In the labyrinth of financial planning, disability insurance stands as a beacon of security, providing a safety net against unforeseen circumstances that may jeopardize one’s ability to earn a living. However, when it comes to tip income, a common source of earnings in various service industries, questions arise about its coverage under disability insurance policies.

This comprehensive guide delves into the intricacies of disability insurance and tip income, exploring the eligibility criteria, policy variations, documentation requirements, legal considerations, and strategies for maximizing coverage. Through real-life case studies and expert insights, we aim to shed light on this often overlooked aspect of disability insurance, ensuring individuals can navigate the complexities with confidence.

Disability Insurance Coverage for Tip Income

Disability insurance is a type of insurance that provides financial support to individuals who are unable to work due to illness, injury, or disability. The purpose of disability insurance is to help individuals maintain their standard of living and meet their financial obligations during a period of disability.

Tip income is a form of compensation that is earned by individuals who provide services to customers. Examples of occupations where tip income is common include waiters, waitresses, bartenders, hairdressers, and taxi drivers.

Taxation of Tip Income

Tip income is considered taxable income and must be reported to the Internal Revenue Service (IRS). Employers are required to withhold taxes from tip income, just as they do from wages and salaries.

Disability Insurance and Tip Income

In general, disability insurance policies do not cover tip income. This is because tip income is not considered to be “earned income” under the terms of most disability insurance policies. Earned income is typically defined as income that is received from an employer for services performed.

However, there are some disability insurance policies that do cover tip income. These policies are typically more expensive than policies that do not cover tip income.

Determining Eligibility for Disability Benefits

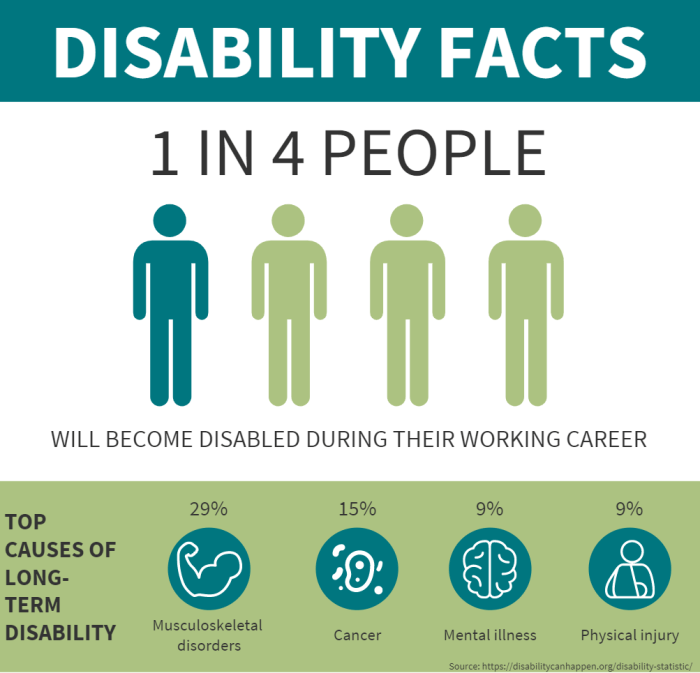

Disability insurance policies establish specific criteria to assess an individual’s eligibility for disability benefits. These criteria vary among insurers, but typically consider factors such as the individual’s occupation, income, and medical condition. In the context of tip income, determining eligibility for disability benefits involves evaluating the role of tips in assessing insurability and the impact of tip income on the approval or denial of disability claims.

Assessing Insurability and Tip Income

When assessing an individual’s insurability for disability insurance, insurers consider various factors, including the individual’s occupation and income. Tip income, being a variable and often unreported source of income, can pose challenges in determining insurability. Insurers may request documentation of tip income, such as tax returns or employer statements, to accurately assess the individual’s financial situation and insurability.

Factors Influencing Disability Claims Approval/Denial

The approval or denial of disability claims based on tip income depends on several factors. These factors include:

- Documentation of Tip Income: The availability of accurate and consistent documentation of tip income is crucial. Lack of proper documentation can lead to difficulties in substantiating the claim and may result in denial.

- Consistency of Tip Income: Insurers assess the consistency of tip income over time. Consistent tip income, reported regularly, strengthens the claim’s credibility.

