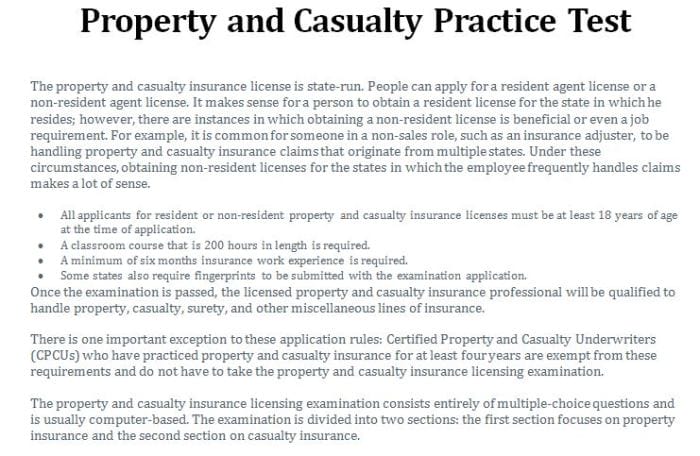

The property and casualty insurance exam is a gateway to a rewarding career in the insurance industry. Whether you’re an aspiring insurance professional or seeking to advance your career, mastering this exam is crucial. In this comprehensive guide, we’ll provide you with invaluable tips and strategies to help you excel in the exam and kickstart your insurance journey.

From understanding the exam format and syllabus to leveraging effective study resources and managing your time wisely, we’ll cover everything you need to know to conquer this challenge. We’ll also delve into essential insurance concepts, policy analysis, risk management, and ethical considerations, ensuring you possess a well-rounded understanding of the field.

Understanding Insurance Concepts

Property and casualty insurance is a complex field with many intricate concepts. Understanding these concepts is essential for anyone working in the insurance industry, whether as an agent, underwriter, or claims adjuster. It is also important for consumers who want to make informed decisions about their insurance coverage.

The fundamental concepts of property and casualty insurance include:

- Types of policies: There are many different types of property and casualty insurance policies available, each designed to protect against a specific type of loss. Common types of policies include homeowners insurance, renters insurance, auto insurance, and business insurance.

- Coverage options: Each type of policy offers a variety of coverage options, which allow policyholders to customize their coverage to meet their specific needs. Common coverage options include property damage, liability coverage, and medical payments coverage.

- Underwriting process: The underwriting process is the process by which insurance companies assess the risk of insuring a particular individual or business. This process includes collecting information about the applicant’s claims history, credit history, and other factors that may affect the risk of loss.

In addition to these fundamental concepts, there are a number of other important aspects of property and casualty insurance that consumers and insurance professionals should understand. These include:

- Risk assessment: Risk assessment is the process of identifying and evaluating the potential for loss. This process is used by insurance companies to determine the appropriate premium for a particular policy.

- Claims handling: Claims handling is the process of investigating and settling claims. This process includes communicating with the policyholder, gathering evidence, and determining the amount of the claim.

- Loss prevention: Loss prevention is the process of taking steps to reduce the likelihood of a loss. This process includes educating policyholders about risk management and providing them with resources to help them prevent losses.

Policy Analysis and Interpretation

Understanding how to analyze and interpret insurance policies is vital for providing accurate advice to clients. Policies vary based on type, such as homeowners, auto, and commercial, and it’s essential to grasp their terms, conditions, and exclusions.

Understanding Policy Language

Insurance policies often contain complex legal jargon. Translating this language into clear and understandable terms for clients is crucial. Focus on explaining key terms, definitions, and concepts in a manner that’s easy to comprehend.

Identifying Coverage and Exclusions

Policies Artikel the specific perils or events that are covered and those that are excluded. Carefully examine the policy to identify what is and isn’t covered. This analysis helps determine whether additional coverage is needed to fill any gaps.

