In the dynamic world of insurance, cross-selling has emerged as a strategic maneuver, enabling companies to expand their portfolio and deepen client relationships. By adeptly presenting complementary products and services, insurers can unlock a wealth of untapped potential, boosting revenue and enhancing customer satisfaction.

Delve into this comprehensive guide as we unveil the secrets of cross-selling, empowering you to elevate your insurance business to new heights.

Cross-selling in the insurance industry is not merely a numbers game; it’s an art form that requires a deep understanding of client needs, effective communication, and the ability to build enduring relationships. As we embark on this journey, we’ll explore the intricacies of cross-selling, providing practical tips and strategies to help you excel in this field.

Introduction

In the competitive world of insurance, cross-selling has emerged as a strategic approach to enhance customer satisfaction, drive revenue growth, and strengthen client relationships. Cross-selling involves introducing additional insurance products or services to existing clients who already hold one or more policies with the same insurance company.

By understanding the unique needs and circumstances of each client, insurance companies can tailor cross-selling strategies that provide comprehensive coverage and personalized solutions. This proactive approach not only benefits the insurance company but also offers significant advantages to the clients.

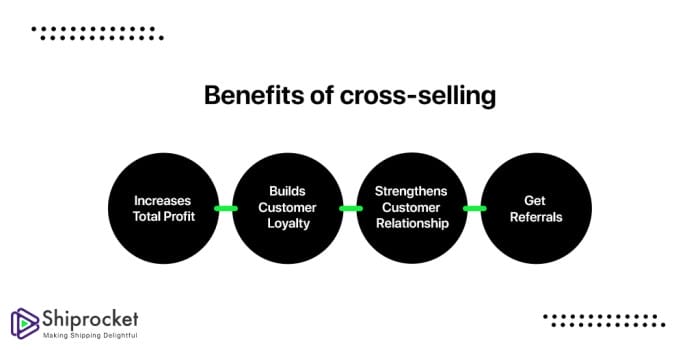

Benefits of Cross-Selling

For Insurance Companies:

- Increased Revenue: Cross-selling opens up opportunities to generate additional revenue from existing clients, fostering long-term business growth.

- Customer Retention: By fulfilling a wider range of insurance needs, cross-selling helps retain existing clients and reduce customer churn, leading to a stable and loyal customer base.

- Improved Client Relationships: Cross-selling demonstrates a commitment to understanding and meeting clients’ evolving needs, strengthening relationships and fostering trust.

For Clients:

- Comprehensive Coverage: Cross-selling allows clients to consolidate their insurance policies under one provider, ensuring comprehensive coverage and eliminating the hassle of managing multiple policies.

- Convenience: Dealing with a single insurance company for multiple policies simplifies the claims process and provides a seamless customer experience.

- Cost Savings: Bundling multiple policies with the same insurer often leads to cost savings through discounts and premium adjustments.

Understanding Client Needs

To effectively cross-sell insurance products to existing clients, it is essential to understand their unique needs, preferences, and financial circumstances. By doing so, you can tailor your recommendations to address their specific requirements and provide them with solutions that genuinely benefit them.

Gathering Client Data

The first step in understanding client needs is to gather relevant data and information. This can be done through various methods, such as client surveys, questionnaires, and in-person or virtual meetings. It is important to ask thoughtful questions that delve into their current insurance coverage, financial goals, risk tolerance, and any specific concerns or priorities they may have.

Analyzing Client Data

Once you have gathered client data, it is crucial to analyze it thoroughly to identify potential cross-selling opportunities. This involves examining their current policies, coverage gaps, and areas where they may benefit from additional protection or services. By carefully analyzing client data, you can gain valuable insights into their needs and preferences, allowing you to make informed recommendations that align with their best interests.

Building Relationships with Clients

Building strong and lasting relationships with clients is essential for effective cross-selling. By establishing trust and rapport, you can foster open communication and gain a deeper understanding of their evolving needs. Regular check-ins, proactive follow-ups, and personalized service can help strengthen your relationships with clients, making them more receptive to your recommendations and more likely to consider additional products or services from you.

Building Relationships

Cultivating solid client relationships is the cornerstone of effective cross-selling. When clients perceive you as a trusted advisor, they are more likely to be receptive to your recommendations and consider additional products or services that align with their evolving needs.

