In the realm of financial planning, life insurance stands as a cornerstone, providing peace of mind and financial security for individuals and families. Ameriprise Financial, a leading financial services provider, specializes in crafting tax-advantaged life insurance solutions that optimize wealth transfer and retirement planning.

Join us as we delve into the intricacies of life insurance taxation, uncovering strategies to maximize benefits while minimizing tax implications.

Ameriprise Financial’s expertise in tax-efficient life insurance strategies empowers clients to navigate the complexities of life insurance taxation. Through personalized advice and a comprehensive suite of tax-advantaged life insurance products, Ameriprise Financial helps individuals and families achieve their financial goals while preserving wealth for future generations.

Introduction to Tax Tips for Life Insurance from Ameriprise Financial

In the intricate world of personal finance, life insurance stands as a cornerstone of prudent planning. Its ability to provide financial protection for loved ones and secure future goals cannot be overstated. However, the complexities of tax regulations can often overshadow the benefits of life insurance, making it essential to seek guidance from experts who can navigate these complexities and tailor solutions that maximize tax advantages.

Ameriprise Financial emerges as a beacon of expertise in the realm of tax-efficient life insurance strategies. With a deep understanding of the nuances of tax laws and a commitment to personalized service, Ameriprise Financial empowers individuals to harness the full potential of life insurance as a tax-advantaged financial tool.

Ameriprise Financial’s Tailored Tax-Advantaged Life Insurance Solutions

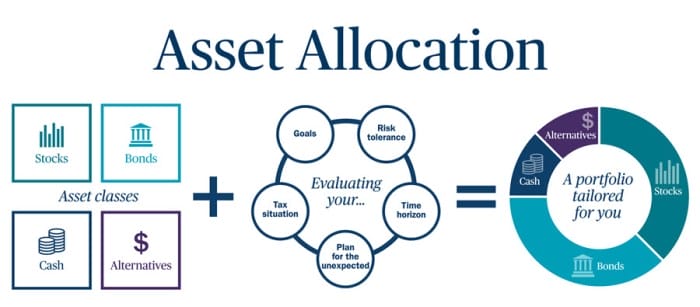

Ameriprise Financial’s approach to tax-efficient life insurance is characterized by a comprehensive and individualized approach. They recognize that every individual’s financial circumstances are unique, and therefore, their life insurance strategies must be meticulously crafted to align with their specific goals and objectives.

Through a collaborative process, Ameriprise Financial advisors work closely with clients to understand their financial aspirations, risk tolerance, and tax situation. This in-depth understanding enables them to recommend life insurance policies that not only provide the desired level of protection but also optimize tax benefits.

Ameriprise Financial’s commitment to excellence extends beyond the initial policy selection. They provide ongoing monitoring and review of clients’ life insurance portfolios, ensuring that they continue to align with changing circumstances and evolving tax regulations.

Understanding the Basics of Life Insurance Taxation

Life insurance policies offer financial protection and peace of mind to policyholders and their loved ones. Understanding the federal income tax implications associated with life insurance is crucial for making informed financial decisions. This section provides a comprehensive overview of the tax treatment of life insurance policies, clarifying the tax implications of premiums, death benefits, and cash value accumulation.

It also explains the concept of tax-deferred growth and its advantages in life insurance.

Tax Implications of Premiums

Generally, premiums paid for life insurance policies are not tax-deductible. However, there are exceptions for certain types of life insurance policies, such as qualified retirement plans and employer-sponsored group life insurance plans. In these cases, premiums may be deductible as business expenses or as part of retirement contributions.

Taxation of Death Benefits

Death benefits paid to beneficiaries from life insurance policies are generally excluded from federal income tax. This tax-free treatment applies to both the principal amount of the policy and any accumulated interest or dividends. However, if the death benefit is paid in installments, only the interest portion is taxable.

Taxation of Cash Value Accumulation

Cash value accumulation in life insurance policies grows on a tax-deferred basis. This means that policyholders do not pay taxes on the accumulated cash value until it is withdrawn or the policy is surrendered. Withdrawals of cash value are generally treated as loans and are not taxable, but they may reduce the death benefit.

If the policy is surrendered, any gain on the cash value accumulation is taxable as ordinary income.

