In the realm of personal finance, Martin Lewis stands as a beacon of wisdom, guiding individuals toward financial freedom. Among his many areas of expertise, car insurance holds a prominent position. With rising insurance costs, Martin Lewis’ money-saving tips have become an invaluable resource for those seeking to navigate the complexities of car insurance and secure substantial savings.

This comprehensive guide delves into the intricacies of car insurance policies, empowering you with the knowledge to make informed decisions. We’ll explore the various coverage options, deductibles, and premium calculations, helping you understand the factors that influence your insurance costs.

Furthermore, we’ll uncover the hidden savings opportunities, such as discounts, benefits, and cost-saving strategies, that can significantly reduce your insurance premiums.

Martin Lewis’ Introduction to Car Insurance Savings

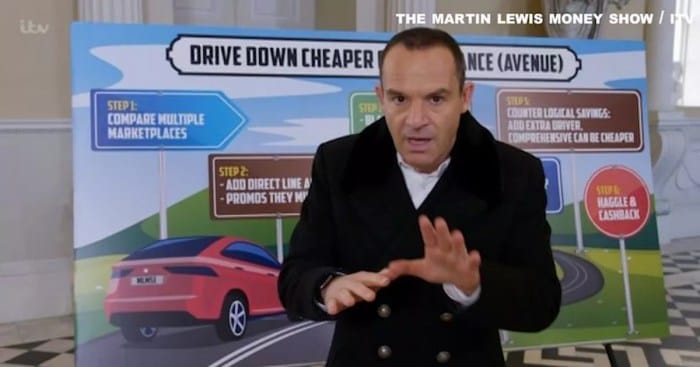

Car insurance is a significant expense for many individuals, and saving money on this cost can provide substantial financial relief. Martin Lewis is a renowned personal finance expert and consumer champion who has dedicated years to helping people save money on their car insurance policies.

Martin Lewis’s expertise in the field of car insurance savings is widely recognized. He has conducted extensive research, analyzed market trends, and negotiated exclusive deals with insurance providers to bring forth valuable tips and advice that can help individuals save hundreds of pounds on their car insurance premiums.

How Martin Lewis’s Tips Can Help Save Money on Car Insurance

Martin Lewis’s tips and advice on car insurance savings can benefit individuals in several ways:

- Comparison and Research: Martin Lewis emphasizes the importance of comparing quotes from multiple insurance providers to find the best deal. He provides access to comparison tools and resources that make it easy for individuals to compare policies and identify the most affordable options.

- Negotiation and Discounts: Martin Lewis has negotiated exclusive discounts and deals with insurance providers, which can provide significant savings for individuals who take advantage of these offers. He also shares tips on how to negotiate with insurance companies to secure the best possible rate.

- Understanding Coverage: Martin Lewis educates consumers about the different types of car insurance coverage and helps them understand what they need and what they don’t. This knowledge enables individuals to tailor their policies to their specific needs, potentially saving money by avoiding unnecessary coverage.

- Loyalty and Multi-Policy Discounts: Martin Lewis highlights the potential savings available through loyalty discounts and multi-policy discounts. He encourages individuals to explore these options with their insurance providers to maximize their savings.

Understanding Car Insurance Policies

Car insurance policies provide financial protection against losses and damages arising from car accidents and other covered events. Understanding the different aspects of car insurance policies, including coverage options, deductibles, and premium calculations, is crucial for making informed decisions and choosing the right policy that meets your specific needs and budget.

Coverage Options

Car insurance policies typically offer a range of coverage options to protect drivers and their vehicles. Common coverage options include:

- Liability Coverage: Covers damages caused to other people or their property as a result of an accident you cause.

- Collision Coverage: Covers damages to your own vehicle caused by a collision with another object, regardless of who is at fault.

- Comprehensive Coverage: Covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers in the event of an accident, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: Covers damages caused by drivers who do not have insurance or have insufficient insurance to cover the damages they cause.

Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums. It’s important to choose a deductible that balances your budget and risk tolerance.

Premium Calculations

Car insurance premiums are calculated based on various factors, including your age, driving record, location, type of vehicle, and coverage options selected. Insurance companies use complex algorithms and statistical models to assess your risk profile and determine your premium.

Importance of Comparing Policies

It’s essential to compare different car insurance policies from multiple insurance companies before making a decision. This allows you to find the best coverage options and premium rates that meet your needs and budget. Make sure to read the terms and conditions of each policy carefully to understand the coverage details, exclusions, and limitations.

Identifying Savings Opportunities

Recognizing areas where you can potentially save money on car insurance premiums is crucial. Factors such as driving history, vehicle type, and usage play a significant role in determining insurance costs. By understanding these aspects, you can make informed decisions that could lead to savings.

Driving History

Maintaining a clean driving record is essential for securing lower insurance premiums. Insurers view drivers with a history of accidents, moving violations, or DUIs as higher risks, leading to increased premiums. To avoid such penalties, practice safe driving habits, obey traffic laws, and avoid engaging in risky behaviors behind the wheel.

Vehicle Type

The type of vehicle you drive also influences insurance costs. Generally, vehicles with higher safety ratings, anti-theft devices, and lower theft rates are associated with lower premiums. Consider these factors when selecting a vehicle to minimize insurance expenses.

Vehicle Usage

The purpose and frequency of your vehicle usage can impact insurance rates. For instance, if you use your car primarily for commuting to work or school, you may qualify for lower premiums compared to those who use their vehicles for business or pleasure purposes.

Additionally, driving fewer miles annually can result in lower insurance costs.

Shopping Around for the Best Deals

Finding the best car insurance deals requires research and comparison. By shopping around, you can potentially save hundreds of pounds on your annual premiums.

Comparison Websites

Comparison websites allow you to quickly and easily compare quotes from multiple insurance providers. These websites typically have access to a wide range of insurers, making it convenient to find the best deal for your needs.

When using a comparison website, be sure to provide accurate information about your vehicle, driving history, and other relevant factors. This will ensure that you receive accurate quotes.

Independent Agents

Independent agents represent multiple insurance companies, giving you access to a variety of quotes. They can provide personalized advice and help you find the best coverage for your needs.

When working with an independent agent, be clear about your coverage needs and budget. This will help the agent find the best options for you.

Negotiating with Insurers

Once you have received a few quotes, you can start negotiating with insurers to get the best deal possible. Be prepared to provide documentation of your driving history, such as a clean driving record, to support your case for a lower premium.

You can also try bundling your car insurance with other policies, such as home insurance, to get a discount.

Maximizing Discounts and Benefits

Insurance companies offer various discounts and benefits to incentivize customers and encourage safe driving. Understanding and maximizing these opportunities can significantly reduce insurance premiums.

Multi-Car Discounts

Multi-car discounts are offered to policyholders who insure multiple vehicles under the same policy. This discount acknowledges the reduced risk associated with insuring multiple vehicles with a single company. The discount typically ranges from 5% to 15% per additional vehicle.

Loyalty Discounts

Loyalty discounts reward customers who remain with the same insurance company for an extended period. These discounts typically start at 5% and can increase over time, reaching up to 20% or more for long-term customers. Loyalty discounts incentivize customers to maintain a continuous relationship with the insurance company.

Safe Driver Discounts

Safe driver discounts are offered to policyholders who demonstrate responsible driving habits and have a clean driving record. These discounts can range from 5% to 20% and are based on factors such as the number of years of accident-free driving, the type of vehicle driven, and the policyholder’s age and experience.

Other Discounts and Benefits

In addition to the above, insurance companies may offer other discounts and benefits, such as:

- Good student discounts for policyholders who maintain a certain grade point average.

- Defensive driving course discounts for policyholders who complete approved defensive driving courses.

