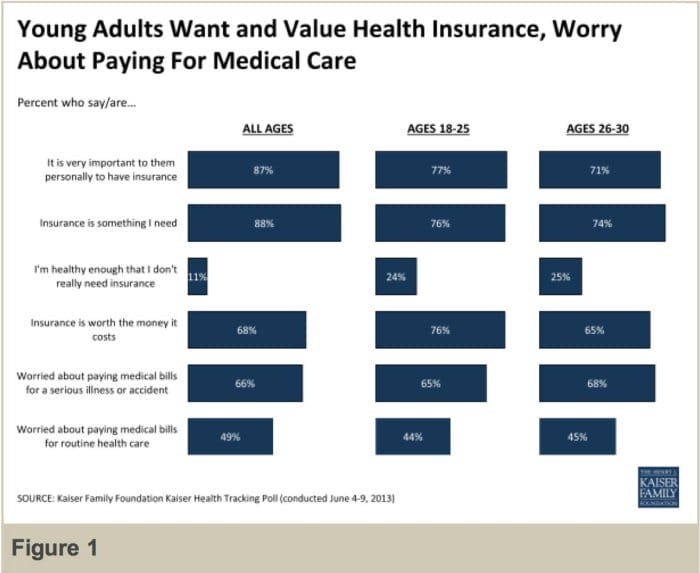

In the realm of personal finance, health insurance stands as a cornerstone, safeguarding your well-being and financial stability. As a young adult embarking on this journey, understanding and managing your health insurance can be daunting. This comprehensive guide will equip you with the knowledge and strategies to navigate the complexities of health insurance, ensuring you make informed decisions that prioritize your health and financial security.

From deciphering the intricacies of coverage types to maximizing preventive care and managing out-of-pocket expenses, we’ll delve into every aspect of health insurance. Whether you’re just starting out or seeking to optimize your current coverage, this guide will empower you to take control of your health insurance journey.

Understanding Health Insurance Basics

Health insurance is a complex but essential aspect of financial planning, especially for young adults entering the workforce or starting families. Understanding the fundamentals of health insurance, including coverage types, premiums, deductibles, and copays, is crucial for making informed decisions about health insurance plans.

Health insurance provides financial protection against the high costs of medical care, ensuring access to necessary treatments and services. By understanding the basic concepts of health insurance, young adults can select a plan that meets their specific needs and budget.

Types of Health Insurance Coverage

There are various types of health insurance coverage available, each with its own benefits and limitations:

- Health Maintenance Organization (HMO): HMOs offer comprehensive coverage within a network of healthcare providers. Premiums are typically lower than other plans, but patients are limited to using providers within the HMO network.

- Preferred Provider Organization (PPO): PPOs offer more flexibility in choosing healthcare providers, both within and outside the network. Premiums are usually higher than HMOs, but patients have more freedom to select their providers.

- Point-of-Service (POS): POS plans combine features of both HMOs and PPOs. Patients can choose to use providers within the network for lower costs or seek care from out-of-network providers at a higher cost.

- Fee-for-Service (FFS): FFS plans allow patients to choose any healthcare provider they want, but premiums and out-of-pocket costs are typically higher.

Assessing Individual Needs

Choosing the right health insurance plan is crucial for young adults to protect their health and finances. Understanding personal needs and priorities is the first step toward finding a plan that fits. Key factors to consider include age, lifestyle, medical history, and budget.

Young adults should evaluate their current health status and any pre-existing conditions they may have. Consider their lifestyle, including activities and hobbies that may increase the risk of injury or illness. Additionally, it’s essential to assess their budget and determine how much they can afford to spend on monthly premiums and out-of-pocket expenses.

Medical History and Pre-existing Conditions

Pre-existing conditions can significantly impact health insurance coverage and costs. Young adults with pre-existing conditions may face higher premiums or even be denied coverage by some insurers. It’s important to disclose all pre-existing conditions accurately and completely when applying for health insurance.

Lifestyle and Risk Factors

Lifestyle choices can also affect health insurance premiums. Factors such as smoking, alcohol consumption, and participation in high-risk activities can increase the cost of coverage. Young adults should consider their lifestyle and make healthy choices to keep their premiums low.

