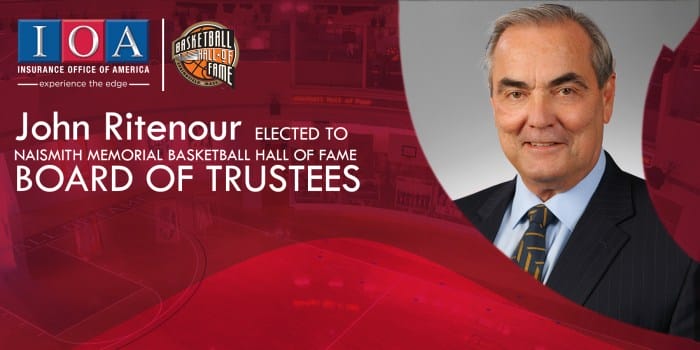

In the intricate world of insurance, John Ritenour stands as a beacon of clarity and expertise. With decades of experience navigating the nuances of insurance policies, his insights have become invaluable to individuals and businesses seeking to protect their assets and mitigate risks.

His ability to decipher complex insurance jargon and simplify intricate concepts has earned him a reputation as a trusted advisor in the industry.

Through his comprehensive understanding of insurance policies, risk assessment techniques, and industry trends, John Ritenour offers a wealth of knowledge that empowers individuals and organizations to make informed decisions about their insurance coverage. His guidance extends beyond mere policy selection; he provides practical strategies for effective risk management, claim filing, and fraud prevention, ensuring that his clients receive the maximum benefits from their insurance plans.

Introduction

John Ritenour, an insurance industry veteran with over three decades of experience, has established himself as a trusted source of knowledge and expertise. His extensive background in underwriting, claims management, and risk assessment positions him as an authority on insurance matters.

Ritenour’s insights and tips on insurance are highly valued by individuals, businesses, and insurance professionals alike, owing to his ability to simplify complex concepts and provide practical guidance.

Understanding Insurance Policies

Navigating the intricacies of insurance policies can be daunting, but Ritenour’s guidance makes it accessible. He emphasizes the importance of carefully reviewing policy documents to grasp the coverage details, exclusions, and limitations. Ritenour also stresses the significance of understanding the claims process and knowing how to file a claim effectively.

Choosing the Right Insurance Coverage

Selecting the appropriate insurance coverage is crucial for optimal protection. Ritenour advises individuals and businesses to conduct thorough research and consider their specific needs, risks, and financial situation. He advocates for seeking professional advice from insurance agents or brokers to ensure a tailored insurance plan that aligns with their unique circumstances.

Managing Insurance Costs

Managing insurance costs effectively is a concern for many policyholders. Ritenour suggests exploring discounts and cost-saving measures offered by insurance companies. He recommends maintaining a good credit score, implementing risk-reduction strategies, and bundling policies to potentially lower premiums.

Dealing with Insurance Claims

Filing and managing insurance claims can be a stressful process. Ritenour emphasizes the importance of promptly reporting claims to the insurance company and providing detailed documentation. He advises policyholders to keep meticulous records of expenses and damages, and to communicate effectively with the insurance adjuster to ensure a fair and timely settlement.

Understanding Insurance Policies

Comprehending insurance policies is of utmost importance to ensure clarity, protection, and peace of mind. Policies often contain intricate details, terms, and conditions that can be confusing and overwhelming to the average individual. It’s essential to thoroughly review and understand these policies to make informed decisions and avoid potential pitfalls.

Common Pitfalls and Misconceptions

Numerous common misconceptions and pitfalls exist when it comes to insurance coverage. Here are some prevalent issues:

- Assuming coverage for all situations: Policies may have specific exclusions or limitations that restrict coverage in certain scenarios. It’s crucial to be aware of these limitations to avoid unexpected gaps in protection.

- Misunderstanding policy limits and deductibles: Policy limits determine the maximum amount of coverage provided, while deductibles represent the initial amount an individual is responsible for before the insurance company begins to pay. Understanding these aspects is essential for financial planning and budgeting.

- Overlooking riders and endorsements: Riders and endorsements are additional coverage options or modifications to a policy that can enhance or alter its scope. Failing to consider these add-ons may result in inadequate coverage.