Nurturing these relationships requires a proactive and empathetic approach. Here are strategies to build trust and strengthen your client connections:

Active Listening

Make an effort to truly listen to your clients’ concerns, goals, and financial aspirations. Active listening involves paying attention not only to their words but also to their body language and emotions. Demonstrating genuine interest in their well-being fosters a sense of trust and rapport.

Personalized Communication

Tailor your communication to each client’s unique situation and preferences. Understand their risk tolerance, investment objectives, and communication style. Personalizing your interactions shows that you value their individuality and are committed to providing tailored solutions.

Regular Check-Ins

Schedule regular check-ins with your clients to review their financial goals and assess any changes in their circumstances. These touchpoints demonstrate your ongoing commitment to their financial well-being and provide opportunities to identify potential cross-selling opportunities.

Transparency and Honesty

Maintain transparency and honesty in all your dealings with clients. Avoid jargon and technical terms that may confuse them. Provide clear explanations and ensure they fully understand the benefits, risks, and implications of any recommended products or services.

Going the Extra Mile

Exceed your clients’ expectations by providing exceptional service. Respond promptly to their inquiries, address their concerns diligently, and proactively offer assistance whenever needed. Going the extra mile creates a positive client experience and reinforces their trust in you.

Product Knowledge

Insurance agents who possess in-depth knowledge of the products they sell are more effective in cross-selling, as they can confidently explain the benefits and features of each product and tailor their recommendations to the specific needs of their clients. This not only enhances customer satisfaction but also increases the likelihood of successful cross-selling.

To stay updated with new products and offerings, insurance agents should:

Continuously Educate Themselves

- Attend industry conferences, workshops, and seminars to learn about new products and trends.

- Read industry publications, blogs, and online resources to stay informed about the latest developments.

- Take advantage of online courses and webinars offered by insurance companies and industry associations.

Seek Feedback from Clients

- Ask clients for feedback on their current insurance coverage and what additional products they might be interested in.

- Listen to client concerns and questions to identify potential cross-selling opportunities.

Stay Organized

- Keep detailed records of client policies and preferences to easily identify potential cross-selling opportunities.

- Use customer relationship management (CRM) software to track client interactions and manage cross-selling activities.

Effective Communication

In the realm of cross-selling insurance products to current clients, effective communication plays a pivotal role in fostering trust, understanding client needs, and ultimately driving sales success. Clear and concise communication enables insurance professionals to convey the value and benefits of additional products, address client concerns, and build rapport, leading to increased client satisfaction and retention.

Clarity and Simplicity

Clarity and simplicity are paramount in product presentation. Avoid jargon and technical terms that may confuse clients. Use plain language that resonates with their understanding. Tailor your communication to the client’s level of financial literacy and ensure they grasp the essence of the product’s features and benefits.

Active Listening and Empathy

Active listening is a cornerstone of effective communication. Engage in attentive listening, demonstrating genuine interest in the client’s concerns, aspirations, and financial goals. Empathize with their unique circumstances and tailor your product recommendations accordingly. Active listening fosters trust and positions you as a trusted advisor, not just a salesperson.

Handling Objections and Concerns

Objections and concerns are natural responses to sales conversations. Approach these moments as opportunities to demonstrate your expertise and provide value. Acknowledge the client’s concerns genuinely and validate their apprehensions. Address objections with well-researched facts, testimonials, and real-life examples that resonate with the client’s situation.

Offer alternative solutions or product variations that align better with their needs.

Leverage Testimonials and Case Studies

Testimonials and case studies are powerful tools in cross-selling. Share success stories of clients who have benefited from additional products or services. Testimonials add a human touch to your sales pitch and demonstrate the tangible benefits of your recommendations. Case studies provide in-depth insights into how specific products have addressed real-life challenges, making them relatable and persuasive.

Follow-Up and Relationship Building

Effective communication extends beyond the initial sales conversation. Regular follow-ups are essential in nurturing relationships with clients and ensuring their satisfaction. Stay in touch through personalized emails, phone calls, or client appreciation events. These touchpoints demonstrate your commitment to their well-being and create opportunities for further cross-selling opportunities.

