Homeownership brings a sense of pride and responsibility, but it also comes with financial obligations, including homeowners insurance. Navigating the complexities of homeowners insurance can be daunting, especially when it comes to saving money. This comprehensive guide unveils a treasure trove of tips and strategies to help homeowners protect their assets and save money on their insurance premiums.

From raising deductibles and bundling policies to implementing home security features and improving claims history, this guide covers a wide range of strategies to help homeowners optimize their insurance coverage and reduce their financial burden. Additionally, it delves into exploring discounts, adjusting coverage limits, considering riders, negotiating premiums, and utilizing online comparison tools.

Ways to Raise Homeowners Insurance Deductible

Homeowners insurance deductibles are a crucial factor in determining the cost of your premiums. Understanding the concept of deductibles and their impact on premiums is essential to make informed decisions about your homeowners insurance policy. By opting for a higher deductible, you can potentially save money on your premiums, but it also means you will be responsible for a larger out-of-pocket expense in the event of a claim.

Benefits of Raising Deductible

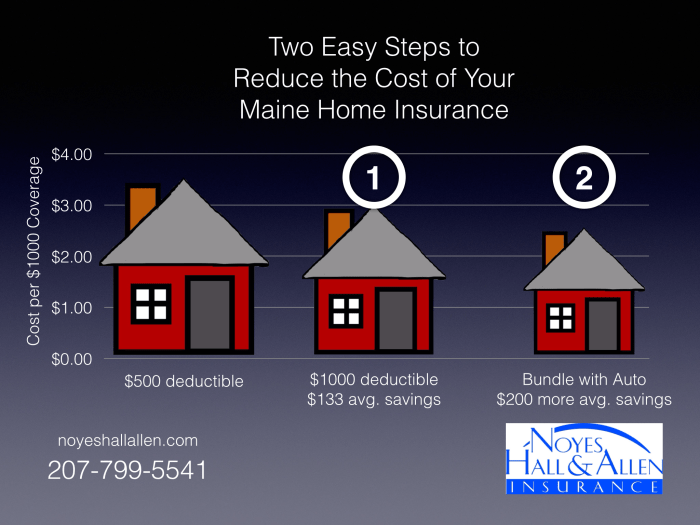

- Lower Premiums: The higher the deductible, the lower your insurance premiums. This is because the insurance company assumes less risk by having you pay a larger portion of the claim. For example, if you raise your deductible from $500 to $1,000, you may see a significant decrease in your annual premiums.

- Encourages Responsible Behavior: A higher deductible can encourage you to be more cautious and take better care of your home. Knowing that you will have to pay a larger amount out-of-pocket in the event of a claim may motivate you to take steps to prevent accidents and damages.

Considerations Before Raising Deductible

- Financial Stability: Before opting for a higher deductible, assess your financial situation and make sure you have enough savings or emergency funds to cover the deductible amount in case of a claim. If you cannot afford to pay a large deductible, a lower deductible may be a better option for you.

- Claims History: Consider your claims history when making a decision about your deductible. If you have a history of frequent claims, a higher deductible may not be suitable for you as it could result in higher overall costs.

- Type of Coverage: Some insurance policies, such as flood insurance, may have lower deductibles by default. Carefully review your policy and consider the type of coverage you need before deciding to raise your deductible.

Bundling Homeowners and Auto Insurance

By bundling your homeowners and auto insurance policies with the same insurer, you can often save money and simplify your insurance management.

Bundling your policies can offer several benefits, including:

Discounts and Savings

- Reduced Premiums: Many insurers offer discounts for bundling policies, typically ranging from 5% to 25% off the total cost of your premiums.

- Convenience: Having all your policies with one insurer makes it easier to manage your coverage and pay your bills. You’ll only have one company to deal with, one bill to pay, and one customer service department to contact if you have any questions or need to make a claim.

- Simplified Claims Process: If you ever need to file a claim, having your homeowners and auto insurance with the same company can streamline the process. The insurer will have all your information on file, making it easier to process your claim quickly and efficiently.

The amount of savings you can get from bundling your policies will vary depending on the insurer, the type of coverage you have, and your individual circumstances. However, it’s generally worth considering bundling your policies if you’re looking for ways to save money on your insurance costs.

Comparing Quotes

Before you decide to bundle your policies with a particular insurer, it’s important to compare quotes from multiple insurers to make sure you’re getting the best deal. Not all insurers offer the same discounts for bundling, and some may have lower rates overall.

By comparing quotes, you can ensure that you’re getting the best coverage at the best price.