Tips for Deciphering Complex Insurance Policies

To ensure clarity and understanding of complex insurance policies, consider these practical tips:

- Read the policy thoroughly: Diligently read the entire policy, paying attention to both the main sections and the fine print. Highlight or mark important clauses and terms for easy reference.

- Consult a professional: If you find the policy challenging to comprehend, consider seeking assistance from an insurance agent or broker. They can explain the policy’s provisions and answer your questions.

- Request a policy summary: Some insurance companies provide policy summaries that offer a simplified overview of the policy’s key features and benefits. This can be a helpful tool for gaining a quick understanding.

- Compare policies from different providers: When shopping for insurance, compare policies from multiple providers to find the one that best suits your needs and budget. Be sure to compare coverage limits, deductibles, and other relevant factors.

Risk Assessment and Management

Risk assessment and management are crucial aspects of ensuring financial stability and minimizing potential losses. By proactively evaluating and addressing risks, individuals and businesses can make informed decisions and implement strategies to mitigate their exposure to adverse events.

Risk assessment involves identifying, analyzing, and evaluating potential hazards and their likelihood of occurrence. This process helps prioritize risks and allocate resources effectively for risk management. Various techniques and tools can be employed for risk assessment, such as scenario analysis, probability and impact matrices, and risk registers.

Risk Assessment Techniques

- Scenario Analysis: This technique involves creating hypothetical situations that could potentially lead to losses and analyzing the impact of each scenario.

- Probability and Impact Matrices: These matrices assess the likelihood of a risk occurring and the potential severity of its impact, allowing for a comprehensive evaluation of risks.

- Risk Registers: Risk registers are centralized repositories that document identified risks, their likelihood, impact, and mitigation strategies, providing a structured approach to risk management.

Practical Tips for Risk Minimization

- Diversification: Spreading investments across different asset classes and industries can help reduce exposure to specific risks associated with any single investment.

- Hedging: Using financial instruments like options and futures to offset potential losses from price fluctuations or other risks.

- Emergency Funds: Maintaining a financial cushion to cover unexpected expenses or income disruptions can help mitigate the impact of unforeseen events.

- Insurance: Obtaining appropriate insurance coverage can transfer the financial burden of certain risks to insurance companies.

- Risk Management Policies and Procedures: Implementing clear policies and procedures for risk management can help ensure a consistent and effective approach to identifying, assessing, and mitigating risks.

Types of Insurance Coverage

Navigating the world of insurance can be overwhelming, given the diverse range of coverage options available. Understanding the key features, benefits, and limitations of each type of insurance is crucial for selecting the most appropriate coverage that aligns with your specific needs and circumstances.

Insurance coverage can be broadly categorized into two primary types: personal insurance and commercial insurance. Personal insurance policies are designed to protect individuals and their families from various risks, while commercial insurance policies are tailored to safeguard businesses and organizations.

Personal Insurance Coverage

- Life Insurance: Provides financial protection for your loved ones in the event of your untimely demise. It ensures that your family can maintain their standard of living and meet financial obligations even in your absence.

- Health Insurance: Covers medical expenses incurred due to illness, injury, or hospitalization. It provides peace of mind, knowing that you and your family have access to quality healthcare without facing significant financial burdens.

- Homeowners Insurance: Protects your home and its contents against damages caused by fire, theft, natural disasters, and other covered perils. It also provides liability coverage in case someone is injured on your property.

- Auto Insurance: Covers damages to your vehicle and provides liability protection in case of an accident. It is mandatory in most countries and states to ensure financial responsibility while operating a motor vehicle.

- Travel Insurance: Offers protection against unforeseen events during your travels, such as lost luggage, medical emergencies, trip cancellations, and delays. It provides peace of mind and financial assistance when things go awry while you’re away from home.

Commercial Insurance Coverage

- Commercial Property Insurance: Protects a business’s physical assets, such as buildings, equipment, and inventory, against damages caused by fire, theft, natural disasters, and other covered perils.

