In today’s economic climate, saving money is paramount, and car insurance is no exception. Consumer Reports, a trusted source of unbiased product reviews, has meticulously compiled a wealth of tips to help drivers pay less for car insurance. Buckle up and join us as we delve into these strategies, empowering you to make informed decisions and navigate the complexities of the car insurance landscape.

From understanding insurance policies and comparing quotes to leveraging discounts and managing claims, we’ll cover it all. Discover how safety features, driving habits, and long-term planning can impact your premiums. Get ready to transform from a passive insurance consumer into a savvy money-saving expert.

Introduction

Consumer reports play a pivotal role in empowering individuals to make informed decisions and potentially save money on car insurance. These reports provide comprehensive insights into the various factors that influence car insurance premiums, enabling consumers to navigate the complexities of the insurance market and identify policies that align with their specific needs and budget.

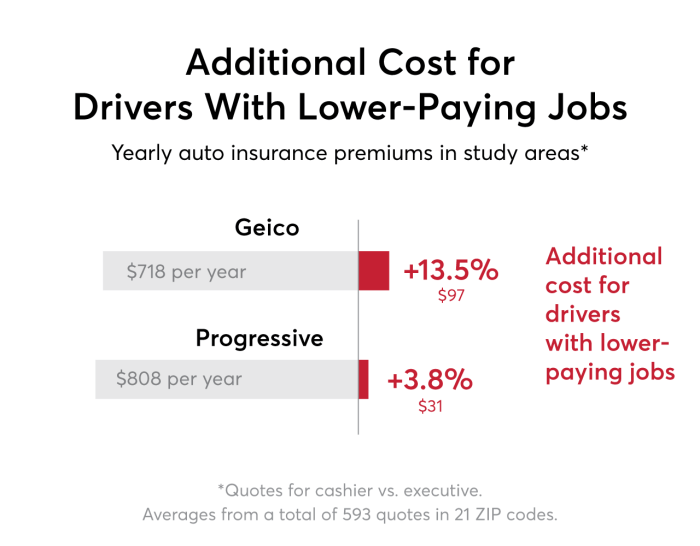

Car insurance premiums are determined by a multitude of factors, including the driver’s age, gender, driving history, and location, as well as the make, model, and year of the insured vehicle. Consumer reports meticulously analyze these factors and provide valuable information that helps individuals understand how each element impacts their insurance costs.

Understanding Insurance Premiums

To make informed decisions about car insurance, it is essential to understand the key factors that influence premiums. Consumer reports offer detailed explanations of these factors and how they are used by insurance companies to calculate rates.

- Driver’s Age and Gender: Younger drivers and males are typically associated with higher premiums due to their perceived higher risk of accidents.

- Driving History: A history of accidents, moving violations, or DUI convictions can significantly increase insurance premiums.

- Location: Premiums vary across regions based on factors such as traffic congestion, crime rates, and the frequency of accidents.

- Vehicle Make, Model, and Year: The cost of insuring a vehicle is influenced by its safety features, performance, and repair costs.

Understanding Insurance Policies

Navigating the world of car insurance can be overwhelming, given the array of policies and coverage options available. It’s crucial to comprehend the different types of insurance policies, their key features, and the terms, conditions, and coverage limits associated with each one before making a purchase decision.

Types of Car Insurance Policies

There are various types of car insurance policies available, each providing a unique combination of coverage options. The most common types include:

- Liability Insurance: Covers damages and injuries caused to others in an accident you are responsible for.

- Collision Insurance: Covers damages to your own vehicle in an accident, regardless of who is at fault.

- Comprehensive Insurance: Covers damages to your vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Covers damages and injuries caused by drivers who are uninsured or underinsured.

Importance of Understanding Policy Terms, Conditions, and Coverage Limits

It’s essential to thoroughly understand the terms, conditions, and coverage limits of your car insurance policy before purchasing it. This knowledge empowers you to make informed decisions about the coverage you need and helps avoid surprises in the event of an accident.

- Policy Terms: Review the policy’s terms and conditions carefully to understand your rights and responsibilities as the policyholder.

- Coverage Limits: Pay attention to the coverage limits specified in your policy. These limits determine the maximum amount the insurance company will pay for covered damages or injuries.