Tax-Deferred Growth in Life Insurance

The tax-deferred growth of cash value in life insurance policies offers several advantages. It allows policyholders to accumulate wealth on a tax-advantaged basis, potentially generating significant returns over time. Additionally, the cash value can be used for various purposes, such as paying for education expenses, retirement planning, or supplementing retirement income, without triggering a taxable event.

Utilizing Life Insurance for Tax-Efficient Wealth Transfer

Life insurance serves as a powerful estate planning tool, providing tax-efficient strategies for transferring wealth to beneficiaries. The proceeds from a life insurance policy, when structured properly, are generally exempt from federal income tax, allowing beneficiaries to receive the full death benefit without any tax liability.

Tax Benefits of Life Insurance Proceeds

- Tax-Free Death Benefit: The death benefit paid to beneficiaries is generally not subject to federal income tax. This tax-free transfer of wealth can provide significant financial relief to beneficiaries, particularly in cases where the deceased individual had a high income or estate.

- Income Tax-Free Accumulation: The cash value of a life insurance policy grows on a tax-deferred basis, meaning that the policyholder does not pay taxes on the accumulated earnings until the policy is cashed out or surrendered. This tax-deferred growth can help policyholders accumulate wealth more efficiently.

- Estate Tax Mitigation: Life insurance proceeds are generally not included in the deceased individual’s taxable estate, reducing the overall value of the estate subject to estate taxes. This can potentially save beneficiaries from having to pay significant estate taxes on the inherited assets.

Preserving Wealth through Life Insurance

- Protecting Against Estate Taxes: Life insurance can help minimize or eliminate estate taxes by providing liquidity to pay these taxes without having to sell assets. By structuring the policy appropriately, the death benefit can be used to cover estate taxes, ensuring that beneficiaries receive a larger portion of the estate.

- Wealth Preservation for Heirs: Life insurance can provide a secure financial foundation for heirs, ensuring that they receive a substantial inheritance regardless of market conditions or economic downturns. The death benefit can be used to fund education, cover living expenses, or provide a financial safety net for beneficiaries.

- Charitable Giving: Life insurance can be used as a tax-efficient way to make charitable contributions. By naming a charity as the beneficiary of a life insurance policy, the death benefit can be used to fund charitable causes, potentially generating significant tax savings for the policyholder’s estate.

Strategies for Optimizing Tax Benefits of Life Insurance

Identifying and implementing effective strategies can maximize the tax advantages offered by life insurance policies. Understanding the fundamental concepts of policy ownership and selecting the appropriate policy type are crucial steps in optimizing tax efficiency.

Policy Ownership and Taxation

The ownership of a life insurance policy significantly influences its tax treatment. When the policy is owned by the insured individual, the death benefit is generally not subject to income tax. However, any accumulated cash value within the policy may be subject to taxation upon withdrawal.

Conversely, if the policy is owned by an irrevocable life insurance trust (ILIT), the death benefit and cash value growth are typically not subject to income or estate tax.

Selecting the Appropriate Life Insurance Policy Type

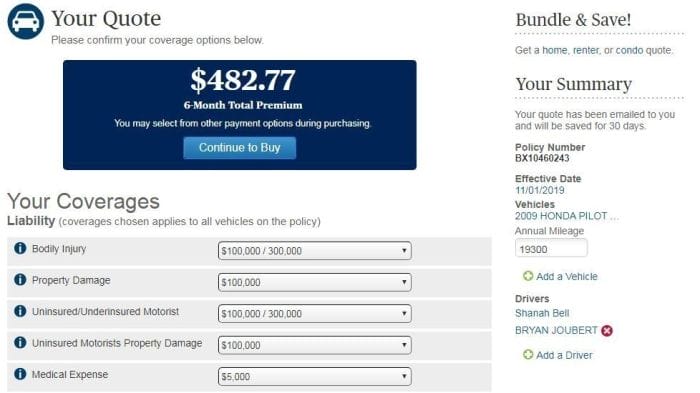

The choice of life insurance policy type can also impact tax efficiency. Whole life insurance policies offer the advantage of accumulating cash value on a tax-deferred basis, meaning that withdrawals from the cash value are not taxed until they exceed the amount of premiums paid.

Universal life insurance policies provide flexibility in premium payments and death benefit amounts, while also allowing for tax-deferred cash value accumulation. Term life insurance policies, while offering lower premiums, do not provide a cash value component and any death benefit payments are not subject to income tax.