Taking Advantage of Home Security Features

Installing security systems and devices can help lower homeowners insurance premiums by reducing the risk of break-ins, theft, and other covered losses.

Types of Security Features That Can Reduce Premiums

Security features that can reduce homeowners insurance premiums include:

- Burglar alarms: Burglar alarms sound an alarm when doors or windows are opened or broken, deterring burglars and alerting homeowners to potential break-ins.

- Motion detectors: Motion detectors detect movement inside a home, triggering an alarm or sending a notification to the homeowner’s smartphone.

- Security cameras: Security cameras record video footage of a home’s exterior and interior, providing evidence in case of a break-in or other incident.

- Deadbolt locks: Deadbolt locks are more secure than standard locks and can help prevent burglars from entering a home.

- Window locks: Window locks prevent windows from being opened from the outside, making it more difficult for burglars to enter a home through a window.

Examples of How Installing Security Systems and Devices Can Save Money

Installing security systems and devices can save money on homeowners insurance premiums in several ways:

- Discounts: Many insurance companies offer discounts to homeowners who install certain security features, such as burglar alarms, motion detectors, and security cameras.

- Lower claims: Homes with security systems and devices are less likely to be burglarized or damaged, which can lead to lower claims and, consequently, lower premiums.

- Peace of mind: Knowing that a home is secure can give homeowners peace of mind, reducing stress and anxiety.

Importance of Maintaining Security Features Properly

It is important to maintain security features properly to ensure they are working correctly and providing the intended level of protection.

- Regular maintenance: Security systems and devices should be inspected and maintained regularly to ensure they are in good working order.

- Updates: Security systems and devices should be updated regularly to keep up with the latest technology and security threats.

- Testing: Security systems and devices should be tested regularly to ensure they are functioning properly.

By taking advantage of home security features, homeowners can reduce their risk of loss, save money on their homeowners insurance premiums, and enjoy peace of mind knowing that their home is secure.

Improving Home’s Claims History

A history of claims can significantly impact homeowners insurance rates. Insurance companies consider homes with a higher frequency of claims to be riskier, resulting in higher premiums. Conversely, homes with a clean claims history are often rewarded with lower rates.Regular

maintenance and upkeep of your home can help prevent potential issues that could lead to claims. Inspect your roof, plumbing, and electrical systems regularly, and address any problems promptly. This proactive approach can save you money in the long run by reducing the likelihood of costly repairs or replacements.Working

with a reputable insurance company that offers various discounts and benefits can also help you save money on your homeowners insurance. Some insurers provide discounts for claims-free years, security features, and loyalty. Choosing a reliable insurer with a solid reputation for customer service and claims handling can provide peace of mind and potentially lead to lower insurance costs.

Preventing Claims

Taking steps to prevent claims can significantly reduce your risk of filing a claim and potentially lower your homeowners insurance rates. Here are some tips for preventing claims:

- Regularly inspect and maintain your home’s exterior, including the roof, gutters, and foundation.

- Keep your home’s interior clean and dry to prevent mold and water damage.

- Install security features such as smoke detectors, carbon monoxide detectors, and burglar alarms.

- Keep your yard free of debris and overhanging branches to reduce the risk of damage from storms.

- Educate yourself about common home hazards and take steps to mitigate them.

Mitigating Claims

In the event of a claim, there are steps you can take to mitigate the damage and potentially reduce the cost of repairs.

- Report the claim to your insurance company promptly.

- Document the damage with photos and videos.

- Work with a reputable contractor to repair the damage.

- Keep receipts for all repairs and replacements.

- Cooperate with your insurance company throughout the claims process.

Working with a Reputable Insurance Company

Choosing the right insurance company can impact your homeowners insurance rates and overall experience. Consider the following factors when selecting an insurance provider:

- Financial stability and reputation.

- Customer service and claims handling.

- Discounts and benefits offered.

- Coverage options and policy limits.

- Ease of doing business.

Exploring Discounts and Credits

Insurance companies offer various discounts and credits to homeowners to lower their insurance premiums. These discounts can be applied to the base rate of the policy, resulting in significant savings.

Eligibility Criteria and Requirements

The eligibility criteria and requirements for obtaining discounts vary among insurance companies. Generally, homeowners can qualify for discounts by meeting certain conditions, such as maintaining a good claims history, installing security features, and bundling their homeowners and auto insurance policies.

Common Discounts and Credits

Some common discounts and credits offered by insurance companies include:

- Claims-Free Discount: This discount rewards homeowners who have not filed any claims for a specified period, typically three to five years. The discount can range from 5% to 20%.

