In the ever-evolving healthcare landscape, credentialing insurance companies has become a crucial aspect of ensuring the quality of care and compliance with regulatory standards. This intricate process involves evaluating and verifying the qualifications, experience, and competence of insurance companies to provide healthcare services.

Join us as we delve into the intricacies of credentialing insurance companies, exploring its significance, regulatory requirements, and best practices. Discover how credentialing can benefit insurance companies, healthcare providers, and patients alike, and gain insights into the strategies for managing provider networks and monitoring performance.

As we navigate the credentialing maze, we will uncover the role of technology in streamlining the process and enhancing efficiency. We will also examine emerging trends shaping the future of credentialing insurance companies and the challenges and opportunities they present.

Whether you’re an insurance company seeking to improve your credentialing processes or a healthcare provider looking to understand the credentialing requirements, this comprehensive guide will provide valuable insights and practical tips to help you succeed.

Credentialing Basics

Credentialing is a vital process for insurance companies as it verifies and evaluates the qualifications, experience, and expertise of healthcare providers within their network. It ensures that patients have access to competent and qualified healthcare professionals, while protecting insurance companies from financial risk and legal liability.

Prominent insurance companies like Aetna, UnitedHealthcare, and Blue Cross Blue Shield have implemented successful credentialing processes. These processes involve thorough background checks, license verification, and peer references to ensure the credibility of healthcare providers.

Benefits of Credentialing

Credentialing offers numerous benefits for insurance companies, healthcare providers, and patients alike:

- Quality Assurance: Credentialing helps insurance companies ensure the quality of care provided by healthcare providers within their network, leading to better patient outcomes and reduced risks.

- Risk Mitigation: By verifying the qualifications and experience of healthcare providers, insurance companies can mitigate the risk of malpractice claims and legal liabilities.

- Cost Control: Credentialing enables insurance companies to identify and prevent fraudulent or unnecessary claims, resulting in cost savings and improved financial performance.

- Provider Reputation: Credentialing enhances the reputation and credibility of healthcare providers, attracting more patients and expanding their practice.

- Patient Confidence: Patients have greater confidence in healthcare providers who have been credentialed by reputable insurance companies, leading to increased patient satisfaction.

Regulatory Requirements

Credentialing insurance companies involves adhering to a set of regulations and standards established by various governing bodies. These regulations aim to ensure the financial stability, solvency, and ethical conduct of insurance providers, thereby protecting policyholders and maintaining the integrity of the insurance industry.

The specific credentialing requirements for insurance companies vary across different jurisdictions, reflecting the unique regulatory frameworks and market conditions in each region. However, there are some common elements that are generally applicable across multiple jurisdictions.

Licensing and Solvency Requirements

Insurance companies are typically required to obtain a license from the relevant regulatory authority in order to operate within a particular jurisdiction. The licensing process involves meeting certain financial and operational criteria, such as maintaining a minimum level of capital and reserves, adhering to accounting and reporting standards, and demonstrating a sound risk management framework.

Solvency regulations are also imposed on insurance companies to ensure that they have sufficient financial resources to meet their obligations to policyholders. These regulations typically require insurance companies to maintain a certain level of surplus or capital relative to their liabilities, as well as to conduct regular stress tests to assess their ability to withstand financial shocks.

Ethical and Conduct Requirements

Insurance companies are expected to adhere to ethical and conduct standards that promote fair and transparent dealings with policyholders and other stakeholders. These standards may include requirements for disclosure of material information, avoidance of conflicts of interest, and compliance with anti-money laundering and counter-terrorism financing regulations.

Insurance companies are also required to have in place effective systems and procedures for handling complaints and disputes, ensuring prompt and fair resolution of policyholder concerns.

Role of Accreditation Bodies

In some jurisdictions, accreditation bodies play a role in the credentialing of insurance companies. These bodies assess the financial strength, operational capabilities, and compliance track record of insurance companies, and issue accreditation or certification that demonstrates their adherence to certain standards or best practices.