Navigating Tax Implications of Life Insurance Loans and Withdrawals

Understanding the tax implications associated with life insurance loans and withdrawals is crucial for policyholders seeking to access cash value benefits. This section explores the tax consequences of these transactions and provides strategies for minimizing taxes when utilizing life insurance cash value.

Tax Consequences of Life Insurance Loans

Loans taken against the cash value of a life insurance policy are not taxable events. However, the outstanding loan amount reduces the death benefit of the policy, potentially impacting beneficiaries. Interest paid on the loan is also not tax-deductible.

Tax Treatment of Withdrawals from a Life Insurance Policy

Withdrawals from a life insurance policy are generally treated as taxable income. The amount of taxable income depends on the policy’s cost basis, which is the total amount of premiums paid into the policy. Withdrawals that exceed the cost basis are subject to ordinary income tax rates.

Tips for Minimizing Taxes When Accessing Cash Value Benefits

*

-*Consider a loan instead of a withdrawal

Loans against the cash value are not taxable events, while withdrawals are subject to income tax.

-

-*Withdraw funds gradually

Spreading withdrawals over multiple years can help reduce the tax burden by keeping withdrawals below the cost basis.

-*Utilize tax-advantaged policies

Some life insurance policies, such as variable universal life insurance (VUL) and indexed universal life insurance (IUL), offer tax-advantaged withdrawals.

-*Consult a financial advisor

Working with a qualified financial advisor can help you develop a strategy for accessing cash value benefits in a tax-efficient manner.

Coordinating Life Insurance with Retirement Planning

Integrating life insurance with retirement savings strategies is a smart financial move.

Life insurance can complement retirement accounts like IRAs and 401(k)s, offering tax-efficient wealth transfer and helping achieve retirement goals.

Utilizing Life Insurance for Tax-Efficient Retirement Savings

- Death Benefit: Life insurance provides a tax-free death benefit to beneficiaries, ensuring financial security for loved ones even after retirement.

- Tax-Deferred Cash Value: Some life insurance policies accumulate cash value on a tax-deferred basis. This cash value can be accessed through loans or withdrawals during retirement, potentially reducing taxable income.

- Tax-Free Loan: Loans from life insurance policies with cash value are generally tax-free, providing access to funds without affecting the death benefit or policy’s cash value.

Life Insurance and Retirement Account Coordination

- Maximize Tax-Deferred Savings: Life insurance can complement retirement accounts by providing additional tax-deferred savings, diversifying retirement income sources, and reducing reliance on taxable accounts.

- Protect Retirement Savings: Life insurance can provide a safety net for retirement savings in case of premature death, ensuring that beneficiaries receive a tax-free death benefit to maintain their financial stability.

- Estate Planning: Life insurance can be used for estate planning purposes, helping to reduce estate taxes and ensuring a smooth transfer of wealth to beneficiaries.

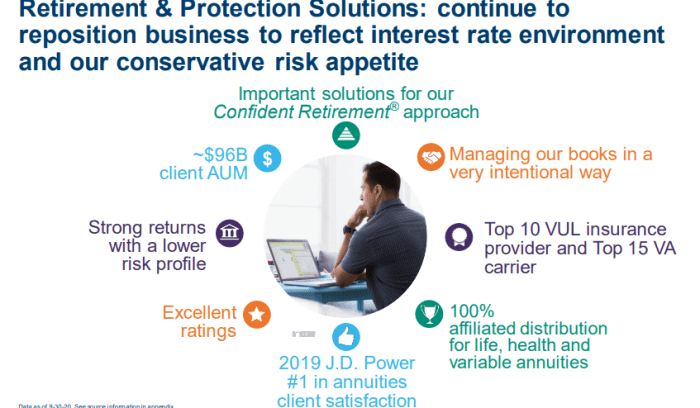

Tax-Advantaged Life Insurance Products Offered by Ameriprise Financial

Ameriprise Financial offers a comprehensive suite of tax-advantaged life insurance products designed to help clients meet their financial goals and objectives. These products provide a range of benefits, including death benefit protection, cash value accumulation, and tax-deferred growth.Ameriprise Financial’s tax-advantaged life insurance products fall into two main categories: whole life insurance and universal life insurance.

Whole life insurance provides lifelong coverage with a guaranteed death benefit and a cash value component that grows over time. Universal life insurance offers flexible premiums and death benefit options, along with a cash value component that can be used for a variety of purposes, such as retirement savings or education funding.