- Security Discount: Homeowners who install security features such as burglar alarms, deadbolts, and fire extinguishers may be eligible for a security discount. The discount can range from 5% to 15%.

- Multi-Policy Discount: Bundling homeowners and auto insurance policies with the same company can result in a multi-policy discount. The discount can range from 5% to 25%.

- Green Home Discount: Some insurance companies offer discounts to homeowners who have made energy-efficient improvements to their homes, such as installing solar panels or energy-efficient appliances. The discount can range from 5% to 10%.

- Loyalty Discount: Long-term customers may be eligible for a loyalty discount, which can range from 5% to 15%.

Examples of Savings

The amount of savings you can achieve by taking advantage of discounts and credits varies depending on the insurance company and your individual circumstances. However, the following examples illustrate how these discounts can lower your premiums:

- A homeowner who has been claims-free for five years may receive a 10% discount, resulting in annual savings of $100 on a $1,000 premium.

- A homeowner who installs a burglar alarm and deadbolts may be eligible for a 15% security discount, resulting in annual savings of $150 on a $1,000 premium.

- A homeowner who bundles their homeowners and auto insurance policies may receive a 20% multi-policy discount, resulting in annual savings of $200 on a $1,000 premium.

By exploring the discounts and credits available, homeowners can potentially save hundreds of dollars on their homeowners insurance premiums.

Reviewing and Adjusting Coverage Limits

Homeowners insurance coverage limits should be reviewed and adjusted regularly to ensure they accurately reflect the value of your home and belongings. This process helps maintain adequate protection while avoiding overpaying for unnecessary coverage.

Assessing Coverage Needs

Begin by evaluating your home’s current market value and the estimated cost to rebuild it. Consider any improvements or renovations made since your last review. Additionally, review the value of your personal belongings, including furniture, electronics, and jewelry.

Adjusting Coverage Limits

Once you have determined your coverage needs, compare them to your current policy limits. If your coverage is insufficient, you may need to increase your limits to ensure you have adequate protection. Conversely, if your coverage is excessive, you may be able to lower your limits and save money on your premium.

Consequences of Insufficient or Excessive Coverage

Having insufficient coverage can leave you financially responsible for any losses that exceed your policy limits. This can be particularly devastating in the event of a major disaster or theft. On the other hand, excessive coverage ties up your money unnecessarily and results in higher premiums.

Considering Homeowners Insurance Riders

Homeowners insurance riders are optional add-ons that can enhance the coverage of your standard homeowners insurance policy. They provide additional protection against specific risks that may not be covered under the basic policy.

Riders can be a cost-effective way to tailor your insurance policy to your specific needs and provide peace of mind. Here are some common riders that you may want to consider:

Flood Insurance Rider

- Covers damage caused by floods, which are not typically covered under standard homeowners insurance.

- Flood insurance is especially important if you live in an area that is prone to flooding.

Earthquake Insurance Rider

- Provides coverage for damage caused by earthquakes, which are also typically not covered under standard homeowners insurance.

- Earthquake insurance is particularly important if you live in an area that is seismically active.

Sewer Backup Insurance Rider

- Covers damage caused by sewer backups, which can be a major source of water damage.

- Sewer backup insurance is a good idea for homeowners who live in areas with older sewer systems or who have experienced sewer backups in the past.

Jewelry and Valuables Insurance Rider

- Provides coverage for valuable items such as jewelry, art, and antiques that may not be fully covered under the standard policy’s personal property coverage.

- Jewelry and valuables insurance riders typically require you to provide an appraisal of the items to be covered.

Home Business Insurance Rider

- Provides coverage for business equipment and activities that are conducted from your home.

- Home business insurance riders are a good idea for homeowners who run a business from their home, even if it is a part-time business.

The cost of a homeowners insurance rider will vary depending on the type of rider, the amount of coverage you choose, and the deductible. However, the added protection that riders can provide is often worth the cost.

8. NEGOTIATING PREMIums with Insurance Companies

Intro ParagraphEngaging in constructive discussions with insurance providers can lead to more favorable homeowners insurance premiums. Understanding the insurance company’s perspective and presenting a compelling case for a premium reduction can yield positive results. Additionally, building a long-term relationship with your insurer can be beneficial.

Understanding the Insurance Company’s Perspective

Comprehend the insurance company’s objectives and priorities to effectively negotiate lower premiums. By understanding their standpoint, you can tailor your strategy to address their concerns and priorities.

