In an era of digital convenience, purchasing term life insurance online has emerged as a viable and accessible option. This comprehensive guide will equip you with the knowledge and strategies to navigate the online term life insurance market confidently. Whether you’re a first-time insurance buyer or seeking to optimize your existing coverage, this guide will empower you to make informed decisions and secure the financial protection you and your loved ones deserve.

From understanding the intricacies of term life insurance policies to evaluating insurance companies and getting the best rates, this guide covers all aspects of the online term life insurance buying process. By following these expert tips and insights, you can ensure that you find the right policy that meets your unique needs and budget, providing peace of mind for years to come.

Online Comparison Tools

introductory paragraphOnline comparison tools offer a convenient and efficient way to compare term life insurance policies from multiple providers. They allow you to get quotes from different insurers in one place, making it easier to find the best policy for your needs and budget.

Popular Online Comparison Tools

Some popular online comparison tools include:*

-*PolicyGenius

This tool allows you to compare quotes from over 30 different life insurance providers. It also provides educational resources and guides to help you make an informed decision.

-

-*Insure.com

This tool allows you to compare quotes from over 20 different life insurance providers. It also provides information on different types of life insurance and how to choose the right policy for you.

-*LifeQuotes.com

This tool allows you to compare quotes from over 10 different life insurance providers. It also provides a variety of calculators and tools to help you determine how much life insurance you need and how much it will cost.

Tips for Getting the Most Accurate Quotes from Online Comparison Tools

*

- *Be specific about your needs. When you’re getting quotes from online comparison tools, be as specific as possible about your needs. This includes your age, health, and the amount of coverage you need. The more information you provide, the more accurate your quotes will be.

- *Compare multiple quotes. Don’t just get a quote from one online comparison tool. Get quotes from several different tools to make sure you’re getting the best possible deal.

- *Read the fine print. Before you purchase a term life insurance policy, read the fine print carefully. Make sure you understand the terms and conditions of the policy and that you’re comfortable with them.

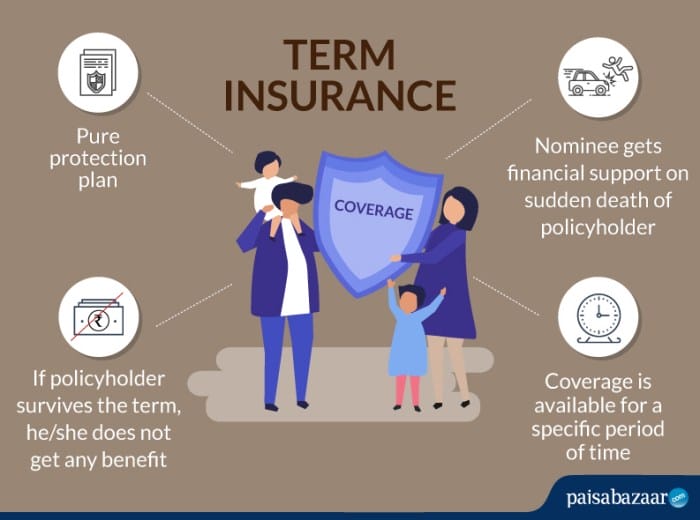

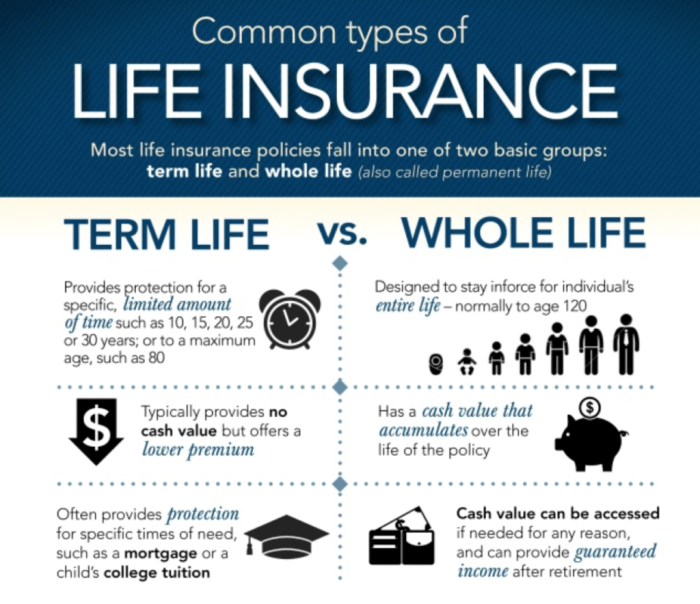

Understanding Term Life Insurance Policies

Term life insurance policies provide coverage for a specified period, such as 10, 20, or 30 years. They offer a straightforward and affordable way to protect your loved ones financially in case of your untimely death during the policy term.