- Usage-based insurance discounts for policyholders who agree to have their driving habits monitored through a telematics device.

- Bundling discounts for policyholders who combine their car insurance with other policies, such as home or renters insurance.

To maximize these discounts and benefits, policyholders should:

- Inquire about available discounts when obtaining quotes from insurance companies.

- Maintain a clean driving record and take advantage of safe driver discounts.

- Consider bundling multiple policies with the same insurance company.

- Ask about loyalty discounts and negotiate for the best possible rate.

By maximizing discounts and benefits, policyholders can significantly reduce their car insurance premiums and save money.

Implementing Cost-Saving Strategies

To effectively reduce car insurance costs, consider implementing practical strategies such as increasing deductibles, opting for higher excess, and bundling policies. However, it’s essential to understand the potential drawbacks and considerations associated with each approach.

Increasing Deductibles

Increasing your deductible can lead to lower premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you assume more financial responsibility for any claims, resulting in lower premiums.

However, it’s crucial to choose a deductible that you can comfortably afford in case of an accident.

Opting for Higher Excess

Similar to increasing deductibles, opting for a higher excess can also reduce your premiums. Excess is the amount you pay towards a claim before your insurance coverage takes over. By selecting a higher excess, you effectively agree to pay more out of pocket in the event of a claim, leading to lower premiums.

As with deductibles, it’s essential to choose an excess amount that aligns with your financial capabilities.

Bundling Policies

Bundling your car insurance policy with other insurance policies, such as home or renters insurance, can often result in significant savings. Insurance companies frequently offer discounts for customers who bundle multiple policies with them. This strategy can be particularly advantageous if you have a good claims history and a low-risk profile.

Avoiding Common Pitfalls

Car insurance is a crucial financial decision that can have long-term implications. However, individuals often make mistakes when purchasing car insurance, leading to overpaying for coverage, choosing the wrong policy, or neglecting to shop around. Avoiding these pitfalls is essential for making informed decisions and saving money.

One common mistake is overpaying for coverage . It’s important to assess your actual needs and choose a policy that provides adequate coverage without unnecessary add-ons. Additionally, failing to shop around and compare quotes from multiple insurers can result in missing out on better deals and potential savings.

Choosing the Wrong Policy

Selecting the wrong policy can lead to inadequate coverage or unnecessary expenses. Carefully consider your driving habits, vehicle type, and coverage needs to choose a policy that aligns with your specific requirements. Avoid opting for a policy with high premiums and low coverage limits.

Neglecting to Shop Around

Failing to shop around for car insurance quotes can result in missing out on potentially lower rates and better coverage options. It’s advisable to obtain quotes from multiple insurers, including both traditional companies and online providers, to ensure you’re getting the best deal.

Utilize comparison websites or work with an insurance broker to streamline the process.

Not Considering Usage-Based Insurance

Usage-based insurance (UBI) programs, also known as pay-as-you-drive or pay-per-mile insurance, can provide significant savings for low-mileage drivers. These programs track your driving habits and adjust your premium accordingly. Explore UBI options if you drive less than the average mileage or primarily use your vehicle for short commutes.

Overlooking Discounts and Benefits

Many insurers offer discounts and benefits that can reduce your premium. These may include discounts for bundling multiple policies, maintaining a clean driving record, installing safety features in your vehicle, or opting for electronic payments. Make sure to inquire about available discounts and take advantage of those that apply to your situation.

Staying Informed and Up-to-Date

In the dynamic landscape of car insurance, staying informed about regulatory changes, industry trends, and emerging products is crucial for making informed decisions and optimizing savings. This section highlights the importance of staying current and provides resources to access up-to-date information and expert advice.

Resources for Staying Informed

Navigating the complexities of car insurance can be daunting. However, several resources are available to help individuals stay informed and make informed decisions:

- Official Government Websites: Government agencies responsible for regulating insurance, such as the National Association of Insurance Commissioners (NAIC), provide comprehensive information on regulations, consumer rights, and complaint-handling procedures.

