Navigating the complexities of health insurance can be daunting, especially when it comes to understanding how various income sources, including tips, are factored into coverage eligibility and premium calculations. In Oregon, where a significant portion of the population relies on tips as a source of income, it is crucial to delve into the nuances of how tips are treated in the context of health insurance.

This comprehensive guide will provide a thorough examination of the relationship between tips and health insurance in Oregon, addressing key aspects such as eligibility criteria, reporting requirements, premium calculations, and tax implications. By exploring these factors, individuals can gain a clear understanding of how tips impact their access to affordable and comprehensive health coverage.

Tips as Income

In the context of Oregon health insurance, tips received by individuals working in certain service industries, such as food service and hospitality, are considered income for determining eligibility and calculating premium amounts.

For health insurance purposes, tips are generally counted as part of an individual’s gross income. This means that when determining eligibility for premium subsidies or cost-sharing assistance, the total amount of tips received in a given year is included in the calculation of the individual’s modified adjusted gross income (MAGI).

Calculating Tips as Income

There are various methods for calculating tips as income, depending on the specific industry and the individual’s employment situation. Some common methods include:

- Direct Reporting: In some cases, individuals may directly report their tips to their employer. The employer then includes the reported tips in the employee’s wages for tax and insurance purposes.

- Tip Pooling: In many service industries, tips are pooled among employees and then distributed based on a predetermined formula. The individual’s share of the tip pool is considered income for health insurance purposes.

- Estimated Tips: In certain situations, individuals may be required to estimate their tips based on a percentage of their sales or hours worked. The estimated tips are then included in the individual’s income for health insurance purposes.

It is important to note that the specific rules and procedures for calculating tips as income may vary depending on the state and the individual’s specific circumstances. Individuals should consult with their employer, health insurance provider, or a qualified tax professional for guidance on how tips are treated for health insurance purposes.

Eligibility and Coverage

The treatment of tips as income can have an impact on an individual’s eligibility for Oregon health insurance programs. Generally, tips are considered earned income and counted towards an individual’s total income when determining eligibility for health insurance coverage.

