In today’s dynamic healthcare landscape, short-term health insurance has emerged as a viable option for individuals seeking temporary coverage or bridging gaps between major medical plans. Understanding the intricacies of short-term health insurance, its benefits, and the nuances of obtaining it can be daunting.

This comprehensive guide will provide you with valuable insights and practical tips to navigate the process of securing short-term health insurance, ensuring you make informed decisions for your healthcare needs.

Short-term health insurance offers a flexible and cost-effective solution for those seeking temporary coverage. Whether you’re transitioning between jobs, waiting for major medical coverage to begin, or simply seeking supplemental coverage, short-term plans can provide peace of mind and financial protection against unexpected medical expenses.

Definition and Understanding

Short-term health insurance is a temporary health insurance plan that provides coverage for a limited duration, typically ranging from a few weeks to a year. It is designed to bridge gaps in health insurance coverage, such as when you are between jobs or waiting for your new health insurance plan to take effect.

Short-term health insurance is different from major medical health insurance, which is a comprehensive health insurance plan that provides coverage for a wide range of medical expenses, including hospitalization, doctor visits, and prescription drugs. Major medical health insurance is typically offered through employers or purchased individually.

Benefits of Short-term Health Insurance

- Provides temporary health coverage during gaps in insurance.

- More affordable than major medical health insurance.

- Can be purchased without a medical exam.

- Can be customized to meet your specific needs.

Limitations of Short-term Health Insurance

- Does not cover all medical expenses.

- May have high deductibles and copays.

- May not cover pre-existing conditions.

- May not be renewable.

Benefits and Advantages

Short-term health insurance offers several benefits and advantages, making it a valuable option for individuals seeking temporary coverage or as a bridge to other health insurance plans.

Short-term health insurance provides peace of mind and financial protection against unexpected medical expenses, especially for individuals who are between jobs, waiting for employer-sponsored coverage to start, or facing a gap in coverage due to life transitions.

Flexibility and Convenience

- Flexibility: Short-term health insurance plans offer flexibility in terms of coverage duration, allowing individuals to choose a plan that aligns with their specific needs and budget.

- Easy Application: The application process for short-term health insurance is typically straightforward and can be completed quickly, often without the need for a medical exam.

- Portability: Short-term health insurance plans are typically portable, meaning that coverage can be maintained even if an individual moves to a different state.

Cost-Effectiveness

- Affordability: Short-term health insurance plans are generally more affordable than traditional health insurance plans, making them a budget-friendly option for individuals seeking temporary coverage.

- Tailored Coverage: Short-term health insurance plans allow individuals to choose the level of coverage that best suits their needs, enabling them to control their monthly premiums.

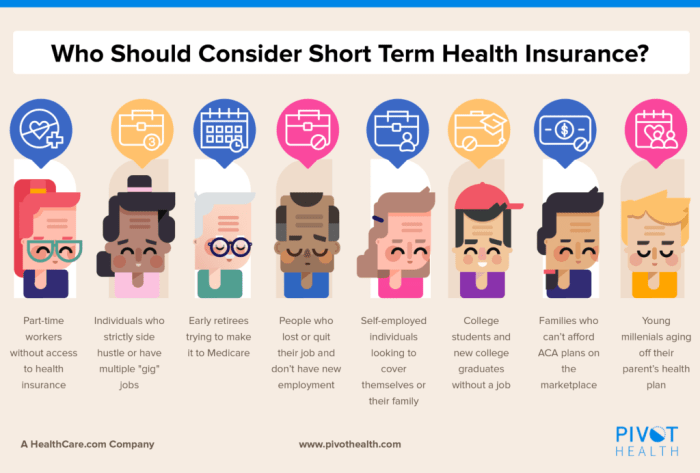

Specific Situations

- Job Transitions: Short-term health insurance can provide coverage during periods of job transition when an individual may not have access to employer-sponsored health insurance.

- Waiting Periods: Short-term health insurance can bridge the gap for individuals waiting for their employer-sponsored health insurance coverage to start or for their Medicare coverage to become effective.

- Temporary Coverage: Short-term health insurance can provide temporary coverage for individuals who are traveling, studying abroad, or participating in short-term projects.

Eligibility and Qualifications

To obtain short-term health insurance, individuals must meet certain eligibility requirements. Understanding these requirements is essential before applying for coverage.

Generally, short-term health insurance is available to individuals who:

- Are United States citizens or legal residents.

- Are not eligible for other health insurance coverage, such as employer-sponsored plans, Medicare, or Medicaid.

- Are between the ages of 18 and 64 (age restrictions may vary depending on the state and insurance provider).

- Do not have pre-existing medical conditions or are in good health (some providers may offer coverage to individuals with pre-existing conditions, but premiums may be higher).

