In the ever-changing landscape of life, safeguarding your loved ones and your precious assets is paramount. Life insurance and auto insurance serve as pillars of financial stability, providing peace of mind and protection against unforeseen circumstances. Navigating the complexities of these policies can be daunting, but with the right guidance, you can unlock the secrets to making informed decisions that align with your unique needs and goals.

This comprehensive guide delves into the intricacies of life insurance and auto insurance, empowering you with the knowledge to make well-informed choices. Discover the various types of life insurance policies, the factors that influence premiums, and strategies for selecting the best insurance company.

Gain insights into auto insurance coverage options, understand the impact of different factors on premiums, and learn valuable tips for saving money on both life and auto insurance.

Types of Life Insurance Policies

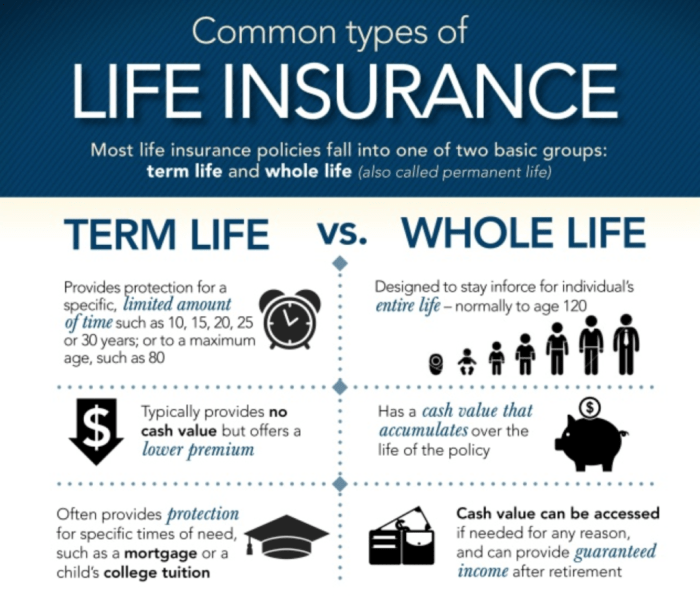

Life insurance offers financial protection for your loved ones in the event of your untimely death. Understanding the different types of life insurance policies available can help you make informed decisions to suit your specific needs and financial situation.

Life insurance policies can be broadly categorized into four main types: term life, whole life, universal life, and variable life. Each type offers unique features, benefits, and drawbacks, which we will explore in this guide.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. During this period, you pay a fixed premium, and if you pass away within the policy term, a death benefit is paid to your beneficiaries.

Term life insurance is generally the most affordable type of life insurance, making it a popular choice for individuals on a budget or those seeking temporary coverage.

Whole Life Insurance

Whole life insurance provides lifelong coverage, as long as you continue paying the premiums. It offers a death benefit, as well as a cash value component that grows over time. The cash value can be borrowed against or withdrawn, providing additional financial flexibility.

Whole life insurance premiums are typically higher than term life insurance, but the policy lasts your entire life, and the cash value component can provide long-term savings and benefits.

Universal Life Insurance

Universal life insurance combines features of term and whole life insurance. It offers lifelong coverage with a death benefit, but also provides flexibility in premium payments and cash value accumulation.

With universal life insurance, you can adjust your premium payments and the amount of coverage as your needs and financial situation change. The cash value component can also be used for various purposes, such as education funding or retirement savings.

Variable Life Insurance

Variable life insurance is similar to universal life insurance, but the cash value component is invested in a variety of sub-accounts, such as stocks, bonds, or money market funds.

The performance of the sub-accounts determines the growth of the cash value, which can provide the potential for higher returns but also carries the risk of investment losses.

Factors Affecting Life Insurance Premiums

The cost of life insurance is not fixed and varies among individuals. Several factors influence the premium amount, which insurance companies consider when assessing the risk associated with insuring a person’s life. Understanding these factors can help you make informed decisions about your life insurance coverage and potentially lower your premiums.

Age

Age is a primary factor that significantly impacts life insurance premiums. Generally, younger individuals pay lower premiums compared to older individuals. This is because younger people are statistically less likely to pass away prematurely, making them a lower risk for insurance companies.

Health

Your overall health status plays a crucial role in determining your life insurance premiums. Individuals with good health, such as those with no major medical conditions or risk factors, typically qualify for lower premiums. Conversely, individuals with pre-existing health conditions or a family history of severe illnesses may face higher premiums due to the increased risk of making a claim.

