In the dynamic world of insurance, striking a balance between professional pursuits and personal well-being is crucial for agents to thrive. Work-life balance enables insurance agents to maintain a harmonious relationship between their professional responsibilities and personal life, leading to increased productivity, reduced stress, and overall job satisfaction.

This comprehensive guide delves into practical strategies, techniques, and tips tailored specifically for insurance agents to achieve work-life balance. From effective time management and boundary setting to self-care and stress management, we’ll explore the essential elements that contribute to a fulfilling and balanced life.

Effective Time Management

In the realm of insurance, where juggling multiple clients, policies, and tasks can be overwhelming, effective time management is paramount to success. This guide delves into proven techniques tailored specifically for insurance agents, empowering them to prioritize tasks, set realistic goals, and minimize distractions, ultimately enhancing productivity and achieving a harmonious work-life balance.

Prioritizing Tasks

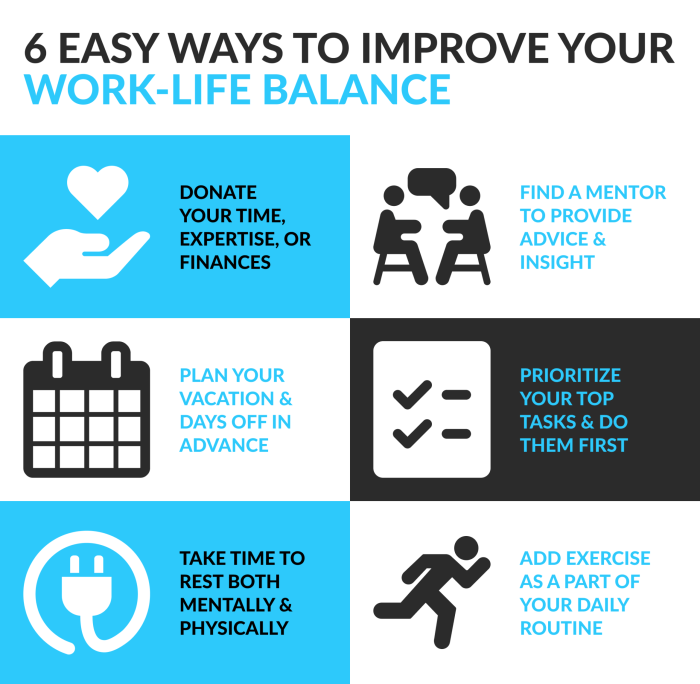

Prioritizing tasks is the cornerstone of effective time management. It involves identifying and focusing on high-priority activities that align with your long-term goals. Utilize the Eisenhower Matrix, a popular prioritization tool, to categorize tasks into four quadrants: urgent and important, important but not urgent, urgent but not important, and neither urgent nor important.

Concentrate your efforts on tasks that fall in the urgent and important quadrant, while delegating or rescheduling less critical tasks.

Setting Realistic Goals

Setting realistic and achievable goals is essential for maintaining motivation and focus. Break down long-term goals into smaller, manageable milestones. Each milestone should be specific, measurable, achievable, relevant, and time-bound (SMART). Regularly review and adjust your goals to ensure they remain aligned with your priorities and changing circumstances.

Minimizing Distractions

Minimizing distractions is crucial for maintaining focus and productivity. Identify common distractions in your work environment and take proactive steps to mitigate them. Utilize tools such as noise-canceling headphones to block out background noise, disable unnecessary notifications on your devices, and designate specific times for checking emails and social media.

Consider implementing the Pomodoro Technique, a time management method that involves working for 25 minutes, followed by a 5-minute break, to maintain focus and prevent burnout.

Creating a Daily Schedule

Creating a daily schedule is a powerful tool for organizing your time and ensuring that important tasks are completed. At the start of each workday, allocate time slots for specific tasks, meetings, and breaks. Be realistic in your estimations and leave some buffer time for unexpected events.

Review and adjust your schedule regularly to accommodate changes and ensure that it remains aligned with your priorities.

Setting Boundaries

For insurance agents, striking a healthy work-life balance requires establishing clear boundaries between professional and personal spheres. These boundaries ensure agents prioritize their well-being, maintain healthy relationships, and prevent burnout.