- Meet any additional requirements set by the insurance provider.

Age Restrictions

Short-term health insurance plans typically have age restrictions, with most providers offering coverage to individuals between the ages of 18 and 64. However, some states may allow insurers to offer plans to individuals up to age 65. It’s important to check with the insurance provider or state insurance department to determine the specific age eligibility requirements.

Health Restrictions

Short-term health insurance plans may have health restrictions, such as excluding coverage for pre-existing medical conditions. This means that if an individual has a pre-existing condition, they may not be eligible for coverage or may have limited coverage for that condition.

Some providers may offer coverage to individuals with pre-existing conditions, but premiums may be higher. It’s important to disclose any pre-existing conditions to the insurance provider during the application process.

Income Restrictions

Short-term health insurance plans typically do not have income restrictions. However, some states may have income eligibility requirements for certain types of short-term health insurance plans. It’s important to check with the insurance provider or state insurance department to determine if there are any income restrictions for the plan you are considering.

Cost and Premiums

Understanding the factors that determine the cost of short-term health insurance can help individuals make informed decisions about their coverage. Various factors influence premium rates, including age, health status, coverage duration, and deductible.

In general, younger and healthier individuals tend to pay lower premiums compared to older and less healthy individuals. Additionally, the duration of coverage plays a role, with longer-term plans typically costing more than shorter-term plans. Lastly, the deductible, which is the amount an individual must pay out-of-pocket before the insurance coverage kicks in, also impacts the premium rates.

Age and Health Status

- Age: Younger individuals typically pay lower premiums due to a lower risk of developing health issues.

- Health Status: Individuals with pre-existing conditions or chronic illnesses may face higher premiums due to the increased risk of medical expenses.

Coverage Duration

The duration of coverage significantly impacts premium rates. Short-term health insurance plans typically offer coverage for periods ranging from a few weeks to a year. Generally, longer-term plans cost more than shorter-term plans.

Deductible

The deductible is the amount an individual must pay out-of-pocket before the insurance coverage begins. Plans with higher deductibles typically have lower premiums, while plans with lower deductibles have higher premiums.

Application and Enrollment Process

Applying for and obtaining a short-term health insurance plan typically involves several straightforward steps:

To begin, you’ll need to research and compare different plans available in your area. Consider factors such as coverage options, premiums, and provider networks. It’s essential to choose a plan that aligns with your budget and healthcare needs.

Required Documentation and Information

Once you’ve selected a plan, you’ll need to provide personal information and supporting documents during the application process. Common requirements include:

- Full name, address, and date of birth

- Social Security number

- Proof of income

- Health history (if applicable)

- Information about your current health insurance coverage (if any)

Claims and Reimbursements

Understanding the claims and reimbursement process is crucial for maximizing the benefits of your short-term health insurance plan. Let’s delve into the specifics of filing claims and seeking reimbursements, as well as deciphering Explanation of Benefits (EOB) statements.

Filing Claims

When seeking medical care, ensure you provide your short-term health insurance card to the healthcare provider. They will typically file the claim on your behalf, simplifying the process for you. However, if you need to file a claim yourself, gather the necessary documentation, including receipts, bills, and any other relevant medical records.

Submit these documents to your insurance company, either online or by mail, as specified in your policy.

Reimbursement Process

Once your claim is processed, you will receive a reimbursement check or direct deposit into your bank account, depending on your preferred method. The reimbursement amount may not always cover the full cost of your medical expenses, as your policy may have deductibles, coinsurance, or copayments.

These costs are your responsibility and must be paid before receiving reimbursement.

Explanation of Benefits (EOB)

After your claim is processed, you will receive an Explanation of Benefits (EOB) statement. This document provides a detailed breakdown of your claim, including the services provided, the amount billed, the amount covered by your insurance, and the amount you are responsible for paying.

Carefully review the EOB to ensure accuracy and address any discrepancies promptly.

Renewals and Cancellations

Short-term health insurance plans typically have a limited duration, usually ranging from a few months to a year. Understanding the renewal and cancellation processes is essential for managing your coverage effectively.

Renewals

Renewing your short-term health insurance plan ensures continuous coverage beyond the initial policy period. The renewal process may vary depending on the insurance company and plan. Generally, you will receive a renewal notice from your insurer before the policy expires.

This notice will Artikel the terms and conditions of the renewed policy, including any changes in premiums or coverage.

To renew your plan, you may need to provide updated information, such as your current health status and any changes in your income or household size. You may also need to pay a renewal premium. It’s important to review the renewal notice carefully and contact your insurer if you have any questions or concerns.