- General Liability Insurance: Provides coverage for businesses against claims of bodily injury or property damage caused to third parties due to the business’s operations, products, or services.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees who suffer work-related injuries or illnesses. It is mandatory in most countries and states to protect both employees and employers.

- Business Interruption Insurance: Provides financial compensation to businesses that experience a temporary shutdown or loss of income due to covered events, such as fire, natural disasters, or equipment breakdowns.

- Cyber Liability Insurance: Protects businesses against financial losses and legal liabilities arising from data breaches, cyber attacks, and other cyber-related incidents.

Selecting the most appropriate insurance coverage requires careful consideration of your specific needs and circumstances. It is advisable to consult with an experienced insurance agent or broker who can provide personalized advice and help you navigate the complexities of insurance policies.

Insurance Claims Process

Filing an insurance claim can be a daunting task, but by understanding the process and gathering the necessary documentation, you can make it as smooth and efficient as possible.

Steps Involved in Filing an Insurance Claim

1. Report the Claim

Contact your insurance company as soon as possible after an incident occurs. Provide them with the basic details of the incident, such as the date, time, and location.

2. Gather Documentation

Compile all relevant documentation related to the claim, including photographs of the damage, receipts for repairs or replacements, and any other relevant paperwork.

3. Submit the Claim

Submit the completed claim form along with the supporting documentation to your insurance company. You can usually do this online, by mail, or over the phone.

4. Review and Investigation

The insurance company will review your claim and may conduct an investigation to verify the information you have provided.

5. Settlement

Once the investigation is complete, the insurance company will determine the amount of your settlement. This amount will be based on the terms of your policy and the extent of the damage.

6. Payment

The insurance company will issue payment for the approved claim amount. This payment can be made in the form of a check, direct deposit, or repair or replacement services.

Tips for Effectively Communicating with Insurance Companies

1. Be Clear and Concise

When communicating with the insurance company, be clear and concise in your explanations. Avoid using jargon or technical terms that the claims adjuster may not understand.

2. Be Honest and Accurate

Provide honest and accurate information about the incident and the damage. Any misrepresentation or omission of facts can jeopardize your claim.

3. Be Prepared to Answer Questions

The insurance company may have questions about the incident and the damage. Be prepared to answer these questions honestly and thoroughly.

4. Be Patient

The claims process can take time. Be patient and persistent in following up with the insurance company until your claim is resolved.

Insurance Fraud Detection and Prevention

Insurance fraud, a growing concern in the industry, can have serious consequences for both policyholders and insurance companies. This segment aims to shed light on the prevalence and impact of insurance fraud, share common red flags that may indicate fraudulent claims, and provide practical tips for policyholders to protect themselves from falling victim to such schemes.

Insurance fraud is a widespread problem that affects all types of insurance, from auto and homeowners to health and life insurance. It is estimated that insurance fraud costs the industry billions of dollars each year, driving up premiums for honest policyholders.

Red Flags of Insurance Fraud

There are several red flags that may suggest a fraudulent insurance claim. These include:

- Exaggerated or Inconsistent Claims: Be wary of claims that seem inflated or inconsistent with the actual damages or injuries sustained.

- Unreasonable Demands: If a claimant is overly aggressive or makes unreasonable demands, it may be a sign of fraud.

- Lack of Documentation: If a claimant has minimal or no documentation to support their claim, it raises suspicions.

- Suspicious Timing: Be cautious of claims filed shortly before a policy’s expiration date or after a significant life event.

- Prior Fraudulent Claims: If a claimant has a history of making fraudulent claims, it is a strong indicator of potential fraud.

Tips to Protect Yourself from Insurance Fraud

Policyholders can take proactive steps to protect themselves from falling victim to insurance fraud:

- Be Informed: Educate yourself about common types of insurance fraud and red flags to watch out for.

- Document Everything: Keep detailed records of all insurance-related transactions, including policies, claims, and correspondence.

- Report Suspicious Activity: If you suspect fraud, report it to your insurance company immediately.

- Choose Reputable Insurance Providers: Opt for insurance companies with a strong reputation for integrity and customer service.

- Be Cautious of Unsolicited Offers: Be wary of unsolicited offers for insurance or claims assistance, as they may be fraudulent.