- Medical Evidence: The severity of the medical condition and its impact on the individual’s ability to work are key factors in determining claim approval. Medical evidence, such as doctor’s reports and test results, must support the claim.

- Occupation and Job Duties: The nature of the individual’s occupation and job duties is considered. If tip income is a significant portion of the individual’s total income and the disability prevents them from performing their job duties, the claim is more likely to be approved.

Policy Variations and Coverage Options

Disability insurance policies vary in terms of their coverage options and provisions related to tip income. It’s essential to understand these variations to make an informed decision about the right policy for your needs.

Types of Disability Insurance Policies

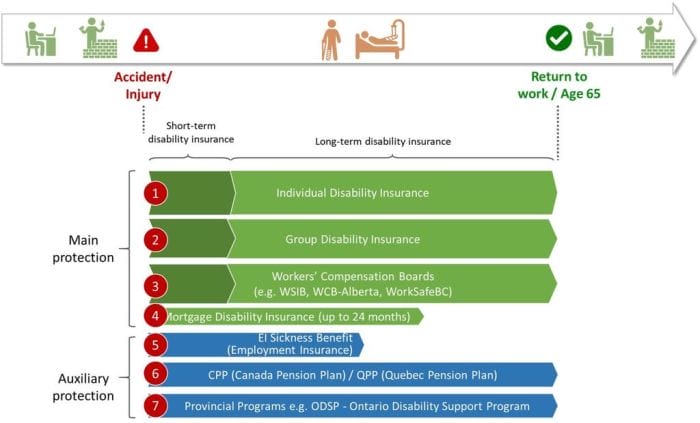

There are two main types of disability insurance policies:

- Short-term disability insurance: This type of policy provides benefits for a limited period, typically up to one year, while you are unable to work due to a disability.

- Long-term disability insurance: This type of policy provides benefits for a longer period, typically up to age 65 or the end of your working life, if you are unable to work due to a disability.

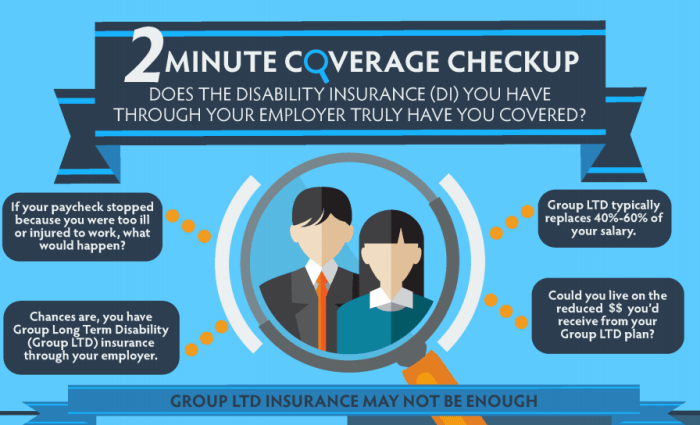

Both short-term and long-term disability insurance policies can be purchased as individual or group policies. Group policies are typically offered through employers and may provide more affordable rates than individual policies.

Coverage Options for Tip Income

Disability insurance policies may offer various coverage options for tip income, including:

- Inclusion of tip income: Some policies may allow you to include tip income as part of your covered earnings, which can increase the amount of benefits you receive if you become disabled.

- Exclusion of tip income: Other policies may exclude tip income from coverage, which means that you will not receive benefits for any lost tip income if you become disabled.

- Partial inclusion of tip income: Some policies may allow you to include a portion of your tip income, such as a percentage or a fixed amount, as part of your covered earnings.

It’s important to carefully review the policy provisions and exclusions related to tip income before purchasing a disability insurance policy to ensure that you understand the coverage that is provided.