Presenting a Strong Case for Premium Reduction

When negotiating for a lower premium, it is essential to present a compelling case. This may include providing evidence of your home’s security features, such as a burglar alarm or fire suppression system, as well as a history of on-time payments and a lack of recent claims.

Building a Positive Relationship with the Insurer

Fostering a positive and professional relationship with your insurance company can be beneficial in the long run. By communicating effectively, being responsive to inquiries, and paying premiums on time, you can build trust and rapport with your insurer, which may lead to more favorable premium rates.

Utilizing Online Comparison Tools

Harness the power of the internet to research and compare homeowners insurance quotes from multiple providers. Online comparison tools provide a convenient and efficient way to evaluate and select the best coverage options at competitive rates.

Reputable Online Comparison Tools

Numerous reputable online comparison tools are available to assist homeowners in comparing insurance quotes. These platforms offer a user-friendly interface, allowing for quick and easy comparison of coverage options and rates. Some popular online comparison tools include:

- Insure.com

- Policygenius

- The Zebra

- ValuePenguin

- QuoteWizard

Effective Usage of Comparison Tools

To effectively utilize online comparison tools, follow these steps:

- Gather Information: Collect relevant information about your property, including square footage, construction materials, age, location, and any recent renovations or upgrades.

- Input Details: Enter the necessary information into the comparison tool’s online form, ensuring accuracy and completeness.

- Compare Quotes: The tool will generate quotes from multiple insurance providers. Compare these quotes side-by-side, considering coverage limits, deductibles, and premiums.

- Read Reviews: Research and read reviews of the insurance companies under consideration. Customer feedback can provide valuable insights into the quality of service and claims handling.

- Consult an Agent: If you have specific questions or need personalized advice, consider consulting an insurance agent or broker. They can provide expert guidance and help you understand the nuances of different policies.

Advantages of Comparing Quotes

Comparing quotes from multiple insurers offers several advantages:

- Competitive Rates: By comparing quotes, you can identify the most competitive rates available in the market.

- Tailored Coverage: Comparing quotes allows you to find coverage options that align with your specific needs and budget.

- Informed Decisions: Having multiple quotes empowers you to make informed decisions, enabling you to select the policy that best suits your requirements.

Maintaining a Good Credit Score

A strong credit score can be a valuable asset when it comes to homeowners insurance. Insurance companies often use credit scores as a factor in determining insurance rates. A higher credit score may lead to lower insurance premiums, while a lower credit score may result in higher premiums.

There are several ways to improve your credit score and maintain good credit. Here are a few tips:

Paying Bills on Time

- Make all your bill payments on time, every time. This is one of the most important factors that affect your credit score.

- Set up automatic payments or reminders to help you stay on top of your bills.

Keeping Credit Utilization Low

- Keep your credit utilization low. This means not using too much of your available credit.

- Aim to keep your credit utilization below 30%.

Getting a Credit Mix

- Having a mix of different types of credit, such as credit cards, installment loans, and mortgages, can help your credit score.

- This shows lenders that you can manage different types of credit responsibly.

Avoiding Hard Inquiries

- Avoid applying for too much credit in a short period of time. This can lead to hard inquiries, which can lower your credit score.

- Only apply for credit when you need it.

Maintaining a good credit score can have a positive impact on your homeowners insurance premiums. Insurance companies may view you as a lower-risk customer, which can lead to lower rates.

Final Thoughts

By following these practical tips, homeowners can make informed decisions about their insurance coverage, ensuring adequate protection without breaking the bank. Embracing these strategies not only saves money but also promotes responsible financial management and peace of mind, knowing that their homes and belongings are well-protected.

FAQ Section

Q: What is the significance of maintaining a good credit score in relation to homeowners insurance premiums?

A: A good credit score is often associated with lower homeowners insurance premiums. Insurance companies view individuals with higher credit scores as responsible borrowers, making them less likely to file claims. As a result, they may offer lower premiums to policyholders with good credit.

Q: How can homeowners effectively negotiate lower premiums with insurance companies?

A: Homeowners can negotiate lower premiums by presenting a strong case for a reduction. This includes providing a claims-free history, implementing home security features, and maintaining a good credit score. Additionally, building a positive relationship with the insurer and shopping around for quotes from multiple companies can also increase the chances of securing a lower premium.

Q: What are some common discounts and credits offered by insurance companies for homeowners insurance?

A: Insurance companies often offer a range of discounts and credits to homeowners, including discounts for bundling policies, installing security systems, maintaining a claims-free history, and being a long-term customer. Additionally, credits may be available for homeowners who take steps to mitigate risks, such as installing hurricane shutters or upgrading their electrical systems.