To set effective boundaries, agents can implement several strategies:

Establishing Clear Work Hours

- Define specific work hours: Determine the start and end times of your workday and adhere to them consistently. This routine helps create a structured schedule and signals to clients and colleagues when you’re available.

- Communicate your work hours: Inform clients and colleagues about your work hours through email signatures, voicemail messages, and social media. This transparency sets expectations and helps them understand when they can reach you.

Avoiding Work-Related Tasks During Personal Time

- Resist the urge to check work emails and messages outside of work hours: Constant connectivity can blur the line between work and personal life, leading to stress and burnout. Designate specific times during the day to check and respond to work-related communications.

- Refrain from taking work home: Establish a dedicated workspace at home, separate from your living areas. Avoid bringing work materials into personal spaces to maintain a clear distinction between work and home.

Communicating Boundaries to Clients and Colleagues

- Be assertive when declining additional work or requests: Politely decline additional work or requests that conflict with your personal time. Explain that you prioritize your well-being and maintaining a healthy work-life balance.

- Set expectations with clients: Communicate your availability and response times clearly to clients. Explain that you may not be immediately available outside of work hours but will respond during your designated work time.

Creating a Dedicated Workspace

A dedicated workspace is a crucial element for insurance agents to maintain a healthy work-life balance. It provides a designated area for focused work, minimizing distractions and promoting productivity.

Benefits of a Dedicated Workspace

1. Improved Focus

A dedicated workspace helps insurance agents stay focused on their tasks by eliminating distractions from other areas of the home or office.

2. Increased Productivity

A well-organized workspace with the necessary tools and resources can enhance productivity by reducing time spent searching for items and minimizing interruptions.

3. Better Time Management

Having a dedicated workspace allows insurance agents to better manage their time by establishing a routine and schedule for work-related activities.

4. Improved Work-Life Balance

By creating a physical separation between work and personal life, a dedicated workspace helps insurance agents maintain a healthier balance between the two.

Tips for Setting Up an Ergonomic and Organized Workspace

1. Choose a Quiet and Comfortable Location

Select a space that is free from distractions and has adequate lighting and ventilation. Ensure that the furniture and chair are comfortable and provide proper support.

2. Organize Your Workspace

Keep your workspace neat and tidy by using storage solutions like shelves, drawers, and organizers. Label folders and files clearly to easily locate documents and materials.

3. Use Ergonomic Equipment

Invest in ergonomic equipment such as an adjustable desk, keyboard, and mouse to reduce physical strain and promote long-term health.

4. Personalize Your Workspace

Add personal touches like plants, artwork, or motivational quotes to create a comfortable and inspiring work environment.

Maintaining a Clutter-Free and Comfortable Workspace

1. Regularly Declutter

Regularly clear your workspace of unnecessary items, paperwork, and clutter to maintain a clean and organized environment.

2. Take Breaks

Step away from your workspace periodically to stretch, move around, or take a short walk to refresh your mind and body.

3. Maintain Proper Lighting

Ensure that your workspace has adequate lighting to prevent eye strain and headaches. Adjust the lighting to suit your preferences and the time of day.

4. Control Noise Levels

Minimize background noise by using noise-canceling headphones or earplugs if necessary. Create a quiet and peaceful environment to enhance focus and concentration.

Utilizing Technology

In the modern digital landscape, insurance agents have a wealth of technological tools and apps at their disposal to streamline their work and improve efficiency. These tools can help agents manage their time, stay organized, and provide better service to their clients.

Productivity Apps:

- Task management apps like Todoist, Asana, and Trello help agents keep track of their tasks, set priorities, and collaborate with team members.

- Calendar apps like Google Calendar and Outlook allow agents to schedule appointments, track meetings, and set reminders.

- Note-taking apps like Evernote and OneNote provide a digital space for agents to capture ideas, record client information, and keep track of important details.

Time Tracking Tools:

- Time tracking tools like Toggl and RescueTime help agents monitor how they spend their time, identify areas where they can be more efficient, and bill clients accurately.

- These tools can also generate reports that provide valuable insights into an agent’s productivity and help them make adjustments to their work habits.

