Life insurance is a crucial financial tool that provides a safety net for individuals and their families in the event of an untimely death. For those in their 40s, securing a life insurance policy is particularly important as they often have dependents relying on their income and may have significant financial obligations.

This comprehensive guide will delve into the intricacies of life insurance policies, providing valuable insights and practical tips to help 40-year-olds make informed decisions about their coverage. From understanding the different types of policies and assessing individual needs to selecting the right riders and comparing quotes, this guide will equip readers with the knowledge and strategies to navigate the life insurance landscape and ensure the financial well-being of their loved ones.

Understanding Life Insurance for 40-Year-Olds

Life insurance is a crucial financial tool for individuals in their 40s, providing financial protection for their families and loved ones in the event of their unexpected death. Understanding the significance of life insurance and the different types of policies available can help individuals make informed decisions to secure their families’ future.

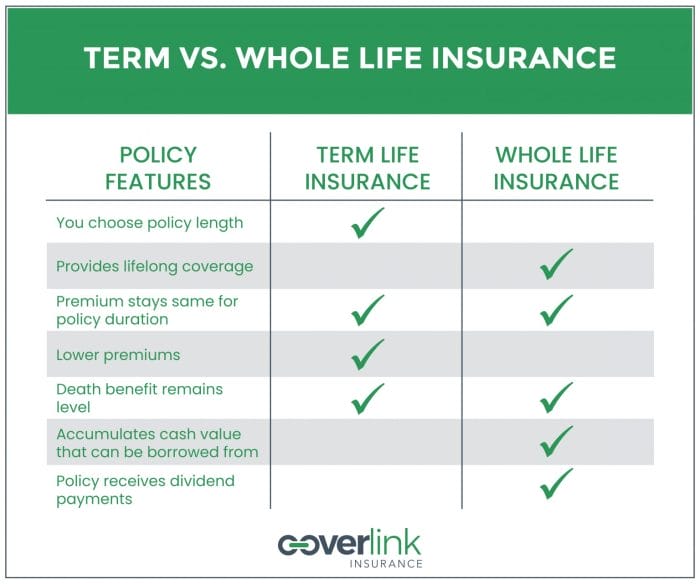

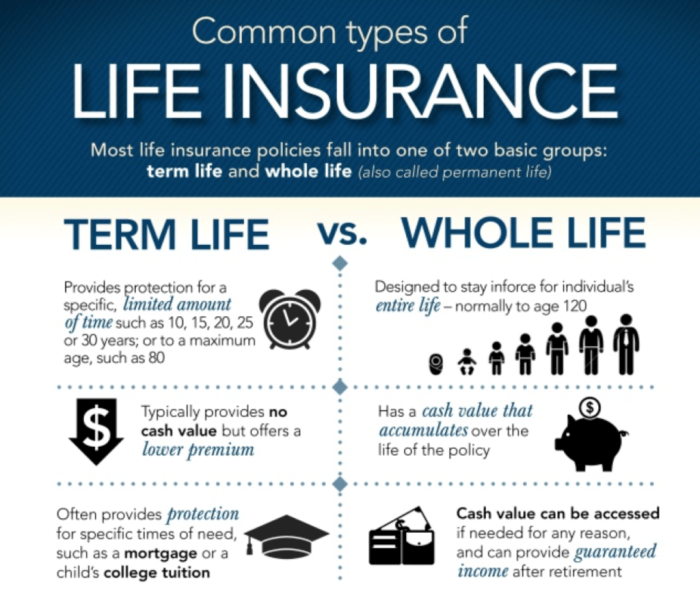

Life insurance policies come in various forms, each offering unique benefits and features. The two primary types are term life insurance and whole life insurance.