Understanding the key features and terms of term life insurance policies is essential before making a purchase.

Coverage Amounts

The coverage amount is the maximum amount the insurance company will pay to your beneficiaries upon your death. It’s crucial to determine the appropriate coverage amount based on your income, debts, family size, and future financial goals. Consider factors such as your mortgage balance, outstanding loans, education expenses for children, and retirement savings.

Policy Lengths

Term life insurance policies come with varying lengths, typically ranging from 10 to 30 years. The policy length should align with your financial obligations and life stage. For instance, if you have young children, a longer policy term may be suitable to provide coverage until they become financially independent.

Premiums

Premiums are the periodic payments you make to the insurance company to keep your policy active. Premiums for term life insurance are generally lower compared to permanent life insurance policies. Factors that influence premiums include your age, health status, coverage amount, and policy length.

Types of Term Life Insurance Policies

There are various types of term life insurance policies available, each with unique features and benefits. Some common types include:

- Level Term Life Insurance: Provides a fixed coverage amount and premium throughout the policy term.

- Decreasing Term Life Insurance: The coverage amount decreases over time, while the premium remains level.

- Return of Premium Term Life Insurance: At the end of the policy term, if you haven’t filed a claim, a portion or all of the premiums paid may be returned to you.

- Renewable Term Life Insurance: Allows you to renew the policy at the end of the term, typically at a higher premium.

Importance of Understanding Policy Terms and Conditions

Before purchasing a term life insurance policy, it’s crucial to carefully review and understand the terms and conditions of the policy. Pay attention to the following:

- Exclusions: Understand any circumstances or activities that may void the policy or result in a denied claim.

- Riders: Additional coverage options, such as accidental death benefit or waiver of premium, can be added to the policy for an extra cost.

- Grace Period: The period during which you can pay a missed premium without the policy lapsing.

- Beneficiaries: Specify who will receive the death benefit.

By thoroughly understanding the terms and conditions of your term life insurance policy, you can ensure that your loved ones are adequately protected and that you’re making an informed decision.

Assessing Your Insurance Needs

Understanding your insurance needs is crucial in determining the appropriate term life insurance coverage. Consider the following factors to assess your requirements accurately:

Income and Debts

Evaluate your current income and outstanding debts, including mortgages, loans, and credit card balances. Ensure your coverage amount is sufficient to cover these obligations, providing financial security for your loved ones in case of your untimely demise.

Family Situation

Consider your family’s current and future needs. If you have dependents, such as a spouse, children, or aging parents, your coverage should be adequate to maintain their standard of living and provide for their education, healthcare, and other expenses.

Future Financial Needs and Goals

Anticipate your future financial needs and goals, such as retirement planning, a child’s education, or a down payment on a house. Incorporate these long-term objectives into your coverage amount to ensure your policy remains relevant and beneficial throughout your life.

Evaluating Insurance Companies

When purchasing term life insurance online, it’s crucial to evaluate the financial strength and reputation of the insurance companies you’re considering. Here are some tips to help you make an informed decision:

Financial Strength Ratings

Financial strength ratings provide an assessment of an insurance company’s ability to meet its financial obligations, including paying claims and fulfilling contracts. Reputable rating agencies like A.M. Best, Standard & Poor’s, and Moody’s assign these ratings. Aim for companies with strong ratings, typically in the “A” or higher range.

Customer Service Ratings

Customer service ratings reflect the quality of service provided by an insurance company. These ratings are often based on customer satisfaction surveys and feedback. Look for companies with consistently high customer service ratings, as they indicate a commitment to policyholder satisfaction.

Claims-Paying History

A company’s claims-paying history provides insight into its track record of promptly and fairly settling claims. Check for companies with a history of paying claims quickly and without unnecessary hassle. You can find this information through consumer review websites or by contacting the insurance company directly.

Examples of Reputable Insurance Companies

Here are a few examples of insurance companies known for their reliability and customer satisfaction:

- State Farm: Renowned for its financial strength, customer service, and claims-paying history.

- Northwestern Mutual: Consistently high customer satisfaction ratings and a strong financial position.

- New York Life: Known for its long-standing reputation, financial stability, and customer-centric approach.

Getting the Best Rates

Securing the most favorable rates for term life insurance demands a proactive approach. Research, comparison, and a thorough understanding of the factors influencing insurance premiums are crucial. Explore strategies to secure the best rates and navigate the nuances of comparing quotes from multiple insurance companies.

Comparing Quotes

Comparing quotes from multiple insurance companies is essential for securing the best rates. This allows you to assess the competitive landscape and identify insurers offering the most favorable terms. Consider using online comparison tools or working with an insurance broker to obtain quotes from various providers.