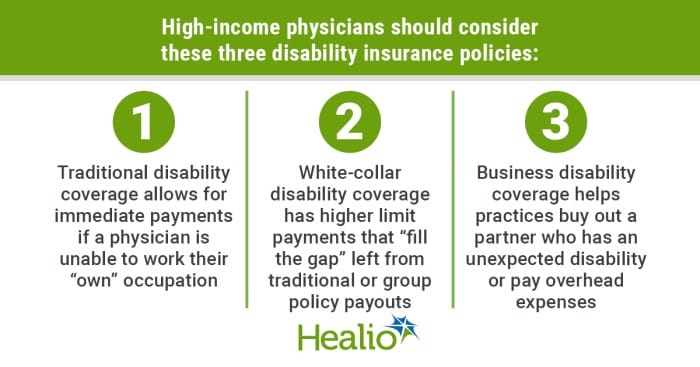

Policy Riders or Endorsements

Some insurance companies offer policy riders or endorsements that can be added to a disability insurance policy to provide additional coverage for tip income. These riders or endorsements may allow you to:

- Increase the amount of benefits you receive for lost tip income.

- Extend the period of time that you can receive benefits for lost tip income.

- Include tip income as part of your covered earnings, even if it is not otherwise covered by the policy.

Policy riders or endorsements can provide valuable additional coverage for tip income, but they may also increase the cost of your policy. It’s important to weigh the cost of the rider or endorsement against the potential benefits it provides before deciding whether to purchase it.

Impact of Tip Income on Disability Benefit Calculations

Tip income, a common source of earnings for service industry workers, can impact disability benefit calculations in various ways. Understanding these implications is crucial for individuals seeking disability benefits.

Determining Disability Benefit Amounts

When determining disability benefit amounts, insurance companies consider several factors, including the individual’s pre-disability earnings. For employees with tip income, the calculation of disability benefits can be more complex due to the fluctuating and often unreported nature of tips.

Methods for Calculating Benefits

To account for tip income, insurance companies may use different methods to determine disability benefits. These methods aim to estimate the individual’s average earnings, including tips, over a specific period before the disability.

- Actual Tip Income: In some cases, insurance companies may request detailed records of tip income, such as tip logs or tax returns, to determine the actual amount of tips earned.

- Reported Tip Income: If actual tip income is unavailable, insurance companies may rely on reported tip income, which is the amount of tips declared to the tax authorities.

- Estimated Tip Income: When neither actual nor reported tip income is available, insurance companies may estimate tip income based on industry averages, job type, and other factors.

Formulas and Calculations

The specific formula used to calculate disability benefits varies among insurance companies. However, the general approach involves multiplying the individual’s average pre-disability earnings, including tips, by a percentage specified in the disability insurance policy.For example, if an individual’s average monthly earnings, including tips, were $3,000 and their disability insurance policy provides a 60% benefit, their monthly disability benefit would be calculated as follows:

Disability Benefit = Average Monthly Earnings x Percentage of Benefit

Disability Benefit = $3,000 x 60%

Disability Benefit = $1,800

It’s important to note that these calculations are illustrative and actual benefit amounts may vary depending on the specific terms and conditions of the disability insurance policy.

Documentation and Reporting Requirements

Disability insurance claims involving tip income necessitate meticulous documentation and reporting. Providing accurate and timely information is crucial for ensuring a smooth claims process and avoiding potential complications.

Required Documentation

When filing a disability claim that includes tip income, several documents are typically required to support the claim:

- Income Tax Returns: Copies of recent income tax returns, including all schedules and attachments, are essential for verifying tip income reported to the Internal Revenue Service (IRS).

- Pay Stubs: Pay stubs from the period leading up to the disability should be provided to demonstrate the claimant’s regular wages, including tips.

- Employer Statements: A statement from the employer or supervisor confirming the claimant’s tip income is often requested by disability insurance carriers. This statement should include details such as the claimant’s job title, duties, and average tip earnings.

- Bank Statements: Bank statements can be used to corroborate tip income by showing deposits that align with the claimant’s reported earnings.

- Tip Records: If the claimant kept personal records of their tip income, these records can be submitted to support the claim. These records should include dates, amounts, and any other relevant details.

Reporting Tip Income to Disability Insurance Carriers

It is crucial to report tip income accurately and promptly to disability insurance carriers. This can be done by:

- Initial Application: When applying for disability benefits, the claimant should disclose all sources of income, including tip income. This information should be provided on the application form or in a separate statement.

- Regular Reporting: During the disability period, the claimant is typically required to submit periodic reports to the disability insurance carrier. These reports should include updates on the claimant’s income, including any tip income received.

Consequences of Misrepresentation or Failure to Report Tip Income

Misrepresenting or failing to report tip income in the context of a disability claim can have serious consequences:

- Claim Denial: The disability insurance carrier may deny the claim altogether if it discovers that tip income was not accurately reported.