Term Life Insurance

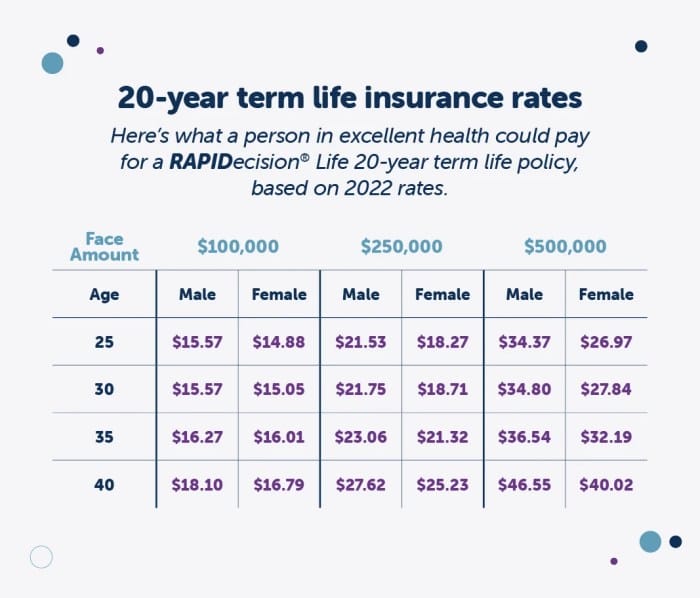

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers affordable premiums and is often recommended for individuals seeking temporary coverage, such as paying off a mortgage or providing financial support for young children.

- Fixed Premium: Premiums for term life insurance remain constant throughout the policy term.

- Temporary Coverage: Coverage expires at the end of the policy term unless renewed or converted to a permanent policy.

- Renewal Options: Some term life insurance policies allow for renewal at the end of the term, but premiums may increase significantly.

Whole Life Insurance

Whole life insurance provides coverage for the entire life of the insured person, as long as premiums are paid. It offers lifelong protection and includes a cash value component that grows over time on a tax-deferred basis.

- Fixed or Adjustable Premiums: Premiums for whole life insurance can be fixed or adjustable, depending on the policy.

- Lifelong Coverage: Coverage continues throughout the insured person’s life, as long as premiums are paid.

- Cash Value Component: Whole life insurance policies accumulate a cash value that can be borrowed against or withdrawn for various purposes.

Assessing Life Insurance Needs

Determining the appropriate amount of life insurance coverage is a crucial step in securing financial protection for your loved ones. To ensure you have adequate coverage, consider these factors:

Income and Expenses

Evaluate your current income and expenses, including housing costs, utilities, groceries, and transportation. Consider your future income potential, such as expected salary increases or potential career changes.

Debts and Liabilities

Calculate your outstanding debts, including mortgages, car loans, credit card balances, and any other financial obligations. Ensure your life insurance coverage is sufficient to cover these debts, allowing your family to pay them off in the event of your passing.

Family Size and Future Goals

Consider the number of dependents you have, including spouse, children, or aging parents. Think about their future needs, such as education costs, mortgage payments, or retirement expenses. Adjust your coverage accordingly to ensure their financial well-being.

Calculating Coverage Amount

To determine the appropriate amount of life insurance coverage, consider the following methods:

- Income Replacement: Multiply your annual income by 10-12 times to estimate the coverage amount needed to replace your income for a specific period.

- Human Life Value: Calculate your life insurance coverage based on your earning potential and future income prospects. This method considers your age, education, skills, and earning potential.

- Expense Coverage: Estimate the total expenses your family would incur in the event of your passing, including funeral costs, outstanding debts, and future living expenses. This method ensures your coverage is sufficient to cover these expenses.

Benefits of Life Insurance for 40-Year-Olds

Life insurance offers a range of benefits that can provide peace of mind and financial security for individuals and their families. These benefits include financial protection, tax advantages, and the potential for savings and investment.

Financial Protection for Families

One of the primary benefits of life insurance is the financial protection it provides to families in the event of the insured person’s death. If the policyholder passes away, the death benefit paid out by the insurance company can help replace the income they would have provided, cover final expenses, and provide financial support for their spouse, children, or other dependents.

Tax Advantages

Life insurance policies offer certain tax advantages that can further enhance their value. For example, the death benefit paid out to beneficiaries is generally tax-free, meaning that the family receives the full amount without having to pay taxes on it.

Additionally, the premiums paid for life insurance policies may be eligible for tax deductions or credits, depending on the type of policy and the individual’s tax situation.

Savings and Investment Tool

Some life insurance policies, known as cash value policies, have a savings or investment component that allows the policyholder to accumulate cash value over time. This cash value can be borrowed against or withdrawn for various purposes, such as paying for education, making a down payment on a house, or supplementing retirement income.