Factors Impacting Rates

Several factors significantly influence insurance rates, including:

- Age: Generally, younger individuals are offered lower rates compared to older individuals due to a lower risk of health complications.

- Health: Individuals with pre-existing medical conditions or a family history of severe illnesses may face higher rates.

- Lifestyle: Engaging in high-risk activities, such as extreme sports or smoking, can result in higher premiums.

- Occupation: Certain occupations deemed hazardous, such as construction or firefighting, may lead to increased rates.

Health and Lifestyle Factors

Health and lifestyle factors play a significant role in determining term life insurance rates. Insurance companies evaluate these factors to assess the risk of insuring an individual and determine the appropriate premium.

Common health conditions that can affect insurance rates include:

- High blood pressure

- High cholesterol

- Diabetes

- Heart disease

- Cancer

- Obesity

- Smoking

- Alcohol abuse

- Drug use

Individuals with these conditions may be charged higher premiums or may be denied coverage altogether.

Improving your health and lifestyle can help you qualify for lower rates. Here are some tips:

- Maintain a healthy weight.

- Eat a healthy diet.

- Get regular exercise.

- Control your blood pressure and cholesterol.

- Manage your diabetes.

- Quit smoking.

- Limit alcohol consumption.

- Avoid illegal drug use.

By following these tips, you can improve your health and lifestyle, which can lead to lower term life insurance rates.

Riders and Optional Benefits

Term life insurance policies can be customized to meet your specific needs by adding riders, which are additional coverage options that provide extra protection. These riders can be added to your policy for an additional cost, and they can provide valuable benefits that can help you and your family in the event of your death.

There are many different types of riders available, so it’s important to talk to your insurance agent about which ones are right for you. Some common riders include:

Accidental Death Benefit

This rider provides a death benefit if you die as a result of an accident. The amount of the death benefit is typically equal to the amount of your base policy, but it can be higher or lower depending on the policy you choose.

Waiver of Premium

This rider waives your premium payments if you become disabled. This means that your policy will continue to be in force, even if you can’t afford to pay the premiums. The waiver of premium rider is typically available for an additional cost, and it can provide peace of mind knowing that your family will be protected even if you’re unable to work.

Children’s Coverage

This rider provides coverage for your children. The amount of coverage is typically equal to a percentage of your base policy, and it can be increased as your children grow older. The children’s coverage rider is typically available for an additional cost, and it can provide valuable protection for your family in the event of your death.

Adding riders to your term life insurance policy can provide valuable benefits, but it’s important to weigh the costs and benefits before you make a decision. Talk to your insurance agent about which riders are right for you, and make sure you understand the terms and conditions of the riders before you add them to your policy.

Medical Exams and Underwriting

The medical exam is a crucial step in the term life insurance application process. It helps the insurance company assess your health status and determine your risk level. Preparing for the medical exam can increase your chances of getting a favorable underwriting decision and securing the best possible rates.

Preparing for the Medical Exam

Fasting

Follow the instructions provided by the insurance company regarding fasting before the exam. Typically, you will be asked to fast for 8-12 hours before the exam.

Hydration

Drink plenty of water before the exam to stay hydrated. Dehydration can affect your blood pressure and other test results.

Avoid Alcohol and Smoking

Abstain from alcohol and smoking for at least 24 hours before the exam. These substances can interfere with test results.

Bring Your Medications

Bring a list of all your current medications and dosages to the exam. The insurance company will need this information to assess your health status.

Be Honest

Be honest and forthcoming with the insurance company about your medical history, lifestyle habits, and any pre-existing conditions. Misrepresenting information can lead to a denied claim or policy cancellation.

Impact of Medical Conditions and Lifestyle Choices

Your medical conditions and lifestyle choices can significantly impact the underwriting process. Pre-existing conditions such as heart disease, cancer, or diabetes can increase your risk level and lead to higher premiums. Similarly, unhealthy lifestyle choices like smoking, excessive alcohol consumption, or obesity can also affect your insurability and rates.

Smoking

Smokers generally pay higher premiums than non-smokers due to the increased risk of health problems associated with smoking.

Alcohol Consumption

Excessive alcohol consumption can also lead to higher premiums or even denial of coverage.

Weight and Body Mass Index (BMI)

Being overweight or obese can increase your risk of developing health problems, leading to higher premiums.

High-Risk Activities

Engaging in high-risk activities, such as skydiving or rock climbing, can also impact your insurability and rates.

Online Application Process

Applying for term life insurance online is a straightforward process that can be completed in a few simple steps. By following these steps carefully and avoiding common mistakes, you can ensure a smooth and successful application experience.

Choosing an Insurance Company

Before starting the online application, it’s essential to choose a reputable and reliable insurance company. Research different providers, compare their rates and coverage options, and read reviews from customers to make an informed decision.