- Benefit Reduction: If tip income was initially reported incorrectly, the disability insurance carrier may reduce the claimant’s benefits to reflect the actual income earned.

- Legal Penalties: In some cases, misrepresenting or failing to report tip income may constitute fraud, which can result in legal penalties, including fines or imprisonment.

Legal and Regulatory Considerations

The coverage of tip income under disability insurance policies is governed by a complex interplay of federal and state laws and regulations. Understanding these legal and regulatory considerations is crucial for individuals seeking disability benefits and insurance providers.

Federal Laws and Regulations

At the federal level, the Social Security Act (SSA) and the Employee Retirement Income Security Act of 1974 (ERISA) are the primary pieces of legislation that impact disability insurance and tip income. The SSA defines disability as the inability to engage in substantial gainful activity (SGA) due to a medically determinable physical or mental impairment that is expected to last for at least 12 months or result in death.

ERISA, on the other hand, sets minimum standards for employee benefit plans, including disability insurance, and provides guidelines for the administration and funding of these plans.

State-Specific Laws and Regulations

In addition to federal laws, state-specific laws and regulations can also impact the coverage of tip income under disability insurance policies. These laws vary from state to state and may address issues such as the definition of disability, the calculation of benefits, and the reporting requirements for tip income.

For example, some states may have specific rules regarding the inclusion or exclusion of tip income when determining eligibility for disability benefits.

Legal Cases and Precedents

Over the years, several legal cases have been brought before the courts to determine the coverage of tip income under disability insurance policies. These cases have helped shape the legal landscape and provide guidance to insurance companies and individuals seeking disability benefits.

One notable case is Smith v. Hartford Life & Accident Insurance Co. , in which the court ruled that tip income could be considered earned income for the purpose of calculating disability benefits under ERISA.

Strategies for Maximizing Disability Coverage

Accurate record-keeping, open communication, and understanding policy terms can help individuals maximize their disability coverage while considering tip income.

Accurate Record-Keeping and Documentation

Tip income is often overlooked or underreported, leading to potential discrepancies between actual earnings and reported income. Accurate and consistent record-keeping of tip income is crucial for ensuring that disability benefits accurately reflect the individual’s true income.

- Maintain a daily or weekly log of tip income, including the date, amount, and source of the tips.

- Keep receipts, credit card slips, and other documentation that show tip income.

- Use a mobile app or software to track tip income easily and efficiently.

Open Communication with Disability Insurance Carriers

Transparency and open communication with disability insurance carriers are essential for ensuring that tip income is properly accounted for in disability benefit calculations.

- Inform the carrier about tip income during the application process.

- Provide regular updates on tip income throughout the policy term.

- Notify the carrier promptly of any changes in tip income, such as an increase or decrease.

Understanding Policy Terms and Conditions

Reviewing and understanding the terms and conditions of the disability insurance policy is crucial for determining how tip income is treated in disability benefit calculations.

- Read the policy carefully to determine if tip income is considered taxable income.

- Check the definition of “income” in the policy to see if it includes tip income.

- Contact the carrier or an insurance professional if you have questions about how tip income is treated under the policy.

Case Studies and Real-Life Examples

Understanding the real-life impact of tip income on disability insurance claims can provide valuable insights into the challenges and complexities faced by individuals and insurance carriers.

The following case studies illustrate the diverse experiences and outcomes of individuals whose disability insurance claims were affected by tip income:

Case Study 1: A Server’s Struggle for Disability Benefits

Sarah, a server at a popular restaurant, sustained a severe hand injury while on the job. Due to her injury, she was unable to continue working and filed a disability insurance claim. However, her claim was denied because a significant portion of her income came from tips, which were not considered by the insurance carrier as part of her regular earnings.

Sarah faced financial hardship as she struggled to make ends meet without her regular income. She appealed the insurance carrier’s decision, arguing that tips were an integral part of her livelihood and should be included in calculating her disability benefits.

After a lengthy appeals process, Sarah eventually won her case and received the disability benefits she was entitled to.

Case Study 2: A Bartender’s Successful Claim

John, a bartender at a busy nightclub, suffered a debilitating back injury that prevented him from continuing his work. He filed a disability insurance claim, and his insurance carrier approved the claim based on his regular wages and tips. John’s policy included a provision that specifically covered tip income, ensuring that he received a fair and adequate disability benefit.