Whole Life Insurance

Whole life insurance is a permanent life insurance policy that provides lifelong coverage with a guaranteed death benefit. The cash value component of a whole life insurance policy grows over time on a tax-deferred basis, meaning that no taxes are due on the accumulated gains until the policy is surrendered or the insured person dies.

Benefits of Whole Life Insurance:

- Lifelong coverage with a guaranteed death benefit

- Cash value accumulation on a tax-deferred basis

- Death benefit proceeds are generally income tax-free to beneficiaries

- Cash value can be borrowed against or withdrawn for various needs

Universal Life Insurance

Universal life insurance is a flexible life insurance policy that offers customizable premiums and death benefit options. The cash value component of a universal life insurance policy can be used for a variety of purposes, such as retirement savings or education funding.

Benefits of Universal Life Insurance:

- Flexible premiums and death benefit options

- Cash value accumulation on a tax-deferred basis

- Death benefit proceeds are generally income tax-free to beneficiaries

- Cash value can be borrowed against or withdrawn for various needs

Case Study: How Ameriprise Financial’s Tax-Advantaged Life Insurance Products Helped a Client Achieve Their Financial Goals

John, a successful business owner, was looking for a way to protect his family’s financial future and provide for his retirement. He worked with an Ameriprise Financial advisor to select a whole life insurance policy that provided him with lifelong coverage, a guaranteed death benefit, and a cash value component that he could use for retirement savings.Over

the years, John’s cash value grew on a tax-deferred basis, and he was able to use it to supplement his retirement income. When John passed away, his family received the death benefit from his life insurance policy tax-free, which helped them maintain their standard of living and secure their financial future.Ameriprise

Financial’s tax-advantaged life insurance products offer a variety of benefits that can help clients achieve their financial goals. These products provide lifelong coverage, guaranteed death benefits, cash value accumulation, and tax-deferred growth. Ameriprise Financial’s advisors can help clients select the right life insurance product to meet their specific needs and objectives.

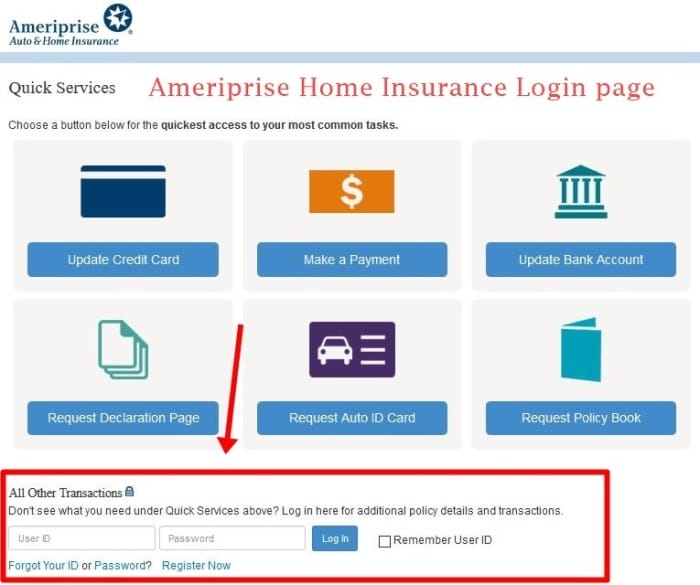

Consulting a Financial Advisor for Personalized Tax Planning

Navigating the complexities of life insurance taxation can be challenging. Consulting a qualified financial advisor can provide invaluable guidance in developing a personalized tax plan that optimizes the benefits of life insurance while minimizing potential tax liabilities.

Finding a Reputable and Experienced Financial Advisor

Choosing the right financial advisor is crucial for effective tax planning. Here are some tips to help you find a reputable and experienced professional:

- Seek Recommendations: Ask friends, family, or colleagues for referrals to financial advisors they trust.

- Verify Credentials: Ensure the advisor is registered with relevant regulatory authorities and holds appropriate certifications.

- Research Background: Investigate the advisor’s experience, qualifications, and any potential conflicts of interest.

- Conduct Interviews: Meet with multiple advisors to assess their knowledge, communication skills, and alignment with your financial goals.

- Evaluate Fees: Understand the advisor’s fee structure and ensure it aligns with your budget and expectations.

