In the intricate tapestry of unemployment insurance, the treatment of tips as wages has long been a topic of debate and intrigue. This discourse delves into the complexities of this issue, exploring how tips are defined, their impact on unemployment benefits, and the varying regulations across jurisdictions.

The significance of accurately reporting tip income, the impact on unemployment insurance premiums, and recent developments in this domain are also brought to light, shedding light on the intricacies of this multifaceted topic.

Wage Definition for Unemployment Insurance

When it comes to unemployment insurance, understanding what constitutes “wages” is crucial. Wages, in this context, encompass various forms of compensation an individual receives for services rendered during employment.

Examples of wages include:

- Hourly pay: This is the most common form of wages, calculated by multiplying the hourly rate by the number of hours worked.

- Commissions: Commissions are payments made to employees based on their sales or performance achievements.

- Bonuses: Bonuses are one-time payments given to employees as rewards for exceptional performance or achieving specific goals.

Tips as Compensation

In certain service industries, tips form a crucial component of employees’ compensation. These gratuities, customarily provided by customers in appreciation for satisfactory service, play a significant role in shaping the overall earnings of individuals working in these sectors.

Typically, tips are considered a form of non-guaranteed income, meaning they are not included in the base wage or salary paid to employees. However, in many jurisdictions, tips are subject to taxation and may also be factored into calculations for benefits such as social security and unemployment insurance.

Varying Treatment of Tips Across Jurisdictions

The treatment of tips in relation to regular wages varies across different jurisdictions. In some regions, tips are viewed as a supplement to wages, while in others, they are considered a form of compensation in their own right. This disparity in treatment can lead to differences in how tips are accounted for in employment-related matters.

- Pooling and Sharing of Tips: In certain establishments, it is common practice for tips to be pooled and shared among employees, ensuring a more equitable distribution of gratuities. This practice can help address potential disparities in earnings between employees who receive more tips and those who receive fewer.

- Minimum Wage Calculations: In some jurisdictions, tips may be counted towards meeting the minimum wage requirements. This means that employers can pay a lower base wage as long as tips bring the total compensation up to the minimum wage threshold.

- Reporting and Taxation: In many jurisdictions, employees are required to report their tip income to tax authorities. This ensures that tips are subject to taxation, contributing to government revenue and supporting public services.

The varying treatment of tips across jurisdictions highlights the need for clear and consistent regulations governing the handling of gratuities in the workplace. These regulations should strike a balance between protecting the rights of employees and ensuring fairness in compensation practices.

Impact of Tips on Unemployment Benefits

Tips, a common form of compensation in certain industries, can have a significant impact on an individual’s eligibility for unemployment benefits and the amount of benefits they receive. Understanding how tips are treated when calculating unemployment benefits is crucial for individuals who rely on this form of income.

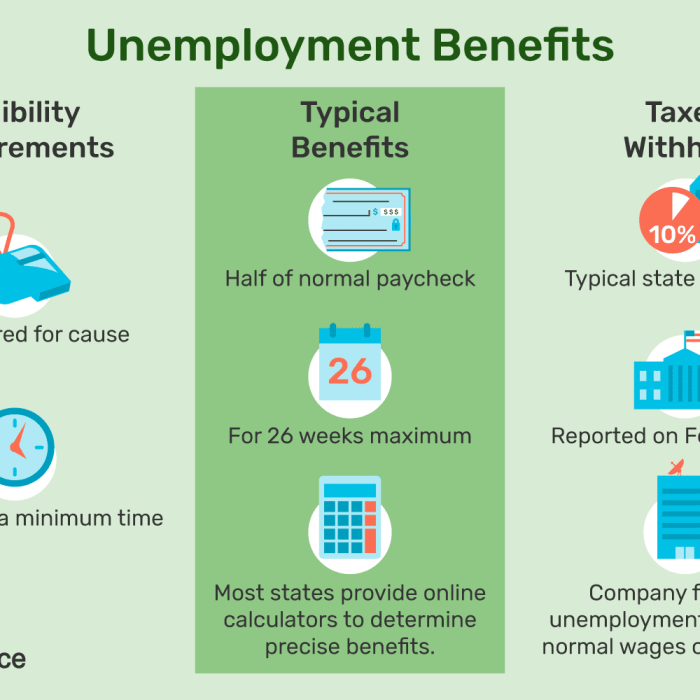

Eligibility for Unemployment Benefits

In general, tips are considered wages for the purpose of determining eligibility for unemployment benefits. This means that individuals who receive tips as part of their income may be eligible for unemployment benefits if they meet other eligibility requirements, such as having worked a minimum number of hours or earning a certain amount of wages in a base period.