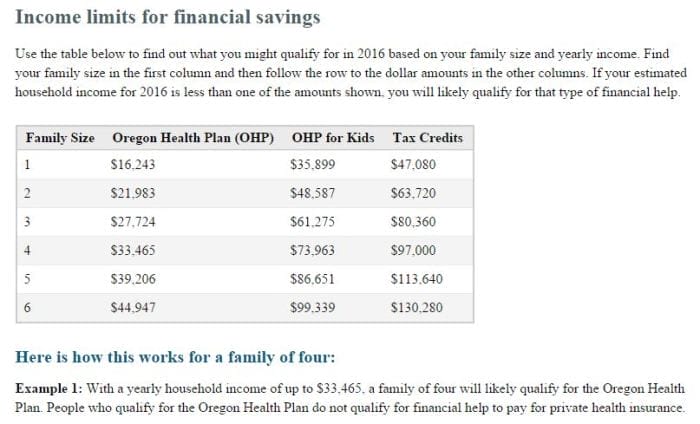

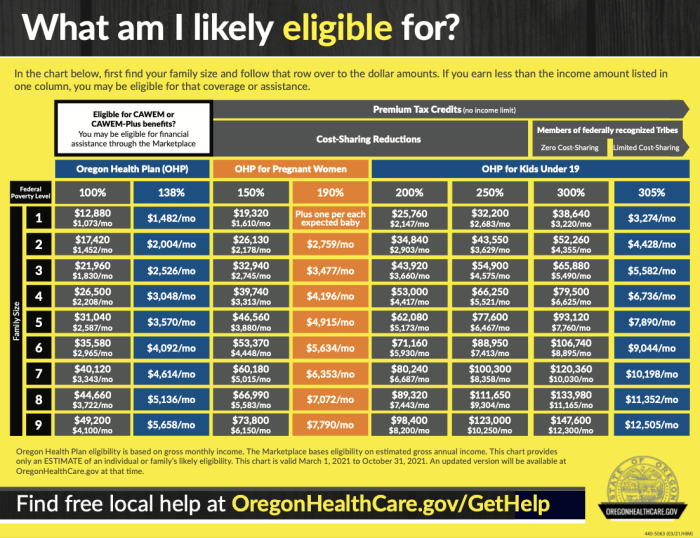

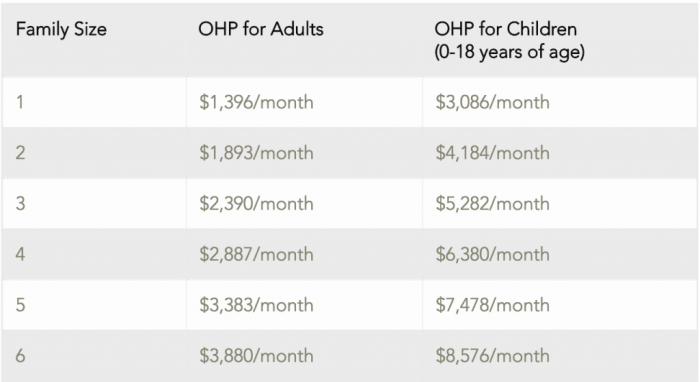

There are specific requirements and limitations related to tips and health insurance coverage. For instance, under the Oregon Health Plan (OHP), tips are included in the calculation of an individual’s Modified Adjusted Gross Income (MAGI). MAGI is a measure of income used to determine eligibility for OHP.

Individuals with MAGI below certain thresholds are eligible for OHP coverage.

Reporting Tips for Health Insurance Eligibility

Individuals who receive tips as part of their income are required to report their tip income accurately when applying for health insurance coverage. Failure to report tip income could result in ineligibility for coverage or incorrect premium calculations.

There are various ways to report tip income for health insurance purposes. Individuals can use pay stubs, employer statements, or Form 4070, Employee’s Report of Tips to Employer, to document their tip income.

It’s important to note that the specific requirements and limitations related to tips and health insurance coverage may vary depending on the specific health insurance program and the individual’s circumstances. Individuals should consult with the relevant health insurance agency or program administrator for accurate information regarding their eligibility and coverage options.

Reporting Tips

Individuals applying for or renewing their Oregon health insurance coverage must accurately report their tip income. Tips are considered income and affect eligibility for subsidies and the amount of coverage.

Consequences of Not Reporting Tips

Not reporting tips accurately can have serious consequences, including:

- Potential Penalties: Failing to report tips may result in penalties, such as fines or having to repay benefits received.

- Ineligibility for Benefits: In some cases, individuals who do not report tips may be found ineligible for health insurance benefits altogether.

Impact on Premium Calculations

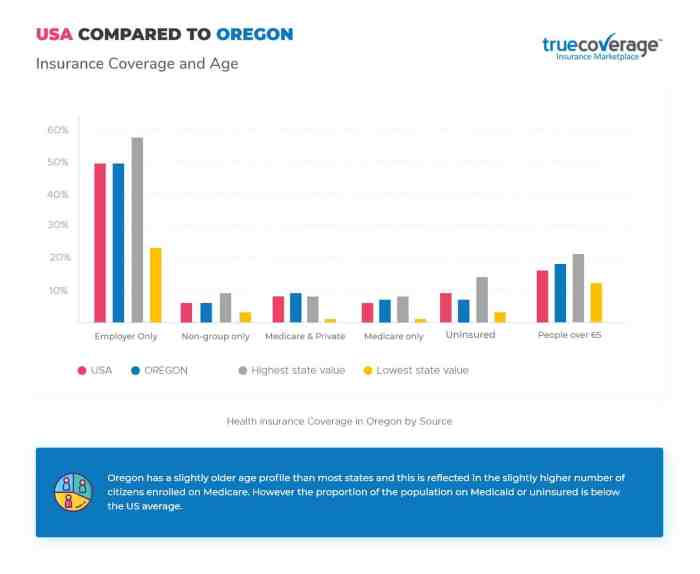

In Oregon, tips received by an employee are considered income and can affect the calculation of health insurance premiums. The treatment of tips for premium calculations may vary depending on the type of health insurance plan or program an individual is enrolled in.