Cancellations

There may be situations when you need to cancel your short-term health insurance plan before the end of the policy period. Cancellation policies vary among insurance companies, and it’s essential to understand the terms and conditions related to cancellations.

Generally, you can cancel your plan for certain qualifying reasons, such as obtaining other health insurance coverage, experiencing a significant life event (e.g., marriage, birth of a child), or moving out of the plan’s service area. Some plans may also allow you to cancel for any reason, but this may result in cancellation fees or penalties.

To cancel your plan, you will typically need to submit a written cancellation request to your insurer. The request should include your name, policy number, and the date you want the cancellation to take effect. You may also need to provide supporting documentation, such as proof of new health insurance coverage or a change in your circumstances.

State Regulations and Compliance

The regulatory landscape governing short-term health insurance varies across states, with each state having its own set of requirements and restrictions. Understanding these regulations is crucial for both consumers and insurers operating within a particular state.

Specific Requirements and Restrictions

Specific requirements and restrictions imposed by states on short-term health insurance plans may include:

- Duration Limits: States may set limits on the maximum duration of short-term health insurance coverage, typically ranging from 3 months to 12 months.

- Renewal Restrictions: Some states may impose restrictions on the renewal of short-term health insurance plans, such as limiting the number of times a plan can be renewed or requiring a waiting period before renewal.

- Benefit Mandates: Certain states may mandate that short-term health insurance plans cover specific essential health benefits, such as emergency services, hospitalization, and prescription drugs.

- Network Adequacy: States may have regulations regarding the adequacy of provider networks offered by short-term health insurance plans, ensuring that enrollees have access to a sufficient number of healthcare providers.

- Marketing and Advertising Rules: States may have specific rules governing the marketing and advertising of short-term health insurance plans, aimed at preventing misleading or deceptive practices.

Tips and Considerations

Selecting the most suitable short-term health insurance plan demands careful evaluation and understanding of various factors. This section offers practical tips to guide individuals in making informed decisions.

Understanding Policy Terms and Conditions: Before purchasing a short-term health insurance plan, thoroughly review the policy’s terms, conditions, and exclusions. Pay attention to the coverage limits, deductibles, copayments, and coinsurance. Ensure that the plan covers the essential healthcare services you require and aligns with your budget.

Factors to Consider:

- Coverage Duration: Short-term health insurance plans typically offer coverage for a maximum of 364 days, with the option to renew or extend coverage if necessary.

- Network of Providers: Consider the network of healthcare providers covered by the plan. Ensure that your preferred healthcare providers are included in the network to avoid out-of-network expenses.

- Premiums and Deductibles: Premiums are the regular payments made to maintain the insurance coverage, while deductibles are the initial amount you pay for covered services before the insurance coverage kicks in. Carefully assess these costs to ensure they fit your budget.

- Exclusions and Limitations: Be aware of any exclusions or limitations in the policy. Some plans may exclude coverage for certain pre-existing conditions, elective procedures, or specific treatments.

- Renewal and Cancellation: Understand the renewal and cancellation policies associated with the plan. Determine the conditions for renewing the coverage and the process for canceling the policy if necessary.

Choosing the Right Plan:

Selecting the most suitable short-term health insurance plan involves comparing different options and considering individual needs and circumstances. Factors to consider include the type of coverage desired, budget constraints, network of providers, and the reputation of the insurance company.

Conclusion

Navigating the world of short-term health insurance can be a complex task, but with careful consideration and the right guidance, you can secure a plan that meets your specific needs and budget. Remember to thoroughly research different plans, compare coverage options, and understand the terms and conditions before committing.

By following these tips and seeking professional advice when necessary, you can make an informed decision and gain access to the healthcare coverage you need during life’s transitional periods.

FAQ Section

What are the key benefits of having short-term health insurance?

Short-term health insurance offers several key benefits, including temporary coverage for medical expenses, financial protection against unexpected medical bills, and the flexibility to choose a plan that aligns with your specific needs and budget.

Who is eligible to purchase short-term health insurance?

Eligibility for short-term health insurance typically depends on factors such as age, health status, and residency. Generally, individuals between the ages of 18 and 64 who are not eligible for major medical coverage or government-sponsored programs may be able to purchase a short-term plan.

How do I determine the cost of short-term health insurance?

The cost of short-term health insurance is influenced by several factors, including the type of plan, coverage level, deductible, and the applicant’s age, health status, and location. Premiums can vary significantly, so it’s important to compare quotes from multiple providers to find the most affordable option.

What is the process for filing claims and seeking reimbursements under a short-term health insurance plan?

To file a claim under a short-term health insurance plan, you typically need to submit a claim form along with supporting documentation, such as receipts and medical records, to your insurance provider. The provider will review the claim and determine the amount of reimbursement you are entitled to receive.