Customer Relationship Management (CRM) Systems:

- CRM systems like Salesforce and HubSpot help agents manage their relationships with clients, track sales opportunities, and provide personalized service.

- These systems allow agents to store client data, track interactions, and generate reports that help them identify trends and opportunities.

Remote Work and Flexible Scheduling:

Technology has made it possible for insurance agents to work remotely and set their own schedules. This can be a major benefit for agents who want to have more control over their work-life balance.

- With the help of video conferencing tools like Zoom and Skype, agents can meet with clients and colleagues virtually, eliminating the need for travel.

- Cloud-based software and mobile apps allow agents to access their work files and tools from anywhere, making it easier to work from home or on the go.

Practicing Self-Care

Insurance agents often find themselves juggling multiple responsibilities, which can lead to burnout and work-life imbalance. Prioritizing self-care is crucial for maintaining a healthy balance and overall well-being.

Regular Exercise and Healthy Eating

- Regular exercise and a balanced diet are vital for physical and mental health. Aim for at least 30 minutes of moderate-intensity exercise most days of the week.

- Incorporate nutritious foods into your diet, including fruits, vegetables, whole grains, and lean protein. Avoid excessive consumption of processed foods, sugary drinks, and unhealthy fats.

Adequate Sleep

- Getting enough sleep is essential for cognitive function, mood regulation, and overall health. Aim for 7-8 hours of quality sleep each night.

- Establish a regular sleep routine, going to bed and waking up at the same time each day, even on weekends.

Breaks and Hobbies

- Take regular breaks throughout the day to recharge and maintain focus. Step away from work, stretch, or engage in a relaxing activity.

- Pursue hobbies and interests outside of work to provide mental stimulation and relaxation. These activities can help reduce stress and improve overall well-being.

Support Network

- Having a strong support network of friends, family, or a therapist can provide emotional support and help manage stress.

- Openly communicate your feelings and challenges with those you trust. Seeking professional help is not a sign of weakness but a proactive step towards maintaining mental well-being.

Managing Stress

Insurance agents often face a myriad of stressors, including demanding workloads, client expectations, and market fluctuations. It’s crucial to recognize these stressors and develop effective coping mechanisms to maintain a healthy work-life balance.

To effectively manage stress, it’s important to identify its common sources and develop strategies to address them. Some common stressors for insurance agents include:

- Client demands and expectations: Meeting client expectations and resolving their concerns can be a significant source of stress.

- Work overload: Juggling multiple clients, policies, and deadlines can lead to feelings of overwhelm and stress.

- Market fluctuations: Changes in the insurance market, such as economic downturns or regulatory shifts, can create uncertainty and stress.

- Lack of control: Insurance agents often have limited control over external factors that can impact their work, such as client behavior or market conditions.

- Time constraints: The need to meet deadlines and manage multiple tasks simultaneously can lead to feelings of time pressure and stress.

To effectively manage stress, insurance agents can employ various strategies:

- Prioritize tasks: Identifying and focusing on high-priority tasks can help agents manage their time and workload more effectively.

- Set realistic goals: Setting achievable goals can help reduce feelings of overwhelm and stress.

- Learn to say no: It’s important for agents to recognize their limits and decline additional responsibilities when necessary.

- Delegate tasks: Delegating tasks to colleagues or support staff can help agents free up time and reduce their workload.

- Take breaks: Regular breaks throughout the day can help prevent burnout and improve focus and productivity.

In addition to these strategies, insurance agents can also benefit from practicing relaxation techniques to reduce stress levels. These techniques may include:

- Deep breathing exercises: Taking slow, deep breaths can help calm the nervous system and reduce stress.

- Meditation: Practicing meditation can help agents focus on the present moment and reduce stress and anxiety.

- Yoga: Yoga combines physical postures, breathing exercises, and meditation to promote relaxation and stress reduction.

It’s also important for insurance agents to maintain a positive mindset and practice gratitude. Focusing on the positive aspects of their work and expressing gratitude for their accomplishments can help reduce stress and promote overall well-being.

If stress becomes overwhelming, it’s important to seek professional help. A therapist can help agents identify the root causes of their stress and develop coping mechanisms to manage it effectively.