Accreditation can provide assurance to policyholders and other stakeholders that an insurance company has undergone a rigorous review process and meets certain quality standards. It can also facilitate market access for insurance companies by demonstrating their credibility and reliability to potential customers.

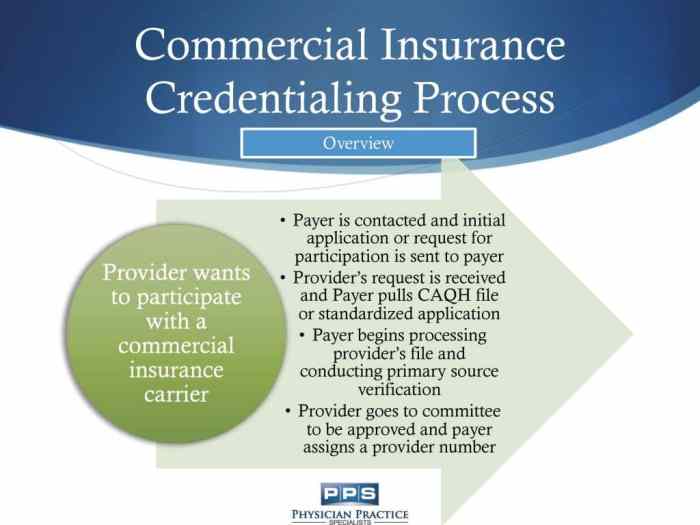

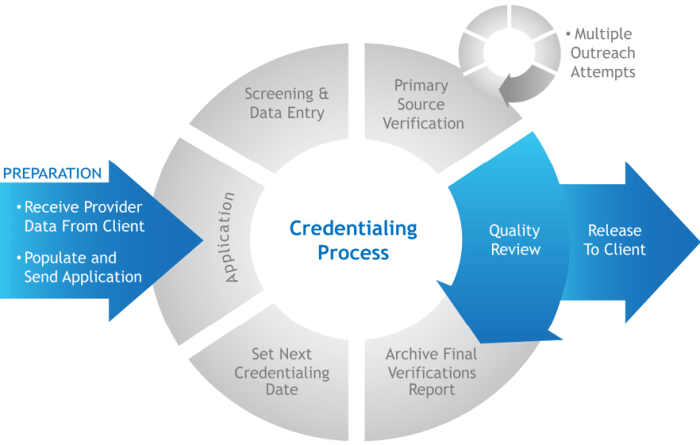

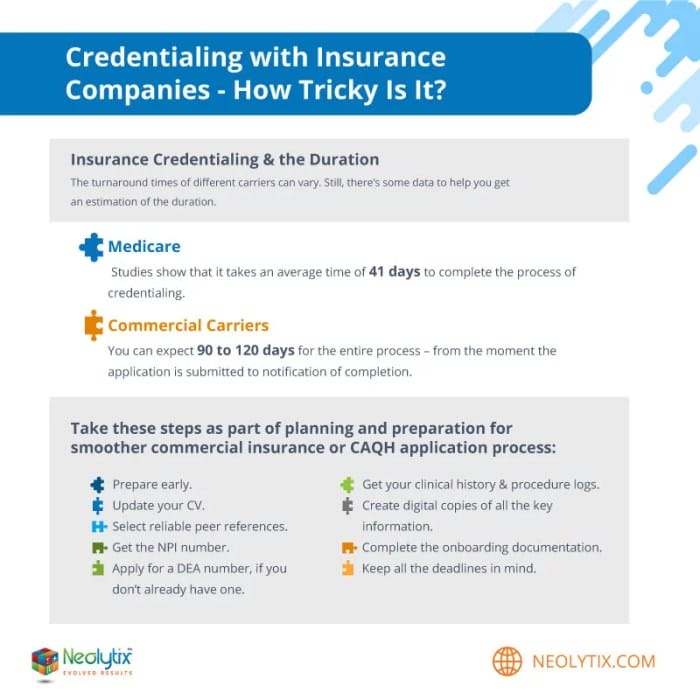

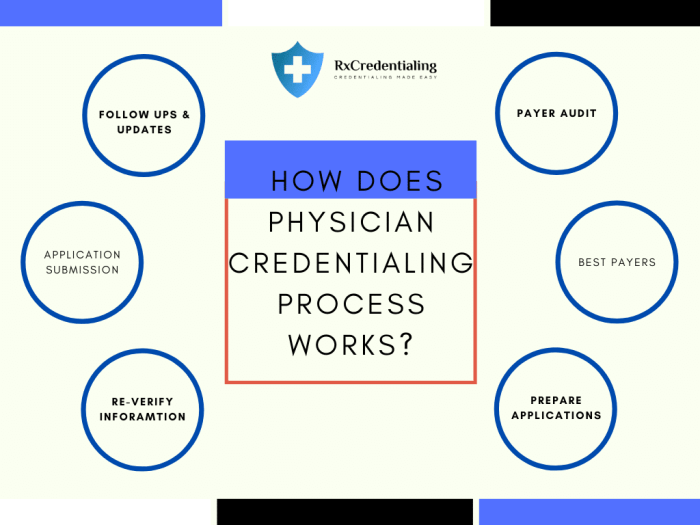

Credentialing Process

Credentialing of insurance companies is a comprehensive process involving several steps to ensure they meet specific standards and requirements. It’s crucial for maintaining the quality of healthcare services and ensuring patients have access to qualified and competent providers.

The credentialing process typically involves the following steps:

Document Submission

Insurance companies must submit a comprehensive set of documents and information to the credentialing committee for review. This includes:

- Basic company information (name, address, contact details)

- Licenses and certifications

- Financial statements

- Claims history

- Provider network information

- Quality assurance and risk management policies

Background Checks

Thorough background checks are conducted on insurance companies to assess their financial stability, legal compliance, and overall reputation. This may include:

- Credit checks

- Legal and regulatory compliance checks

- Review of any pending or past lawsuits or investigations

- Assessment of customer satisfaction and complaint history

Evaluation and Decision

The credentialing committee reviews the submitted documents and background check results to assess the insurance company’s qualifications and suitability. They consider factors such as:

- Financial stability and solvency

- Claims payment history and performance

- Provider network adequacy and quality

- Quality assurance and risk management practices

- Overall reputation and customer satisfaction