Choosing the Right Life Insurance Policy

Selecting the right life insurance policy involves careful consideration of your individual needs, financial situation, and future goals. This guide will help you navigate the process of choosing a life insurance policy that provides adequate coverage and peace of mind.

To begin, you’ll need to assess your life insurance needs. Consider your income, debts, family responsibilities, and future expenses. Use online calculators or consult with a financial advisor to determine the appropriate coverage amount.

Step-by-Step Guide to Selecting a Life Insurance Policy

- Assess Your Needs: Determine the amount of coverage you need based on your income, debts, family responsibilities, and future expenses.

- Choose a Policy Type: Select between term life insurance (temporary coverage) and whole life insurance (permanent coverage with cash value).

- Compare Quotes: Obtain quotes from multiple insurance companies to compare coverage options, premiums, and benefits.

- Consider Riders and Add-Ons: Explore optional riders such as accidental death benefit, waiver of premium, and guaranteed insurability to enhance your coverage.

- Review the Policy: Carefully read the policy document before signing to understand the terms, conditions, and exclusions.

Comparing Term Life Insurance and Whole Life Insurance

When choosing between term life insurance and whole life insurance, consider the following factors:

- Coverage: Term life insurance provides temporary coverage for a specific period, while whole life insurance offers permanent coverage throughout your lifetime.

- Premiums: Term life insurance premiums are typically lower than whole life insurance premiums due to the limited coverage period.

- Benefits: Whole life insurance policies accumulate a cash value component that can be borrowed against or withdrawn, providing additional financial flexibility.

Choosing the Right Policy Riders and Add-Ons

Policy riders and add-ons can enhance the coverage and benefits of your life insurance policy. Some common options include:

- Accidental Death Benefit: Provides additional coverage in case of death resulting from an accident.

- Waiver of Premium: Waives future premium payments if you become disabled and unable to work.

- Guaranteed Insurability: Allows you to increase your coverage amount in the future without undergoing another medical exam.

Factors Affecting Life Insurance Premiums

Life insurance premiums for 40-year-olds are influenced by several factors that determine the risk associated with insuring an individual. Understanding these factors and how they impact premiums can help you make informed decisions about your life insurance coverage.

The primary factors that affect life insurance premiums for 40-year-olds include age, health status, lifestyle choices, and occupation.

Age

Age is a significant factor in determining life insurance premiums. Generally, younger individuals pay lower premiums compared to older individuals because they have a longer life expectancy and lower risk of death. As you age, your premiums may increase as the insurance company considers you to be at a higher risk of death.

Health Status

Your health status plays a crucial role in determining your life insurance premiums. If you have a history of serious medical conditions or ongoing health issues, you may be charged higher premiums. This is because insurance companies consider individuals with health problems to be at a higher risk of death.

Lifestyle Choices

Your lifestyle choices can also impact your life insurance premiums. Engaging in high-risk activities, such as smoking, excessive alcohol consumption, or participating in dangerous sports, may lead to higher premiums. Insurance companies view these behaviors as increasing your risk of death.

Occupation

Your occupation can also affect your life insurance premiums. If you work in a hazardous or high-risk profession, you may be charged higher premiums. This is because insurance companies consider individuals in certain occupations to be at a higher risk of death due to potential accidents or health hazards associated with their jobs.

To reduce your life insurance premiums without compromising coverage, consider the following tips:

- Maintain a healthy lifestyle: By adopting healthy habits, such as eating a balanced diet, exercising regularly, and avoiding harmful substances like tobacco and excessive alcohol, you can improve your health status and potentially lower your premiums.

- Choose a non-hazardous occupation: If possible, opt for a career that is considered less risky. This can help you secure lower life insurance premiums.

- Compare quotes from multiple insurance companies: Don’t settle for the first quote you receive. Shop around and compare offers from different insurance providers to find the most competitive rates.

- Consider term life insurance: Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. Since term life insurance does not offer lifelong coverage, it is generally more affordable than whole life insurance.

Medical Exams and Underwriting

Life insurance companies use medical exams and underwriting to assess the risk of insuring an applicant. This process helps determine the policy’s premium and whether the application is approved.