Maintaining Work-Life Integration

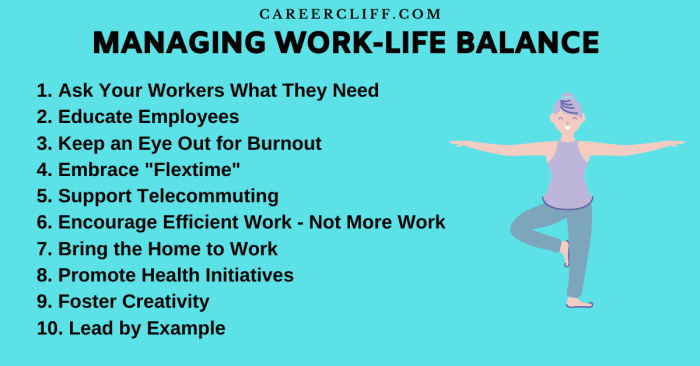

Achieving work-life integration is a holistic approach that aims to harmonize professional and personal aspects of an insurance agent’s life. It involves recognizing the interconnectedness of these domains and prioritizing a balanced lifestyle that enhances overall well-being.

Benefits of Work-Life Integration

- Improved Productivity: A balanced lifestyle reduces stress and improves focus, leading to increased productivity and effectiveness in work tasks.

- Enhanced Well-being: Integrating work and personal life promotes overall well-being by fostering satisfaction, reducing burnout, and improving mental and physical health.

- Stronger Relationships: Prioritizing personal life strengthens relationships with family, friends, and loved ones, creating a supportive network that contributes to overall happiness.

- Increased Motivation: A balanced lifestyle enhances motivation by providing a sense of purpose and fulfillment, both professionally and personally.

Strategies for Achieving Work-Life Integration

- Set Boundaries: Establish clear boundaries between work and personal time to prevent work from encroaching on personal life and vice versa.

- Take Breaks: Regular breaks throughout the day, including short walks or engaging in non-work activities, can help refresh the mind and maintain focus.

- Delegate and Prioritize: Prioritize tasks and delegate responsibilities to create a manageable workload, reducing stress and allowing for more personal time.

- Embrace Flexibility: When possible, embrace flexible work arrangements, such as remote work or flexible hours, to accommodate personal commitments and family needs.

Finding the Right Balance

Striving for work-life integration involves finding a balance that allows for both professional success and personal fulfillment. It requires ongoing self-reflection, adjustment, and a willingness to make changes as circumstances evolve. By nurturing both professional and personal aspects of life, insurance agents can achieve a harmonious and fulfilling lifestyle.

Building a Support Network

In the insurance industry, having a robust support network is crucial for navigating the demands and challenges of the job. Connecting with colleagues, mentors, and industry peers can provide invaluable guidance, emotional support, and opportunities for professional growth.

To foster a supportive network, consider the following strategies:

Networking with Colleagues

- Attend industry events, conferences, and workshops to connect with peers and exchange insights.

- Join local insurance associations or groups to expand your professional circle.

- Utilize social media platforms to connect with industry professionals and engage in discussions.

Seeking Mentorship

- Identify experienced insurance professionals who can provide guidance and mentorship.

- Approach potential mentors with a genuine interest in learning and a willingness to commit.

- Regularly communicate with your mentor to seek advice, share experiences, and receive feedback.

Joining Professional Organizations

- Consider joining professional organizations such as the National Association of Insurance and Financial Advisors (NAIFA) or the Independent Insurance Agents & Brokers of America (IIABA) to connect with industry peers and access resources.

- Participate in organization events, webinars, and forums to expand your knowledge and network.

- Engage with online communities and forums dedicated to insurance professionals to share experiences and insights.

Continuous Learning and Development

In the ever-evolving insurance industry, continuous learning and professional development are crucial for insurance agents to stay updated with industry trends, enhance their skills, and provide exceptional service to clients. By embracing ongoing learning, agents can remain knowledgeable, adaptable, and competitive in the dynamic insurance landscape.

To facilitate continuous learning, insurance agents should actively seek relevant training opportunities, attend industry conferences, and engage with industry publications. Additionally, obtaining industry certifications and designations demonstrates a commitment to excellence and enhances an agent’s credibility and expertise.