Additional Resources and Tools for Tax-Efficient Life Insurance Planning

In addition to the strategies discussed, here are some resources and tools to help you plan for tax-efficient life insurance:

Relevant Articles, Whitepapers, and Resources:

- “The Ultimate Guide to Life Insurance Taxation”: A comprehensive whitepaper that covers all aspects of life insurance taxation, including tax-advantaged strategies, pitfalls to avoid, and recent tax law changes.

- “Life Insurance Tax Calculator”: An online tool that helps you estimate the potential tax benefits of life insurance based on your specific circumstances.

- “Tax-Efficient Life Insurance Strategies”: A series of articles that provide in-depth insights into various tax-saving strategies involving life insurance.

Books and Seminars:

- “Life Insurance and Estate Planning”: A book that explores the role of life insurance in estate planning and provides guidance on how to use life insurance to minimize estate taxes.

- “Tax-Smart Life Insurance Strategies”: A seminar that covers advanced tax-saving techniques using life insurance, including case studies and real-life examples.

Case Studies of Successful Tax-Efficient Life Insurance Strategies

Real-life case studies showcase the effectiveness of tax-efficient life insurance strategies implemented by individuals and families.

These case studies highlight the challenges faced, the strategies implemented, and the positive outcomes achieved by clients who have utilized Ameriprise Financial’s tax-advantaged life insurance solutions.

The Browns: Utilizing Life Insurance for Wealth Transfer

The Browns, a married couple in their late 50s, sought to ensure the financial security of their children and grandchildren while minimizing the tax burden on their estate.

They worked with an Ameriprise Financial advisor to establish an irrevocable life insurance trust, transferring ownership of their life insurance policies to the trust. This strategy effectively removed the death benefit from their taxable estate, providing a substantial tax savings for their heirs.

The Smiths: Tax-Efficient Retirement Planning with Life Insurance

The Smiths, a young couple in their early 30s, recognized the importance of long-term financial planning and sought to optimize their retirement savings.

They utilized a life insurance policy with a cash value component as part of their retirement strategy. The cash value accumulation grew on a tax-deferred basis, providing a tax-advantaged savings vehicle for their retirement years. Additionally, the death benefit provided a financial safety net for their family in case of an untimely death.

The Joneses: Navigating Life Insurance Loans and Withdrawals

The Joneses, a middle-aged couple, faced a financial setback due to unexpected medical expenses.

They leveraged the cash value of their life insurance policy by taking a policy loan. This provided them with access to funds without surrendering the policy or triggering a taxable event. The loan interest was paid from the policy’s cash value, ensuring the policy remained in force and continued to provide a death benefit.

Last Point

Life insurance, when integrated with a well-rounded financial plan, serves as a powerful tool for tax-efficient wealth transfer and retirement planning. Ameriprise Financial’s commitment to personalized tax planning and comprehensive life insurance solutions empowers clients to confidently navigate the complexities of life insurance taxation.

By leveraging the expertise of Ameriprise Financial’s financial advisors, individuals and families can unlock the full potential of life insurance, securing their financial future while minimizing tax burdens.

Q&A

What is the significance of tax-efficient life insurance strategies?

Tax-efficient life insurance strategies play a crucial role in optimizing wealth transfer and retirement planning. By minimizing tax implications, individuals and families can preserve more of their assets, ensuring financial security for future generations.

How does Ameriprise Financial specialize in providing tailored tax-advantaged life insurance solutions?

Ameriprise Financial’s team of experienced financial advisors possesses in-depth knowledge of life insurance taxation. They work closely with clients to understand their unique financial goals and objectives, crafting personalized life insurance solutions that align with their tax-efficiency needs.

What are the key strategies for maximizing tax advantages in life insurance policies?

Maximizing tax advantages in life insurance policies involves careful consideration of policy ownership, selecting the appropriate policy type, and understanding the tax implications of loans and withdrawals. Ameriprise Financial’s financial advisors provide expert guidance in navigating these complexities.

How can life insurance be used as an effective estate planning tool?

Life insurance serves as a powerful estate planning tool, allowing individuals to transfer wealth to beneficiaries in a tax-efficient manner. The death benefit proceeds received by beneficiaries are generally income tax-free, preserving the value of the estate.

How does life insurance complement retirement savings strategies?

Life insurance complements retirement savings strategies by providing a death benefit that can replace lost income and ensure financial security for surviving family members. Additionally, life insurance cash value accumulation can supplement retirement income, offering tax-advantaged growth potential.