Interpreting Policy Conditions

Policies include various conditions that must be met for coverage to apply. These may involve duties of the insured, such as timely reporting of claims or maintaining the property in good condition. Understanding these conditions ensures clients are aware of their obligations.

Analyzing Endorsements and Riders

Endorsements and riders modify or extend the coverage provided by the policy. They can add or remove specific perils, increase coverage limits, or exclude certain risks. Reviewing these amendments ensures a comprehensive understanding of the policy’s coverage.

Considering Applicable Laws and Regulations

Insurance policies are subject to various laws and regulations. Staying updated on these legal requirements is essential to ensure the policy complies with the latest rules and provides adequate protection to clients.

Risk Management and Underwriting

Risk management and underwriting are key aspects of property and casualty insurance. They help insurers assess and mitigate risks, determine premiums, and issue policies.

Risk Management

Risk management involves identifying, assessing, and mitigating risks associated with property and casualty insurance. It helps insurers understand the potential losses and take steps to minimize their impact.

- Risk Assessment: Insurers assess risks by analyzing historical data, industry trends, and specific characteristics of the property or activity being insured. This helps them estimate the likelihood and severity of potential losses.

- Risk Mitigation: Once risks are identified, insurers implement strategies to reduce their impact. This may include requiring safety measures, conducting inspections, and providing loss prevention advice to policyholders.

- Risk Transfer: When risks cannot be eliminated or reduced, insurers use risk transfer techniques to shift the financial burden of potential losses to policyholders. This is done through insurance policies, which transfer the risk from the policyholder to the insurer.

Underwriting

Underwriting is the process of evaluating risks, determining premiums, and issuing policies. It involves assessing the risk profile of an applicant and determining the appropriate terms and conditions of the insurance policy.

- Evaluating Risks: Underwriters evaluate risks by considering various factors, such as the property’s condition, the applicant’s claims history, and the overall risk profile. They use this information to determine the likelihood and severity of potential losses.

- Determining Premiums: Based on the risk assessment, underwriters determine the premium that the policyholder will pay. Premiums are calculated to cover the expected losses, administrative costs, and a profit margin for the insurer.

- Issuing Policies: Once the premium is agreed upon, the underwriter issues the insurance policy. The policy Artikels the terms and conditions of the coverage, including the covered perils, limits of liability, and exclusions.

Claims Handling and Settlement

Claims handling is a critical aspect of property and casualty insurance. It involves the process of receiving, investigating, and settling claims made by policyholders. Effective claims handling is crucial for ensuring customer satisfaction, maintaining a positive reputation, and minimizing financial losses for the insurance company.

The claims handling process typically begins with the policyholder filing a first notice of loss (FNOL). This can be done through various channels, such as phone, email, or an online portal. The FNOL should include essential information about the claim, such as the date and location of the loss, the type of property damaged, and the estimated amount of the loss.

Investigation

Once the FNOL is received, the insurance company will assign an adjuster to investigate the claim. The adjuster’s role is to gather information, assess the damage, and determine the cause of the loss. This may involve visiting the property, interviewing witnesses, and reviewing relevant documents.

The adjuster will also work with the policyholder to ensure they understand the claims process and their rights and responsibilities under the policy.

Settlement

After the investigation is complete, the insurance company will determine the amount of the claim settlement. This is based on the terms and conditions of the policy, as well as the information gathered during the investigation. The settlement amount may include reimbursement for the cost of repairs or replacement of damaged property, as well as compensation for any additional expenses incurred as a result of the loss.

Importance of Effective Communication and Customer Service

Effective communication and customer service are essential in claims handling. The claims adjuster should keep the policyholder informed throughout the process, explaining the steps involved and answering any questions they may have. The adjuster should also be empathetic and understanding, as the policyholder may be going through a difficult time.

Positive and effective communication can help build trust and rapport between the policyholder and the insurance company, leading to a more satisfactory claims experience.