John’s case demonstrates the importance of having a disability insurance policy that explicitly covers tip income. By carefully reviewing the policy terms and ensuring that tips are included in the definition of covered earnings, individuals can protect themselves against potential claim denials.

Insurance Carrier Decision-Making Process

In assessing disability insurance claims involving tip income, insurance carriers consider various factors, including:

- The policy language and definitions of covered earnings.

- The individual’s employment history and the consistency of tip income.

- Documentation and records of tip income, such as pay stubs, tax returns, and employer statements.

- The impact of the disability on the individual’s ability to perform their job duties.

Insurance carriers may also consider the industry norms and practices regarding tip income in the specific occupation or profession.

Future Trends and Developments

The landscape of disability insurance and tip income is constantly evolving, influenced by technological advancements, changing employment patterns, and evolving legal and regulatory frameworks. It is essential to stay informed about these trends to ensure that individuals and organizations can adequately protect their interests.

Impact of Technological Advancements

Technological advancements are transforming the world of work, leading to new opportunities for individuals to earn income through various platforms and flexible work arrangements. This shift may impact the way disability insurance policies define and calculate tip income, as traditional methods of tracking and reporting tips may no longer be applicable.

Changing Employment Patterns

The rise of the gig economy and remote work has led to a more diverse and flexible workforce. These changes may present challenges in determining eligibility for disability benefits, as traditional employment relationships may not always exist. Disability insurance providers may need to adapt their policies to accommodate these evolving employment models.

Emerging Legal and Regulatory Issues

Legal and regulatory changes can significantly impact the coverage of tip income under disability insurance policies. For example, changes in minimum wage laws or regulations governing the treatment of tips may affect how disability insurance providers calculate benefits. It is crucial for individuals and organizations to stay updated on these developments to ensure compliance and adequate coverage.

Additional Considerations

Disability insurance policies’ coverage of tip income is influenced by several additional factors. Understanding these factors is crucial for individuals and insurance providers to ensure fair treatment of claims.

Transparency and clear communication are vital to ensuring that both parties are aware of the terms and conditions of the policy, including the treatment of tip income.

Advocacy Groups and Organizations

Advocacy groups and organizations play a significant role in supporting individuals with disabilities and ensuring access to adequate disability insurance coverage. They provide resources, information, and support to individuals navigating the complexities of the disability insurance system.

These groups advocate for policy changes and reforms to improve the coverage and benefits available to individuals with disabilities. Their efforts contribute to a more equitable and supportive system for individuals affected by disability.

Summary

As the world of work continues to evolve, the relationship between disability insurance and tip income remains a dynamic and ever-changing landscape. It is crucial for individuals and insurance providers to stay abreast of the latest trends and developments to ensure fair and equitable treatment of disability claims involving tip income.

By fostering open communication, maintaining accurate records, and seeking guidance from experts, we can collectively navigate the complexities of disability insurance and tip income, empowering individuals to secure their financial well-being in times of adversity.

FAQ

Q: What is disability insurance, and how does it relate to tip income?

A: Disability insurance provides financial protection in the event of an illness or injury that prevents an individual from working. Tip income, a common source of earnings in service industries, is often a factor considered when determining eligibility for disability benefits and calculating benefit amounts.

Q: How is tip income typically treated when calculating disability benefits?

A: The treatment of tip income in disability benefit calculations varies depending on the insurance policy and state regulations. Some policies may consider a portion of tip income as part of the insured’s earnings, while others may exclude it altogether.

It is essential to carefully review the policy provisions to understand how tip income will be factored into benefit calculations.

Q: What documentation is required to support disability claims involving tip income?

A: To support disability claims involving tip income, individuals may need to provide documentation such as pay stubs, tax returns, and records of tip income. Accurate and detailed records of tip income are crucial for substantiating the claim and ensuring a fair assessment of benefits.

Q: What are some strategies for maximizing disability coverage considering tip income?

A: To maximize disability coverage considering tip income, individuals should keep accurate records of their tip earnings, communicate transparently with their insurance carrier about tip income, and consider purchasing additional riders or endorsements that may provide broader coverage for tip income.