Based on this evaluation, the committee makes a decision to grant or deny credentialing to the insurance company.

Ongoing Monitoring

Once credentialed, insurance companies are subject to ongoing monitoring to ensure they continue to meet the required standards. This may include periodic reviews of financial performance, claims history, and quality assurance practices.

Provider Network Management

Effective provider network management is crucial for insurance companies to ensure the quality and accessibility of healthcare services for their members. This involves strategies for selecting, contracting, and monitoring healthcare providers within the network.

Criteria for Provider Selection

Insurance companies employ various criteria to select healthcare providers for their networks. These criteria typically include:

- Credentials and licensure: Providers must possess the necessary credentials, certifications, and licenses to practice in their respective fields.

- Experience and expertise: Insurance companies consider the provider’s years of experience, specialized training, and expertise in treating specific medical conditions.

- Quality of care: Providers are evaluated based on their adherence to evidence-based practices, patient outcomes, and compliance with regulatory standards.

- Cost-effective care: Insurance companies seek providers who deliver high-quality care while maintaining cost-effective practices.

- Patient satisfaction: Feedback from patients regarding their experiences with the provider is also taken into account.

Effective Provider Network Management Practices

Insurance companies implement various practices to effectively manage their provider networks, including:

- Network design: Designing the network to ensure adequate geographic distribution and access to care for members.

- Provider contracting: Negotiating contracts with providers that Artikel payment terms, quality standards, and performance metrics.

- Performance monitoring: Regularly assessing providers’ performance based on quality, cost, and patient satisfaction metrics.