Legal and Regulatory Framework

The property and casualty insurance industry operates within a complex legal and regulatory framework designed to protect consumers and ensure the financial stability of insurance companies. This framework includes state insurance laws, regulations, and industry standards.

State Insurance Laws

State insurance laws are enacted by state legislatures and regulate the business of insurance within each state. These laws typically address issues such as the licensing of insurance companies and agents, the types of insurance products that can be sold, and the rates that can be charged for insurance premiums.

State insurance laws also establish consumer protection measures, such as requiring insurers to provide clear and concise policy language and to promptly pay claims.

Insurance Regulations

Insurance regulations are issued by state insurance departments and provide more detailed guidance on how state insurance laws should be implemented. These regulations cover a wide range of topics, including financial reporting requirements, investment restrictions, and claims handling procedures. Insurance regulations are designed to ensure that insurance companies are financially sound and that they treat their policyholders fairly.

Industry Standards

Industry standards are developed by insurance industry organizations and provide guidance on best practices for the insurance industry. These standards cover a wide range of topics, including underwriting, claims handling, and customer service. Industry standards are not legally binding, but they are widely followed by insurance companies because they help to ensure that the industry operates in a fair and efficient manner.

Role of Insurance Regulators

Insurance regulators are responsible for enforcing state insurance laws and regulations. They also have the authority to investigate insurance companies and take enforcement actions, such as imposing fines or suspending licenses. Insurance regulators play a critical role in protecting consumers and ensuring the financial stability of the insurance industry.

Ethical Considerations

In property and casualty insurance, ethical considerations play a pivotal role in upholding the integrity and trust of the industry. Insurance professionals must adhere to strict ethical standards to ensure fair dealing, transparency, and the protection of policyholders’ interests.

Ethical considerations encompass a wide range of aspects, including conflicts of interest, misrepresentation, and fair dealing. It is imperative for insurance professionals to recognize and address potential conflicts of interest that may arise during the course of their duties. This includes situations where personal or financial interests may influence decision-making processes or compromise the impartiality of their actions.

Misrepresentation

Misrepresentation involves providing false or misleading information to policyholders or insurers. This can occur intentionally or unintentionally and can have serious consequences, including the voiding of policies or denial of claims. Insurance professionals must be truthful and transparent in their communications, ensuring that all relevant information is accurately disclosed.

Fair Dealing

Fair dealing is a fundamental principle that requires insurance professionals to act in the best interests of policyholders. This includes providing clear and understandable explanations of policies, promptly handling claims, and ensuring that policyholders receive fair treatment throughout the insurance process.

Insurance professionals must avoid any actions that could be considered deceptive or misleading, and they must always act with the utmost good faith.

Professional Integrity

Professional integrity is the cornerstone of ethical conduct in the insurance industry. Insurance professionals must maintain the highest standards of integrity and honesty in all their dealings. This includes acting with impartiality, avoiding conflicts of interest, and adhering to all applicable laws and regulations.

By upholding professional integrity, insurance professionals can inspire trust and confidence among policyholders and other stakeholders.

Last Word

Remember, success in the property and casualty insurance exam is not just about memorizing facts; it’s about developing a deep understanding of the industry and applying your knowledge to real-world scenarios. With dedication, effective preparation, and a positive mindset, you can confidently navigate the exam and embark on a fulfilling career in property and casualty insurance.

Q&A

Question: How can I effectively manage my time during exam preparation?

Answer: Create a realistic study schedule that allocates specific times for different topics. Set achievable goals and prioritize challenging areas. Use techniques like the Pomodoro Technique to maintain focus and avoid burnout.

Question: What are some common mistakes to avoid on exam day?

Answer: Arriving late, forgetting essential materials, and rushing through the exam are common pitfalls. Ensure you arrive early, bring all necessary items, and allocate sufficient time for each question.

Question: How can I stay motivated throughout the study process?

Answer: Set realistic goals, reward yourself for milestones achieved, and maintain a positive attitude. Join study groups or online forums to connect with peers and seek support when needed.