Budget and Financial Considerations

Health insurance can be a significant financial burden for young adults. It’s essential to set a realistic budget and consider both monthly premiums and out-of-pocket expenses, such as deductibles, copays, and coinsurance. Young adults should compare plans to find one that fits their budget and provides the coverage they need.

Navigating the Health Insurance Marketplace

The Health Insurance Marketplace, often known as the “Exchange,” is a crucial resource for individuals seeking affordable health insurance coverage. Created under the Affordable Care Act, it facilitates comparison and enrollment in various health insurance plans.

Navigating the Marketplace can be daunting, but understanding its functions and available resources can simplify the process. Let’s delve into tips for comparing plans, comprehending subsidies, and enrolling in coverage through the Marketplace.

Comparing Health Insurance Plans

When comparing plans on the Marketplace, consider the following factors:

- Premium: The monthly payment you’ll make for your coverage.

- Deductible: The amount you pay out-of-pocket before your insurance starts covering costs.

- Coinsurance: The percentage of covered services you’ll pay for after meeting your deductible.

- Copay: A fixed amount you pay for specific services, such as a doctor’s visit.

- Network: The group of healthcare providers that accept your insurance.

Understanding Subsidies

The Marketplace offers subsidies to help lower the cost of health insurance. Eligibility is based on income and household size. These subsidies can significantly reduce your monthly premiums and out-of-pocket costs.

Enrolling in Coverage

To enroll in coverage through the Marketplace, you can:

- Visit the Marketplace website: Create an account and provide personal and income information.

- Compare plans: Review the available plans and select the one that best suits your needs and budget.

- Apply for subsidies: If eligible, complete the application for premium tax credits or cost-sharing reductions.

- Enroll in a plan: Once you’ve selected a plan, complete the enrollment process and pay your first premium.

Maximizing Preventive Care

Preventive care is a crucial aspect of maintaining good health and reducing healthcare costs in the long run. It involves taking proactive steps to prevent illnesses and diseases before they occur, rather than waiting until they manifest. By prioritizing preventive care, young adults can lay the foundation for a healthier lifestyle and avoid potential health complications down the road.

Benefits of Preventive Care

- Early Detection: Regular checkups and screenings can help identify health issues at an early stage, when they are often more treatable and manageable.

- Reduced Healthcare Costs: Investing in preventive care can help prevent costly medical treatments and hospitalizations in the future.

- Improved Quality of Life: By addressing health issues early on, preventive care can help individuals maintain a higher quality of life and engage in activities they enjoy.

- Increased Lifespan: Preventive care can contribute to a longer and healthier lifespan by reducing the risk of chronic diseases and premature death.

Strategies for Utilizing Preventive Care Services

- Regular Checkups: Schedule regular checkups with a primary care physician to monitor overall health and address any concerns promptly.

- Preventive Screenings: Follow recommended guidelines for preventive screenings, such as mammograms, colonoscopies, and pap smears, to detect potential health issues early.

- Vaccinations: Stay up-to-date on recommended vaccinations to protect against preventable diseases.

- Healthy Lifestyle: Adopt a healthy lifestyle that includes regular exercise, a balanced diet, and adequate sleep to reduce the risk of chronic diseases.

- Mental Health Check-Ins: Regularly assess mental well-being and seek support when needed to maintain emotional health.

Managing Out-of-Pocket Expenses

Minimizing out-of-pocket expenses associated with healthcare is crucial for young adults seeking affordable healthcare coverage. Strategies to reduce these costs include utilizing in-network providers, negotiating medical bills, and seeking financial assistance programs.

Reducing Out-of-Pocket Costs

Several methods can help reduce out-of-pocket expenses for healthcare:

- Utilizing In-Network Providers: Opting for healthcare providers within your insurance network typically results in lower out-of-pocket costs, as these providers have negotiated rates with your insurance company.

- Negotiating Medical Bills: Contacting healthcare providers directly to discuss medical bills may lead to reduced charges. Politely inquire about potential discounts or payment plans.

- Seeking Financial Assistance Programs: Government programs like Medicaid and the Children’s Health Insurance Program (CHIP) provide financial assistance to eligible individuals and families. Additionally, some hospitals and clinics offer financial assistance programs for low-income patients.

Understanding Co-Insurance

Co-insurance is a cost-sharing arrangement between the insured individual and the insurance company. Under this arrangement, the insurance company covers a percentage of the healthcare costs, while the insured individual is responsible for the remaining percentage.