Insurance Industry Trends and Innovations

The insurance industry is undergoing a period of rapid transformation, driven by technological advancements, changing consumer preferences, and regulatory shifts. These trends are reshaping the way insurance is provided and consumed, creating new opportunities and challenges for policyholders and insurers alike.

Emerging Technologies

One of the most significant trends shaping the insurance industry is the rise of emerging technologies. Artificial intelligence (AI), machine learning (ML), and blockchain are just a few of the technologies that are being used to automate processes, improve risk assessment, and enhance customer service.

For example, AI-powered chatbots are being used to provide personalized recommendations and answer customer questions, while ML algorithms are being used to analyze large datasets to identify patterns and trends that can help insurers better understand and price risks.

Changing Consumer Preferences

Another major trend shaping the insurance industry is the changing preferences of consumers. Today’s consumers are more informed and demanding than ever before, and they expect a seamless and personalized experience from their insurance providers. They want to be able to purchase insurance online, file claims quickly and easily, and access their policy information at any time.

Insurers are responding to these demands by investing in digital transformation initiatives and developing new products and services that are designed to meet the needs of the modern consumer.

Regulatory Shifts

The insurance industry is also being shaped by a number of regulatory shifts. In recent years, there has been a growing focus on consumer protection and market conduct. Regulators are taking a closer look at the way insurance companies operate, and they are imposing stricter rules and regulations.

This is leading to increased compliance costs for insurers, but it is also helping to ensure that consumers are treated fairly.

Insurance Regulation and Compliance

In the realm of insurance, regulatory bodies play a pivotal role in overseeing the industry, ensuring its stability and protecting the interests of policyholders. These regulatory bodies establish and enforce regulations and compliance requirements that insurance companies must adhere to.

This ensures fair and ethical practices, promotes transparency, and maintains the integrity of the insurance market.

Key Regulations and Compliance Requirements

Insurance companies are required to comply with a comprehensive set of regulations and compliance requirements. These regulations cover various aspects of insurance operations, including:

- Financial Stability: Insurance companies must maintain adequate capital reserves and financial strength to meet their obligations to policyholders. This ensures their ability to pay claims and fulfill their contractual commitments.

- Product Approvals: New insurance products must be approved by regulatory authorities before they can be offered to consumers. This process ensures that products are fair, clearly defined, and meet the needs of policyholders.

- Claims Handling: Insurance companies must have transparent and efficient claims handling procedures in place. This includes setting clear timelines for claims processing, providing fair claim settlements, and ensuring prompt communication with policyholders.

- Market Conduct: Insurance companies must engage in fair and ethical marketing practices. This includes providing accurate and unbiased information about insurance products, avoiding misleading or deceptive advertising, and ensuring that agents are properly trained and licensed.

Importance of Staying Updated and Ensuring Compliance

The regulatory landscape is constantly evolving, with new regulations and compliance requirements being introduced regularly. Insurance companies must stay updated on these changes and ensure that they are in full compliance. This is crucial for maintaining a positive reputation, avoiding legal and financial penalties, and upholding the trust of policyholders.Failure

to comply with regulatory requirements can have severe consequences, including fines, license suspensions or revocations, and reputational damage. It can also lead to legal challenges from policyholders who feel they have been treated unfairly or misled.

Insurance Education and Resources

Understanding insurance and making informed decisions can be challenging. Fortunately, numerous resources and platforms are available to help individuals learn more about insurance and stay informed about the latest developments.

Online Resources

- Insurance Company Websites: Many insurance companies offer comprehensive information about their products, services, and the claims process on their websites.

- Government Agencies: Government agencies such as the National Association of Insurance Commissioners (NAIC) and the Insurance Information Institute (III) provide valuable resources, including consumer guides, brochures, and online tools.

- Independent Insurance Agents: Independent insurance agents can provide personalized guidance and assistance in choosing the right insurance policies and understanding coverage options.

- Online Insurance Forums and Communities: Online forums and communities dedicated to insurance can be a great source of information, tips, and support from fellow insurance professionals and consumers.