Identifying Relevant Training Opportunities

Identifying relevant training opportunities is essential for insurance agents to enhance their knowledge and skills. Agents can explore online courses, workshops, and seminars offered by insurance associations, industry experts, and educational institutions.

- Research industry trends and identify areas where additional knowledge or skills are required.

- Stay informed about upcoming training events and conferences through industry newsletters, social media, and professional networks.

- Seek recommendations from colleagues, mentors, or industry experts regarding valuable training programs.

Attending Industry Conferences

Attending industry conferences provides insurance agents with an invaluable opportunity to learn about the latest industry developments, network with peers and experts, and gain insights into best practices.

- Research and select conferences that align with specific areas of interest or expertise.

- Actively participate in conference sessions, workshops, and panel discussions to maximize learning.

- Network with fellow attendees, industry experts, and potential clients to expand professional connections.

Reading Industry Publications

Reading industry publications, such as trade magazines, journals, and online articles, keeps insurance agents informed about industry news, regulatory changes, and emerging trends.

- Subscribe to reputable industry publications and regularly review their content.

- Follow industry thought leaders and experts on social media and online platforms to stay updated with their insights.

- Engage in online forums and discussions to exchange ideas and learn from peers.

Obtaining Industry Certifications and Designations

Obtaining industry certifications and designations demonstrates an insurance agent’s commitment to professional excellence and enhances their credibility and expertise.

- Research and identify industry certifications and designations that align with specific areas of expertise.

- Prepare for certification exams by studying relevant materials, attending training programs, and gaining practical experience.

- Maintain certifications and designations by fulfilling continuing education requirements and staying updated with industry developments.

Seeking Professional Help

Insurance agents are often faced with high-pressure situations and demanding schedules, which can make it difficult to maintain a healthy work-life balance. Seeking professional help is an important step in addressing these challenges and improving overall well-being.

Recognizing the Need for Professional Help

It is important to recognize the signs that may indicate a need for professional help. These signs can include:

- Feeling overwhelmed, stressed, or anxious on a regular basis.

- Having difficulty sleeping or concentrating.

- Experiencing physical symptoms, such as headaches or stomach problems.

- Withdrawing from social activities or hobbies.

- Feeling irritable or angry most of the time.

- Having thoughts of harming yourself or others.

Finding the Right Professional

There are many different types of professionals who can help insurance agents with work-life balance issues. These include:

- Therapists: Therapists can help you identify the root of your problems and develop coping mechanisms.

- Counselors: Counselors can provide support and guidance during difficult times.

- Psychiatrists: Psychiatrists can prescribe medication if necessary.

- Life coaches: Life coaches can help you set goals and develop strategies for achieving them.

Final Thoughts

In conclusion, achieving work-life balance as an insurance agent requires a conscious effort, effective strategies, and a commitment to personal well-being. By implementing the tips and techniques discussed in this guide, insurance agents can navigate the demands of their profession while maintaining a fulfilling personal life, leading to increased job satisfaction, productivity, and overall happiness.

Common Queries

Question: How can insurance agents prioritize tasks effectively?

Answer: Insurance agents can prioritize tasks by creating a daily schedule, setting realistic goals, and utilizing time management techniques such as the Eisenhower Matrix or the Pomodoro Technique.

Question: What are some strategies for setting boundaries between work and personal life?

Answer: Strategies for setting boundaries include communicating availability to clients and colleagues, avoiding taking work home, and establishing specific work hours.

Question: How can insurance agents create a dedicated workspace that promotes productivity?

Answer: To create a productive workspace, insurance agents should choose a quiet and organized area, ensure ergonomic setup, and maintain a clutter-free environment.

Question: What technological tools can insurance agents use to streamline their work?

Answer: Insurance agents can utilize productivity apps, time tracking tools, and customer relationship management (CRM) systems to enhance efficiency and streamline their workload.

Question: Why is self-care essential for insurance agents?

Answer: Self-care is crucial for insurance agents to manage stress, maintain physical and mental well-being, and prevent burnout, leading to increased productivity and job satisfaction.