Personalization

In cross-selling, personalization involves tailoring recommendations to each client’s unique needs, preferences, and circumstances. This approach enhances the customer experience, increases sales, and strengthens the client-advisor relationship.

Personalization can be achieved through various methods, including data analysis, client surveys, and regular conversations. By understanding clients’ financial goals, risk tolerance, and current coverage, advisors can make informed recommendations that align with their clients’ best interests.

Benefits of Personalization

- Increased Sales: Personalized recommendations are more likely to resonate with clients, leading to higher conversion rates and increased sales.

- Enhanced Customer Experience: Clients appreciate the attention to detail and the feeling that their advisor genuinely understands their needs. This leads to greater satisfaction and loyalty.

- Stronger Relationships: When clients feel understood and valued, they are more likely to trust their advisor and maintain a long-term relationship.

Examples of Personalization

- Client A: A young professional with a growing family may be recommended a term life insurance policy to protect their income and provide financial security for their loved ones.

- Client B: A retiree with a substantial investment portfolio may be advised to consider an annuity to provide a steady stream of income in retirement.

- Client C: A business owner may be offered a commercial insurance policy tailored to the specific risks associated with their industry and operations.

Timing and Delivery

Timing and delivery play a crucial role in the success of cross-selling efforts. Approaching clients at the right time and using effective methods to present cross-selling offers can significantly impact the likelihood of acceptance.

Identifying the Right Time

The timing of cross-selling offers should be carefully considered to optimize their effectiveness. Some key factors to consider include:

- Client’s Current Situation: Understanding the client’s current situation, financial goals, and challenges can help determine the most appropriate time to approach them with cross-selling offers.

- Life Events: Significant life events, such as marriage, childbirth, or retirement, can create opportunities for cross-selling relevant products or services.

- Policy Renewal Dates: Policy renewal dates provide a natural opportunity to discuss cross-selling options, as clients are already engaged in reviewing their insurance coverage.

- Regular Reviews: Conducting regular reviews of clients’ insurance portfolios allows agents to identify gaps in coverage and recommend suitable cross-selling products.

Effective Delivery Methods

The delivery method of cross-selling offers should be tailored to the client’s preferences and the nature of the product or service being offered. Some effective methods include:

- In-Person Meetings: Face-to-face meetings provide an opportunity for agents to build rapport with clients, understand their needs in detail, and present cross-selling offers in a personalized manner.

- Phone Calls: Phone calls can be an efficient way to reach clients who may not be available for in-person meetings or prefer discussing insurance matters over the phone.

- Email and Direct Mail: Email and direct mail can be used to send targeted cross-selling offers to clients, providing them with information about new products or services that may be of interest.

- Online Platforms: Online platforms, such as client portals or mobile apps, can be utilized to provide clients with easy access to information about cross-selling offers and allow them to purchase additional products or services conveniently.

Overcoming Objections

Cross-selling conversations can sometimes encounter objections from clients. It’s crucial to anticipate these objections and develop strategies to address them professionally and effectively, transforming them into opportunities for further engagement and strengthening the client relationship.

Common objections may include concerns about affordability, the perceived necessity of additional coverage, skepticism about the benefits, or apprehension about the claims process. To handle these objections effectively, consider the following approaches:

Handling Affordability Concerns

Understanding the client’s financial situation and budget constraints is key. Explore options for tailoring coverage to fit their budget, such as adjusting deductibles or exploring different policy structures. Highlight the long-term value of adequate protection and the potential cost savings that come with comprehensive coverage.

Addressing Necessity Concerns

Help the client understand the risks and potential consequences of not having adequate coverage. Provide concrete examples of how additional coverage can provide peace of mind and protect their assets or income in case of unforeseen events. Emphasize the importance of being prepared for unexpected circumstances.

Dispelling Skepticism about Benefits

Provide clear and tangible examples of how the additional coverage can benefit the client. Use real-life scenarios or case studies to illustrate the value of the coverage and how it can make a positive impact in times of need. Offer to provide detailed information or arrange a consultation with a specialist to address any lingering doubts.

