In the competitive landscape of the insurance industry, interviews play a crucial role in securing employment opportunities. To make a lasting impression and increase your chances of landing your dream job, it is essential to prepare thoroughly and showcase your knowledge, skills, and enthusiasm during the interview process.

This comprehensive guide provides valuable tips, questions, and insights to help you navigate the insurance interview process with confidence and leave a lasting impression on potential employers.

From researching the insurance company and industry trends to mastering effective communication and sales techniques, this guide covers all aspects of the insurance interview process. You will gain insights into appropriate attire and etiquette, the significance of teamwork and collaboration, and strategies for handling challenging situations.

Whether you are a seasoned professional or a recent graduate, this guide will equip you with the tools and knowledge you need to excel in your insurance interview and embark on a successful career in the industry.

Interview Preparation

Preparing for an interview at an insurance company requires thorough research, practice, and understanding of the role and industry. This will help you demonstrate your qualifications, enthusiasm, and alignment with the company’s goals.

To begin, delve into the company’s website, annual reports, and social media platforms to gather information about its history, mission, values, and recent developments. Understanding their products, services, and target market will give you a comprehensive overview of their operations.

Researching the Specific Role

Once you have a grasp of the company, delve into the specific role you are applying for. Review the job description meticulously, noting the required qualifications, skills, and responsibilities. Use online resources, such as industry blogs and forums, to learn more about the day-to-day tasks and challenges associated with the position.

Practicing Common Interview Questions

To prepare for common interview questions, practice your responses in front of a mirror or with a friend. Focus on delivering clear, concise, and confident answers that highlight your relevant experiences and skills. Remember to tailor your responses to the specific role and company you are applying to.

Understanding Industry Trends

Staying informed about industry trends is crucial. Read industry publications, attend webinars, and follow thought leaders on social media to stay updated on the latest developments, challenges, and opportunities in the insurance sector. This knowledge will demonstrate your passion for the field and your ability to contribute to the company’s success.

Professional Attire and Etiquette

In the insurance industry, maintaining a professional image is crucial to making a good impression during an interview. Proper attire and demeanor reflect your attention to detail, respect for the company, and commitment to professionalism.

Appropriate Attire

- Business Formal: This attire is typically required for more traditional insurance companies. It includes a dark suit, dress shirt, tie, and polished shoes for men, and a conservative dress or suit for women.

- Business Casual: Some insurance companies may allow for a more relaxed dress code. In such cases, opt for smart casual attire such as a blazer with khakis or a dressy blouse with dress pants.

- Grooming: Ensure your hair is neat, your nails are clean, and your accessories are minimal and appropriate. Avoid excessive jewelry or fragrances that may be distracting.

Professional Demeanor

- Body Language: Maintain good posture, make eye contact, and have a firm handshake. These nonverbal cues convey confidence and attentiveness.

- Communication: Speak clearly and concisely, using professional language. Be polite, respectful, and attentive to the interviewer’s questions.

- Be Prepared: Bring copies of your resume, references, and any other relevant documents. Arrive on time and be ready to answer questions about your qualifications and experience.

Punctuality

Arriving on time for your interview is a sign of respect and punctuality. It demonstrates your ability to manage your time effectively and meet deadlines. Plan your journey in advance, allowing ample time for unexpected delays.

Effective Communication Skills

In an interview, effective communication is vital for conveying your abilities, experience, and enthusiasm for the insurance position. It encompasses active listening, engaging with the interviewer, maintaining eye contact, using body language effectively, and clearly articulating responses.

Active Listening and Engagement:

- Focus on the interviewer’s questions and comments, indicating you’re attentive and interested.

- Ask clarifying questions to demonstrate understanding and genuine interest in the role and company.

- Maintain a natural and positive demeanor, showing enthusiasm and willingness to contribute.

Eye Contact and Body Language:

- Make direct eye contact with the interviewer, as it conveys confidence and sincerity.

- Maintain good posture, sitting up straight, and avoiding fidgeting or slouching.

- Use hand gestures and facial expressions appropriately to emphasize key points and show engagement.

Clear Articulation and Language:

- Speak clearly and at a moderate pace, ensuring the interviewer can understand you.

- Use appropriate language, avoiding jargon or technical terms that the interviewer may not be familiar with.

- Tailor your responses to the specific questions asked, providing concise and relevant information.

Researching the Insurance Industry

Familiarize yourself with the current state of the insurance industry, including emerging trends, key players, and recent developments. Understanding the industry’s dynamics will demonstrate your knowledge and enthusiasm to the interviewer.

Explore the various types of insurance products, such as life, health, property, and casualty insurance. Gain insights into their unique features, benefits, and significance in addressing different risks and needs.