Lifestyle

Your lifestyle choices can also affect your life insurance premiums. Engaging in high-risk activities, such as extreme sports or hazardous occupations, can increase your premiums. This is because these activities are associated with a higher likelihood of accidents or injuries, which could lead to a claim.

Occupation

Your occupation can also influence your life insurance premiums. Certain occupations that involve higher risks, such as firefighters, police officers, or construction workers, may lead to higher premiums. This is because these occupations are associated with a greater chance of accidents or injuries that could result in a claim.

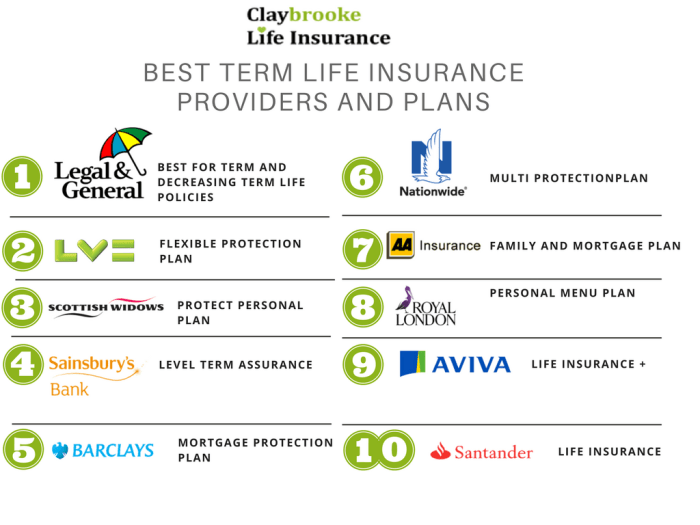

Evaluating Life Insurance Companies

Choosing the right life insurance company is crucial for securing the financial well-being of your loved ones. Before making a decision, it’s essential to thoroughly evaluate various life insurance companies based on key criteria to ensure you select the one that best suits your needs and provides reliable coverage.

To assist you in this process, consider the following checklist when evaluating life insurance companies:

Financial Strength

- Examine the company’s financial stability and strength by checking its ratings from reputable agencies like AM Best, Standard & Poor’s, and Moody’s. Higher ratings indicate a stronger financial position and a lower risk of the company failing to meet its obligations.

- Look for companies with a long history of financial stability and a track record of paying claims promptly and in full.

Customer Service

- Research the company’s customer service record. Read reviews and testimonials from existing policyholders to gauge their satisfaction with the company’s responsiveness, efficiency, and overall customer service experience.

- Consider the availability of various communication channels, such as phone, email, and online chat, to ensure you can easily reach customer service representatives when needed.

Claims Processing Speed

- Find out the company’s average claims processing time. A shorter processing time indicates that the company is efficient in handling claims and paying out benefits promptly.

- Check if the company offers an accelerated claims process for expedited payment in cases of urgent financial need.

Product Offerings

- Review the range of life insurance products offered by the company to ensure they align with your specific needs and preferences. Consider factors such as policy types, coverage amounts, and riders available.

- Compare the premiums and benefits of different policies to find the best value for your money.

Reputation and Market Presence

- Research the company’s reputation in the industry and among consumers. Look for any history of complaints or legal issues.

- Consider the company’s market presence and size. A larger and well-established company may have more resources and a stronger track record.

Understanding Auto Insurance Coverage

Auto insurance coverage protects drivers and their vehicles against financial losses resulting from accidents and other covered events. There are various types of auto insurance coverage available, each offering different levels of protection and addressing specific risks.

The primary types of auto insurance coverage include:

Liability Coverage

Liability coverage is required in most states and provides financial protection if the insured driver causes an accident that results in bodily injury or property damage to others. It covers legal defense costs and赔偿 (compensation) for damages awarded to the injured party.

Collision Coverage

Collision coverage protects the insured vehicle in case of damage resulting from a collision with another vehicle or object. It covers repairs or replacement of the insured vehicle, regardless of who is at fault.