Gathering Necessary Information

To complete the online application, you’ll need to gather personal and financial information, including your name, address, date of birth, Social Security number, income, and health history. You may also need to provide information about your lifestyle habits, such as smoking or alcohol consumption.

Completing the Application

Once you’ve chosen an insurance company and gathered the necessary information, you can start the online application process. Typically, the application will involve several sections, including personal information, health history, lifestyle habits, and coverage options. Carefully review each section and provide accurate and complete answers to all questions.

Submitting the Application

After completing the application, review it carefully for any errors or omissions. Once you’re satisfied that the information is correct, submit the application to the insurance company. You may need to create an account with the insurance company or provide an electronic signature to complete the submission process.

Common Mistakes to Avoid

To avoid delays or complications during the online application process, be sure to avoid these common mistakes:

- Inaccurate or incomplete information: Providing inaccurate or incomplete information can lead to delays in processing your application or even denial of coverage.

- Omitting important details: Be sure to disclose all relevant information, including any health conditions or lifestyle habits that may affect your insurability.

- Rushing through the application: Take your time to carefully review each section of the application and provide accurate and complete answers.

- Not reviewing the policy details: Before finalizing your application, be sure to review the policy details, including the coverage amount, premium, and terms and conditions.

Policy Delivery and Activation

Once your term life insurance application is approved, you will receive a policy document in the mail or electronically. This document Artikels the terms and conditions of your coverage, including the death benefit, premium amount, and policy length.

The policy will typically go into effect on the date of issue, which is the date the insurance company approves your application. However, there may be a waiting period before the full death benefit is payable. During this waiting period, which typically lasts for two years, the insurance company will only pay a portion of the death benefit if you die.

Making the First Premium Payment

Your first premium payment is usually due within 30 days of the policy’s effective date. You can make your premium payments monthly, quarterly, semi-annually, or annually. The insurance company will send you a bill for each premium payment.

It is important to make your premium payments on time to keep your policy in force. If you miss a premium payment, your policy may lapse, and you will no longer be covered by the insurance.

Reviewing the Policy Carefully

When you receive your policy, it is important to review it carefully to make sure you understand all of its terms and conditions. If you have any questions, you should contact your insurance agent or the insurance company directly.

Make sure you understand the following:

- The death benefit: This is the amount of money that will be paid to your beneficiaries if you die while the policy is in force.

- The premium amount: This is the amount you will pay each month, quarter, or year to keep your policy in force.

- The policy length: This is the length of time the policy will be in force. Most term life insurance policies are for 10, 20, or 30 years.

- The waiting period: This is the period of time before the full death benefit is payable. During this period, the insurance company will only pay a portion of the death benefit if you die.

- The riders and optional benefits: These are additional features that you can add to your policy for an additional cost. Riders and optional benefits can provide coverage for things like accidental death, dismemberment, and critical illness.

Closure

As you embark on your journey to purchase term life insurance online, remember that knowledge is power. By educating yourself about the key factors to consider, comparing quotes, and evaluating insurance companies, you can make informed decisions that align with your financial goals and provide the protection you need.

Embrace the convenience and accessibility of online term life insurance, but always prioritize thorough research and understanding to ensure the best possible outcome.

Answers to Common Questions

Q: What are the advantages of using online comparison tools for term life insurance?

A: Online comparison tools offer a convenient and efficient way to compare multiple term life insurance policies from various providers. They allow you to quickly assess coverage options, premiums, and policy features, enabling you to make informed decisions based on your specific needs and budget.

Q: How can I get the most accurate quotes from online comparison tools?

A: To obtain the most accurate quotes from online comparison tools, provide accurate and complete information about your age, health, lifestyle, and coverage needs. Be transparent about any pre-existing medical conditions or high-risk activities that may impact your insurability and premium rates.

Q: What are some common health conditions that can affect term life insurance rates?

A: Common health conditions that can influence term life insurance rates include heart disease, cancer, diabetes, obesity, and respiratory conditions. The severity and prognosis of the condition, as well as your age and lifestyle factors, will impact the assessment of your risk and the resulting premium rates.

Q: What is the medical exam process for term life insurance, and how can I prepare for it?

A: The medical exam for term life insurance typically involves a physical examination, blood and urine tests, and a review of your medical history. To prepare for the exam, provide accurate information about your health and lifestyle, and follow any specific instructions provided by the insurance company.

Q: What is the online application process for term life insurance, and what are some tips to avoid common mistakes?

A: The online application process for term life insurance typically involves completing an online form with personal information, health history, and coverage details. To avoid common mistakes, ensure you provide accurate and complete information, review the application thoroughly before submitting it, and submit it well before the policy’s effective date.