Staying Updated on Industry News and Regulations

Staying informed about industry news and regulations is crucial to demonstrate your commitment to staying current with the evolving landscape. Here’s how you can stay updated:

- Read Industry Publications and Websites: Subscribe to insurance industry magazines, journals, and online news sources to stay abreast of the latest developments, trends, and regulatory changes.

- Attend Industry Events and Webinars: Participate in industry conferences, seminars, and webinars to gain insights from experts, network with professionals, and learn about new products and services.

- Follow Insurance Industry Influencers: Connect with thought leaders, analysts, and experts on social media platforms to stay updated on their insights, opinions, and predictions about the industry.

- Monitor Regulatory Updates: Keep track of changes in insurance regulations and compliance requirements by following relevant government agencies, regulatory bodies, and industry associations.

Understanding Insurance Products and Services

Gaining a thorough understanding of insurance products and services is crucial for effectively communicating with clients and fulfilling their insurance needs. By delving into the nuances of various insurance policies, advisors can equip themselves to provide comprehensive guidance and ensure clients make informed decisions.

Types of Insurance Policies

The insurance landscape encompasses a diverse range of policies, each catering to specific risks and eventualities. Some of the most prevalent types of insurance policies include:

- Life Insurance: This policy provides financial protection to the policyholder’s beneficiaries in the event of their untimely demise. It ensures that loved ones are financially secure and can maintain their standard of living.

- Health Insurance: Health insurance policies safeguard individuals against the financial burden of medical expenses. They cover a wide spectrum of healthcare services, including hospitalization, doctor consultations, and prescription medications.

- Property Insurance: Property insurance policies protect individuals and businesses against losses or damages to their properties. This includes coverage for homes, vehicles, and other tangible assets.

- Casualty Insurance: Casualty insurance policies provide coverage for liability claims arising from accidents or injuries caused by the policyholder or their property. This includes automobile liability insurance, general liability insurance, and workers’ compensation insurance.

Importance of Understanding Benefits and Limitations

Understanding the benefits and limitations of each insurance policy is paramount in providing sound advice to clients. This enables advisors to:

- Tailor Recommendations: By comprehending the unique needs and circumstances of clients, advisors can recommend policies that align with their specific requirements and offer optimal coverage.

- Manage Client Expectations: Clearly communicating the limitations of an insurance policy helps clients set realistic expectations and avoid potential misunderstandings or disappointments.

- Mitigate Risks: A thorough understanding of policy limitations allows advisors to identify potential gaps in coverage and suggest additional policies or riders to mitigate those risks.

Explaining Insurance Concepts to Clients

Effectively conveying insurance concepts to clients requires clear, concise, and jargon-free communication. Advisors can employ the following strategies:

- Use Simple Language: Avoid using technical terms or industry-specific jargon that may confuse or alienate clients. Opt for straightforward language that is easily comprehensible.

- Provide Real-Life Examples: Illustrating insurance concepts with relatable scenarios or examples helps clients grasp the practical applications and benefits of the policies.

- Utilize Visual Aids: Incorporating charts, graphs, or infographics can enhance understanding and make complex concepts more accessible to clients.

- Encourage Questions: Foster an environment where clients feel comfortable asking questions and seeking clarifications. This demonstrates a genuine interest in their concerns and helps address any lingering doubts.

Sales and Customer Service Techniques

To excel in the insurance industry, mastering effective sales techniques and delivering exceptional customer service are crucial. This involves promoting insurance products and services while building strong customer relationships and resolving complaints professionally.

Effective Sales Techniques

Successful insurance sales professionals employ various techniques to promote their products and services effectively:

- Understanding Customer Needs: Identifying and addressing customers’ specific insurance needs is essential for tailored solutions.

- Product Knowledge: In-depth knowledge of insurance products and their benefits allows sales representatives to present them confidently.

- Building Rapport: Establishing a connection with customers through active listening and empathy fosters trust and receptiveness.

- Effective Communication: Clear and concise communication helps convey the value and relevance of insurance products to customers.

- Handling Objections: Anticipating and addressing customer objections professionally demonstrates understanding and a commitment to finding solutions.

- Closing the Sale: Summarizing the benefits and value of the insurance product or service encourages customers to make informed decisions.

Building Strong Customer Relationships

Exceptional customer service is vital for retaining customers and building long-term relationships:

- Proactive Service: Reaching out to customers regularly to ensure their needs are met and expectations are exceeded.

- Personalized Service: Tailoring insurance solutions to individual customer needs and preferences demonstrates a genuine commitment to their well-being.