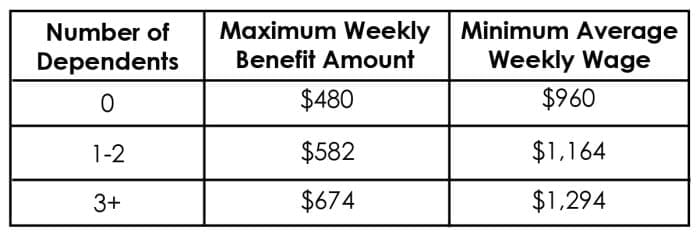

Calculating Unemployment Benefits

When calculating unemployment benefits, tips are typically included as part of an individual’s wages. This can have a positive impact on the amount of benefits an individual receives, as tips can increase their overall earnings and thus lead to higher benefit payments.

However, it’s important to note that the specific rules for calculating unemployment benefits, including the treatment of tips, can vary from state to state.

Examples of Impact

To illustrate the impact of tips on unemployment benefits, consider the following examples:

-

-*Example 1

A server who earns $10 per hour in wages and receives an average of $5 per hour in tips may be eligible for higher unemployment benefits compared to a server who earns only $10 per hour in wages. The tips increase the server’s overall earnings, resulting in a higher benefit amount.

-*Example 2

A bartender who earns $15 per hour in wages and receives an average of $10 per hour in tips may be eligible for unemployment benefits even if they are laid off during a slow season when tips are lower.

The tips provide a cushion that helps the bartender meet the minimum earnings requirement for unemployment benefits.

-*Example 3

A hairstylist who earns $20 per hour in wages and receives an average of $15 per hour in tips may be eligible for higher unemployment benefits if they are laid off due to a salon closure. The tips supplement the hairstylist’s wages, leading to a more substantial unemployment benefit payment.

Reporting Requirements for Tips

To ensure the accurate calculation of unemployment insurance benefits, it is crucial to report tip income accurately to unemployment insurance agencies. Different states have varying reporting requirements for tip income. It is essential to understand these requirements to fulfill reporting obligations and receive the appropriate benefits.

Significance of Reporting Tip Income

Accurately reporting tip income to unemployment insurance agencies is important for several reasons:

- Accurate Benefit Calculation: Tip income is considered part of an individual’s earnings and must be included when calculating unemployment insurance benefits. Failing to report tip income can result in receiving lower benefits than you are entitled to.

- Eligibility Determination: Some states have minimum earnings requirements to qualify for unemployment insurance benefits. Accurately reporting tip income helps ensure that you meet these requirements and are eligible for benefits.

- Benefit Duration: The duration of unemployment insurance benefits is often based on an individual’s earnings history. Accurately reporting tip income can impact the duration of benefits you receive.

- Legal Compliance: Failing to report tip income can be a violation of state laws and may result in penalties, including fines or even prosecution.

Consequences of Failing to Report Tip Income

There are several potential consequences of failing to report tip income to unemployment insurance agencies:

- Reduced Benefits: As mentioned earlier, failing to report tip income can lead to receiving lower unemployment insurance benefits than you are entitled to.

- Benefit Disqualification: In some cases, failing to report tip income can result in disqualification from receiving unemployment insurance benefits altogether.

- Penalties: As discussed earlier, failing to report tip income may result in penalties, including fines or even prosecution, depending on state laws.

- Impact on Future Claims: Failing to report tip income can negatively impact future unemployment insurance claims, as it may create a pattern of misreporting income.

Variations in State Laws

State laws governing the treatment of tips for unemployment insurance purposes vary across the United States. Some states explicitly include tips as wages, while others do not. This variation can significantly impact the amount of unemployment benefits that a worker is eligible to receive.

States That Include Tips as Wages

In states that include tips as wages, the amount of unemployment benefits that a worker is eligible to receive is based on their total earnings, including tips. This means that workers who receive tips will typically receive higher unemployment benefits than workers who do not receive tips.

- California

- New York

- Illinois

- Pennsylvania

- Texas

States That Do Not Include Tips as Wages

In states that do not include tips as wages, the amount of unemployment benefits that a worker is eligible to receive is based on their base wages only. This means that workers who receive tips will typically receive lower unemployment benefits than workers who do not receive tips.