Comprehensive Coverage

Comprehensive coverage provides protection for the insured vehicle against non-collision damages, such as theft, vandalism, fire, hail, and natural disasters. It also covers damages caused by animals and falling objects.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects the insured driver and passengers in case of an accident caused by an uninsured or underinsured motorist. It covers medical expenses, lost wages, and pain and suffering.

| Coverage Type | Coverage Limits | Exclusions |

|---|---|---|

| Liability Coverage | Varies by state and policy | Intentional acts, racing, driving under the influence |

| Collision Coverage | Actual Cash Value (ACV) or Replacement Cost Value (RCV) | Wear and tear, mechanical breakdowns |

| Comprehensive Coverage | Actual Cash Value (ACV) | Wear and tear, mechanical breakdowns, acts of war |

| Uninsured/Underinsured Motorist Coverage | Varies by state and policy | Intentional acts, racing, driving under the influence |

Factors Affecting Auto Insurance Premiums

Auto insurance premiums are not set in stone and can vary significantly from one individual to another. Several factors play a crucial role in determining the cost of auto insurance, ranging from personal characteristics to vehicle-related attributes and geographical location.

Understanding these factors can help you make informed decisions to potentially lower your insurance premiums.

Age

Age is a significant factor that insurance companies consider when calculating premiums. Generally, younger drivers (typically below the age of 25) pay higher premiums compared to older drivers. This is due to the higher risk associated with younger drivers, who are statistically more likely to be involved in accidents.

Driving History

Your driving history is another crucial factor that insurance companies evaluate. A clean driving record with no accidents or traffic violations can result in lower premiums. Conversely, a history of accidents, traffic violations, or DUIs can lead to higher premiums as you are considered a higher-risk driver.

Vehicle Type

The type of vehicle you drive also impacts your insurance premiums. Generally, sports cars, luxury vehicles, and high-performance vehicles are associated with higher premiums compared to more economical and safer vehicles. This is because these vehicles are often more expensive to repair or replace in the event of an accident.

Location

Your geographical location can also affect your auto insurance premiums. Areas with higher rates of accidents, theft, and vandalism tend to have higher premiums. Additionally, urban areas typically have higher premiums compared to rural areas due to increased traffic congestion and the higher likelihood of accidents.

Tips for Saving Money on Life Insurance

Shopping around for life insurance quotes is a great way to save money. Different companies offer different rates, so it’s important to compare quotes before you buy a policy. You can get quotes online, from an insurance agent, or over the phone.Improving

your health can also help you save money on life insurance. If you’re in good health, you’re less likely to file a claim, which means the insurance company is less likely to raise your rates. There are many things you can do to improve your health, such as eating a healthy diet, exercising regularly, and getting enough sleep.Considering

a longer policy term can also help you save money on life insurance. A longer policy term means you’ll be paying premiums for a longer period of time, but the total amount you pay will be less than if you had a shorter policy term.

This is because the insurance company is spreading the risk of your death over a longer period of time.

Shop Around for Quotes

The first step to saving money on life insurance is to shop around for quotes. You can get quotes from multiple insurance companies online, through an insurance agent, or over the phone. Be sure to compare the quotes carefully before you make a decision.

Improve Your Health

If you’re in good health, you’re less likely to file a claim, which means the insurance company is less likely to raise your rates. There are many things you can do to improve your health, such as eating a healthy diet, exercising regularly, and getting enough sleep.

Consider a Longer Policy Term

A longer policy term means you’ll be paying premiums for a longer period of time, but the total amount you pay will be less than if you had a shorter policy term. This is because the insurance company is spreading the risk of your death over a longer period of time.

Consider a Term Life Insurance Policy

Term life insurance policies are typically less expensive than whole life insurance policies. This is because term life insurance policies only provide coverage for a specific period of time, while whole life insurance policies provide coverage for your entire life.

Increase Your Deductible

Increasing your deductible can help you save money on life insurance premiums. A deductible is the amount you have to pay out of pocket before the insurance company starts to pay for your claims. The higher your deductible, the lower your premiums will be.

Tips for Saving Money on Auto Insurance

Saving money on auto insurance is essential for many individuals and families. By implementing specific strategies and making informed decisions, you can potentially reduce your auto insurance premiums without compromising coverage.

Maintain a Good Driving Record

Maintaining a clean driving record is one of the most effective ways to lower your auto insurance premiums. Insurance companies consider drivers with a history of accidents, traffic violations, or moving violations as higher risks, leading to increased premiums. By practicing safe driving habits, avoiding distractions, and obeying traffic laws, you can minimize the likelihood of incidents that could affect your driving record.