During a medical exam, a healthcare professional will measure the applicant’s height, weight, and blood pressure. They will also ask about the applicant’s medical history and lifestyle. The results of the medical exam are used to calculate the applicant’s risk of death.

Underwriting Process

The underwriting process is the process of evaluating an applicant’s risk of death and determining the policy premium. The underwriter will consider the applicant’s medical history, lifestyle, and occupation. They will also consider the amount of coverage the applicant is seeking.

Based on this information, the underwriter will determine the applicant’s risk of death. This risk is used to calculate the policy premium. The higher the risk, the higher the premium.

Improving Underwriting Outcomes

There are a few things an applicant can do to improve their underwriting outcomes and secure a favorable premium. These include:

- Maintaining a healthy lifestyle

- Quitting smoking

- Managing chronic conditions

- Avoiding high-risk activities

- Being honest about medical history

Life Insurance Riders and Add-Ons

Life insurance policies often offer riders and add-ons that can enhance the coverage and provide additional benefits to policyholders. These riders can be customized to meet specific needs and circumstances, ensuring comprehensive protection for individuals and their loved ones.

Benefits of Riders and Add-Ons

Riders and add-ons can provide a range of benefits, including:

- Increased coverage: Riders can increase the death benefit amount, providing additional financial protection for beneficiaries.

- Enhanced coverage: Riders can extend coverage to include specific events or situations, such as accidental death or disability.

- Flexibility: Riders can be added or removed as needed, allowing policyholders to adjust their coverage as their circumstances change.

- Affordability: Riders are typically offered at an additional cost, but they can be a cost-effective way to enhance coverage.

Common Riders and Add-Ons

Some common riders and add-ons available with life insurance policies include:

- Accidental death benefit: This rider provides an additional death benefit if the insured person dies as a result of an accident.

- Waiver of premium: This rider waives the premium payments if the insured person becomes disabled and unable to work.

- Long-term care: This rider provides coverage for long-term care expenses, such as nursing home care or assisted living.

- Child rider: This rider provides coverage for the insured person’s children, typically until they reach a certain age or become financially independent.

- Guaranteed insurability: This rider allows the insured person to purchase additional coverage in the future without having to undergo another medical exam.

Choosing the Right Riders

When selecting riders and add-ons, it’s important to consider the following factors:

- Specific needs: Assess your individual needs and circumstances to determine which riders would be most beneficial.

- Cost: Consider the additional cost of the riders and ensure that it fits within your budget.

- Policy limits: Be aware of any limits or restrictions associated with the riders, such as maximum coverage amounts or age limitations.

- Compatibility: Ensure that the riders are compatible with your existing life insurance policy and that they do not conflict with any other provisions.

By carefully evaluating your needs and options, you can choose the riders and add-ons that best complement your life insurance policy and provide the necessary protection for you and your loved ones.

Comparing Life Insurance Quotes

Shopping for life insurance quotes from multiple providers is essential for making an informed decision. It enables you to compare coverage options, premiums, and policy terms, ensuring you find the best value for your money.

Gathering Life Insurance Quotes

- Define Your Needs: Determine the coverage amount, policy term, and any additional riders or benefits you need.

- Research Providers: Look for reputable life insurance companies with a strong track record and competitive rates.

- Contact Agents: Reach out to insurance agents representing different providers to obtain quotes.

- Compare Coverage: Review the coverage details, including policy limits, exclusions, and riders, to ensure they meet your requirements.

- Analyze Premiums: Compare the premium amounts and payment options to find the most affordable policy.

Negotiating for Better Terms

- Ask for Discounts: Inquire about discounts available for non-smokers, healthy lifestyles, or multiple policies.

- Consider Bundling Policies: Explore the possibility of bundling your life insurance with other insurance policies, such as home or auto insurance, for potential savings.

- Review Policy Riders: Assess whether additional riders, such as accelerated death benefits or waiver of premium, are necessary and worth the extra cost.

- Review Beneficiary Options: Ensure that the beneficiary designations on your policy are accurate and up-to-date.

Estate Planning and Life Insurance

Life insurance plays a pivotal role in estate planning, offering a range of benefits that can help individuals minimize estate taxes, ensure a smooth transfer of assets, and protect their loved ones’ financial well-being.