- Timely Response: Promptly addressing customer inquiries and concerns conveys professionalism and responsiveness.

- Resolving Complaints Professionally: Handling customer complaints promptly, thoroughly, and with empathy fosters positive relationships.

- Feedback Mechanism: Encouraging customer feedback and acting on it shows a willingness to improve service continuously.

Handling Customer Objections and Resolving Complaints Professionally

Effectively handling customer objections and resolving complaints is crucial for maintaining positive customer relationships:

- Active Listening: Listening attentively to customer concerns and objections demonstrates respect and understanding.

- Empathy: Showing empathy for the customer’s situation helps build rapport and defuse negative emotions.

- Clarifying Needs: Asking open-ended questions to clarify customer needs and concerns ensures a comprehensive understanding of the issue.

- Presenting Solutions: Offering solutions that address the customer’s concerns and meet their needs demonstrates a commitment to resolving the issue.

- Following Up: Following up after resolving a complaint to ensure customer satisfaction and address any lingering concerns.

Teamwork and Collaboration

In the dynamic insurance industry, teamwork and collaboration are essential for success. Insurance companies operate in a complex and interconnected environment, where various departments and teams work together to provide comprehensive services to policyholders and clients. Effective teamwork and collaboration enable insurance professionals to pool their knowledge, skills, and expertise, leading to improved outcomes and enhanced customer satisfaction.

Strategies for Effective Collaboration

Fostering effective collaboration within an insurance company requires a conscious effort to promote open communication, shared responsibilities, and mutual respect among team members. This can be achieved through:

- Clear Communication: Establishing open lines of communication, both formal and informal, is crucial for effective collaboration. Regular meetings, team huddles, and transparent information sharing help align goals, address challenges, and ensure everyone is on the same page.

- Shared Responsibilities: Encouraging a shared sense of ownership and accountability among team members promotes a collaborative spirit. Assigning tasks and responsibilities based on individual strengths and expertise allows team members to contribute their unique skills to the overall success of the project or initiative.

- Mutual Respect: Creating a culture of mutual respect and appreciation within the team fosters a positive and supportive work environment. Recognizing and valuing the contributions of each team member, regardless of their role or seniority, builds trust and strengthens the collaborative spirit.

Benefits of Open Communication and Knowledge Sharing

Open communication and knowledge sharing within a team bring numerous benefits to the insurance company and its clients:

- Enhanced Problem-Solving: When team members openly share their knowledge, insights, and experiences, it creates a collective pool of expertise that can be leveraged to solve complex problems more effectively and efficiently.

- Improved Decision-Making: By sharing diverse perspectives and ideas, teams can make more informed and well-rounded decisions. Collaborative decision-making also fosters a sense of ownership and commitment among team members.

- Increased Innovation: Encouraging open communication and knowledge sharing stimulates creativity and innovation within the team. Team members can build upon each other’s ideas, leading to the development of new and innovative solutions to meet the evolving needs of policyholders and clients.

- Strengthened Team Cohesion: When team members work together effectively and share knowledge openly, they develop a sense of camaraderie and trust. This strong team bond enhances overall team cohesion and productivity.

Problem-Solving and Decision-Making

In the dynamic and often unpredictable world of insurance, analytical thinking and problem-solving skills are essential for success. Insurance professionals are tasked with evaluating risks, making informed decisions, and finding creative solutions to complex challenges.

Assessing Risks and Making Informed Decisions

Insurance professionals are responsible for evaluating and managing risks, a core aspect of the insurance industry. They use analytical tools and techniques to assess the likelihood and severity of potential losses, enabling them to make informed decisions about underwriting policies, pricing, and risk management strategies.

Staying Calm and Composed Under Pressure

Insurance professionals often face challenging situations that require quick thinking and decision-making under pressure. They must remain calm and composed, even in the most stressful circumstances, to make sound judgments and avoid impulsive or rash decisions.

Career Advancement Opportunities

The insurance industry offers a multitude of career paths and advancement opportunities, allowing individuals to explore various roles and responsibilities throughout their careers.

Continuous Learning and Professional Development

Continuous learning and professional development are paramount for career advancement in the insurance industry. By staying updated with industry trends, regulations, and innovative products, individuals can enhance their skills, expand their knowledge, and increase their value to their organizations.

Networking and Building Relationships

Networking and building relationships with industry professionals is crucial for career growth. Attending industry events, joining professional organizations, and actively participating in online forums and communities can help individuals connect with potential mentors, learn about new opportunities, and stay informed about the latest developments in the field.