- Provider education and training: Offering educational programs and training to providers to keep them updated on best practices and regulatory changes.

- Grievance and appeals process: Establishing a process for members to address grievances and appeal denied claims.

By implementing these strategies and practices, insurance companies can maintain a network of qualified healthcare providers who deliver high-quality care to their members.

Quality Assurance and Performance Monitoring

Quality assurance and performance monitoring play a vital role in ensuring that credentialed insurance companies meet regulatory requirements and provide high-quality services to their customers.

Methods of Performance Monitoring

There are various methods used to monitor the performance of credentialed insurance companies, including:

- Claims Analysis: This involves reviewing claims data to identify trends, patterns, and potential issues. It helps in identifying areas where the insurance company may need to improve its processes or services.

- Customer Feedback: Collecting feedback from customers through surveys, reviews, and complaints can provide valuable insights into the performance of the insurance company. This feedback can be used to identify areas where the company can improve its customer service.

- Regulatory Audits: Regulatory authorities may conduct audits of credentialed insurance companies to ensure compliance with regulations and standards. These audits can help identify areas where the company needs to make improvements.

- Peer Review: Credentialed insurance companies may also participate in peer review programs, where they are evaluated by other insurance companies or industry experts. This can provide valuable feedback on the company’s performance and help identify areas for improvement.

Examples of Quality Assurance and Performance Monitoring Programs

There are various quality assurance and performance monitoring programs that are used to evaluate credentialed insurance companies. Some examples include:

- National Committee for Quality Assurance (NCQA): NCQA is a private, non-profit organization that accredits health insurance plans and providers. NCQA’s accreditation process includes a rigorous review of the organization’s quality assurance and performance monitoring programs.

- Accreditation Association for Ambulatory Health Care (AAAHC): AAAHC is a private, non-profit organization that accredits ambulatory health care organizations, including insurance companies. AAAHC’s accreditation process includes a review of the organization’s quality assurance and performance monitoring programs.

- The Joint Commission: The Joint Commission is a private, non-profit organization that accredits hospitals, health care systems, and other health care organizations. The Joint Commission’s accreditation process includes a review of the organization’s quality assurance and performance monitoring programs.

Risk Management

Risk management is a crucial aspect of credentialing insurance companies. It involves identifying potential risks, developing strategies to mitigate them, and implementing risk management practices to ensure the integrity and effectiveness of the credentialing process.

The risks associated with credentialing insurance companies can be categorized into several types, including:

- Financial Risk: The risk of financial loss due to fraudulent or improper claims, overpayment to providers, or inadequate provider reimbursement.

- Reputational Risk: The risk of damage to the reputation of the insurance company due to negative publicity, regulatory action, or customer dissatisfaction.

- Legal Risk: The risk of legal liability due to negligence in the credentialing process, failure to comply with regulatory requirements, or failure to adequately assess provider qualifications.

- Operational Risk: The risk of disruptions to the credentialing process due to system failures, human error, or natural disasters.

To mitigate these risks, insurance companies can implement a range of strategies, including:

- Due Diligence: Conducting thorough due diligence on providers before granting them credentials, including verifying their licenses, certifications, and references.

- Risk Assessment: Regularly assessing the risks associated with credentialing and taking steps to mitigate those risks.

- Continuous Monitoring: Continuously monitoring provider performance and taking action to address any concerns or issues that arise.

- Provider Education: Providing education and training to providers on the credentialing process and their obligations under the insurance contract.

- Claims Management: Implementing effective claims management processes to identify and investigate fraudulent or improper claims.

Some examples of risk management practices that insurance companies can implement include:

- Using a credentialing software system: This can help to streamline the credentialing process and reduce the risk of errors.

- Implementing a risk-based approach to credentialing: This involves focusing on providers who pose a higher risk of fraud or abuse.

- Conducting regular audits of the credentialing process: This can help to identify any areas where the process can be improved.

- Working with a reputable credentialing vendor: This can help to ensure that the credentialing process is conducted in a compliant and efficient manner.