- Exclusions: Be aware of any exclusions or limitations in your policy that may restrict coverage in certain situations.

- Endorsements and Riders: Consider adding endorsements or riders to your policy to enhance coverage for specific needs, such as rental car reimbursement or roadside assistance.

3. Comparing

Comparing car insurance quotes from multiple providers is a crucial step in finding the best coverage at an affordable price.

Introduction

Shopping around for car insurance quotes is a great way to save money and ensure you’re getting the coverage you need. Here’s why comparing quotes is essential:

Why Compare Car Insurance Quotes?

Insurance companies assess risk differently, leading to variations in quoted premiums. By comparing quotes, you can find the best price for your coverage needs.

What to Consider When Comparing Quotes

When comparing car insurance quotes, there are several factors to take into account:

Coverage Levels

Make sure the quotes you’re comparing offer similar coverage levels. Otherwise, it’s like comparing different products.

Deductibles

The deductible is the amount you pay before insurance kicks in. Comparing quotes with different deductibles can help you find the best balance between coverage cost and the amount you’re willing to pay upfront.

Endorsements

Endorsements are additional coverage options you can add to your policy. When comparing quotes, ensure that they include any endorsements you need or want.

Discounts

Many insurance companies offer discounts for things like safe driving, multiple vehicles, or insuring multiple drivers. Make sure to ask about discounts when comparing quotes.

Customer Service

While cost is essential, customer service shouldn’t be overlooked. Look for companies with a track record of good customer service and claims handling.

Get Multiple Quotes

The more quotes you compare, the better chance you have of finding the best deal. Aim for at least three quotes from different companies.

Review and Compare

Take the time to review and compare each quote in detail. Make sure you understand the coverage levels, deductibles, endorsements, and discounts offered.

Make an Informed Decision

After comparing quotes, choose the one that offers the best coverage at a fair price and suits your needs and preferences.

Discounts and Savings

Consumer Reports offers a wide range of discounts and savings opportunities to help consumers pay less for car insurance. These discounts can be applied to various types of policies, including auto, home, and life insurance.

Multi-Car Discounts

Multi-car discounts are a great way to save money on your car insurance premiums. Many insurance companies offer discounts for insuring multiple cars under the same policy. The discount typically increases with the number of cars insured. For example, you may receive a 5% discount for insuring two cars, a 10% discount for insuring three cars, and a 15% discount for insuring four or more cars.

Loyalty Discounts

Loyalty discounts reward policyholders for staying with the same insurance company for a certain period. The discount typically increases with the length of time you have been with the company. For example, you may receive a 5% discount after one year, a 10% discount after three years, and a 15% discount after five years.

Good Driver Discounts

Good driver discounts are available to policyholders who have a clean driving record. The discount typically increases with the number of years you have been accident-free. For example, you may receive a 5% discount for one year of accident-free driving, a 10% discount for three years of accident-free driving, and a 15% discount for five years of accident-free driving.

Claims Handling

Selecting an insurance provider with a reputable claims handling process is crucial. A seamless and fair claims settlement depends on effective communication with insurance companies.

Tips for Effective Communication:

- Prompt Reporting: Immediately report claims to your insurer, ensuring all necessary details are provided.

- Document Thoroughly: Maintain detailed records of the incident, including photos, police reports, and witness contacts.

- Clear Communication: Use clear and concise language when explaining the incident to your insurer.

- Honesty and Accuracy: Provide accurate and truthful information to avoid delays or complications in the claims process.

- Professional Conduct: Maintain a respectful and professional demeanor during interactions with insurance representatives.

Appealing a Claim Denial:

- Review the Denial Letter: Understand the reasons for denial and identify potential areas for appeal.

- Gather Supporting Evidence: Compile additional documentation or evidence to strengthen your case.

- Request a Review: Formally request a review of the denied claim, explaining why the decision should be reversed.

- Mediation or Arbitration: Consider alternative dispute resolution methods if the review is unsuccessful.

Safety Features and Technology

With advancements in technology, vehicles now come equipped with a range of safety features and advanced technologies that can influence insurance premiums. Insurance companies recognize these features as they can potentially reduce the likelihood of accidents and claims.