For example, if your co-insurance rate is 20%, you will be responsible for 20% of the total cost of covered healthcare services, while your insurance company will cover the remaining 80%.

Formula: Co-Insurance Payment = (Total Cost of Covered Services) x (Co-Insurance Rate)

Understanding co-insurance is essential for budgeting and planning for healthcare expenses.

Understanding Prescription Drug Coverage

Prescription drug coverage is a crucial aspect of health insurance, ensuring access to necessary medications at affordable prices. It involves understanding formularies, tiers, and generic alternatives, as well as utilizing prescription drug discount programs.

Formularies are lists of prescription drugs covered by an insurance plan. Each plan has its own formulary, which may vary in terms of the drugs included, their coverage levels, and their costs. Tiers are categories within a formulary that assign different cost-sharing levels to different drugs.

Typically, generic drugs are placed in lower tiers with lower cost-sharing, while brand-name drugs are placed in higher tiers with higher cost-sharing.

Generic Alternatives

Generic alternatives are medications that are equivalent to brand-name drugs in terms of active ingredients, dosage, and safety. They are typically more affordable than brand-name drugs, as they do not carry the same research and development costs. Generic alternatives can be found by looking for the generic name of the medication on the prescription label or by asking a pharmacist.

Prescription Drug Discount Programs

Prescription drug discount programs are available to help reduce the cost of prescription drugs. These programs may be offered by insurance companies, pharmaceutical companies, or non-profit organizations. They can provide discounts on both brand-name and generic drugs, and some programs may even offer free medications to eligible individuals.

Preparing for Unexpected Medical Expenses

Unforeseen medical expenses can put a significant financial strain on young adults. Health savings accounts (HSAs) and flexible spending accounts (FSAs) are valuable tools that can help you save money for these unexpected costs and maximize your healthcare dollars.

Understanding HSAs and FSAs

HSAs and FSAs are tax-advantaged savings accounts that allow you to set aside money for qualified medical expenses. HSAs are available to individuals with high-deductible health plans (HDHPs), while FSAs are available to employees whose employers offer them.

Maximizing Contributions to HSAs and FSAs

To make the most of your HSA or FSA, contribute as much as you can afford. HSAs have annual contribution limits, while FSAs may have employer-set limits.

Utilizing HSAs and FSAs Effectively

Use your HSA or FSA funds to pay for qualified medical expenses, such as deductibles, copayments, and coinsurance. You can also use these funds to pay for over-the-counter medications, dental and vision care, and other eligible expenses.

Advantages of HSAs and FSAs

* Tax-free contributions

- Tax-free growth of investments (HSAs only)

- Tax-free withdrawals for qualified medical expenses

- Unused funds can be carried over from year to year (HSAs only)

Navigating Insurance Claims and Appeals

Effectively navigating insurance claims and appeals is crucial for ensuring timely reimbursement and access to necessary medical care. Understanding the process and following the appropriate steps can significantly improve the chances of a successful claim or appeal.

Filing an insurance claim involves submitting a detailed report of medical expenses and relevant documentation to the insurance company. It’s essential to provide accurate and complete information, including receipts, invoices, and any other supporting documents that justify the claim.

Filing an Insurance Claim

- Timely Filing: Submit the claim within the specified timeframe Artikeld in your insurance policy. Late submissions may result in denied claims.

- Accuracy and Completeness: Ensure all the necessary information is included in the claim form, such as patient information, provider details, dates of service, and detailed descriptions of the medical services received.

- Supporting Documentation: Attach relevant documentation, such as receipts, invoices, and medical records, to support the claim. Clear and organized documentation enhances the claim’s credibility.

- Clear Communication: Communicate effectively with the insurance company if they request additional information or clarification. Prompt responses can expedite the claim processing.

Appealing a Denied Claim

- Review the Explanation of Benefits (EOB): Carefully examine the EOB to understand the reason for the denied claim. This document Artikels the specific reasons for denial, which can guide the appeal process.

- Timeframe for Appeal: Initiate the appeal process within the timeframe specified in the insurance policy. Delays may result in the denial of the appeal.

- Gather Evidence: Compile additional documentation and evidence to support the appeal. This may include medical records, expert opinions, or additional information not included in the initial claim.

- Written Appeal: Submit a written appeal to the insurance company, outlining the reasons why the claim should be reconsidered. Clearly state the errors or omissions in the initial claim decision.