Technology and Automation

Technology plays a vital role in streamlining and automating the credentialing process for insurance companies, bringing numerous benefits and efficiencies to the process.

Credentialing insurance companies with technology involves the use of software applications, online portals, and data analytics tools to automate and manage the credentialing process. These tools help insurance companies streamline the application process, verify provider credentials, track application status, and ensure compliance with regulatory requirements.

Benefits of Technology in Credentialing Insurance Companies

- Increased Efficiency: Technology automates repetitive tasks, reduces manual paperwork, and improves the overall efficiency of the credentialing process.

- Improved Accuracy: Automated systems help eliminate errors and ensure the accuracy of data entry and processing.

- Enhanced Compliance: Technology tools assist in tracking and monitoring regulatory changes, ensuring compliance with accreditation standards and government regulations.

- Real-Time Status Updates: Providers can track the status of their applications in real-time through online portals, reducing the need for follow-up inquiries.

- Centralized Data Management: Technology centralizes provider data and documentation, making it easily accessible to authorized personnel.

Examples of Technology Tools for Credentialing Insurance Companies

- Credentialing Software: Specialized software designed to manage the credentialing process, including application submission, verification, tracking, and reporting.

- Online Portals: Secure web-based portals allow providers to submit applications, upload supporting documents, and track the status of their applications.

- Data Analytics Tools: These tools help insurance companies analyze provider data, identify trends, and make informed decisions regarding credentialing.

- Electronic Health Records (EHR) Integration: EHR systems can be integrated with credentialing software to automatically populate provider data and streamline the application process.

Continuous Improvement

Continuous improvement is essential for credentialing insurance companies to ensure they are providing high-quality services to their customers. It involves ongoing efforts to identify and address areas where the credentialing process can be improved, leading to increased efficiency, accuracy, and compliance.

Methods used to identify areas for improvement include:

- Customer feedback: Gathering feedback from customers, such as providers and healthcare facilities, can help identify areas where the credentialing process can be improved to better meet their needs.

- Internal audits: Conducting regular internal audits of the credentialing process can help identify areas where improvements can be made to ensure compliance with regulatory requirements and best practices.

- Benchmarking: Comparing the credentialing process with other insurance companies or industry standards can help identify areas where improvements can be made to achieve better performance.

Examples of continuous improvement initiatives in credentialing insurance companies include:

- Streamlining the credentialing process: Implementing electronic credentialing systems and automating tasks can help streamline the credentialing process, reducing the time and effort required for providers to obtain credentials.

- Improving communication: Establishing clear communication channels between the credentialing department and providers can help ensure that all necessary information is provided and that providers are kept informed of the status of their applications.

- Providing training and support: Offering training and support to providers on the credentialing process can help them understand the requirements and complete their applications accurately and efficiently.

Case Studies and Best Practices

Insurance companies can learn from the experiences of others to improve their credentialing processes. Case studies provide valuable insights into successful implementations, best practices, and recommendations for improvement.

Case Study: XYZ Insurance Company

XYZ Insurance Company successfully streamlined its credentialing process by implementing a centralized system. This system allowed providers to submit their credentials electronically, reducing processing time and improving accuracy. The company also implemented a rigorous quality assurance program to ensure that only qualified providers were credentialed.

Best Practices in Credentialing Insurance Companies

- Centralized Credentialing System: A centralized system allows for efficient processing of provider credentials and ensures consistency in the credentialing process.

- Electronic Credentialing: Electronic credentialing allows providers to submit their credentials online, reducing processing time and improving accuracy.

- Rigorous Quality Assurance Program: A quality assurance program helps ensure that only qualified providers are credentialed.

- Continuous Monitoring: Ongoing monitoring of provider performance helps identify and address any issues that may arise.

- Provider Education: Providing education and resources to providers helps them understand the credentialing process and their obligations.

Recommendations for Insurance Companies Seeking to Improve Their Credentialing Processes

- Conduct a Self-Assessment: Evaluate your current credentialing process to identify areas for improvement.