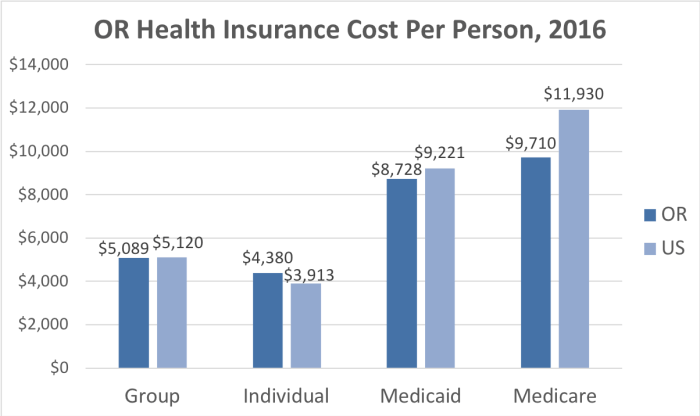

Employer-Sponsored Health Insurance

For employer-sponsored health insurance plans, tips are generally considered taxable income and are included in an employee’s gross wages for the purpose of calculating health insurance premiums. This means that employees who receive tips may pay higher health insurance premiums than those who do not receive tips.

Individual Health Insurance Plans

For individual health insurance plans purchased through the Oregon Health Insurance Marketplace, tips are also considered taxable income and are used to calculate an individual’s modified adjusted gross income (MAGI). MAGI is used to determine an individual’s eligibility for premium subsidies and the amount of the subsidy they may receive.

Individuals who receive tips may have a higher MAGI and may therefore be eligible for lower premium subsidies than those who do not receive tips.

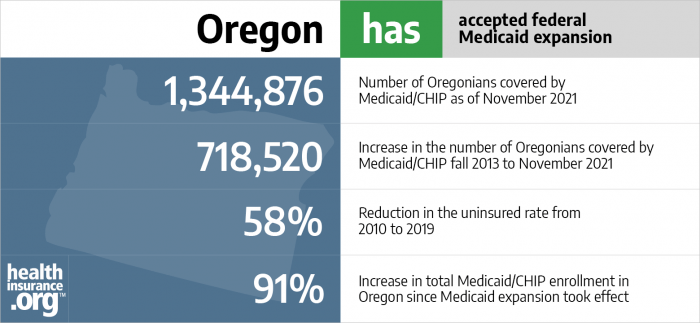

Medicaid

For Medicaid, tips are generally considered income and are counted when determining an individual’s eligibility for Medicaid and the amount of their Medicaid benefits. Individuals who receive tips may have higher income and may therefore be ineligible for Medicaid or may have their benefits reduced.

Verification and Documentation

When applying for or renewing Oregon health insurance, individuals must accurately report their tip income. This section Artikels the process for verifying the amount of tips received and provides examples of acceptable documentation that can be used to support the reported tip income.

Verifying Tip Income

To verify the amount of tips received, the Oregon Health Insurance Marketplace may request documentation from the applicant or enrollee. This documentation may include:

- Pay stubs or other wage statements that show the amount of tips received.

- Records of tips from the employer, such as tip pools or tip reports.

- Statements from the employer or co-workers attesting to the amount of tips received.

- Bank statements or deposit slips showing deposits of tip income.

Acceptable Documentation

The following types of documentation are generally accepted as proof of tip income:

- Pay stubs or wage statements: These documents should show the amount of tips received in each pay period. If the pay stub does not show tips separately, the employer may provide a separate statement showing the amount of tips received.

- Records of tips from the employer: These records may include tip pools, tip reports, or other documents that show the amount of tips received by the employee.

- Statements from the employer or co-workers: These statements should be signed and dated and should include the amount of tips received by the employee.

- Bank statements or deposit slips: These documents should show deposits of tip income into the employee’s bank account.

Self-Employment and Tips

For self-employed individuals in Oregon, understanding how tips are treated when determining health insurance eligibility and premiums is crucial. This section explores the specific considerations and implications for self-employed individuals receiving tips.

Eligibility and Coverage

Self-employed individuals in Oregon are eligible for health insurance coverage through the Oregon Health Insurance Marketplace (OHP). When determining eligibility, the Oregon Health Authority (OHA) considers self-employment income, including tips, as part of the overall household income. Tips are counted as income for the purpose of determining eligibility for premium subsidies and cost-sharing assistance.

This means that higher tip income may affect an individual’s eligibility for subsidies and could potentially lead to higher premiums.