- Advocacy and Persistence: Be persistent in pursuing the appeal. Follow up with the insurance company, provide additional information if requested, and advocate for the coverage you believe is rightfully owed.

Staying Informed and Updated

Understanding health insurance and managing its intricacies can be challenging. Staying informed about changes in health insurance laws, regulations, and policies is crucial to ensure you have adequate coverage and avoid unexpected expenses.

Monitoring Healthcare News and Trends

- Regularly check credible news sources, healthcare websites, and government agencies’ announcements to stay updated on the latest healthcare news and trends.

- Utilize social media platforms and healthcare forums to engage with experts and peers, staying abreast of industry developments.

Reviewing Health Insurance Policies

- Periodically review your health insurance policy to understand your coverage, benefits, and limitations.

- Keep track of changes in your health status, lifestyle, and family situation that may impact your insurance needs.

Consulting with Healthcare Professionals

- Consult with your healthcare providers, such as doctors, nurses, and pharmacists, to understand the impact of insurance coverage on your treatment options and costs.

- Seek guidance from insurance brokers or agents to clarify complex policy terms and conditions.

Seeking Professional Advice

Navigating the complexities of health insurance can be daunting for young adults, and seeking guidance from qualified professionals can make a significant difference. Consulting with an insurance agent or financial advisor who specializes in health insurance can provide valuable insights and personalized advice tailored to individual needs and circumstances.

Choosing the Right Professional

When selecting a health insurance professional, consider the following factors:

- Experience and Qualifications: Look for individuals with extensive knowledge of health insurance products, regulations, and industry trends.

- Licensing and Credentials: Ensure that the professional is licensed and accredited by reputable organizations.

- Reputation and Referrals: Seek recommendations from friends, family, or colleagues who have had positive experiences with a particular professional.

- Availability and Accessibility: Consider the professional’s availability to answer questions, provide ongoing support, and address any concerns promptly.

Benefits of Professional Advice

- Personalized Guidance: Professionals can assess individual needs, financial situation, and health goals to recommend the most suitable health insurance plans.

- Understanding Coverage Options: They can explain the different types of health insurance plans, their benefits, and limitations, helping young adults make informed decisions.

- Navigating the Marketplace: Professionals can assist in navigating the Health Insurance Marketplace, comparing plans, and enrolling in the most appropriate one.

- Maximizing Preventive Care: They can provide guidance on maximizing preventive care coverage, such as annual checkups, screenings, and vaccinations, to maintain good health and avoid costly medical expenses.

- Managing Out-of-Pocket Expenses: Professionals can help young adults understand out-of-pocket expenses, such as deductibles, copays, and coinsurance, and develop strategies to manage these costs effectively.

Summary

Navigating health insurance as a young adult can be a complex endeavor, but with the right knowledge and strategies, you can make informed decisions that prioritize your health and financial well-being. Remember, understanding the basics, assessing your individual needs, and seeking professional advice when needed are key to a successful health insurance journey.

Embrace this opportunity to take charge of your health and financial future, ensuring you’re well-prepared for whatever life throws your way.

Common Queries

What are the key factors to consider when choosing a health insurance plan?

When selecting a health insurance plan, consider factors such as your age, lifestyle, medical history, budget, and any specific healthcare needs you may have. Evaluate your current health status, anticipated medical expenses, and future healthcare goals to determine the most suitable plan for your circumstances.

How can I reduce my out-of-pocket expenses for healthcare?

To minimize out-of-pocket expenses, utilize in-network providers whenever possible, negotiate medical bills if necessary, and explore financial assistance programs that may be available. Additionally, understand the concept of co-insurance and how it affects your out-of-pocket costs.

What are the benefits of preventive care, and how can I utilize these services?

Preventive care plays a crucial role in maintaining good health and reducing healthcare costs in the long run. Regular checkups, screenings, and vaccinations can help detect and address potential health issues early on. Take advantage of preventive care services covered by your health insurance plan to safeguard your health and minimize future medical expenses.

How can I prepare for unexpected medical expenses?

Consider establishing a health savings account (HSA) or flexible spending account (FSA) to set aside funds for unexpected medical expenses. These accounts offer tax advantages and can help you save money for future healthcare needs. Explore your options and determine which account best suits your financial situation and healthcare goals.