- Florida

- Georgia

- North Carolina

- Tennessee

- Virginia

Impact of Variations in State Laws

The variation in state laws governing the treatment of tips for unemployment insurance purposes can have a significant impact on the amount of unemployment benefits that a worker is eligible to receive. In states that include tips as wages, workers who receive tips will typically receive higher unemployment benefits than workers who do not receive tips.

In states that do not include tips as wages, workers who receive tips will typically receive lower unemployment benefits than workers who do not receive tips.

Documentation and Record-Keeping

Maintaining accurate records of tip income is crucial for unemployment insurance purposes. Effective tracking and documentation ensure that individuals can accurately report their earnings and receive the appropriate benefits.

Using Electronic Tip Reporting Systems

Electronic tip reporting systems can greatly simplify the process of tracking and reporting tip income. These systems allow employees to electronically record their tips, often through a mobile app or online portal. This information is then automatically transmitted to the employer, who can then include it in their payroll records.

Electronic tip reporting systems can help ensure that tip income is accurately reported and accounted for, reducing the risk of errors or omissions.

Impact on Unemployment Insurance Premiums

Including tips as wages for unemployment insurance may have several implications for unemployment insurance premiums paid by employers.

Overall Cost of Unemployment Insurance

Including tips as wages can potentially increase the overall cost of unemployment insurance for businesses. This is because unemployment insurance premiums are typically calculated based on a percentage of an employee’s wages. By including tips as wages, the total amount of wages subject to unemployment insurance taxation increases, leading to higher premium payments.

Impact on Premium Rates

The impact of including tips on unemployment insurance premiums can vary depending on the state’s unemployment insurance laws and the specific industry or occupation. In some cases, the inclusion of tips may result in higher premium rates for employers in industries where tipping is common, such as the hospitality industry.

Examples of Premium Impact

Consider the following examples to illustrate the potential impact of including tips on unemployment insurance premiums:

In a state where the unemployment insurance premium rate is 2.7% and an employee earns $10 per hour in wages plus $5 per hour in tips, the employer’s unemployment insurance premium would be calculated as follows

> Unemployment Insurance Premium = 2.7% x ($10 + $5) = $0.405 per hour

If tips were not included as wages, the employer’s unemployment insurance premium would be calculated as follows

> Unemployment Insurance Premium = 2.7% x $10 = $0.27 per hour

In this example, including tips as wages results in a higher unemployment insurance premium for the employer.

Historical Context

The treatment of tips for unemployment insurance purposes has undergone significant evolution over time. Initially, tips were not considered wages subject to unemployment insurance taxes or benefits. However, as the service industry grew and tips became a more substantial portion of workers’ earnings, the need for a more comprehensive approach to unemployment insurance coverage became evident.

Changing Policies and Milestones

- 1935: The Social Security Act establishes unemployment insurance as a federal-state program, but tips are not explicitly addressed.

- 1976: The Unemployment Insurance Amendments of 1976 define “wages” for unemployment insurance purposes to include tips reported to the employer. This change was driven by concerns that excluding tips from the definition of wages disadvantaged tipped workers and created an unfair burden on other workers and employers.

- 1983: The Tax Equity and Fiscal Responsibility Act (TEFRA) clarifies the definition of tips and establishes a mandatory reporting requirement for employers to report tips to the Internal Revenue Service (IRS). This change aimed to ensure that tips were accurately reported and that tipped workers received the unemployment benefits they were entitled to.

- 2018: The Bipartisan Budget Act of 2018 amends the definition of “wages” for unemployment insurance purposes to exclude tips from the calculation of base period wages. This change was intended to provide more flexibility for states in determining unemployment benefits for tipped workers.

These milestones reflect the ongoing efforts to ensure that unemployment insurance programs adequately address the unique circumstances of tipped workers and maintain a fair and equitable system for all workers.

Recent Developments and Trends

The treatment of tips for unemployment insurance purposes has undergone significant changes in recent years, driven by evolving labor market dynamics and legislative initiatives. This section explores recent developments and trends in this area, identifying emerging issues and challenges, and discussing potential future changes and their implications for unemployment benefits.