- Implement a Centralized Credentialing System: If you do not already have one, consider implementing a centralized system to streamline the credentialing process.

- Adopt Electronic Credentialing: If you do not already offer electronic credentialing, consider implementing this option to reduce processing time and improve accuracy.

- Develop a Rigorous Quality Assurance Program: Implement a quality assurance program to ensure that only qualified providers are credentialed.

- Provide Provider Education: Offer education and resources to providers to help them understand the credentialing process and their obligations.

Emerging Trends

The credentialing landscape for insurance companies is constantly evolving, driven by technological advancements, regulatory changes, and shifting market dynamics. These emerging trends are reshaping the way insurance companies approach credentialing, presenting both challenges and opportunities for the industry.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The integration of AI and ML technologies is revolutionizing the credentialing process. These technologies automate tasks, streamline workflows, and enhance decision-making, resulting in improved efficiency, accuracy, and consistency. AI-powered systems can analyze vast amounts of data to identify patterns, predict outcomes, and make informed decisions, leading to faster and more accurate credentialing decisions.

Blockchain for Secure Credentialing

Blockchain technology is gaining traction as a means to enhance the security and transparency of credentialing processes. Blockchain-based platforms can securely store and manage credentialing data, ensuring its integrity and preventing unauthorized access. This technology eliminates the risk of data breaches and fraud, fostering trust and confidence among stakeholders.

Telehealth and Virtual Credentialing

The rise of telehealth and virtual care has necessitated the adaptation of credentialing processes to accommodate remote providers. Virtual credentialing platforms enable insurance companies to verify and assess the qualifications of providers who deliver care remotely, ensuring the same level of quality and standards as in-person care.

This trend has expanded access to care and improved patient convenience.

Focus on Provider Network Management

Insurance companies are increasingly focusing on managing their provider networks more effectively. This includes optimizing network composition, ensuring provider quality, and monitoring performance. Network management strategies aim to reduce costs, improve patient outcomes, and enhance the overall efficiency of the healthcare system.

Data Analytics and Performance Monitoring

Data analytics and performance monitoring have become integral to credentialing. Insurance companies leverage data to track provider performance, identify trends, and make informed decisions regarding credentialing and network management. This data-driven approach enables continuous improvement, ensures compliance with regulatory requirements, and enhances the overall quality of care.

Final Thoughts

In conclusion, credentialing insurance companies is a multi-faceted process that requires a comprehensive approach to ensure quality and compliance. By adhering to regulatory requirements, implementing robust credentialing processes, and leveraging technology, insurance companies can build strong networks of qualified healthcare providers, ensuring access to high-quality care for patients.

As the healthcare industry continues to evolve, staying abreast of emerging trends and continuously improving credentialing practices will be essential for insurance companies to maintain their competitive edge and deliver exceptional healthcare services.

FAQ

Q: Why is credentialing important for insurance companies?

A: Credentialing helps insurance companies verify the qualifications and competence of healthcare providers, ensuring the quality of care provided to patients. It also mitigates risks associated with partnering with unqualified providers and enhances the reputation of the insurance company.

Q: What are some common regulatory requirements for credentialing insurance companies?

A: Regulatory requirements vary across jurisdictions but typically include verifying providers’ licenses, certifications, and education. Insurance companies must also establish policies and procedures for conducting background checks, monitoring provider performance, and handling complaints.

Q: How can insurance companies leverage technology to streamline the credentialing process?

A: Technology tools such as online credentialing platforms and automation software can significantly reduce the time and effort required for credentialing. These tools help insurance companies gather and verify provider information, conduct background checks, and track the status of applications.

Q: What are some emerging trends shaping the future of credentialing insurance companies?

A: Emerging trends include the use of artificial intelligence (AI) and machine learning (ML) to automate credentialing tasks, the adoption of blockchain technology to enhance data security and transparency, and the increasing focus on patient-centered care and value-based payment models.