Premium Calculations

For self-employed individuals, premium calculations for health insurance coverage are based on the household income, including tips. The OHA uses a sliding scale to determine the amount of premium subsidies an individual is eligible for. Higher tip income can result in a higher household income, potentially reducing the amount of premium subsidy an individual qualifies for.

As a result, self-employed individuals with higher tip income may pay a larger portion of their health insurance premiums.

Tax Implications

In Oregon, tips are considered income and are subject to state and federal income taxes. This means that individuals who receive tips must report them to the Internal Revenue Service (IRS) and the Oregon Department of Revenue (DOR) on their tax returns.

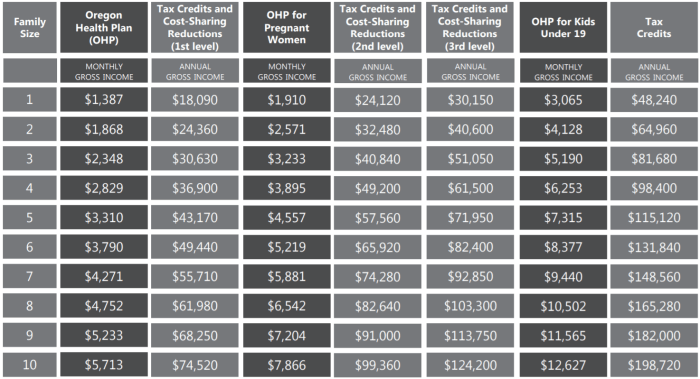

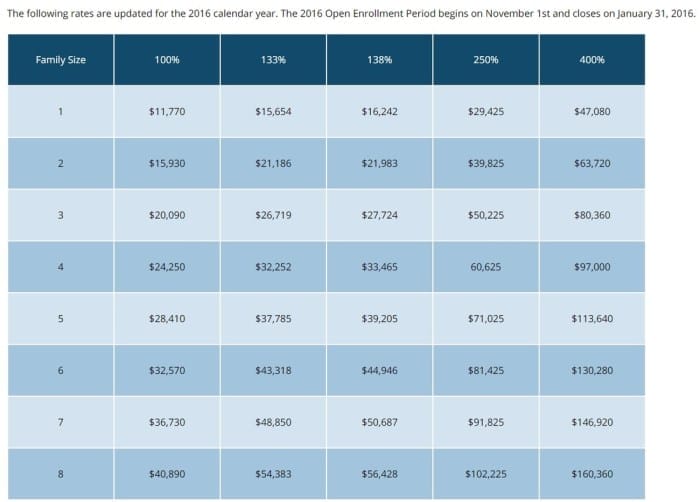

The tax implications of tips can impact an individual’s overall health insurance costs, as tips are included in the calculation of modified adjusted gross income (MAGI), which determines eligibility for premium subsidies and cost-sharing reductions under the Affordable Care Act (ACA).

Impact on Health Insurance Premiums

The amount of taxes paid on tips can affect an individual’s eligibility for premium subsidies and cost-sharing reductions under the ACA. These subsidies are available to individuals and families with incomes below certain limits. The higher an individual’s income, the lower the amount of subsidies they are eligible for.

Since tips are considered income, they can increase an individual’s MAGI and potentially reduce their eligibility for subsidies.

For example, an individual who earns $20,000 per year and receives $5,000 in tips would have a MAGI of $25,000. This individual would be eligible for a smaller premium subsidy than an individual who earns $20,000 per year and does not receive any tips.

Health Insurance

Tips, as part of income, can impact an individual’s eligibility for subsidies or tax credits when purchasing health insurance through the Oregon Health Insurance Marketplace. Understanding these rules and regulations is crucial to determine potential financial assistance and ensure accurate reporting of income.

Impact on Premium Calculations

When determining premium costs for health insurance plans, the Oregon Health Insurance Marketplace considers an individual’s modified adjusted gross income (MAGI), which includes income from all sources, including tips. Tips are counted as taxable income and are added to an individual’s wages, salaries, and other forms of compensation to calculate their MAGI.

Higher MAGI levels can result in lower subsidies or tax credits for health insurance premiums. Therefore, accurately reporting tips is essential to ensure individuals receive the appropriate level of financial assistance based on their true income.

Verification and Documentation

To verify an individual’s income, including tips, the Oregon Health Insurance Marketplace may request documentation such as pay stubs, W-2 forms, or tax returns. Self-employed individuals may need to provide additional documentation, such as business records or 1099 forms, to substantiate their income, including tips.