Growing Prevalence of Tipped Work

One notable trend is the increasing prevalence of tipped work, particularly in the service industry. As the economy shifts towards more customer-facing roles, the number of workers who rely on tips as a substantial portion of their income has grown.

This trend has raised questions about the adequacy of unemployment insurance benefits for tipped workers, who may experience significant income fluctuations during periods of economic downturn or job loss.

Legislative Changes and Court Rulings

Several states have recently enacted legislation or issued court rulings that have impacted the treatment of tips for unemployment insurance purposes. These changes have varied in their approach, with some states expanding eligibility for unemployment benefits to include tips and others implementing stricter rules for reporting and documenting tip income.

These legislative and legal developments have contributed to a patchwork of regulations across the country, leading to inconsistencies in the treatment of tipped workers.

Focus on Tip Reporting and Documentation

There has been a growing emphasis on accurate and timely reporting of tip income by both employers and employees. Many states have implemented electronic tip reporting systems to streamline the process and ensure compliance. Additionally, there is a trend towards requiring employers to provide employees with clear guidance and training on tip reporting requirements.

These efforts aim to improve the accuracy of unemployment insurance claims and ensure that tipped workers receive the benefits they are entitled to.

Potential Future Changes

The future of tip treatment for unemployment insurance purposes is likely to be shaped by ongoing debates about the adequacy of benefits for tipped workers, the role of technology in tip reporting and tracking, and the impact of the gig economy on traditional employment relationships.

Potential future changes could include the expansion of unemployment insurance eligibility to include more tipped workers, the implementation of standardized tip reporting and documentation requirements across states, and the development of new strategies to address the challenges faced by tipped workers in the gig economy.

Case Studies and Real-World Examples

Examining real-world scenarios provides valuable insights into the practical implications of treating tips as wages for unemployment insurance.

One notable case study involves a server named Sarah who worked at a popular restaurant. During the COVID-19 pandemic, the restaurant was forced to close temporarily, resulting in Sarah losing her job. When she applied for unemployment benefits, the state unemployment agency initially denied her claim, arguing that her tips were not considered wages and thus not subject to unemployment insurance.

Factors Contributing to the Outcome

- State Law: The outcome of Sarah’s case was largely influenced by the specific unemployment insurance laws in her state. In some states, tips are explicitly excluded from the definition of wages for unemployment insurance purposes, while in others, they are included.

- Employer’s Reporting Practices: The employer’s reporting practices also played a role. In Sarah’s case, her employer had consistently reported her tips as part of her wages, which helped establish a record of her earnings and supported her claim for unemployment benefits.

- Documentation: Sarah’s ability to provide documentation of her tip earnings, such as pay stubs and bank statements, further strengthened her case and demonstrated the accuracy of her reported income.

Lessons Learned and Implications

The case of Sarah highlights the importance of clear and consistent state laws regarding the treatment of tips as wages for unemployment insurance. It also emphasizes the need for employers to accurately report tip earnings and for individuals to maintain records of their tip income.

The implications of this case extend beyond Sarah’s individual situation. It underscores the need for policymakers to consider the unique circumstances of tipped workers when designing unemployment insurance programs and to ensure that these workers have access to the same benefits as other employees.

Final Conclusion

As the landscape of employment continues to evolve, the treatment of tips for unemployment insurance purposes remains a dynamic and ever-changing terrain. Understanding the nuances of these regulations is paramount for individuals, employers, and policymakers alike, ensuring that unemployment insurance remains an effective safety net for those facing job loss.

FAQ

Q: How are tips typically treated in relation to regular wages for unemployment insurance purposes?

A: The treatment of tips varies across jurisdictions. In some areas, tips may be considered a form of wages and included in the calculation of unemployment benefits, while in others, they may be excluded.

Q: What are the potential implications of including tips as wages when calculating unemployment benefits?

A: Including tips as wages can potentially increase the amount of unemployment benefits an individual is eligible to receive. However, it may also impact the individual’s tax liability and could potentially affect their eligibility for other government assistance programs.

Q: What are the reporting requirements for tips in various jurisdictions?

A: Reporting requirements for tips vary depending on the jurisdiction. In some areas, employees are required to report their tip income to their employer, while in others, they may be required to report it directly to the unemployment insurance agency.

Q: What are the potential consequences of failing to report tip income?

A: Failing to report tip income can have serious consequences, including potential fines, penalties, and even prosecution in some cases. Additionally, it could result in a reduction or denial of unemployment benefits.