Life insurance can be used as a tool to:

- Pay estate taxes: Life insurance proceeds can be used to pay estate taxes, helping to reduce the overall tax burden on an individual’s estate.

- Provide liquidity: When an individual passes away, their assets may not be immediately available to their beneficiaries. Life insurance can provide a source of liquidity to cover immediate expenses, such as funeral costs and outstanding debts, while the estate is being settled.

- Preserve assets: Life insurance can be used to protect assets from being sold or liquidated to pay estate taxes or other expenses. This allows beneficiaries to inherit the full value of the individual’s estate.

- Transfer wealth to beneficiaries: Life insurance can be used to transfer wealth to beneficiaries in a tax-advantaged manner. Life insurance proceeds are generally not subject to income tax, and they can be structured to provide a steady stream of income for beneficiaries over time.

Examples of Life Insurance for Estate Planning

Here are some examples of how life insurance can be used for estate planning purposes:

- A married couple with children: A husband and wife can each purchase life insurance policies to provide for their children in the event of their untimely death. The proceeds from the policies can be used to cover expenses such as mortgage payments, education costs, and living expenses.

- A business owner: A business owner can purchase a life insurance policy to protect their business from financial loss in the event of their death. The proceeds from the policy can be used to pay off debts, cover operating expenses, and provide a financial cushion for the business’s employees.

- A wealthy individual: A wealthy individual can purchase a life insurance policy to pay estate taxes and ensure that their assets are transferred to their beneficiaries in a tax-advantaged manner.

Life Insurance for Business Owners

Business owners face unique life insurance needs due to their involvement in entrepreneurial ventures. Understanding these specific requirements and available insurance options is essential for protecting their businesses and families.

Key Person Insurance

Key person insurance protects businesses from the financial impact of losing a key employee or owner whose skills and expertise are crucial to the company’s success. In the event of the insured person’s death or disability, the insurance policy provides funds to cover the costs of hiring and training a replacement, as well as any lost profits during the transition period.

Business Continuation Insurance

Business continuation insurance ensures that a business can continue to operate smoothly even after the death or disability of a key owner or partner. This type of insurance provides a lump sum payment to the business, which can be used to cover expenses such as buying out the deceased owner’s share, paying off debts, or maintaining operations during the transition to new ownership or management.

Selecting the Right Life Insurance Policy for Business Owners

Choosing the appropriate life insurance policy for business owners involves careful consideration of several factors, including:

- Amount of Coverage: The coverage amount should be sufficient to cover the financial impact of the insured person’s death or disability on the business.

- Type of Policy: Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and includes a cash value component.

- Policy Riders: Additional riders, such as disability income insurance or accidental death and dismemberment (AD&D) insurance, can provide extra protection and benefits.

- Cost: The cost of the policy should be affordable and fit within the business’s budget.

Conclusion

Life insurance is a powerful financial tool that can provide peace of mind and financial security for individuals and their families. By carefully considering the factors discussed in this guide, 40-year-olds can make informed decisions about their life insurance coverage, ensuring that their loved ones are protected and their financial legacy is secure.

FAQ Section

What are the different types of life insurance policies available?

There are two main types of life insurance policies: term life insurance and whole life insurance. Term life insurance provides coverage for a specific period, while whole life insurance provides coverage for the entire life of the insured individual.

How can I determine the appropriate amount of life insurance coverage?

To determine the appropriate amount of life insurance coverage, consider factors such as your income, debts, family size, and future goals. You can use online calculators or consult with a financial advisor to help you determine the right coverage amount.

What are the benefits of life insurance for 40-year-olds?

Life insurance offers several benefits for 40-year-olds, including financial protection for their families, tax advantages, and the potential for savings and investment.

How can I choose the right life insurance policy?

To choose the right life insurance policy, consider factors such as your coverage needs, budget, and health status. Compare quotes from multiple providers and consult with a financial advisor to help you make an informed decision.

What factors affect life insurance premiums for 40-year-olds?

Factors that affect life insurance premiums for 40-year-olds include age, health status, lifestyle choices, and occupation. Maintaining a healthy lifestyle and avoiding risky behaviors can help reduce your premiums.