Accurate and timely reporting of tips is crucial to avoid potential issues during the verification process. Individuals should keep detailed records of their tip income, including dates, amounts, and sources, to facilitate the verification process.

Self-Employment and Tips

Self-employed individuals who receive tips as part of their income should report these earnings accurately on their tax returns. The IRS provides guidance on how to report tip income, including the use of Form 4137, Social Security and Medicare Tax on Unreported Tip Income.

When applying for health insurance through the Oregon Health Insurance Marketplace, self-employed individuals should include their tip income as part of their MAGI calculation. Accurately reporting tip income ensures that they receive the appropriate level of financial assistance based on their true income.

Special Circumstances

In certain scenarios, the handling of tips for health insurance purposes may differ from the general rules. These special circumstances include:

Tips Paid Directly to Employees

In some cases, tips may be paid directly to employees rather than through the employer. In such situations, the employee is responsible for reporting the tips to the Oregon Health Authority (OHA) and paying the applicable taxes. The OHA will then determine the employee’s eligibility for health insurance based on their total income, including tips.

Tips Received by Self-Employed Individuals

Self-employed individuals who receive tips are also responsible for reporting their income, including tips, to the OHA. They must pay self-employment taxes and determine their eligibility for health insurance based on their total income.

Tips Received by Non-Resident Employees

Non-resident employees who work in Oregon and receive tips may be subject to different rules regarding the reporting of tips and eligibility for health insurance. They should consult with the OHA for specific guidance.

Recent Changes or Updates

Oregon’s laws, regulations, and policies related to tips and health insurance have remained largely unchanged in recent years. However, some minor updates and clarifications have been made.

In 2022, the Oregon Health Authority issued a revised policy clarifying the treatment of tips as income for the purposes of determining eligibility for and calculating premiums for health insurance coverage through the Oregon Health Plan (OHP). This policy update was intended to ensure that tips are treated consistently with other forms of income when determining an individual’s eligibility for OHP and the amount of their premium.

Impact on Health Insurance Coverage and Costs

The recent changes and updates to Oregon’s laws, regulations, and policies related to tips and health insurance have had a limited impact on individuals’ health insurance coverage and costs.

The revised policy on the treatment of tips as income for OHP eligibility and premium calculation purposes has resulted in some individuals seeing a slight increase or decrease in their monthly premium amounts. However, for the majority of individuals, the impact has been negligible.

Final Thoughts

In conclusion, the treatment of tips as income in the context of Oregon health insurance is a multifaceted issue that requires careful consideration. Individuals should thoroughly understand the eligibility criteria, reporting requirements, and potential impact on premiums to ensure accurate coverage and avoid any adverse consequences.

By staying informed and seeking guidance from relevant resources, individuals can navigate the complexities of health insurance and make informed decisions that safeguard their access to quality healthcare.

FAQ Corner

Q: How do tips affect eligibility for Oregon health insurance programs?

A: Tips can impact eligibility for Oregon health insurance programs by affecting an individual’s income level. Depending on the specific program and income limits, tips may be counted as income and used to determine eligibility.

Q: What are the consequences of not reporting tips accurately when applying for Oregon health insurance?

A: Failing to report tips accurately can have serious consequences, including potential penalties, ineligibility for benefits, and even criminal charges in some cases. It is crucial to provide accurate information about all sources of income, including tips, to ensure proper coverage and avoid legal issues.

Q: How do tips impact health insurance premiums in Oregon?

A: Tips can influence health insurance premiums in Oregon by affecting an individual’s income level. Higher income, including tips, may result in higher premiums. However, some health insurance plans or programs may have different rules regarding the treatment of tips in premium calculations.

Q: What is the process for verifying tip income when applying for or renewing Oregon health insurance?

A: Verifying tip income for Oregon health insurance typically involves providing documentation that supports the reported tip income. Acceptable documentation may include pay stubs, bank statements, or tax returns. The specific requirements may vary depending on the insurance provider or program.

Q: How are tips treated for self-employed individuals applying for Oregon health insurance?

A: For self-employed individuals, tips are considered self-employment income and are included in the calculation of total income for health insurance purposes. This means that tips will affect both eligibility and premium calculations.