- Industry Publications and Websites: Industry-specific publications, websites, and blogs offer in-depth analysis, news, and expert commentary on car insurance trends, product offerings, and regulatory changes.

- Consumer Advocacy Groups: Non-profit organizations dedicated to consumer protection often provide unbiased information, comparative analyses, and advocacy efforts related to car insurance.

- Financial Advisors and Insurance Agents: Qualified financial advisors and insurance agents can provide personalized guidance and advice tailored to individual circumstances and needs.

Additional Resources and Tools

Navigating the complexities of car insurance can be daunting, but numerous resources and tools are available to simplify the process and help individuals save money.

These resources provide comprehensive information, comparison options, and personalized recommendations to help drivers make informed decisions about their car insurance coverage and costs.

Comparison Websites

Comparison websites aggregate quotes from multiple insurance providers, allowing individuals to compare coverage options and premiums side-by-side.

- These websites often provide user-friendly interfaces, enabling individuals to input their vehicle and driver information to receive personalized quotes.

- Comparison websites can also provide information on insurance providers’ ratings, customer reviews, and additional services.

Insurance Calculators

Insurance calculators estimate the cost of car insurance premiums based on various factors such as age, driving history, vehicle type, and location.

- These calculators provide individuals with a general idea of the insurance costs they can expect to pay, helping them budget accordingly.

- Insurance calculators can also be used to compare different coverage options and deductibles to determine the most cost-effective policy.

Budgeting Apps

Budgeting apps help individuals track their income, expenses, and savings, including car insurance premiums.

- These apps provide insights into spending patterns and help individuals identify areas where they can save money.

- Budgeting apps can also send reminders for insurance premium due dates, ensuring timely payments and avoiding late fees.

Case Studies and Success Stories

Real-life examples and success stories serve as powerful illustrations of how Martin Lewis’s car insurance tips can lead to substantial savings. These case studies highlight the practical application of his advice and its impact on insurance premiums.

Take the case of Sarah, a young professional from Manchester. By following Martin’s guidance, she reduced her annual car insurance premium from £850 to £520, a remarkable 38% saving. Sarah’s careful research, comparison shopping, and utilization of discounts resulted in this significant reduction.

Maximizing Discounts

Another notable example is that of John, a retired teacher from London. John applied Martin’s tips on maximizing discounts and benefits, including loyalty discounts, multi-car discounts, and no-claims bonuses. As a result, he lowered his insurance premium by 25%, saving over £200 annually.

Avoiding Common Pitfalls

Mark, a student from Birmingham, learned the importance of avoiding common pitfalls in car insurance. By paying his premium annually instead of monthly, he eliminated additional fees and saved £30. Additionally, Mark ensured he had a clean driving record, which resulted in lower premiums.

Closure

By following Martin Lewis’ money-saving tips and implementing the strategies Artikeld in this guide, you can unlock significant savings on your car insurance premiums without compromising coverage. Embrace the power of informed decision-making and take control of your insurance expenses.

Remember, small changes can lead to substantial savings, empowering you to allocate those funds toward other financial goals and aspirations.

FAQ Corner

Q: What are some common areas where I can save money on my car insurance premiums?

A: Some common areas where you can save money include increasing your deductible, opting for a higher excess, bundling your policies, and taking advantage of discounts offered by insurance companies, such as multi-car discounts, loyalty discounts, and safe driver discounts.

Q: How can I find the best deals on car insurance?

A: To find the best deals on car insurance, it’s essential to compare quotes from multiple insurance providers. You can use comparison websites, contact independent agents, or negotiate directly with insurers to secure the most competitive rates.

Q: What are some common mistakes to avoid when purchasing car insurance?

A: Some common mistakes to avoid include overpaying for coverage, choosing the wrong policy, and neglecting to shop around. Make sure you understand your coverage needs, compare quotes, and choose the policy that best suits your individual circumstances.