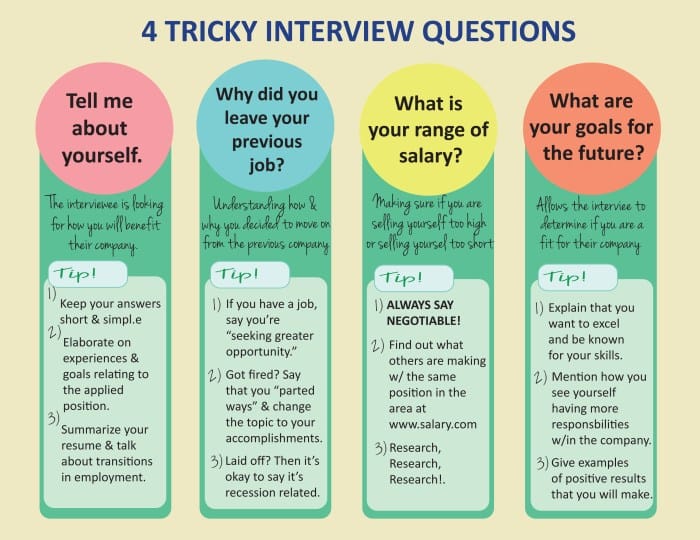

Practice Interview Questions

Preparing for an insurance job interview involves familiarizing yourself with common questions and developing thoughtful responses that highlight your skills and enthusiasm for the role. Below is a compilation of practice questions, organized into behavioral, technical, and situational categories, along with tips for answering them confidently and concisely.

Behavioral Questions

- Tell me about a time when you had to handle a difficult customer or client. How did you manage the situation?

- Describe a situation where you successfully resolved a conflict or disagreement between team members. What was your approach?

- Give an example of a time when you had to work under pressure and meet a tight deadline. How did you manage your time and prioritize tasks?

Technical Questions

- Explain the difference between property and casualty insurance.

- What are the key elements of an insurance policy? How do you determine the appropriate coverage limits for a client?

- Describe the process of underwriting an insurance policy. What factors do you consider when assessing risk?

Situational Questions

- You’re meeting with a potential client who is hesitant about purchasing insurance. How would you address their concerns and build rapport?

- Imagine you’re dealing with a claim from a customer who is dissatisfied with the settlement offer. How would you handle the situation and negotiate a mutually agreeable resolution?

- You’re working on a team project with colleagues who have different working styles. How do you adapt your communication and collaboration style to ensure effective teamwork?

Tips for Answering Interview Questions:

- Be prepared: Research the insurance industry, the company you’re applying to, and the specific role you’re interviewing for. This knowledge will help you answer questions intelligently and demonstrate your interest in the position.

- Be confident: Maintain eye contact, speak clearly and concisely, and project a positive attitude. Confidence is contagious, and it will make a good impression on the interviewer.

- Be concise: Avoid rambling or giving overly long answers. Get to the point quickly and efficiently, ensuring that you address the key aspects of the question.

- Be yourself: Don’t try to be someone you’re not. The interviewer wants to get to know the real you, so be authentic and genuine in your responses.

Conclusion

The insurance industry presents a dynamic and rewarding career path for those who are passionate about providing financial security and peace of mind to individuals and businesses. By following the tips, answering the questions, and incorporating the strategies Artikeld in this guide, you can confidently navigate the insurance interview process and make a lasting impression on potential employers.

Remember to stay authentic, showcase your passion for the industry, and demonstrate your commitment to delivering exceptional service to clients. With dedication and perseverance, you can unlock a world of opportunities and achieve your career aspirations in the insurance industry.

FAQ

What are some common behavioral interview questions asked in insurance interviews?

Behavioral interview questions focus on your past experiences and behaviors in specific situations. Common examples include: “Tell me about a time when you had to resolve a conflict with a customer or colleague,” “Describe a situation where you demonstrated your problem-solving skills,” and “Share an instance where you went above and beyond to provide exceptional customer service.”

How can I effectively answer technical questions related to insurance products and services?

To answer technical questions effectively, demonstrate your knowledge of different insurance policies, their benefits, and limitations. Use clear and concise language to explain complex concepts and provide real-life examples to illustrate your understanding. If you are unsure about a specific question, ask for clarification or provide a thoughtful response based on your general knowledge and industry insights.

What are some tips for handling objections and resolving complaints from customers during an insurance interview?

When handling objections and resolving complaints, maintain a professional and empathetic demeanor. Actively listen to the customer’s concerns, acknowledge their feelings, and demonstrate your understanding of their situation. Offer solutions that are fair and beneficial to both parties, and be willing to go the extra mile to resolve the issue to the customer’s satisfaction.

Showcasing your ability to handle challenging situations calmly and professionally will make a positive impression on the interviewer.