- Insurance Blogs and Websites: Numerous insurance blogs and websites offer insights, analysis, and expert advice on various insurance-related topics.

Staying Informed

- Newsletters and Alerts: Subscribe to newsletters or alerts from insurance companies, industry organizations, or reputable news sources to stay updated on the latest news, developments, and trends in the insurance industry.

- Social Media: Follow insurance companies, industry experts, and insurance-related organizations on social media platforms for up-to-date information and insights.

- Conferences and Seminars: Attend industry conferences, seminars, and webinars to learn from experts, network with peers, and stay abreast of the latest advancements in the insurance field.

Continuing Education

- Professional Development Courses: Many institutions and organizations offer professional development courses and certifications in insurance, catering to individuals looking to enhance their knowledge and skills.

- Online Courses and Webinars: Online courses and webinars provide a convenient way to learn about insurance at your own pace and on your own schedule.

- Insurance Industry Associations: Join industry associations such as the National Association of Insurance and Financial Advisors (NAIFA) or the Independent Insurance Agents & Brokers of America (IIABA) to access educational resources, networking opportunities, and professional development programs.

Insurance Advocacy and Consumer Protection

Insurance advocacy and consumer protection initiatives play a vital role in ensuring fair and equitable treatment of policyholders. These initiatives help protect the rights of individuals and businesses, ensuring they receive the coverage and benefits they are entitled to.

Role of Consumer Advocacy Groups

Consumer advocacy groups play a significant role in advocating for the rights of policyholders. These groups work to educate consumers about their rights and responsibilities, provide guidance on selecting appropriate insurance policies, and advocate for fair treatment by insurance companies.

- Consumer advocacy groups often conduct research and analysis of insurance policies and practices, identifying areas of concern and advocating for changes that benefit policyholders.

- These groups also provide support and guidance to policyholders who have experienced problems with their insurance companies, helping them navigate the claims process and ensuring they receive the benefits they are entitled to.

Individual Involvement in Insurance Advocacy

Individuals can also get involved in insurance advocacy efforts to make a difference in the industry. Here are some ways to get involved:

- Educate Yourself: Learn about your rights and responsibilities as a policyholder, and stay informed about insurance industry trends and developments.

- Support Consumer Advocacy Groups: Join or donate to consumer advocacy groups that work to protect the rights of policyholders. These groups rely on public support to continue their work.

- Share Your Experience: If you have had a positive or negative experience with an insurance company, share your story with consumer advocacy groups or relevant authorities. Your experience can help others and contribute to advocacy efforts.

- Contact Your Elected Officials: Reach out to your elected officials to express your concerns about insurance industry practices or advocate for changes that would benefit policyholders.

Final Thoughts

John Ritenour’s contributions to the insurance industry are profound and far-reaching. His dedication to educating and empowering individuals has transformed the way people perceive and engage with insurance. By demystifying complex insurance concepts and providing actionable advice, he has instilled confidence in policyholders and inspired a new level of understanding and appreciation for the role of insurance in safeguarding financial stability.

FAQ Corner

What is the significance of understanding insurance policies thoroughly?

A comprehensive understanding of insurance policies is crucial for several reasons. It enables individuals to make informed decisions about their coverage, ensuring that they have adequate protection against potential risks. It also empowers policyholders to navigate the claims process effectively, maximizing their benefits and minimizing disputes with insurance companies.

How can I assess and manage risks effectively?

Effective risk assessment and management involve identifying potential hazards, evaluating their likelihood and impact, and implementing strategies to mitigate their consequences. This can include employing risk assessment tools, conducting regular audits, and implementing appropriate safety measures.

What are the common types of insurance coverage available?

There are various types of insurance coverage available, each designed to address specific risks and needs. Some common types include life insurance, health insurance, property insurance, liability insurance, and business insurance. Each type of coverage has its own unique features, benefits, and limitations.

How can I protect myself from falling victim to insurance fraud?

To protect yourself from insurance fraud, be vigilant and aware of common red flags, such as unsolicited offers, requests for personal information, and pressure to make immediate decisions. Carefully review your insurance policies and understand your coverage limits. Report any suspicious activities or concerns to your insurance company promptly.