Bundle Your Policies

Bundling your auto insurance policy with other insurance policies, such as home insurance or renters insurance, can often result in significant savings. Insurance companies frequently offer discounts to customers who purchase multiple policies from them. By bundling your policies, you can take advantage of these discounts and potentially save money on your overall insurance costs.

Increase Your Deductible

Increasing your deductible is another way to potentially lower your auto insurance premiums. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. By choosing a higher deductible, you agree to pay more upfront in the event of an accident, but you will likely benefit from lower monthly premiums.

However, it’s important to strike a balance between a higher deductible and your financial situation, ensuring you can afford the deductible if needed.

Shop Around for Quotes

Don’t settle for the first auto insurance quote you receive. Take the time to shop around and compare quotes from multiple insurance companies. Different companies offer varying rates and coverage options, so it’s essential to find the one that best suits your needs and budget.

Online comparison tools and insurance agents can assist you in gathering quotes and making informed decisions.

Take Advantage of Discounts

Many insurance companies offer discounts for specific groups or individuals. These discounts can be based on factors such as age, occupation, vehicle safety features, or participation in safe driving programs. Be sure to inquire about any available discounts when obtaining quotes from insurance companies.

Consider Usage-Based Insurance

Usage-based insurance (UBI) programs, also known as pay-as-you-drive (PAYD) programs, are becoming increasingly popular. These programs track your driving habits, such as mileage, time of day, and driving behavior, and adjust your premiums accordingly. If you are a low-mileage driver or practice safe driving habits, you may qualify for lower premiums under a UBI program.

Additional Considerations for Life Insurance

When purchasing life insurance, it’s essential to consider additional factors beyond your age and health. These include your family’s financial needs, your income, and your debts.

Your family’s financial needs: Consider your family’s current and future financial needs. How much money would they need to cover living expenses, mortgage or rent payments, and education costs if you were to pass away? You should purchase enough life insurance to cover these needs.

Your income

Your income is another important factor to consider. If you are the primary breadwinner for your family, you will need to purchase enough life insurance to replace your income in the event of your death. This will help ensure that your family can maintain their standard of living.

Your debts

If you have debts, such as a mortgage or credit card debt, you may want to consider purchasing enough life insurance to cover these debts. This will help ensure that your family will not be burdened with these debts if you were to pass away.

Additional Considerations for Auto Insurance

In addition to the factors mentioned earlier, there are other considerations that can impact your auto insurance coverage needs and premiums. These include your daily commute, the type of vehicle you drive, and your driving habits.

Your Daily Commute

The distance you drive each day can affect your insurance rates. If you have a long commute, you’re more likely to be involved in an accident, so you’ll pay more for insurance. This is because insurance companies consider the number of miles you drive each day when calculating your rates.

Type of Vehicle

The type of vehicle you drive can also affect your insurance rates. For example, sports cars and luxury vehicles are more expensive to insure than sedans and minivans. This is because sports cars and luxury vehicles are more likely to be involved in accidents and are more expensive to repair.

Driving Habits

Your driving habits can also affect your insurance rates. If you have a history of accidents or traffic violations, you’ll pay more for insurance. This is because insurance companies consider your driving record when calculating your rates.

Outcome Summary

The journey towards securing your financial future through life insurance and auto insurance is a crucial step towards safeguarding your loved ones and your assets. By delving into the intricacies of these policies, you can make informed decisions that provide the necessary protection and peace of mind.

Remember, knowledge is power, and with the insights gained from this guide, you can navigate the world of insurance with confidence, ensuring that your financial well-being remains uncompromised.

Common Queries

What is the significance of comparing life insurance companies before purchasing a policy?

Comparing life insurance companies is crucial as it allows you to evaluate their financial strength, customer service, and claims processing speed. By conducting thorough research, you can select an insurance provider that aligns with your specific needs and offers reliable coverage.

How can I save money on my auto insurance premiums?

To save money on auto insurance premiums, consider maintaining a good driving record, bundling policies with the same provider, increasing your deductible, and opting for usage-based insurance programs that reward safe driving habits.

What additional factors should I consider when purchasing life insurance?

When purchasing life insurance, it is essential to consider your family’s financial needs, your income, and your debts. These factors will help determine the appropriate amount of coverage you require to ensure that your loved ones are financially secure in the event of your untimely demise.