Certain safety features that are recognized by insurance companies include:

Anti-lock Brake Systems (ABS)

- ABS helps prevent wheels from locking during braking, allowing drivers to maintain control and stability, reducing the risk of accidents.

- Vehicles with ABS may be eligible for lower insurance premiums due to the reduced risk of accidents.

Electronic Stability Control (ESC)

- ESC helps stabilize a vehicle during turns and prevents skidding, reducing the risk of accidents.

- Insurance companies may offer lower premiums for vehicles with ESC due to the increased safety and reduced accident risk.

Airbags

- Airbags provide protection to occupants in the event of a collision, reducing the risk of injuries.

- Vehicles with multiple airbags may be eligible for lower insurance premiums due to the increased safety and reduced severity of accidents.

Lane Departure Warning Systems (LDWS)

- LDWS alerts drivers when they unintentionally drift out of their lane, helping prevent accidents.

- Insurance companies may offer lower premiums for vehicles with LDWS due to the reduced risk of accidents.

Forward Collision Warning Systems (FCWS)

- FCWS warns drivers of potential collisions with vehicles ahead, allowing them to take evasive action.

- Vehicles with FCWS may be eligible for lower insurance premiums due to the reduced risk of accidents.

Adaptive Cruise Control (ACC)

- ACC automatically adjusts a vehicle’s speed to maintain a safe following distance from the vehicle ahead.

- Insurance companies may offer lower premiums for vehicles with ACC due to the reduced risk of rear-end collisions.

In addition to these specific features, insurance companies may also consider the overall safety rating of a vehicle when determining premiums. Vehicles with higher safety ratings may be eligible for lower premiums due to the reduced risk of accidents and claims.

Driving Habits and History

Your driving habits and history play a crucial role in determining your car insurance premiums. Insurance companies assess your risk profile based on factors such as speeding tickets, accidents, and claims. A history of risky driving behaviors can lead to higher insurance rates, while a clean driving record can result in lower premiums.

Speeding Tickets

Speeding tickets are a common traffic violation that can have a significant impact on your insurance rates. Insurance companies view speeding as a sign of reckless driving, which increases the likelihood of accidents. The number of speeding tickets you have, the severity of the offense, and the state in which you live all play a role in determining how much your rates will increase.

Accidents

Accidents are another major factor that can affect your insurance premiums. The type of accident, the extent of the damage, and who was at fault all influence the impact on your rates. At-fault accidents, especially those involving injuries or significant property damage, can lead to substantial premium increases.

Claims

Filing an insurance claim can also have a negative impact on your rates. Insurance companies view claims as evidence of a higher risk of future accidents or losses. The number of claims you file, the severity of the claims, and the type of coverage involved all contribute to the potential increase in your premiums.

Mitigating the Impact of Driving Habits and History

While your driving habits and history can affect your insurance rates, there are steps you can take to mitigate the impact:

- Obey the Speed Limit: Avoiding speeding tickets is one of the most effective ways to keep your insurance rates low. Be mindful of the speed limit and drive cautiously to minimize the risk of getting a ticket.

- Drive Defensively: Practicing defensive driving techniques can help you avoid accidents. Be aware of your surroundings, maintain a safe following distance, and anticipate the actions of other drivers.

- Take a Driver’s Education Course: Completing a driver’s education course can demonstrate your commitment to safe driving and may lead to lower insurance rates. Check with your insurance company to see if they offer discounts for completing a course.

- Maintain a Clean Driving Record: The longer you go without accidents or violations, the better your driving record will be. This can result in lower insurance premiums over time.

Bundling Policies

Bundling car insurance with other insurance policies, such as homeowners or renters insurance, can be a smart way to save money and simplify your insurance needs. By bundling your policies, you can often get a discount on your premiums, as well as other benefits like streamlined billing and claims handling.

Benefits of Bundling Policies

There are several benefits to bundling your car insurance with other insurance policies:

- Cost savings: Bundling your policies can often save you money on your premiums. The exact amount you save will depend on your individual circumstances, but you can typically expect to save at least 5% to 10% on your premiums.

- Convenience: Bundling your policies can make it easier to manage your insurance needs. You’ll only have one company to deal with, and you’ll only have to pay one bill each month.