Addressing Apprehensions about Claims Process

Assure the client that the claims process is designed to be straightforward and efficient. Provide information about the claims process, including timelines, documentation requirements, and contact details for assistance. Offer to walk the client through the process and address any specific concerns they may have.

Measurement and Tracking

Measuring and tracking cross-selling performance is crucial for optimizing strategies and driving business growth. It allows you to gauge the effectiveness of your efforts, identify areas for improvement, and make data-driven adjustments to enhance cross-selling outcomes.

To establish a robust measurement framework, consider these key steps:

Setting Relevant Metrics

- Define clear and measurable cross-selling goals, such as increasing the number of cross-sold policies or generating a specific amount of revenue from cross-selling.

- Identify relevant metrics that align with your goals. Common metrics include cross-sell ratio, average number of policies per customer, and cross-sell revenue.

- Establish benchmarks and targets for each metric to track progress and measure success.

Monitoring Results

- Regularly collect data on your cross-selling performance using customer relationship management (CRM) systems, sales reports, and other relevant sources.

- Analyze the data to track trends, identify patterns, and assess the impact of your cross-selling initiatives.

- Compare your performance against benchmarks and targets to gauge progress and identify areas where adjustments are needed.

Making Data-Driven Adjustments

- Based on the analysis of your cross-selling performance, make informed adjustments to your strategies and tactics.

- Experiment with different approaches, such as refining your product bundling strategies, improving communication channels, or providing targeted incentives.

- Continuously monitor the impact of these adjustments and make further refinements as needed to optimize your cross-selling efforts.

Continuous Improvement

In a dynamic insurance landscape, continuous improvement is essential for enhancing cross-selling outcomes. This involves staying abreast of industry trends, learning from successful case studies, and implementing best practices to optimize cross-selling efforts.

Staying updated with industry trends enables you to identify emerging opportunities, adapt to changing client needs, and leverage new technologies to enhance the cross-selling process. Learning from successful case studies provides valuable insights into effective cross-selling strategies, allowing you to replicate their success and avoid potential pitfalls.

Embrace Industry Best Practices

- Leverage Technology: Implement technology solutions that streamline cross-selling processes, such as customer relationship management (CRM) systems, data analytics tools, and personalized marketing platforms.

- Empower Employees: Provide your team with comprehensive training, resources, and incentives to drive cross-selling initiatives. Encourage a culture of continuous learning and skill development.

- Customer-Centric Approach: Prioritize understanding and fulfilling client needs. Cross-selling should be driven by genuine care for the client’s well-being, not solely by sales targets.

Closing Summary

Cross-selling is not just a sales technique; it’s a testament to the enduring power of relationships and understanding. By embracing the principles Artikeld in this guide, you can transform cross-selling into a cornerstone of your insurance business, propelling it towards sustained growth and exceptional client satisfaction.

Remember, the true essence of cross-selling lies in creating a win-win situation where both the client and the company benefit, fostering a partnership that stands the test of time.

Frequently Asked Questions

What are the key benefits of cross-selling in insurance?

Cross-selling offers a multitude of benefits, including increased revenue streams, enhanced customer retention, and a deeper understanding of client needs. By providing a comprehensive suite of insurance solutions, companies can cater to the evolving needs of their clients, solidifying their position as trusted advisors.

How can insurance agents gather and analyze client data to identify cross-selling opportunities?

Harnessing the power of data is crucial for effective cross-selling. Insurance agents can leverage client surveys, policy records, and interaction history to gain valuable insights into customer preferences and needs. This data-driven approach enables agents to tailor their recommendations, maximizing the likelihood of successful cross-selling.

What strategies can insurance agents employ to build strong relationships with clients?

Building rapport and trust with clients is the cornerstone of successful cross-selling. Insurance agents can foster strong relationships by providing exceptional customer service, actively listening to client concerns, and demonstrating genuine care for their well-being. By establishing a personal connection, agents can create a foundation for effective cross-selling conversations.

Why is product knowledge essential for insurance agents engaged in cross-selling?

In-depth knowledge of insurance products is paramount for successful cross-selling. Insurance agents must possess a comprehensive understanding of the features, benefits, and limitations of each product they offer. This expertise enables them to provide informed recommendations, address client queries confidently, and dispel any misconceptions, ultimately increasing the likelihood of cross-selling success.