- Streamlined claims handling: If you ever have a claim, bundling your policies can make the process easier and faster. Your insurance company will be able to handle all of your claims under one policy, which can save you time and hassle.

How to Find the Best Bundling Options

There are a few things you can do to find the best bundling options for your needs:

- Shop around: Get quotes from several different insurance companies to compare rates. Make sure you’re comparing apples to apples, by getting quotes for the same coverage limits and deductibles.

- Ask about discounts: Many insurance companies offer discounts for bundling policies. Be sure to ask about these discounts when you’re getting quotes.

- Consider your needs: Think about your individual insurance needs and decide which policies you want to bundle. You may want to bundle your car insurance with your homeowners insurance, or you may want to bundle your car insurance with your renters insurance.

Long-Term Planning

Managing car insurance premiums over the long term requires strategic planning and proactive management. By implementing these strategies, you can keep your premiums low and ensure adequate coverage.

Maintaining a good driving record is crucial. Avoiding accidents, traffic violations, and DUIs demonstrates your responsibility and reduces the risk associated with insuring you. Insurance companies reward safe drivers with lower premiums.

Reviewing Policies Regularly

Regularly reviewing your car insurance policy ensures that you have the right coverage and are not paying for unnecessary add-ons. As your circumstances change, your insurance needs may evolve. Reviewing your policy annually or when there are significant life changes, such as getting married or having a child, helps you adjust your coverage accordingly and potentially save money.

Loyalty Discounts

Many insurance companies offer loyalty discounts to customers who stay with them for a certain period. These discounts can be substantial and can save you money over time. Check with your insurance company to see if they offer loyalty discounts and how you can qualify.

Additional Resources

Apart from the tips mentioned above, there are several additional resources available to consumers for saving money on car insurance.

These resources can provide valuable information, tools, and assistance to help individuals make informed decisions and find the best insurance deals.

Online Comparison Tools

Online comparison tools allow consumers to compare quotes from multiple insurance companies quickly and easily.

These tools typically require users to provide basic information about their vehicle, driving history, and coverage needs.

Once this information is entered, the tool will generate a list of quotes from different insurers, making it easy to compare prices and coverage options.

Consumer Advocacy Groups

Consumer advocacy groups, such as the Consumer Federation of America and the National Association of Insurance Commissioners, provide information and resources to help consumers make informed decisions about insurance.

These groups often publish reports and guides on car insurance, as well as provide tips and advice on how to save money.

Insurance Brokers

Insurance brokers are independent agents who work with multiple insurance companies.

They can help consumers compare quotes from different insurers and find the best deal for their needs.

Insurance brokers typically charge a fee for their services, but they can often save consumers money by finding them a lower rate.

Closure

In conclusion, Consumer Reports’ treasure trove of tips offers a roadmap to significant savings on car insurance. By understanding policies, comparing quotes, taking advantage of discounts, and maintaining a safe driving record, you can tame the rising costs of car insurance.

Remember, knowledge is power, and with the insights gained from this discussion, you are now equipped to make informed decisions and secure the best coverage at the most affordable price. Drive safely and prosper!

Common Queries

Q: How do I obtain multiple car insurance quotes for comparison?

A: Contact various insurance providers directly or utilize online comparison tools to gather multiple quotes. Compare coverage levels, deductibles, and discounts to find the best deal.

Q: What are some common discounts available for car insurance?

A: Discounts may include multi-car policies, loyalty discounts for long-term customers, good driver discounts for safe driving records, and discounts for installing safety features in your vehicle.

Q: How can I mitigate the impact of driving violations and accidents on my insurance rates?

A: Maintain a clean driving record by avoiding traffic violations and accidents. Consider enrolling in defensive driving courses to demonstrate your commitment to safe driving and potentially lower your premiums.

Q: What are the benefits of bundling car insurance with other policies?

A: Bundling car insurance with homeowners or renters insurance can often lead to cost savings. Insurance companies may offer discounts for insuring multiple policies with them.

Q: How can I plan for long-term savings on car insurance?

A: Maintain a good driving record, review your policy regularly to ensure you’re getting the best coverage at the best price, and take advantage of loyalty discounts offered by some insurance providers.